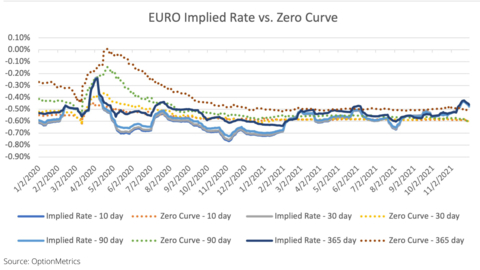

NEW YORK--(BUSINESS WIRE)--OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, is announcing its new options implied methodology, offering even greater accuracy in options calculations in the U.S., Europe, Asia Pacific. OptionMetrics replaces the zero curve (used by other providers) with its implied yield curve, constructed with a term structure of overnight rates and implied risk-free rates from options on major indices, for more accurate implied volatility, forward price, index dividend, and borrow rate calculations.

In leveraging data from index options, OptionMetrics more accurately reflects costs of borrowing and lending in options markets. The methodology reduces implied volatility spreads and offers true volatility and Greek calculations compared to leveraging private bank lending rates or other measures that may include credit risk or unrealistic borrowing assumptions.

Overnight rates, such as SOFR, are also used in the methodology for options expiring in less than 30 days to reduce noise associated with short-dated contracts. As the new standard over LIBOR, SOFR also has nearly zero credit risk exposure.

OptionMetrics constructs term structures of implied rates curves for the:

- Dollar using SOFR (Secured Overnight Financing Rate) and S&P 500 Index options,

- Swiss Franc using SARON (Swiss Average Rate Overnight) and SMI Index options,

- Euro using ESTR (Euro Short-Term Rate) overnight rates and EUROSTOXX 50 options,

- British Pound using SONIA (Sterling Overnight Index Average) and FTSE 100 options,

- Yen using TONAR (Tokyo Overnight Average Rate) and Nikkei 225 options.

OptionMetrics applies a specialized smoothing filter to remove noise from estimates.

“At OptionMetrics, we are committed to ensuring the most accurate options data, Greeks, and implied volatility calculations. Our options implied methodology draws from the options market to more accurately reflect borrowing and lending risks, continuing our strategy to provide the most accurate data to backtest strategies and assess risk,” said OptionMetrics CEO David Hait, Ph.D.

Volatilities are automatically calculated with the new rates across OptionMetrics’ IvyDB US, IvyDB Europe, IvyDB Asia Pacific, and IvyDB Global Indices. No changes are made to table format, file naming, historical calculations.

Email info@optionmetrics.com for more.