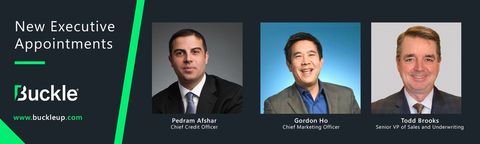

JERSEY CITY, N.J.--(BUSINESS WIRE)--Buckle, the inclusive tech-enabled financial services company, has appointed Pedram Afshar as the company’s new Chief Credit Officer. Pedram was previously Chief Digital and Operating Officer of New York Life Insurance Company with executive credit experience at Capital One and USAA. Buckle also named Gordon Ho as Chief Marketing Officer, bringing more than 30 years of experience driving growth at Princess Cruises, Disney, Hewlett-Packard, Leo Burnett Worldwide, and various startups. Todd Brooks has also joined Buckle as Senior Vice President of Sales and Underwriting. He served Farmers Insurance for 15 years, where he was Chief Underwriting Officer and Head of Distribution and Field Operations.

“Buckle is reimagining financial services for the gig economy and scaling its pioneering, full-stack insurance-as-a-service platform to better serve gig rideshare and delivery drivers across the U.S.,” said Marty Young, co-founder and CEO of Buckle. “We are fortunate to add the expertise of Pedram, Gordon, and Todd to the Buckle leadership team as we execute toward our vision of enabling the rising middle class of gig workers to achieve economic freedom.”

Based in New York City, Pedram has more than 25 years of experience enhancing customer service. He served New York Life Insurance Company for more than five years, was VP, Global Customer Experience Officer at Best Buy, and has held senior roles in customer experience at Capital One and American Century Investments. For nearly a decade, Pedram was Executive Director, Member Experience at USAA where he helped transform the company from a traditional multi-line insurer to a digitally-based customer centric business.

“It’s truly an honor to be in a position and at a company that solely focuses on helping the unsung heroes of our economy, the incredible gig professionals,” said Pedram Afshar. “They have many unmet needs, and they deserve our collective best to solve many of them. No one is better positioned to serve and advocate for this group than Buckle."

Based in Los Angeles, Gordon served as Executive VP of Worldwide Marketing and Content for The Walt Disney Studios $4B Digital and DVD/Blu-ray business, including the creation of the Disney Video Premieres direct-to-video business and Disney’s Movie Rewards loyalty program. As CMO and Head of Sales at Princess Cruises, he helped drive double digit profit through strategic partnerships like Discovery at Sea, e-commerce growth, and content personalization strategies.

Gordon founded Xpertainment.com and currently serves on the Board of CAPE (Coalition of Asian Pacifics in Entertainment) and Ronald McDonald House of Southern California, as well as the advisory boards of Retina, optimizing lifetime value, and OkVera, a personalized medication management tool. Gordon is an adjunct professor at Georgetown (integrated marketing) and USC Marshall (crisis management).

“I’m delighted to join an amazing team at Buckle with the mission of supporting the rapidly growing gig economy workforce,” said Gordon Ho. “Buckle has a great suite of services specifically for rideshare and delivery drivers, and I look forward to helping educate the public about them.”

Todd joined Farmers Insurance more than 30 years ago as a claims adjuster in Springfield, Illinois, advancing through the years to greater responsibility, eventually in commercial underwriting. Most recently, he was Head of Field Operations - Mountain Territory. In 2020, he founded Pradera Financial, a boutique agency representing 19 top rated national and regional insurance carriers. He is based in Denver, Colorado.

“I am excited to now be part of the Buckle team as the company’s new SVP of Sales and Underwriting,” said Todd Brooks. “In my role, I am thrilled to be supporting gig economy rideshare and delivery drivers with full access to affordable financial products and services, including comprehensive auto insurance with both personal and business coverage in one policy.”

Buckle is bringing its gig financial products to the point of sale most preferred by customers, including via agents, digital or embedded. The company has also begun offering automotive financing to its Members and insurance customers, providing a holistic array of financial products and services to enable their economic freedom.

About Buckle

Buckle is the inclusive, digital financial services company serving the rising vital middle class and providers to the gig economy. Using technologies and data sources, Buckle provides insurance and credit products to rideshare and delivery drivers who generally earn less than the average American wage and are subsequently penalized for having poor or no credit. Buckle gig auto insurance is the first insurance policy designed to protect gig drivers with one single affordable policy offering coverage for personal, rideshare, and delivery driving. Unlike traditional insurers who cannot effectively insure gig workers, Buckle provides protection for those driving for leading companies, including Uber, Lyft, DoorDash, GoPuff, Instacart, Amazon Flex, Uber Eats, Grubhub, Favor, and others. Connect with Buckle on Facebook, Twitter and LinkedIn. Visit www.buckleup.com.