BOSTON--(BUSINESS WIRE)--To mark the start of Women’s History Month and celebrate financial wins, Fidelity Investments® today shared the results of its 2022 Money Moves Study revealing three saving and investing behaviors that stand out among younger women, ages 18-35 years old, as this next generation makes strides in breaking down financial boundaries:

- Start Early – On average, the next generation of women (18-35 years old) started investing in a brokerage account at age 21, compared to age 30 for older women1 who started to invest during the same age frame.

- Invest With Purpose – When asked what they are most proud of in respect to their finances, women report events that have personal meaning and purpose: achieving important goals for themselves or family, using money to make a difference or leaving a legacy for their children. While this is evident among all women, it’s higher among the younger generation (43% versus 34%).

- Start Small – More than one-third (35%) of younger women say they started investing with a small amount of money to get comfortable first. This is consistent across generations, and Fidelity makes it even easier, offering zero minimums to start investing, zero commission trades and the ability to place a trade with as little as $1.

“Women's History Month is a time to celebrate the achievements of women including the powerful money moves women have been making – especially during the last two years of unpredictable events and extraordinary pressure,” said Lorna Kapusta, Head of Women Investors & Customer Engagement, Fidelity Investments. “We continue to see more women than ever investing outside of retirement accounts – in fact, our research shows more than two-thirds are doing so – and that momentum is being driven by the next generation who is redefining what it means to ‘invest like a woman.’ That means starting early, starting small, and staying focused on goals that align with what’s important to them.”

Seize the Moment, Start Early

Beyond opening a brokerage account by age 21, Fidelity’s Money Moves Study shows that younger women also opened a retirement account even earlier, age 20, compared to their older peers who opened one at age 34. No surprise, the pandemic has caused many people to reevaluate their finances and in the case for some younger women, this was the time to start investing with 50% reporting they have started to invest in the past six months, or they plan to do so in the next six months. Meanwhile, when women age 36+ reflect on their biggest financial mistakes, more than one-third (36%) say they waited too long to start saving for retirement -- the most common regret cited.

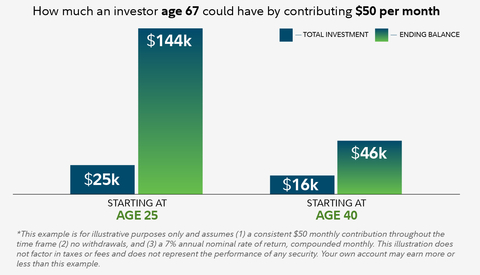

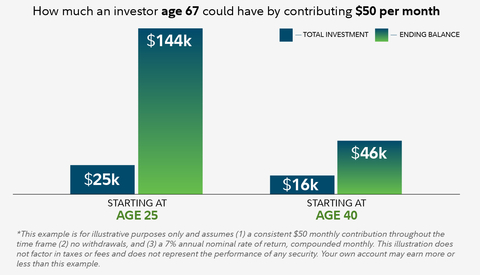

The earlier a person starts to invest, the more time compounding can make an impact on the balance. For instance, compare a person starting to invest at age 25 to a person starting at age 40. With each person contributing $50 per month, by age 67, the person who started earlier will have accumulated approximately $144,000 compared to the person starting 15 years later with $46,000, assuming a hypothetical 7% annual rate of return.

Align Money to Values, Invest with Purpose

Younger women (43%) more so than women ages 36+ (34%) are proud of the actions they are taking that will better the future, whether making a difference at large, or helping themselves and their families. Fidelity’s customer data shows women are directing a higher portion of their contributions into sustainable investment products, aligning their investments to themes shaped by environmental, social or governance factors.

Furthermore, women have been more likely to invest in Fidelity Women’s Leadership Fund and ETF (FWOMX, FDWM), which are actively managed funds investing in companies that prioritize and advance women's leadership. In fact, of the funds’ total investors, two-thirds are women2.

Every Dollar Counts, Start Small

Gone are the days when a person needed thousands of dollars to start investing. In fact, 46% of all study respondents say any amount of money is OK to begin investing, the important thing is to start. Fidelity’s retail investing accounts have zero minimum balance requirements, and someone can invest with as little as $1 thanks to dollar-based investing, which means purchasing a fraction of a share or exchange-traded fund (ETF).

Dollar-based investing makes it more affordable to start investing and more accessible for everyone. Fidelity’s retail business is seeing the same traction among younger customers who want to start small. For customers who have less than $1,000 in their Fidelity accounts, those who are 18-35 years old are three times as likely to have used dollar-based investing in 2021 when compared to older customers.3

Moving Past the Barriers That Hold Back Women Investors

Fidelity recently conducted research into the impact of the pandemic has had on women’s total well-being. Particularly for women with caregiving responsibilities, they are feeling overworked and overwhelmed, causing many to step away from the workforce. For many, a career break or job change may also mean an interruption in saving and investing for retirement or other financial goals.

According to Fidelity’s 2022 Money Moves Study, 30% of women report upcoming transition in their careers -- whether changing jobs, re-entering the workforce or leaving the workforce -- in the next six months, meaning future change is imminent for some. Additionally, 58% of all women report that pandemic is influencing the way they think about money and make financial decisions.

While we’ve seen such encouraging progress, there are still other factors holding back the next generation of women from investing more money:

- They can’t afford it (26%)

- They think investing is risky (20%)

- They think their savings account is the best place to keep their money (20%)

“We’re amid a major shift where more women are talking about money and investing – it’s getting less and less taboo, especially among this younger generation,” added Kapusta. “More female influencers are sharing their financial experiences and tips on social media; more circles of women are talking money and goals with their friends; and our recent study even finds one-in-three young women agree that their parents talked to them about the importance of investing for their futures when they were young. Fidelity is here to help women build on this momentum as we strive to create a community to learn, talk and be heard, while we continue to eliminate the gender investing gap.”

Join Fidelity This Women’s History Month for Weekly Events Highlighting Smart Money Moves

Throughout the month of March, Fidelity is bringing together special guests, including Tori Dunlap (Her First $100K), Erin Lowry (Broke Millennial), Cate Luzio (Luminary), Farnoosh Torabi (Editor at Large CNET and So Money) and Claire Wasserman (Ladies Get Paid), with Fidelity experts and a community of women to get to the real talk about money. The events will cover key issues women tell Fidelity they are facing – from addressing the gender wealth gap, to developing a financial plan, and investing in their careers – the month-long pop-up series has a session for women at all stages of their financial journeys.

Here’s a snapshot of the schedule, and please visit Fidelity.com/investlikeawoman to register for the free learning sessions, view more details about the events, and read speaker bios.

- Week One - Tuesday, March 8 (1:00pm ET): Money Moves to Supercharge Financial Wellness and Close the Gender Wealth Gap

- Week Two - Wednesday, March 16 (1:00pm ET): Money Moves and Healthy Habits to Raise Your Investing Game

-

Week Three – Choose Your Workshop Events

- Monday, March 21 (12:00pm & 4:00pm ET): Steps to Making Your Money Work Harder

- Tuesday, March 22 (12:00pm & 4:00pm ET): Take Your Investing to the Next Level

- Wednesday, March 23 (12:00pm & 4:00pm ET): Build Your Financial Planning Playbook

- Wednesday, March 23 (2:00pm): Taking Stock – Making the Most of Stock Compensation

- Thursday, March 24 (12:00pm): Investing for Good – What is ESG?

- Friday, March 25 (12:00pm): Planning for the retire you dream of

- Week Four - Thursday, March 31 (1:00pm ET): Money Moves to Maximize Your Biggest Investment: Your Career

Fidelity’s Year-Round Resources Helping Women Make Money Moves

- Women Talk Money is a community – created by women, for women – dedicated to closing the gender wealth gap. Each month, on the 2nd Wednesday at 2:00pm ET, Fidelity hosts a virtual Q&A session to normalize talking about money and lead conversations about breaking financial boundaries. This online resource center provides practical ‘what you need to know’ education about different aspects of investing, as well as steps to take to get started, and how to give a portfolio a regular check-up. Visit www.fidelity.com/women

- For those focused on a specific financial goal, Fidelity Spire is a mobile app designed to help users save, plan, and invest for their short- and long-term goals. They can link an account and track financial progress toward a specific goal and see financial tips along the way.

- Everyone has questions, so don’t hold back from asking. Fidelity representatives are available at no cost to answer questions 24/7 at 1-800-FIDELITY, or online at Fidelity.com.

- With a commitment to the next generation of customers, Fidelity understands it can be intimidating not knowing how to get started. There’s plenty of free resources, digital tools, newsletters and educational content that breaks down the basics.

- Fidelity’s Life Events hub, an online experience designed to help plan for and manage major life milestones. This includes a robust library of checklists and other guidance for more than three dozen different life events including managing a job change, caring for aging loved ones, experiencing divorce and losing a loved one.

About Fidelity’s 2022 Money Moves Study

This study presents the findings of a national online survey, among 2,015 adults, 18 years of age and older who own a listed investment account other than checking/savings. Interviewing was conducted December 16-27, 2021 by ENGINE Insights, which is not affiliated with Fidelity Investments. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study. The theoretical sampling error for all respondents is +/- 2.1 % at 95% confidence. Fidelity was not identified as the sponsor of this study.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $11.8 trillion, including discretionary assets of $4.5 trillion as of December 31, 2021, we focus on meeting the unique needs of a diverse set of customers. Privately held for 75 years, Fidelity employs more than 57,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Before investing in any mutual fund or exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus, an offering circular, or, if available, a summary prospectus containing this information. Read it carefully.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Application of FMR's ESG ratings process and/or its sustainable investing exclusion criteria may affect the fund's exposure to certain issuers, sectors, regions, and countries and may affect the fund's performance depending on whether certain investments are in or out of favor. This process may result in the fund forgoing opportunities to buy certain securities when it might otherwise be advantageous to do so, or selling securities for ESG reasons when it might be otherwise disadvantageous for it to do so. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks. The Adviser's applications of the fund's strategy criteria may not achieve its intended results and the fund could underperform the market as a whole.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Zero account fees and minimums are available for retail brokerage accounts only. Expenses charged by investments, (e.g., funds and managed accounts, and certain HSAs) and commissions, interest charges, or other expenses for transactions may still apply. All Fidelity funds that previously required investment minimums of $10k or less, and in stock and bond index fund classes that previously had minimums of $100 million or less, now have zero minimums. See the fund's prospectus and [Fidelity.com/commissions](https://www.fidelity.com/trading/commissions-margin-rates) for further details.

Exchange-traded products (ETPs) are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, foreign securities, commodities, and fixed income investments. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets. ETPs that target a small universe of securities, such as a specific region or market sector, are generally subject to greater market volatility, as well as to the specific risks associated with that sector, region, or other focus. ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. The return of an index ETP is usually different from that of the index it tracks because of fees, expenses, and tracking error. An ETP may trade at a premium or discount to its net asset value (NAV) (or indicative value in the case of exchange-traded notes). The degree of liquidity can vary significantly from one ETP to another and losses may be magnified if no liquid market exists for the ETP's shares when attempting to sell them. Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions.

Fractional share quantities can be entered out to 3 decimal places (.001) as long as the value of the order is at least $1.00. Dollar-based trades can be entered out to 2 decimal places (e.g. $250.00).

Fidelity Investments and Fidelity are registered service marks of FMR LLC.

The third-party trademarks and service marks appearing herein are the property of their respective owners.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

245 Summer Street, Boston, MA 02110

1016819.1.0

©2022 FMR LLC. All rights reserved.

1 Women 36 years and older surveyed in Fidelity’s 2022 Money Moves Study

2 As of 1/1/2022, individuals with more than $0 invested in the Fidelity Women’s Leadership Fund and ETF

3 Fidelity retail customers who are 36 years and older and have less than $1,000 in total retail assets and have made a fractional share trade from January – December 2021