COSTA MESA, Calif.--(BUSINESS WIRE)--As we end the second summer since the arrival of COVID-19, Experian® today announced key findings from its 12th annual State of Credit report. This year’s report also serves as a launch for Operation HOPE’s all-new HOPE Financial Wellness Index, which will help shine a consistent light on the current state of consumer credit. Despite a challenging year and a half, the new data shows consumers are managing credit well with average credit scores climbing seven points since 2020 to 695 – the highest point in more than 13 years.

According to Experian’s report, many consumers were managing credit well before the pandemic’s arrival and the accommodations afforded by the Coronavirus Aid, Relief and Economic Security (CARES) Act may have helped consumers protect their financial health. At the same time, stay-at-home orders and record savings levels1 may have contributed to lower unsecured and total debt levels, lower credit utilization rates and fewer missed payments.

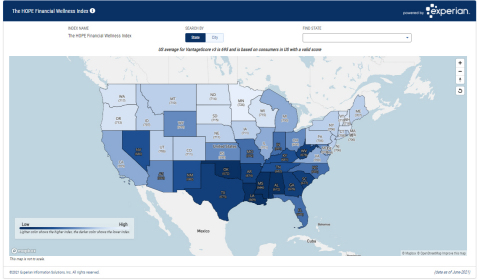

This year, Experian is partnering with Operation HOPE – the nation’s largest nonprofit dedicated to improving financial literacy – to launch the HOPE Financial Wellness Index, which highlights the average credit score in every state and city.

According to the index, consumers in Minnesota have the highest credit scores with an average of 726, followed by Vermont (719), New Hampshire (718), Washington (717) and Massachusetts (716). States with the lowest credit scores were found in the south, including Mississippi (666), Louisiana (669), Alabama (672), Oklahoma (672) and Texas (673).

The HOPE Financial Wellness Index will be updated regularly and will be used to develop programming and identify communities most in need of financial education and resources.

“We believe credit education plays an important role in driving financial inclusion and helping consumers reach their fullest potential,” said Alex Lintner, President Experian Consumer Information Services. “While these findings are positive, we recognize they do not tell the full story and many consumers face financial obstacles due to a limited credit history. We are committed to working with consumers, as well as our partners like Operation HOPE, to improve financial equity and access.”

Given the unique circumstances of 2020, this year’s report compared credit trends over the last three years. While consumers took on more mortgage and auto debt, score improvements were supported by fewer missed payments, lower credit utilization rates and reduced card balances and total debt levels year-over-year and prior to the pandemic’s arrival.

Highlights of Experian’s State of Credit report include:

2021 State of Credit Report |

2019 |

2020 |

2021 |

|||||||

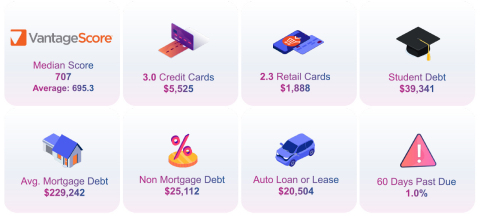

Average VantageScore® 2 |

682 |

688 |

695 |

|||||||

Median VantageScore |

687 |

697 |

707 |

|||||||

Average number of credit cards |

3.0 |

3.0 |

3.0 |

|||||||

Average credit card balance |

$6,494 |

$5,897 |

$5,525 |

|||||||

Average revolving utilization rate |

30% |

26% |

25% |

|||||||

Average number of retail credit cards |

2.50 |

2.42 |

2.33 |

|||||||

Average retail credit card balance |

$1,930 |

$2,044 |

$1,887 |

|||||||

Average nonmortgage debt |

$25,057 |

$25,483 |

$25,112 |

|||||||

Average mortgage debt |

$210,263 |

$215,655 |

$229,242 |

|||||||

Average auto loan or lease debt |

$19,034 |

$19,462 |

$20,505 |

|||||||

Average 30–59 days past due delinquency rates |

3.8% |

2.4% |

2.3% |

|||||||

Average 60–89 days past due delinquency rates |

1.9% |

1.3% |

1.0% |

|||||||

Average 90–180 days past due delinquency rates |

6.6% |

3.8% |

2.5% |

“While consumers on average are managing their credit histories well, we know there are many communities in critical need of more financial education and resources,” said John Hope Bryant, Operation HOPE founder and CEO. “By helping people raise their credit scores, we are empowering them to take advantage of one of our nation’s most democratic tools. From housing and employment to healthcare and education, credit worthiness can be leveraged to improve our overall quality of life. We’re committed to using the HOPE Financial Wellness Index as a force for good in the communities we serve.”

Understanding generational differences

State of Credit also spotlights how each generation is managing their debts, showing scores have improved for every generation year-over-year. This trend is attributed to declining utilization rates and fewer missed payments. Credit utilization rates have declined for nearly every generation since 2019 except Gen Z who saw a slight uptick year-over-year. Similarly, credit card balances decreased for consumers of all age groups except Gen Z who increased their balances by $115 year-over-year.

Across the board, consumers are missing fewer payments, with notable improvements seen among the youngest consumers. Gen Z decreased their 90 – 180 days past due delinquency rate by 29 percent year over year to 1.73 in 2021. This is a 72 percent decrease from the same period in 2019. Millennials also decreased their 90 – 180 days past due delinquency rates to 1.73 percent in 2021, down from 4.4% in 2021 and 10.6 percent in 2019.

Additional 2021 generational findings from Experian’s State of Credit report include:

2021 findings by generation |

Gen Z |

|

|

Gen Y |

|

|

Gen X |

|

|

Boomers |

|

|

Silent |

|||

Average VantageScore® |

660 |

|

|

667 |

|

|

685 |

|

|

724 |

|

|

730 |

|||

Median VantageScore |

674 |

|

|

678 |

|

|

699 |

|

|

755 |

|

|

741 |

|||

Average number of credit cards |

1.7 |

|

|

2.7 |

|

|

3.3 |

|

|

3.4 |

|

|

2.7 |

|||

Average credit card balance |

$2,312 |

|

|

$4,569 |

|

|

$7,236 |

|

|

$6,230 |

|

|

$3,821 |

|||

Average revolving utilization rate |

31% |

|

|

30% |

|

|

30% |

|

|

21% |

|

|

13% |

|||

Average number of retail credit cards |

1.6 |

|

|

2.1 |

|

|

2.5 |

|

|

2.5 |

|

|

2.1 |

|||

Average retail credit card balance |

$1,125 |

|

|

$1,819 |

|

|

$2,214 |

|

|

$1,887 |

|

|

$1,329 |

|||

Average nonmortgage debt |

$12,524 |

|

|

$28,317 |

|

|

$32,898 |

|

|

$24,136 |

|

|

$11,725 |

|||

Average mortgage debt |

$192,276 |

|

|

$255,527 |

|

|

$259,100 |

|

|

$198,203 |

|

|

$163,254 |

|||

Average 30–59 days past due delinquency rates |

2.1% |

|

|

3.1% |

|

|

3.0% |

|

|

1.8% |

|

|

1.1% |

|||

Average 60–89 days past due delinquency rates |

1.0% |

|

|

1.3% |

|

|

1.3% |

|

|

0.8% |

|

|

0.5% |

|||

Average 90–180 days past due delinquency rates |

1.7% |

|

|

3.2% |

|

|

3.4% |

|

|

2.0% |

|

|

1.3% |

A strong credit history and responsible credit management can help consumers save thousands of dollars over a lifetime. For example, a person with a low credit score may pay close to $3,000 more in interest to purchase a $10,000 used car3 and a person with a subprime credit score may pay $241 more per month or $86,503 more over the life of a 30-year fixed-rate mortgage loan than a person with a score of 760 or above4.

“Understanding the information included in your credit report and how it impacts your credit scores is one of the best ways to protect your financial health,” said Rod Griffin, senior director consumer education and advocacy at Experian. “I encourage consumers who are looking to improve or maintain their credit scores to check their credit report regularly and take advantage of the free resources Experian has available to help.”

In addition to the free weekly credit report at annualcreditreport.com, Experian also offers consumers free access to their credit report and ongoing credit monitoring at Experian.com.

Additional credit education resources and tools

- Join Experian’s #creditchat hosted by @Experian on Twitter with financial experts every Wednesday at 3 p.m. Eastern time. Bilingual and Spanish speakers are also invited to join Experian’s monthly #ChatdeCredito hosted on Twitter at 3 p.m. Eastern time beginning September 16.

- Visit the Ask Experian blog for answers to common questions, advice and education about credit.

- Add positive telecom, utility and streaming service payments to your Experian credit report for an opportunity to improve your credit scores by visiting www.experian.com/boost5

- For additional resources, visit http://www.experian.com/consumereducation

Analysis methodology

Experian’s analysis is based on a statistically relevant sampling of Experian’s consumer credit database, available on the Experian Ascend Technology PlatformTM, from Q2 2019, 2020 and 2021. Analyzed credit reports contained no personally identifiable information. Credit scores are based on VantageScore (range 300–850).

About Experian

Experian is the world’s leading global information services company. During life’s big moments — from buying a home or a car to sending a child to college to growing a business by connecting with new customers — we empower consumers and our clients to manage their data with confidence. We help individuals to take financial control and access financial services, businesses to make smarter decisions and thrive, lenders to lend more responsibly, and organizations to prevent identity fraud and crime.

We have 17,800 people operating across 44 countries, and every day we’re investing in new technologies, talented people and innovation to help all our clients maximize every opportunity. We are listed on the London Stock Exchange (EXPN) and are a constituent of the FTSE 100 Index.

Learn more at www.experianplc.com or visit our global content hub at our global news blog for the latest news and insights from the Group.

Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. Other product and company names mentioned herein are the property of their respective owners.

About Operation HOPE

Since 1992, Operation HOPE has been moving America from civil rights to "silver rights'" with the mission of making free enterprise and capitalism work for the underserved—disrupting poverty for millions of low and moderate-income youth and adults across the nation. Through our community uplift model, HOPE Inside, which received the 2016 Innovator of the Year recognition by American Banker magazine, Operation HOPE has served more than 4 million individuals and directed more than $3.2 billion in economic activity into disenfranchised communities—turning check-cashing customers into banking customers, renters and homeowners, small business dreamers into small business owners, minimum wage workers into living wage consumers, and uncertain disaster victims into financially empowered disaster survivors. Project 5117 is our multi-year four-pronged approach to combating economic inequality that aims to improve financial literacy, increase business role models and business internships for youth in underserved communities, and stabilize the American dream by boosting FICO scores. Operation HOPE recently received its seventh consecutive 4-star charity rating for fiscal management and commitment to transparency and accountability by the prestigious non-profit evaluator, Charity Navigator.

For more information: www.OperationHOPE.org. Follow the HOPE conversation on Twitter, Facebook and Instagram.

1 https://www.bea.gov/data/income-saving/personal-saving-rate

2 VantageScore is a registered trademark of VantageScore Solutions, LLC. VantageScore range is 300 to 850.

3 https://www.urban.org/sites/default/files/publication/99021/what_is_the_cost_of_poor_credit_1.pdf

4 https://www.fool.com/the-ascent/banks/articles/heres-how-much-bad-credit-will-really-cost-you/

5 Results may vary. See Experian.com for details