TORONTO--(BUSINESS WIRE)--Givex Information Technology Group Ltd. (formerly County Capital 2 Ltd.) (the "Corporation") (TSX:GIVX), following its listing on the Toronto Stock Exchange upon the completion of the acquisition of Givex Corporation (“Prior Givex” and collectively with the Corporation “Givex”), is pleased to announce Prior Givex’s financial results for the third quarter ending September 30, 2021.

Givex reports in Canadian dollars and in accordance with International Financial Reporting Standards (“IFRS”).

"Our strong third quarter results are a result of the dedication and hard work of everyone in the company,” said Don Gray, CEO of Givex. “We were able to significantly increase our revenue, gross transaction volumes and number of customer locations despite the impact of COVID-19 on the global retail and restaurant industries, further demonstrating the demand for our solutions,” he added.

Third Quarter Financial Highlights and Recent Events

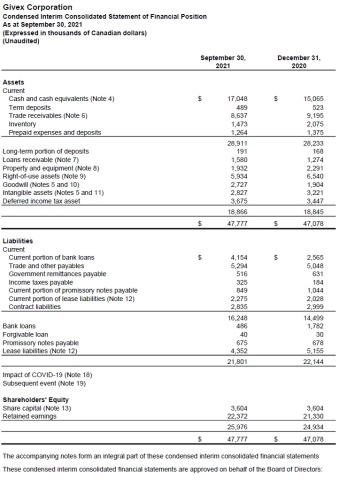

- Revenue grew 33% to $14.6 million compared to Prior Givex’s three-month period ending September 30, 2020

- Revenue for the nine-month period ending September 30, 2021, grew 12% to $40 million compared to Prior Givex’s nine-month period ending September 30, 2020

- Gross Transaction Volume** increased 21% to $1.1 billion compared to Prior Givex’s three-month period ending September 30, 2020

- Gross Transaction Volume increased 16% to $3.6 billion compared to Prior Givex’s nine-month period ending September 30, 2020

- Customer Locations*** expanded to approximately 96,000 globally, an increase of 4,000 since September 30, 2020

- Adjusted EBITDA grew 55% to $2.7 million compared to Prior Givex’s three-month period ending September 30, 2020

Third Quarter Operational Highlights and Recent Events

- The Corporation acquired all issued and outstanding securities of Prior Givex and completed a direct listing on the Toronto Stock Exchange by ways of a qualifying transaction through the facilities of the TSX Venture Exchange in less than three months from announcement

- Completed an upsized $22 million private placement which more than doubled the initial proposed $10 million offering

- Givex launched GivexPay, an integrated payment processing solution, enabling users to facilitate payments with end customers

- Barburrito, a Canadian-based quick service restaurant chain, completed its installation of GivexPOS, Online ordering, Gift Cards and Loyalty in all of its 170 locations

- GivexPOS locations increased to 1,151 in Q3 2021 from 832 in Q3 2020, an increase of 38%

About Givex

Givex (TSX:GIVX) is a fintech company with a 20-year track record of sustainable, profitable growth that developed and commercialized a cloud-based, omnichannel technology platform seamlessly integrating gift and loyalty programs, point-of-sale systems and flexible payment services, to enterprise-level retail and hospitality merchants across the globe. With clients including some of the world's largest brands, Givex's platform is currently deployed in approximately 96,000 client locations across 70 countries.

Visit givex.com for more information.

Non-IFRS Measures and Reconciliation of Non-IFRS Measures

The information presented includes certain financial measures such as “Adjusted EBITDA” (see below for definition), which are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations from management’s perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS. These non-IFRS measures are used to provide investors with supplemental measures of our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS measures. We also believe that securities analysts, investors, and other interested parties frequently use non-IFRS measures in the evaluation of issuers. Our management also uses non-IFRS measures in order to facilitate operating performance comparisons from period to period, to prepare annual operating budgets and forecasts and to determine components of management compensation.

Forward-Looking Statements

This press release contains forward-looking information. Forward-looking information is necessarily based on a number of opinions, estimates and assumptions that we considered appropriate and reasonable as of the date such statements are made, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including but not limited to, the risk factors described under the “Risk Factors” section in the Corporation’s Filing Statement dated November 14, 2021, available on SEDAR at sedar.com and other filings with the Canadian securities regulatory authorities. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, prospective investors should not place undue reliance on forward-looking information, which speaks only as of the date made. See “Cautionary Note Regarding Forward-Looking Information” in the Filing Statement.

Additional Notes

*Adjusted EBITDA is defined as net loss excluding interest, taxes, depreciation and amortization, or EBITDA, as adjusted for stock-based compensation and related expenses, compensation expenses relating to acquisitions completed, foreign exchange gains and losses and transaction-related expenses.

**Gross Transaction Volume (or “GTV”) means the total dollar value of stored and point-of-sale (or “POS”) transactions processed through our cloud-based SaaS platforms in the period, net of refunds, inclusive of shipping and handling, duty and value-added taxes. We believe GTV is an indicator of the success of our customers and the strength of our platforms. GTV does not represent revenue earned by us.

***Customer Locations means a billing customer location for which the term of services has not ended, or with which we are negotiating a renewal contract, and for which the location performed at least one transaction during the period. A single unique customer can have multiple Customer Locations including physical and eCommerce sites. We believe that our ability to increase the number of Customer Locations served by our platforms is an indicator of our success in terms of market penetration and growth of our business.

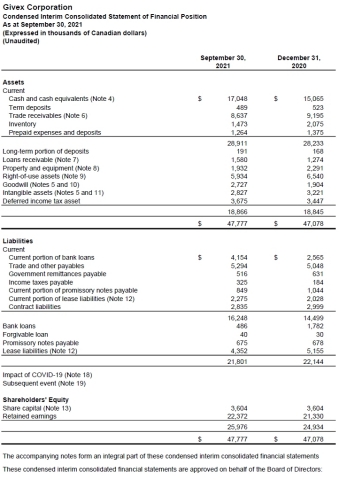

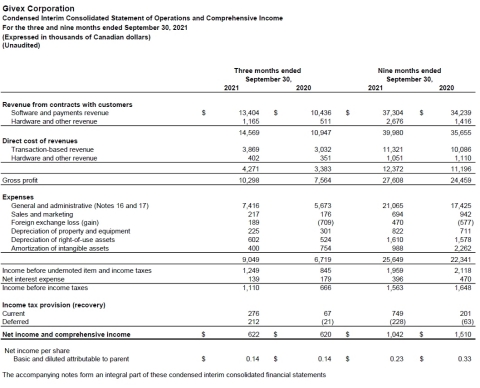

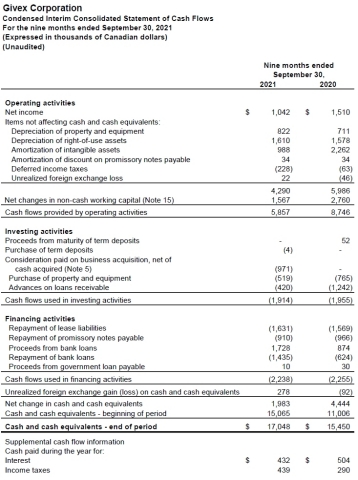

Additional Financial Information

Prior Givex’s unaudited Condensed Interim Consolidated Financial Statements for the three and nine months ended September 30, 2021, and accompanying notes, and Management's Discussion and Analysis dated December 3, 2021 for the three and nine months ended September 30, 2021, are available on the Corporation’s SEDAR at sedar.com.