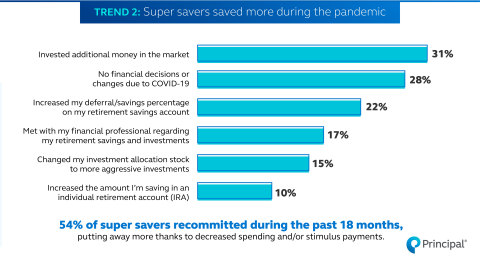

DES MOINES, Iowa--(BUSINESS WIRE)--The COVID-19 pandemic spurred some of the U.S.’s top retirement savers to put away even more money over the past 18 months, according to an annual study released today by Principal Financial Group®.

Among the top retirement “super savers” with Principal® from generations X, Y, and Z, over half (54%) said they saved more than usual over the past 18 months, while 43% saved the same, and only 3% saved less.1 Through strategies such as reducing or eliminating long-term payments on homes and cars, this group reports little debt, 91% have an emergency fund, and more are seeking to attain financial independence earlier in life (10% more than in 2020).

“The past year has presented challenges for all of us. One silver lining is that it seems to have honed the habits and focus of our top retirement savers,” said Sri Reddy, senior vice president, Retirement and Income Solutions at Principal. “Whether it was the pressure of uncertainty, or just their natural tendency to look toward the future, this group managed to save more amid disruptions to both their professional and personal lives.”

Sacrifices and splurges

How did this group of savers improve their retirement outcomes through the pandemic? It wasn’t necessarily through higher earning power. Over half of Principal super savers made less than $100,000 in the past year. Gen Z super savers were particularly focused: nearly 50% made less than $35,000. In most cases, super savers focused on long-term financial sacrifices, not short-term cuts. Their top sacrifices included:

- Driving older vehicles (44%)

- Not traveling as much as they prefer (38%)

- Doing DIY household projects and chores (36%)

- Owning a modest home (35%)

It wasn’t all sacrifice, however. Super savers put discretionary spending most often to home improvement projects, then travel, and then carryout food. Meanwhile, in the coming year the most popular spending option for super savers is “to go on vacation” (57%).

Investment decisions

Nearly all (95%) of super savers invest in a workplace retirement plan, with 64% of those invested in a traditional savings account. About 62% have some or all of their retirement savings in target date funds (TDFs), and 65% believe that target date investment options can help meet their personal retirement goals. In terms of other investments within workplace retirement accounts, super savers are interested in guaranteed future income (66%), exchange-traded funds (ETFs) (53%), and managed accounts (45%).

“Many of our young top savers won’t have pensions to rely on and are concerned about the future of Social Security,” Reddy said. “It’s smart of them to be prioritizing guaranteed income streams for when they reach retirement age.”

A large number (36%) are also interested in environmental, social, and governance (ESG) investment options. More also dipped their toes into the latest investment trends. About 17% invested in non-traditional options such as cryptocurrencies and meme stocks as compared to 11% in 2020. Nearly a quarter (22%) of Gen Z investors used these options.

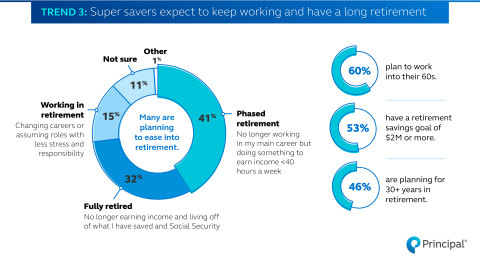

The future of retirement

When super savers think about their retirement, they see themselves taking a phased approach. They still want to work after 65, but in a role outside their main career with fewer hours (41%). That compares to just 32% who plan to retire full-time and 15% who plan to work at full-time jobs, but with less stress and responsibility.

Super saver Erica Leresche, 27, managed to put away 23% of her salary with an eye toward future security. “Savings is non-negotiable,” Leresche said. “Time in the market is on my side and I have options to reduce it later if I need to.”

See more key findings from the study at Building retirement readiness | Principal. You can also hear directly from super savers like Erica at Principal.com.

About the Principal Super Savers Study

The Principal Super Savers study is an online survey conducted by Principal from July 5, 2021–July 12, 2021. Super saver respondents included 1,408 retirement plan participants ages 19-56 with savings behavior of: 61% contributing $17,550+ to their employer sponsored retirement plan in 2020 and 30% deferring 15% or more. Principal conducts periodic “pulse” surveys with customers to gain insight into timely topics. The survey findings reported here explore consumer concerns and actions surrounding saving and planning for retirement, and financial behaviors related to COVID-19.

About Principal Financial Group®

Principal Financial Group® (Nasdaq: PFG) is a global financial company with 18,000 employees[1] passionate about improving the wealth and well-being of people and businesses. In business for more than 140 years, we’re helping more than 45.5 million customers[2] plan, insure, invest, and retire, while working to support the communities where we do business, improve our planet, and build a diverse, inclusive workforce. Principal® is proud to be recognized as one of the World’s Most Ethical Companies[3], a member of the Bloomberg Gender Equality Index, and a Top 10 “Best Places to Work in Money Management[4].” Learn more about Principal and our commitment to sustainability, inclusion, and purpose at Principal.com.

[1] As of June 30, 2021.

[2] As of June 30, 2021.

[3] Ethisphere Institute, 2021.

[4] Pensions & Investments, 2020.

About Target Date Funds: The Retirement Target portfolios, which are target date portfolios, invest in underlying insurance company separate accounts, and mutual funds. Each Retirement Target portfolio is managed toward a particular target (retirement) date, or the approximate date an investor starts withdrawing money. As each Retirement Target portfolio approaches its target date, the investment mix becomes more conservative by increasing exposure to generally more conservative investment options and reducing exposure to typically more aggressive investment options. The asset allocation for each Retirement Target portfolio is regularly re-adjusted within a time frame that extends 15 years beyond the target date, at which point it reaches its most conservative allocation. Retirement Target portfolios assume the value of an investor's account will be withdrawn gradually during retirement. Neither the principal nor the underlying assets of the Retirement Target portfolios are guaranteed at any time, including the target date. Investment risk remains at all times.

This communication is intended to be educational in nature and is not intended to be taken as a recommendation.

Insurance products issued by Principal National Life Insurance Co (except in NY) and Principal Life Insurance Co. Plan administrative services offered by Principal Life. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities offered through Principal Securities, Inc., 800-247-1737, member SIPC and/or independent broker/-dealers. Referenced companies are members of the Principal Financial Group®, Des Moines, Iowa 50392.

1844054-092021

1 Principal super savers put away 15% or more of their income or 90% or more of the IRS maximum.