CHICAGO--(BUSINESS WIRE)--Top-performing real estate investment manager Origin Investments sees investments in Qualified Opportunity Zone funds surging as the December 31 deadline approaches for contributions that can qualify for a 10% reduction on deferred capital gains taxes. To meet demand, the firm launched its Qualified Opportunity Zone Fund II in October after its highly successful inaugural QOZ Fund I closed. Fund II already has six multifamily developments in its pipeline.

“Investor appetite in opportunity zones has accelerated significantly this year for many reasons, but the biggest wave is about to come as the bonus tax reduction on deferred capital gains comes to an end on December 31,” Origin Co-CEO Michael Episcope said. “Unlike other private real estate firms that are still searching for attractive QOZ investment opportunities, we have $700 million worth of projects in our pipeline right now that represent some of the best development sites in the country.”

Since the 2017 Tax Cuts and Jobs Act created the opportunity zone program, QOZ funds have become an attractive option to investors who wish to defer the tax on their gains. The dollars substantiate this point: QOZ Funds raised $17.52 billion through Q2 2021, an increase of 15.5% over the total reported during all of 2020, according to Novogradac, a national certified public accounting firm that specializes in real estate tax credits, among other things.

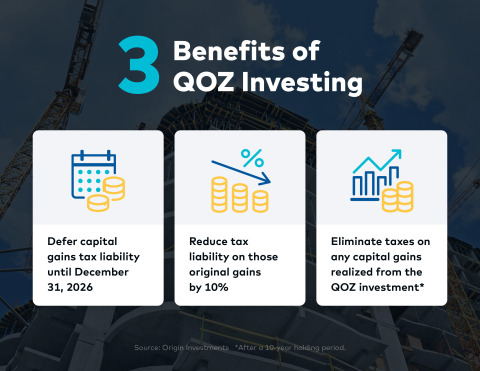

3 Benefits of QOZ Investing Though December 31, 2021

By investing capital gains on or before December 31, 2021 in a QOZ fund, investors can take advantage of three benefits: their capital gains tax liability can be deferred until December 31, 2026; they can reduce tax liability on those original gains by 10%; and they can eliminate taxes on any capital gains realized from the QOZ investment after a 10-year holding period. Some examples of assets that can be sold and the proceeds reinvested in a QOZ fund are stocks, real estate, a private business, precious metals, cryptocurrencies and art.

“Investments in QOZ offerings can be made after December 31 but will not meet the five-year hold requirement prior to December 31, 2026, which is necessary to receive the 10% reduction in their capital gains tax basis,” Origin General Counsel Michael McVickar explained.

Origin QOZ Fund I closed in July 2021 and raised $265 million from more than 800 investors. This level of investment ranked it in the top 2% of the nation’s largest QOZ funds, the Novogradac report concluded. In its QOZ Fund I, Origin currently has 11 multifamily assets totaling about 3,700 units in varying stages of construction with a total value of more than $846 million.

Origin’s QOZ Fund Strategy Has Led to Top Performance

Given the transaction pipeline and reputation Origin has developed since launching its first fund, the firm already has six developments in the QOZ Fund II investment pipeline, with a value of approximately $700 million. Episcope attributes the robust level of activity in Origin’s second QOZ Fund to the activity that was generated looking for deals in its first QOZ Fund. The acquisition team has been active in the QOZ space for more than three years and they see every deal in their target markets.

“From the time we launched QOZ Fund I we have had one goal in mind—to make money for our investment partners. The tax break doesn’t matter if you don’t turn a profit. That’s why we evaluate these opportunities no differently than a deal without the QOZ benefits,” Episcope added.

About Origin Investments: Origin Investments helps high-net-worth investors, family offices and registered investment advisors grow and preserve wealth by providing best-in-class real estate solutions. They are a private real estate manager that builds, buys and lends to multifamily real estate projects in fast-growing markets throughout the U.S. Since its founding in 2007, Origin has executed more than $2.6 billion in real estate transactions and its principals have invested more than $60 million alongside investors. Origin prides itself on offering unparalleled service to investors and its performance ranks the firm in the top decile of the best performing private real estate fund managers ranked globally by Preqin, an independent provider of data on alternative investments. Earlier this year Origin raised $265 million for its QOZ Fund I. The firm is currently accepting new investors for its open IncomePlus, Multifamily Credit and QOZ II Funds. To learn more, visit www.origininvestments.com.