EML Reports Record GDV Of $31.6BN And Revenues Of $114.4M For The First Half Of FY22

EML Reports Record GDV Of $31.6BN And Revenues Of $114.4M For The First Half Of FY22

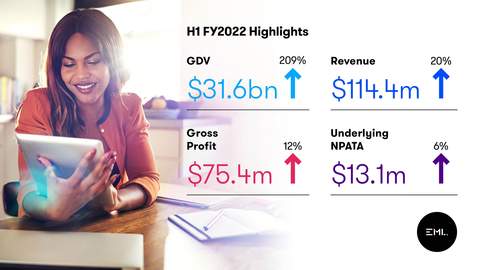

- Group Gross Debit Volume of $31.6 billion, up 209% on PCP;

- Group Revenue1 of $114.4 million, up 20% on PCP;

- Group Underlying EBITDA2 of $26.9 million, down 4% on PCP;

- Group Underlying NPATA of $13.1 million, up 6% on PCP;

- Underlying operating cash inflows of $14.7 million, down 58% on PCP due to timing of two customer receipts into H2; and

- FY22 Reaffirmed Underlying EBITDA Guidance Range of $58.0 million - $65.0 million.

BRISBANE, Australia.--(BUSINESS WIRE)--EML Payments Limited (ASX: EML) is pleased to release its FY22 Interim Report.

Highlights for the six months ended 31 December 2021 include:

Gross Debit Volume (‘GDV’) of $31.6 billion, up 209% on PCP

GDV represents the debit volume processed by the Group through its proprietary processing platforms. The first six months of FY22 delivered a record result, with GDV growing 209% on the prior comparative period (‘PCP’) to $31.6 billion. While this volume translates to revenues at different rates depending on the segment, GDV indicates demand for payment services. In the period, the company saw both organic growth in all segments alongside acquisition growth as it consolidated the Sentenial Group into the Digital Payments segment from 1 October.

GDV from the General Purpose Reloadable (‘GPR’) segment demonstrated strong organic growth, up 29% to finish on $6.3 billion. Strong performance in the gaming, Salary-as-a-Service and government verticals drove the segment result.

The Gift & Incentive (‘G&I’) segment saw a significant recovery from the impacts of COVID-19 in the prior year with record first half GDV. In December, the segment remained impacted by social distancing restrictions introduced in Canada, Germany and the U.K. in response to the Omicron variant. GDV was up 21% on the prior year, with mall volume up 26%. Reward and incentive programs grew 4% on the PCP with tougher comparatives as the prior period benefited from non-recurring COVID-19 programs.

In the Digital Payments (‘DP’) segment, GDV increased by 431% to $24.4 billion, with the acquisition of Sentenial contributing 80% of the total volume. The Sentenial GDV was consolidated into the Group from 30 September 2021 and will continue to provide growth into FY2022 as it contributes for a full six months. Organic GDV growth in the segment was 7% on the prior year.

Revenue of $114.4 million, up 20% on PCP

The Group achieved record revenue of $114.4 million, which is growth of 20% on the PCP. Group Revenue yield is driven by segment mix and moved to 36 bps as the company consolidated the Sentenial Group from 30 September 2021.

GPR revenue represented 61% of Group revenues in the first half. The GPR segment supports customers in multiple industry verticals, including digital banking, government and payroll programs, which have proved resilient in challenging conditions. GPR segment revenue grew organically by 28% to $69.6 million, with the segment revenue yield flat at 111 bps.

Revenue in the G&I segment increased by 6% over the PCP, with improved volumes in the FY22 year. These were offset by the higher breakage rates due to COVID-19 seen in the prior year. Restrictions in Germany, Canada and the U.K. from December meant volumes for the mall vertical were lower than expected. Revenue yield of 408 bps (PCP: 466 bps) was impacted by the timing of revenue recognition with $4.2 million to be recognized in H2 FY22 under AASB15 compared to $3.8 million carried into H2 FY21.

The DP segment increased revenue through the acquisition of Sentenial to $7.7 million, up 33% on PCP. The DP segment generated 7% of Group revenues and is strategically important with the Open Banking product, Nuapay, expected to demonstrate a strong growth profile over the next 10 years. GDV converted to revenue at a revenue yield of 3 bps, down on 13 bps in the prior year due to the consolidation of Sentenial’s acquired legacy direct debit volumes, which convert at under 1 bps.

Gross profit margins of 66%, down 5% over PCP

The Group generated a gross profit margin of 66%, down 5% on the PCP.

As previously guided, the company saw margins impacted by lower interest revenue with historic low central bank rates in all key markets. In H1 FY22, the company generated $0.6m of net interest revenue, down $2.7m on H1 FY21 and an impact on Group margins of approximately 2.4%. In December 2021 and February 2022, the Bank of England raised the cash rate target by 40 bps, which will have an immediate benefit to Group earnings in H2FY22. The company expects to see further interest rate rises in many of its key markets in future periods.

The Group gross profit margins were also impacted by a reduction in set-up revenue due to Central Bank of Ireland (‘CBI’) restrictions. It expects to see improving establishment fee revenue in H2 FY22 as new programs gradually launch. This only impacted the European operations of Prepaid Financial Services (‘PFS’) but the size of that business unit translated to a reduction in the overall GPR segment margins.

During the acquisition of PFS, the company predicted synergies from the insourcing of payments processing which impacts Gross Profit Margins by more than $5 million annually. It has worked hard to develop the internal processing platform since acquisition and following the successful launches of the Northern Ireland stimulus (over 1.4 million cards) and its program with the U.K. Home Office. Volumes from two major customers will start to transition in the second half, and it expects at least $3 million of the total savings to be realised in FY23.

Underlying EBITDA $26.9 million, down 4% on PCP

The Group saw strong organic growth in the period, with revenues up 20% on the PCP. However, it invested additional resources into the PFS business to meet the CBI expectations and address their concerns. This led to a significant increase in people, controls and technology overheads in the period. In H1 FY22, underlying overheads increased to $48.5 million, up 24% on the PCP, with PFS accounting for 63% of the increase.

EML operates in a highly regulated industry and making these investments now positions the Group to support continued rapid revenue growth in future periods. Whilst it is at the forefront of the evolving regulatory requirements, it expects all industry participants to face these same challenges.

Group Underlying EBITDA of $26.9 million was down $1.2 million or 4% on the PCP (H1 FY21: $28.1 million) because of the higher overhead costs, lower net interest income (down $2.7 million) and lower European set-up fees (down $2.4 million on PCP).

It has been working on several initiatives over the last 12 – 18 months, which will now benefit H2 FY22, including projects to increase its interest income, reduce scheme costs and introduce new fees on dormant balances.

The Group was impacted by non-recurring costs associated with the CBI remediation project ($2.2 million) and Group proceedings litigation initiated by Shine Lawyers in late December 2021.

On 16 December 2021, Shine Lawyers filed Group proceedings in the Supreme Court of Victoria. The proceedings allege that EML did not comply with its disclosure obligations and engaged in misleading and deceptive conduct regarding disclosure.

The allegations relate to EML's governance arrangements regarding its Irish subsidiary, PFS Card Services (PCSIL), and PCSIL's interaction with the (CBI). EML strongly denies the allegations and denies any liability. EML has engaged highly experienced, and leading class action defence lawyers and will vigorously defend the proceedings.

It is currently premature to determine the impact (if any) of the class action on EML. As class action proceedings can take an extended period to resolve and EML is resolute in its intention to defend, EML has recognised a $10.5 million provision for the likely legal costs that are expected to be incurred in defence of the claims. EML intends to seek an order for security for such costs from the class action Plaintiffs.

Including these non-recurring costs, Group EBITDA was $14.2 million. However, the Group considers the Underlying EBITDA of $26.9 million to better represent the trading performance of the Group.

Underlying Operating Cash Flow of $14.7 million and Cash on hand of $86.2 million

Underlying operating cash flow of $14.7 million was impacted by the delayed receipt of two large customer balances, totalling $8.6 million, of which approximately 75% has already been received in H2.

Statutory operating cash outflows were $39.2 million, including:

- $27.8 million to refund the dormant fees taken from the cardholder asset prior to acquisition, as announced on 30 July 2021,

- $11.0 million of acquisition-related costs paid

- $15.1 million of payments related to amounts accrued or provided in FY21 but paid in H1 FY22.

Cash outflows from investing activities included $55.8 million for the acquisition of Sentenial. The company continued to invest in software development, capitalising $6.6 million of intangible assets, which will generate an economic return in future periods.

During the period, the Group drew down $48.1 million of interest-bearing borrowings to partially fund the acquisition of the Sentenial Group.

EML ended the period with $86.2 million in cash and $30.0 million of Contract Assets (breakage accrual), of which 63% will convert to cash within 12 months. As G&I volumes have improved in FY22 this has led to a working capital outflow into Contract Assets as compared to the inflows seen FY21 as Contract Assets reduced with lower volumes.

Guidance range for FY22

The company reaffirms its Underlying guidance for FY22 as follows:

- Gross Debit Volume between $81 - $88 billion (FY21: $19.7 billion)

- Revenue between $230 million – $250 million (up 18-29% on FY21)

- Gross Profit Margin of ~69% (up 2% on FY21)

- Overheads between $103 million - $112 million (up 34-46% on FY21)

- Underlying EBITDA forecasted between $58 million – $65 million (up 8-21% on FY21)

- Underlying NPATA forecasted between $27 million – $34 million (down 17%- up 5% on FY21)

In providing this range, it has assumed

- The G&I segment will perform in line with seasonally adjusted trends, with no material new impact from COVID-19

- It is implementing opportunities to reduce dormant state balances including through reactivation programs to drive interchange revenue or dormancy fees. Subject to finalisation of this initiative, it expects a new recurring revenue stream and a non-recurring "catch-up".

- It expects to be able to launch new European programs under its CBI licence and does not expect a material impact from the growth directions which have been imposed.

- Overheads are tracking in line with expectations announced at its AGM in November with higher overheads driven by new roles in Europe to address CBI matters, higher insurance costs and higher internal and external audit fees.

Business Development Update

The Group has had a solid half-year in new business and prospect interest as payments becomes an essential embedded technology in digital-focused businesses across the globe.

- The Group celebrates the success of 33 new contracts signed in the prior 6 months and excluding new business from Nuapay (Sentenial Group);

- PFS has been permitted to sign new customers and onboard new programs. As a result, in December, it launched 22 new programs. It expects the establishment of revenues to improve in H2 FY22;

- The Group renewed the partnership with PCS, one of its largest clients and launched PCS’ metal card, PCS X program; and

- The Group pipeline win rate remains at 40%.

The company continues to see an increasing demand across all industries for digital-first payment solutions, with both new and existing customers shifting to this focus. Cadillac Fairview, one of the largest shopping malls, launched a Canadian first digital gift card solution giving shoppers the ability to send and receive gift cards instantly. Banco Sabadell will launch Nomo, a BaaS digital solution helping SMEs with finance and providing customers with an International Bank Account Number (IBAN) and mobile prepaid card to receive, make payments and control expenses. Crosspay, a British cross border payment platform, has an embedded open banking solution to collect real-time account-to-account payments. Flexischools, an online school platform for parents, has launched a pocket money wallet to help children with financial literacy.

As it heads into H2 FY22 and beyond, the company expects to see further growth in digital-first solutions with the introduction of open banking products in Europe and the upcoming launch of a new gaming proposition that couples the latest in open banking technology with the Group’s industry-leading card solutions for sports betting and social gaming providers. Work is underway to integrate the Nuapay business and provide customers with the ability to access the full suite of open banking, accounts and card payments via a single integration.

The Group continued to make good progress on the three-year Accelerator strategy. A few key highlights include launching Seamless, a fully white-label payment portal solution in the U.S., focused on being a digital alternative to paper cheque payments, which still represents approximately 23% of all payment value made in the U.S. The Group successfully completed the first migrations of programs to the new proprietary cloud-based processor ‘TRACE’. During this period, TRACE proved its scalability with the issuance of 1.4 million cards in under four weeks. In H2 FY22, the Group will also complete a data initiative with the consolidation of multiple data warehouses and making data from all regions available from a single location. Heading into HY FY22 the Group is focused on launching two new embedded payment propositions, BNPL and Subscriptions and furthering the development of the product layer on the new platform.

The Group’s two FINLAB investments are going strong, with Interchecks successfully completing a Series B raise in January and being the technology partner behind the new Seamless product launch. Hydrogen went live in July 2021 and by January, announced it has reached 200 card programs on the platform.

About EML Payments

EML provides an innovative payment solutions platform, helping businesses all over the world create awesome customer experiences. Wherever money is in motion, our agile technology can power the payment process, so money can be moved quickly, conveniently and securely. We offer market-leading programme management and highly skilled payments expertise to create customisable feature-rich solutions for businesses, brands and their customers.

Come and explore the many opportunities our platform has to offer by visiting us at: EMLPayments.com

1 Revenue is adjusted for the reduction of $989,000 of non-cash amortisation of the fair value uplift relating to the bond portfolio at the PFS acquisition date.

2 EML generates interest income on Stored Value balances and, as such, is a source of core revenue. Earnings Before Interest, Tax, Depreciation and Amortisation (‘EBITDA’) is used as the most appropriate measure of assessing the performance of the Group. Underlying EBITDA includes R&D tax offset and excludes share-based payments, acquisition costs, foreign exchange gains or losses and non-recurring costs related to the CBI remediation and Shine group proceedings. Underlying EBITDA is reconciled to statutory profit and loss within the FY22 Interim Report.

Contacts

Sarah Bowles, Group Chief Digital Officer

EML Payments Limited (ASX: EML)

sbowles@emlpayments.com

+61 439 730 968

Marie O’Riordan, Global Director of Public Relations

EML Payments Limited (ASX: EML)

marie.oriordan@emlpayments.com / pr@emlpayments.com

+44 207 183 5856 / +353 46 94 2010 9