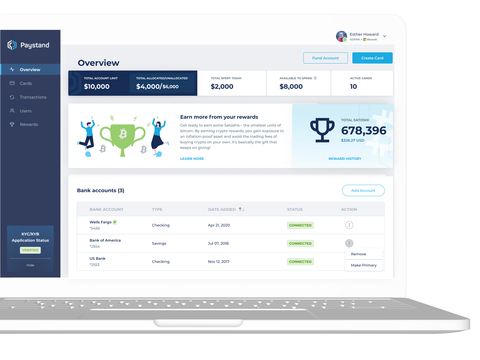

SCOTTS VALLEY, Calif.--(BUSINESS WIRE)--Paystand – the leader in blockchain-enabled B2B payments – today introduced the first business expense card with native crypto rewards. A tech-forward spend management platform, the DeFi Corporate Card offers instant provisioning of virtual and physical cards, advanced spend controls, and real-time expense reporting alongside bitcoin rewards.

With the DeFi Card, businesses earn bitcoin rewards on every purchase. Unlike other business-focused cards that allow businesses to go back and redeem their earned points for crypto rewards, Paystand’s DeFi Corporate Card lets businesses earn bitcoin seamlessly with every dollar they spend. They do not have to modify their everyday workflow; they can make purchases as usual, get tighter control over their corporate spending, and earn bitcoin automatically.

When businesses pay with DeFi Cards over Paystand’s commercial payment network, a Paystand merchant avoids paying transaction fees.

The DeFi Card offers highly desired spend management tools that include:

- Instant provisioning of virtual and physical cards for their employees and expense line items.

- Real-time tracking of transactions by class and category.

- Advanced spend controls including spend limits, merchant category codes, and auto-lock dates, reducing risk and ensuring that their teams always stay within budget.

“We believe blockchain technology and cryptocurrency is the future of finance, and we’re excited to help businesses participate and grow in the digital economy with DeFi Corporate Card,” said Jeremy Almond, CEO and co-founder of Paystand. “By giving businesses a next-gen spend management product that solves everyday pain points and gives them exposure to crypto in the form of rewards, we enable them to participate in the open financial network and benefit from greater control over their finances.”

"We're excited to be using a forward-thinking corporate card like DeFi Card," said Haydn Brill, CEO of Brill & Associates. "Using DeFi Card is a way for us to learn about cryptocurrency without having to figure out buying it ourselves. We get to learn in a low-risk atmosphere while earning rewards."

To learn more about Paystand and DeFi Corporate Card, or to apply, visit here.

Media file link

About Paystand

Paystand is on a mission to create an open and equitable commercial finance system, starting with a zero-fee network for B2B DeFi payments. Using blockchain and cloud technology, Paystand makes it possible to digitize receivables, automate processing, reduce time-to-cash, eliminate transaction fees, and enable new revenue. In August of 2021, Paystand was named to the Inc. 5000 List for the second year in a row. Paystand has raised $86 million and was named to the CB Insights Fintech 250 as one of the world's most promising privately held fintechs. For more information about Paystand, visit us at paystand.com. Follow our blog, and connect with us on Twitter and LinkedIn.