NEW YORK--(BUSINESS WIRE)--Today, American Express (NYSE: AXP) and Extend, a New York City-based fintech specializing in virtual cards, announced their partnership to expand virtual Card solutions for U.S. businesses. U.S. companies with an eligible American Express Business Card can now enroll and create virtual Cards, also known as tokens, through Extend’s app or desktop login in as little as five minutes using their existing American Express Card account.

“We have seen more and more businesses ramp up their use of virtual Cards since the start of the pandemic as they looked to digitize their payments processes and increase their use of touchless payments,” says Dean Henry, Executive Vice President, Global Commercial Services, American Express. “With today’s announcement, our Business Cards can work even harder for our Card Members through this quick and easy virtual Card option. This gives our Card Members enhanced flexibility and control across their day-to-day business spending, including for B2B purchases and enabling their employees to pay for expenses.”

“Virtual Cards can help solve timely needs for many businesses, from finding a reliable and enhanced way to control expenses to automating payment processes or capturing enriched data,” says Andrew Jamison, CEO, Extend. “This market is rapidly growing as businesses realize just how versatile and effective virtual Cards can be—whether it’s managing subscription payments, equipping employees with secure company cards, or developing custom payment solutions with our APIs.”

Benefits of generating virtual Cards with American Express and Extend

According to the Global Business Spend Indicator1 by American Express, 39% of U.S. businesses surveyed expect to expand their use of virtual Cards over the next 12 months. The ability to create American Express virtual Cards through Extend offers significant benefits for businesses, including:

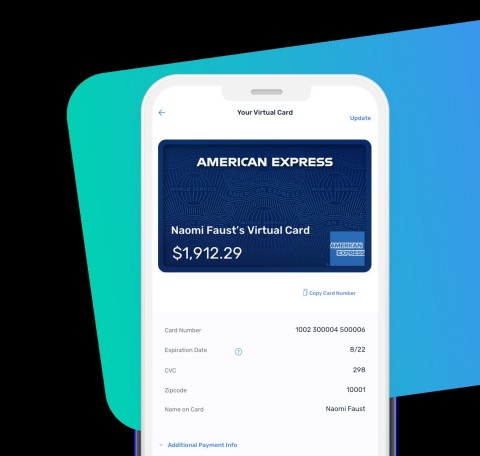

- Quick onboarding: Enroll in as little as five minutes, using an existing American Express Business Card, at no additional cost to Card Members.

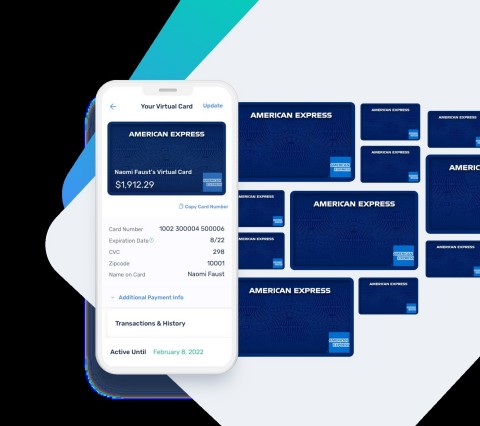

- Flexible and easy to use: Quickly create virtual Cards to track spending on different projects or types of expenses, or to send virtual Cards to employees, contractors, or vendors all within the Extend platform.

- Robust spending controls offered through token technology: Set spending limits, expiration dates, automatic refills, reoccurring payments, merchant category restrictions, and turn Cards on and off as needed.

- Reduced fraud and enhanced security: Achieve an added layer of security through the token technology and eliminate the need to share primary Business Card numbers with anyone.

- Streamlined expense reporting: Categorize expenses and tag virtual Cards and transactions with general ledger codes to automate reconciliation, integrate with expense and reporting software, and reduce time spent on expense reports and reimbursements.

- Rewards of your Card2: Earn the rewards of your Card from the virtual Card payments you make through Extend.

- Automated virtual Card issuing: You can connect directly to Extend’s APIs to automate virtual Card creation without having to log into the Extend app.

Dr. Sarah Roberts, owner of Crabapple Dental, a full-service dental practice in Georgia, is already seeing the benefits of virtual Cards. “Working with American Express and Extend has helped us manage vendor payments using virtual Cards. By setting our own spending limit and expiration date on a virtual Card, we have more control. We also create specific cards for different expenses, which makes it easier to track spending."

American Express and Extend plan to offer additional features and functionality over time, including the ability to add American Express virtual Cards to mobile wallets to make in-store purchases.

Extend is the newest addition to the American Express portfolio of virtual Card solution partnerships; business clients can contact their American Express representative for a range of digital payment offerings.

To learn more about the American Express and Extend partnership or to enroll, visit https://www.paywithextend.com/american-express.

ABOUT AMERICAN EXPRESS

American Express is a globally integrated payments company, providing customers with access to products, insights and experiences that enrich lives and build business success. Learn more at americanexpress.com and connect with us on facebook.com/americanexpress, instagram.com/americanexpress, linkedin.com/company/american-express, twitter.com/americanexpress, and youtube.com/americanexpress. Key links to products, services and corporate responsibility information: charge and credit cards, business credit cards, travel services, gift cards, prepaid cards, merchant services, Accertify, Kabbage, corporate card, business travel, and corporate responsibility.

ABOUT EXTEND

Extend Enterprises Inc provides digital payment infrastructure for trusted financial institutions to enable modern card experiences. Leading banks, businesses, and other innovators can now access the full power of virtual cards for their business, products, and clients. Extend offers several products, including a suite of aggregated virtual card APIs, a digital corporate card app, and an industry-first card tokenization service. Founded in 2017 by industry veterans with decades of experience at Fortune 500 companies, including American Express and Capital One, Extend is headquartered in New York. For more information visit paywithextend.com

Location: U.S.

_______________________________

1 American Express Global Business Spend Indicator

2 Not all Cards are eligible to earn rewards. Terms and limitations vary by Card type.