GetCovered.io Raises $7 Million in Series A Funding Led by RET Ventures to Simplify the Insurance Process for Property Managers and Renters

GetCovered.io Raises $7 Million in Series A Funding Led by RET Ventures to Simplify the Insurance Process for Property Managers and Renters

NEW YORK--(BUSINESS WIRE)--GetCovered.io, the insurance software company that makes it simple to buy and track property and casualty insurance online, today announced the completion of its $7 million Series A financing round led by RET Ventures and joined by Updater, Pelican Ventures, and Crocker Mountain. In addition to the capital investment, the round’s strategic investors also offer direct access to more than 6 million rental units and more than 30 million square feet of real estate.

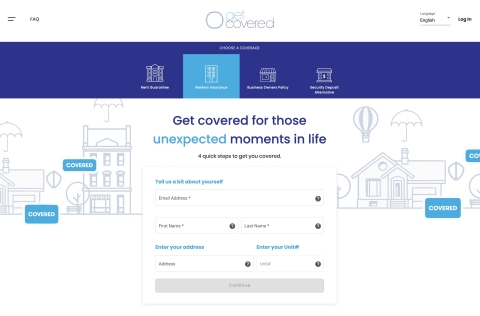

GetCovered works with insurance carriers, agencies, multifamily owner/operators, and proptech companies to ensure that tenants purchase a community’s minimum required policy — for both residential and commercial leases — and tracks policies throughout the term of the lease. GetCovered provides its partners with a customizable frontend for tenants to purchase insurance from A-rated carriers as well as a backend policy admin portal for COI verification, tracking, billing and policy administration.

Founded by Brandon Tobman, Dylan Gaines and Ryan Solomon in 2018, GetCovered was built to bridge the gap between the insurance and real estate sectors.

“By bundling all the relevant insurance products for apartment residents, we’re able to simplify the process for each stakeholder while providing valuable ancillary benefits to landlords, including policy administration and COI tracking,” said GetCovered CEO Brandon Tobman. “In raising this round, we were particularly excited to work with strategic investors like RET Ventures and Updater, who have incredible influence and expertise in the real estate sector. Our mission has been to become the Shopify of Insurance and give the smaller Property Managers and Insurance Agencies access to the same tools the large companies have, and this capital infusion will help turn that vision into a reality.”

GetCovered’s commercial partners include Updater, the largest moving platform in the country, Marsh, NFP, Confie and other major insurance agencies.

“GetCovered’s unique approach to partnership distribution helps them acquire customers much more cost-efficiently than their direct-to-consumer competitors,” said John Helm, Partner of RET Ventures. “Besides its clear value to property managers, the company also has synergies with several of our portfolio companies, which made GetCovered a very compelling investment opportunity for us."

GetCovered helps both agencies and carriers modernize their own technology so they can sell any insurance products online at scale and administer billing and payments to compete with today’s insurtechs. GetCovered counts more than five hundred insurance carriers and agencies as clients.

GetCovered’s API integrates fully with a wide range of property management software, including Yardi Voyager, Onesite, MRI and Entrata, creating further efficiencies for the real estate industry by embedding insurance tracking within their existing processes. The platform also powers several insurance-related proptech companies, including Belong Homes, Obie Risk and Knox Financial.

As part of improving the process of moving, Updater helps its users easily enroll in key services at their new home — including utilities, internet service and insurance. GetCovered and Updater have signed a commercial agreement to help residents more efficiently sign up for the right insurance policies at the appropriate minimum requirements.

"Updater is dedicated to building a more delightful and less stressful moving experience. Providing our users with a seamless experience for setting up insurance at their new home is critical for a great move,” said David Greenberg, Updater’s Founder and CEO. “GetCovered's unique platform will not only benefit millions of Updater users, but also hundreds of our real estate partners, which is why we're thrilled to support GetCovered’s mission."

About GetCovered.io

GetCovered is bringing tenants and landlords a better way to do insurance. The GetCovered software platform is a single portal that streamlines every form of property-related insurance, providing real estate managers and their residents with renters’ insurance, master liability programs, security deposit alternatives and other risk management products. The platform leverages proprietary technology and an easy-to-use interface, as well as partnerships with leading insurance agencies, property managers and proptech firms, to provide a wide range of insurance solutions in just a few clicks, eliminating time and hassle from tenants and landlords.

About RET Ventures

A leading real estate technology investment firm, RET Ventures is the first industry-backed early stage venture fund to strategically focus on helping build cutting-edge “rent tech” — technology for multifamily and single-family rental real estate. RET’s base of Strategic Investors includes some of the largest REITs and private real estate owner-operators and managers, who control approximately 2.4 million apartment units. Through its deep expertise and connections within the industry, RET has created a unique real estate innovation ecosystem that delivers significant value to the companies it backs, providing them with access to thought leaders, development partners and ongoing guidance. For more information, please visit www.ret.vc.

About Updater Technologies

Updater, the US leader in ReloTech, makes moving easier for the millions of American households that relocate every year. Updater streamlines the moving process by serving as a centralized hub where consumers can easily accomplish everything they need such as connecting internet service and transferring utilities, reserving a moving company, updating their address, and much more. Over 1,000 real estate companies have partnered with Updater to deliver a simplified moving experience to their clients. For more information, please visit www.updater.com.

Contacts

Media:

Shlomo Morgulis

Antenna Group

201-465-8007

Shlomo.morgulis@antennagroup.com