DALLAS--(BUSINESS WIRE)--Texas Pacific Land Corporation (NYSE: TPL) (“TPL Corporation” or the “Company”) today sent a letter to stockholders from the Board of Directors (the “Board”) discussing the proposals on the ballot for the Annual Meeting of Stockholders (the “Annual Meeting”) on December 29, 2021.

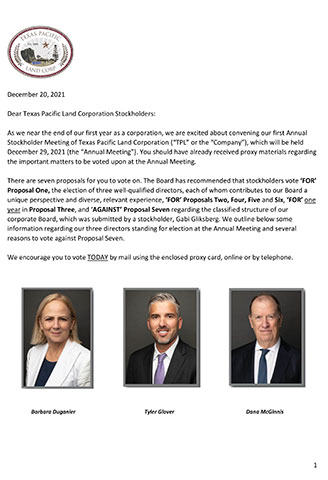

In the letter, the Board urges stockholders to vote TODAY ‘FOR’ Proposal One, the election of three well-qualified directors – Barbara Duganier, Tyler Glover and Dana McGinnis – each of whom contributes to the Board a unique perspective and diverse, relevant experience. The Board also recommends that stockholders vote ‘FOR’ Proposals Two, Four, Five and Six, ‘FOR’ one year in Proposal Three, and ‘AGAINST’ Proposal Seven regarding the classified structure of the Company’s Board.

Highlights from the letter include:

- A snapshot of relevant experience and qualifications of the three directors up for election;

- Important context regarding the Company’s classified board structure and the Board’s Nominating and Corporate Governance Committee plans to begin the process of evaluating the declassification of the Board in 2022; and

- An overview of the Company’s concerns regarding Gabi Gliksberg, the stockholder behind Proposal Seven, who seems intent on a path of litigation and disruption that cannot possibly benefit the Company, its business or stockholders.

Please review the attached letter to stockholders, which will also be filed with the United States Securities and Exchange Commission (“SEC”) and mailed to stockholders ahead of the Annual Meeting. Stockholders who have questions or who need assistance in voting their shares should contact the Company’s proxy solicitor, MacKenzie Partners, at (212) 929-5500 or Toll-Free (800) 322-2885.

About TPL

Texas Pacific Land Corporation is one of the largest landowners in the State of Texas with approximately 880,000 acres of land in West Texas, with the majority of its ownership concentrated in the Permian Basin. The Company is not an oil and gas producer, but its surface and royalty ownership allow revenue generation through the entire value chain of oil and gas development, including through fixed fee payments for use of our land, revenue for sales of materials (caliche) used in the construction of infrastructure, providing sourced water and treated produced water, revenue from our oil and gas royalty interests, and revenues related to saltwater disposal on our land. The Company also generates revenue from pipeline, power line and utility easements, commercial leases and seismic and temporary permits related to a variety of land uses including midstream infrastructure projects and hydrocarbon processing facilities.

Additional Information

In connection with the 2021 Annual Meeting, the Company filed a definitive proxy statement with the SEC on October 4, 2021, an Amendment No. 1 to the definitive proxy statement with the SEC on October 22, 2021, and a revised definitive proxy statement with the SEC on December 7, 2021. The definitive proxy statement, Amendment No. 1, and the revised definitive proxy statement, as well as the form of proxy, have been made available to the Company’s stockholders. Stockholders are urged to read the definitive proxy statement, as amended and revised, and any other documents filed by the Company with the SEC in connection with the 2021 Annual Meeting because they contain important information. Stockholders are able to obtain, for free, copies of documents filed with the SEC at the SEC’s website at http://www.sec.gov.