TEMPE, Ariz. & PRAGUE & LONDON--(BUSINESS WIRE)--NortonLifeLock (NASDAQ: NLOK), a global leader in consumer Cyber Safety, and Avast (LSE: AVST), a global leader in digital security and privacy, are pleased to announce that they have reached agreement on the terms of a recommended merger of Avast with NortonLifeLock, in the form of a recommended offer by NortonLifeLock, for the entire issued and to be issued ordinary share capital of Avast.

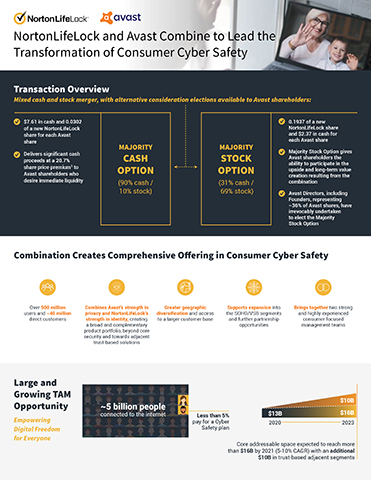

Under the terms of the merger Avast shareholders will be entitled to receive a combination of cash consideration and newly issued shares in NortonLifeLock with alternative consideration elections available. Based on NortonLifeLock’s closing share price of USD 27.20 on July 13, 2021 (being the last trading day for NortonLifeLock shares before market speculation began in relation to the merger on July 14, 2021, resulting in the commencement of the offer period), the merger values Avast’s entire issued and to be issued ordinary share capital between approximately USD 8.1B and USD 8.6B, depending on Avast shareholders’ elections.

The boards of NortonLifeLock and Avast believe that the merger has compelling strategic and financial rationale and represents an attractive opportunity to create a new, industry-leading consumer Cyber Safety business, leveraging the established brands, technology and innovation of both groups to deliver substantial benefits to consumers, shareholders, and other stakeholders.

“This transaction is a huge step forward for consumer Cyber Safety and will ultimately enable us to achieve our vision to protect and empower people to live their digital lives safely,” said Vincent Pilette, Chief Executive Officer of NortonLifeLock. “With this combination, we can strengthen our Cyber Safety platform and make it available to more than 500 million users. We will also have the ability to further accelerate innovation to transform Cyber Safety.”

“At a time when global cyber threats are growing, yet cyber safety penetration remains very low, together with NortonLifeLock, we will be able to accelerate our shared vision of providing holistic cyber protection for consumers around the globe,” said Ondřej Vlček, Chief Executive Officer of Avast. “Our talented teams will have better opportunities to innovate and develop enhanced solutions and services, with improved capabilities from access to superior data insights. Through our well-established brands, greater geographic diversification and access to a larger global user base, the combined businesses will be poised to access the significant growth opportunity that exists worldwide.”

Strategic and Financial Benefits

- Accelerates the transformation of consumer Cyber Safety with over 500 million users;

- Combines Avast’s strength in privacy and NortonLifeLock’s strength in identity, creating a broad and complementary product portfolio, beyond core security and towards adjacent trust-based solutions;

- Strengthens geographic diversification and facilitates expansion into the SOHO / VSB segments;

- Unlocks significant value creation through approximately USD 280 million of annual gross cost synergies1, with additional upside potential from new reinvestment capacity for innovation and growth;

- Brings together two strong and highly experienced consumer-focused management teams.

The Merger will also enhance the financial profile of the combined company through increased scale, long-term growth, cost synergies with reinvestment capacity and strong cash flow generation supported by a resilient balance sheet, and is expected to drive double-digit EPS accretion within the first full year following completion of the Merger and double-digit revenue growth in the long-term.

Organization and Management

Following the completion of the transaction, NortonLifeLock’s CEO, Vincent Pilette, will remain CEO, NortonLifeLock’s CFO, Natalie Derse, will remain CFO, and Avast’s CEO, Ondřej Vlček, is expected to join NortonLifeLock as President and become a member of the NortonLifeLock Board of Directors. In addition, Pavel Baudiš, a co-founder and current director of Avast, is expected to join the NortonLifeLock Board as an independent director.

On completion of the merger, the combined company will be dual headquartered in Prague, Czech Republic, and Tempe, Arizona, USA, and will have a significant presence in the Czech Republic. The combined company will be listed on NASDAQ.

Transaction Details

For specific details of the proposed transaction please visit our transaction microsite.

Conference Call

NortonLifeLock management will discuss the details of this transaction on a conference call today, August 10, 2021 at 2 p.m. PT / 5 p.m. ET.

- Webcast: Investor.NortonLifeLock.com (replay will be posted after the conference call).

- Phone Dial-In: Investor.NortonLifeLock.com to register in advance for call details

Advisors

Evercore is serving as financial advisor to NortonLifeLock and Kirkland & Ellis LLP and Macfarlanes LLP are serving as its legal advisors. UBS and J.P. Morgan Cazenove are serving as financial advisors to Avast and White & Case LLP is serving as its legal advisor.

About NortonLifeLock Inc.

NortonLifeLock Inc. (NASDAQ: NLOK) is a global leader in consumer Cyber Safety, protecting and empowering people to live their digital lives safely. We are the consumer’s trusted ally in an increasingly complex and connected world. Learn more about how we’re transforming Cyber Safety at www.nortonlifelock.com.

About Avast

Avast (LSE:AVST), a FTSE 100 company, is a global leader in digital security and privacy products. With over 435 million users online, Avast offers products under the Avast and AVG brands that protect people from threats on the internet and the evolving IoT threat landscape. The company’s threat detection network is among the most advanced in the world, using machine learning and artificial intelligence technologies to detect and stop threats in real time. Avast digital security products for Mobile, PC or Mac are top-ranked and certified by VB100, AV-Comparatives, AV-Test, SE Labs and others. Avast is a member of Coalition Against Stalkerware, No More Ransom and Internet Watch Foundation. Visit: www.avast.com

No offer or solicitation

The information contained on this press release is not intended to and does not constitute, or form any part of, an offer to sell or the solicitation of an offer to subscribe for an invitation to subscribe for any securities or the solicitation of any vote or approval in any jurisdiction pursuant to the transaction or otherwise, nor shall there be any sale, issuance, subscription or transfer of securities in any jurisdiction in contravention of applicable law or regulation. In particular, this communication is not an offer of securities for sale in the United States. No offer of securities shall be made in the United States absent registration under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or pursuant to an exemption from, or in a transaction not subject to, such registration requirements. Any securities issued in the transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the Securities Act. The transaction will be made solely by means of the scheme document to be published by Avast in due course, or (if applicable) pursuant to an offer document to be published by NortonLifeLock, which (as applicable) would contain the full terms and conditions of the transaction. Any decision in respect of, or other response to, the transaction, should be made only on the basis of the information contained in such document(s). As explained below, if NortonLifeLock ultimately seeks to implement the transaction by way of a takeover offer, that offer will be made in compliance with applicable US laws and regulations.

This press release does not constitute a prospectus or a prospectus exempted document.

Important additional information will be filed with the SEC

In connection with the transaction, NortonLifeLock is expected to file with the U.S. Securities and Exchange Commission (the “SEC”) a proxy statement (the “Proxy Statement”). BEFORE MAKING ANY VOTING DECISION, NORTONLIFELOCK’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT, INCLUDING THE SCHEME DOCUMENT (OR, IF APPLICABLE, THE OFFER DOCUMENT), AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT (IF ANY) CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND THE PARTIES TO THE TRANSACTION . NortonLifeLock’s shareholders and investors will be able to obtain, without charge, a copy of the Proxy Statement, including the scheme document and/or offer document (as referred to above), and other relevant documents filed with the SEC (when available) from the SEC’s website at http://www.sec.gov. NortonLifeLock’s shareholders and investors will also be able to obtain, without charge, a copy of the Proxy Statement, including the scheme document and/or offer document (as referred to above), and other relevant documents (when available) from the Web Page, or by directing a written request to NortonLifeLock (Attention: Investor Relations), or from NortonLifeLock’s website at www.nortonlifelock.com.

Participants in the solicitation

NortonLifeLock and certain of its directors and executive officers and employees may be considered participants in the solicitation of proxies from the stockholders of NortonLifeLock in respect of the transactions contemplated by the scheme document. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the stockholders of NortonLifeLock in connection with the transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set out in the scheme document when it is filed with the SEC. Information regarding NortonLifeLock’s directors and executive officers is contained in NortonLifeLock’s Annual Report on Form 10-K for the fiscal year ended 2 April 2021 filed with the SEC.

Forward-looking Statements

This press release contains certain forward-looking statements with respect to the NortonLifeLock group and the Avast group. These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements often use words such as “anticipate”, “target”, “expect”, “estimate”, “intend”, “plan”, “goal”, “believe”, “aim”, “will”, “may”, “would”, “could” or “should” or other words of similar meaning or the negative thereof. Forward-looking statements include statements relating to the following: (i) future capital expenditures, expenses, revenues, economic performance, financial conditions, dividend policy, losses and future prospects, (ii) business and management strategies and the expansion and growth of the operations of NortonLifeLock or Avast, and (iii) the effects of government regulation on the business of NortonLifeLock or Avast. There are many factors which could cause actual results to differ materially from those expressed or implied in forward-looking statements. Such factors include the possibility that the transaction will not be completed on a timely basis or at all, whether due to the failure to satisfy the conditions of the transaction (including approvals or clearances from regulatory and other agencies and bodies) or otherwise, general business and economic conditions globally, industry trends, competition, changes in government and other regulation, changes in political and economic stability, disruptions in business operations due to reorganisation activities, interest rate and currency fluctuations, the inability of the combined company to realise successfully any anticipated synergy benefits when (and if) the transaction is implemented, the inability of the combined company to integrate successfully NortonLifeLock’s and Avast’s operations when (and if) the transaction is implemented and the combined company incurring and/or experiencing unanticipated costs and/or delays or difficulties relating to the transaction when (and if) it is implemented. Additional information concerning these and other risk factors is contained in the Risk Factors sections of NortonLifeLock’s most recent reports on Form 10-K and Form 10-Q, the contents of which are not incorporated by reference into, nor do they form part of, this press release.

These forward-looking statements are based on numerous assumptions regarding the present and future business strategies of such persons and the environment in which each will operate in the future. By their nature, these forward-looking statements involve known and unknown risks, as well as uncertainties because they relate to events and depend on circumstances that will occur in the future. The factors described in the context of such forward-looking statements in this press release may cause the actual results, performance or achievements of any such person, or industry results and developments, to be materially different from any results, performance or achievements expressed or implied by such forward-looking statements. No assurance can be given that such expectations will prove to have been correct and persons reading this press release are therefore cautioned not to place undue reliance on these forward-looking statements which speak only as at the date of this press release. All subsequent oral or written forward-looking statements attributable to NortonLifeLock or Avast or any persons acting on their behalf are expressly qualified in their entirety by the cautionary statement above. Neither of NortonLifeLock or Avast undertakes any obligation to update publicly or revise forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law, regulation or stock exchange rules.

Dealing and opening position disclosure requirements of the UK City Code on Takeovers and Mergers (the “Code”)

Under Rule 8.3(a) of the Code, any person who is interested in one per cent or more of any class of relevant securities of an offeree company or of any securities exchange offeror (being any offeror other than an offeror in respect of which it has been announced that its offer is, or is likely to be, solely in cash) must make an Opening Position Disclosure following the commencement of an offer period and, if later, following the announcement in which any securities exchange offeror is first identified. An Opening Position Disclosure must contain details of the person’s interests and short positions in, and rights to subscribe for, any relevant securities of each of (i) the offeree company and (ii) any securities exchange offeror(s). An Opening Position Disclosure by a person to whom Rule 8.3(a) applies must be made by no later than 3.30 p.m. (London time) on the 10th Business Day (as defined in the Code) following the commencement of an offer period and, if appropriate, by no later than 3.30 p.m. (London time) on the 10th Business Day (as defined in the Code) following the announcement in which any securities exchange offeror is first identified. Relevant persons who deal in the relevant securities of the offeree company or of a securities exchange offeror prior to the deadline for making an Opening Position Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes, interested in one per cent or more of any class of relevant securities of the offeree company or of any securities exchange offeror must make a Dealing Disclosure if the person deals in any relevant securities of the offeree company or of any securities exchange offeror. A Dealing Disclosure must contain details of the dealing concerned and of the person’s interests and short positions in, and rights to subscribe for, any relevant securities of each of (i) the offeree company and (ii) any securities exchange offeror(s), save to the extent that these details have previously been disclosed under Rule 8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies must be made by no later than 3.30 p.m. (London time) on the Business Day (as defined in the Code) following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or understanding, whether formal or informal, to acquire or control an interest in relevant securities of an offeree company or a securities exchange offeror, they will be deemed to be a single person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree company and by any offeror and Dealing Disclosures must also be made by the offeree company, by any offeror and by any persons acting in concert with any of them (see Rules 8.1, 8.2 and 8.4).

Details of the offeree and offeror companies in respect of whose relevant securities Opening Position Disclosures and Dealing Disclosures must be made can be found in the Disclosure Table on the UK Takeover Panel’s website at www.thetakeoverpanel.org.uk, including details of the number of relevant securities in issue, when the offer period commenced and when any offeror was first identified. You should contact the UK Takeover Panel’s Market Surveillance Unit on +44 (0)20 7638 0129 if you are in any doubt as to whether you are required to make an Opening Position Disclosure or a Dealing Disclosure.

Quantified financial benefit statement

This press release contains statements of estimated cost savings and synergies (together, the “Quantified Financial Benefits Statement”) arising from the proposed acquisition of Avast by NortonLifeLock (the “Merger”).

A copy of the Quantified Financial Benefits Statement is set out below:

“Given the complementary nature of both NortonLifeLock and Avast, the NortonLifeLock Directors believe that the Merger will generate synergies that could not be achieved independently of the Merger and will lead to significant long-term value creation for all shareholders.

Significant recurring cost synergies opportunity

NortonLifeLock anticipates that the Merger will result in recurring annual pre-tax gross cost synergies for the Combined Company to reach a run-rate of approximately USD 280 million, representing between approximately 15% and 20% of combined adjusted cost of sales and operating spend, based on the latest full year reported results for each of NortonLifeLock and Avast. The synergies are expected to be fully realised by the end of the second year following completion of the Merger.

NortonLifeLock intends to approach integration with the aim of retaining and motivating the best talent and structure across the Combined Company to create a best-in-class organisation. The expected sources of the identified cost synergies are as follows:

Organisation: approximately 50% of the total annual run-rate pre-tax gross cost synergies are expected to be generated through the adoption of shared best practice across existing functions and the reduction of duplicate roles across all geographies, and from a broad range of job categories, including management, shared services, product and commercial functions;

Systems & Infrastructure operating costs: approximately 25% of the total annual run-rate pre-tax gross cost synergies are expected to be realised through migration onto a common data and security platform, integration of systems, and shared technology and analytics infrastructure; and

Contracts & Shared Services: approximately 25% of the total annual run-rate pre-tax gross cost synergies are expected to be generated primarily from site rationalisation, procurement and vendor consolidation, and spend de-duplication.

NortonLifeLock expects to realise approximately 60% of the run-rate cost savings by the end of the first full year following completion of the Merger and 100% by the end of the second full year following completion of the Merger, excluding any potential synergy reinvestment and associated benefits. On a reported basis, the synergies assume the Combined Company expects to benefit from approximately USD 75 million of cost savings in the first full year following completion of the Merger, approximately USD 245 million of cost savings in the second full year following completion of the Merger, and the full USD 280 million of the cost savings in the third full year following completion of the Merger, excluding any potential synergy reinvestment and associated benefits.

One-off costs

In order to realise these synergies, NortonLifeLock is expected to incur one-off restructuring and integration costs of approximately one year’s run-rate pre-tax cost savings, or USD 280 million, with approximately USD 180 million estimated to be incurred in the first full year following completion of the Merger and approximately USD 100 million estimated to be incurred in the second full year following completion of the Merger. Aside from integration costs, no material dis-benefits are expected to arise in connection with the Merger. The expected synergies will accrue as a direct result of the Merger and would not be achieved on a standalone basis.

The paragraphs above relating to expected cost synergies constitute a “Quantified Financial Benefits Statement” for the purposes of Rule 28 of the Code.

Given the strong strategic, cultural and operational fit of the two companies, NortonLifeLock believes that the quantified cost synergies are readily achievable.

NortonLifeLock expects to achieve the quantified cost synergies while maintaining appropriate investment levels in sales and technology to meet the Combined Company’s growth targets and other objectives.

The estimated cost synergies referred to above reflect both the beneficial elements and the relevant costs.”

Further information on the bases of belief supporting the Quantified Financial Benefits Statement, including the principal assumptions and sources of information, is set out below.

Bases of belief and principal assumptions

In preparing the Quantified Financial Benefits Statement, a synergy working group comprising senior strategy, operations, technical, sales and financial personnel from NortonLifeLock (the “Working Group”) was established to identify, challenge and quantify the potential synergies available from the integration of the NortonLifeLock and Avast businesses, and to undertake an initial planning exercise.

In preparing the detailed synergy plan, both NortonLifeLock and Avast have shared certain operating and financial information to support the evaluation of the potential synergies available from the Merger and have conducted a series of virtual meetings with the key management personnel of both NortonLifeLock and Avast. This has included input from both the NortonLifeLock and Avast executive leadership teams.

Based on the information shared and interactions with Avast, the Working Group has performed a bottom-up analysis of costs included in the NortonLifeLock and Avast financial information and has sought to include in the synergy analysis those costs which the Working Group believe will be either optimized or reduced as a result of the Merger. In circumstances where the information provided by Avast has been limited for commercial or other reasons, the Working Group has made estimates and assumptions to aid its development of individual synergy initiatives. The assessment and quantification of the potential synergies have in turn been informed by NortonLifeLock management’s industry experience as well as their experience of executing and integrating acquisitions in the past.

The baseline used as the basis for the Quantified Financial Benefits Statement is NortonLifeLock’s adjusted cost base for the financial year ended 2 April 2021, supported where relevant by certain information from NortonLifeLock’s budgeted cost base for the financial year ending 1 April 2022, and Avast’s adjusted cost base for the financial year ended 31 December 2020, supported where relevant by certain information from Avast’s budgeted cost base for the financial year ending 31 December 2021.

The quantified synergies are incremental to NortonLifeLock’s and, to the best of NortonLifeLock’s knowledge, Avast’s existing plans.

In general, the synergy assumptions have in turn been risk adjusted, exercising a degree of prudence in the calculation of the estimated synergy benefit set out above.

In arriving at the estimate of synergies set out in the Quantified Financial Benefits Statement, the NortonLifeLock management has made the following assumptions:

-

regarding organisational savings:

- savings will be possible by removing duplicate resource through the roll-out of the revised operating model;

- the Combined Company will be able to standardise and roll-out best practice systems and procedures, to generate efficiency and enable headcount reductions; and

- no restrictions or delays will arise as a result of industrial relations or employment agreements that significantly affect the realisation of savings by removing duplicate resource;

- there will be no material impact on the underlying operations of either company or their ability to continue to conduct their businesses, including as a result of, or in connection with, the integration of the Avast Group and the NortonLifeLock Group;

- the Combined Company’s product offering generates at least the same level of total revenues as the Avast Group’s and NortonLifeLock Group’s offerings currently generate;

- procurement savings can be realised through rationalising suppliers and renegotiating supplier terms;

- there will be no material change to macroeconomic, political, regulatory, legal or tax conditions in the markets or regions in which NortonLifeLock and Avast operate that will materially impact the implementation of, or costs to achieve, the expected cost savings;

- there will be no material divestments from the existing businesses of either NortonLifeLock or Avast;

- there will be no material change in current foreign exchange rates; and

there will be no business disruptions that materially affect either company, including natural disasters, acts of terrorism, cyber-attacks and/or technological issues or supply chain disruptions.

Reports

As required by Rule 28.1(a) of the Code, Deloitte, as reporting accountants to NortonLifeLock, and Evercore Partners International LLP, as financial adviser to NortonLifeLock, have provided the reports required under that Rule. Copies of these reports are included in the announcement made by NortonLifeLock Inc. and Avast plc on or about the date of this announcement.

Notes

The Quantified Financial Benefits Statement relates to future actions and circumstances which, by their nature, involve risks, uncertainties and contingencies. In addition, due to the scale of the Combined Company, there may be additional changes to the Combined Company’s operations. As a result, the estimated synergies referred to may not be achieved, or may be achieved later or sooner than estimated, or those achieved could be materially different from those estimated.

The Quantified Financial Benefits Statement should not be construed as a profit forecast or interpreted to mean that NortonLifeLock’s earnings in the first full year following completion of the Merger, or in any subsequent period, will necessarily match or be greater than or be less than those of NortonLifeLock or Avast for the relevant preceding financial period or any other period.

For the purposes of Rule 28 of the Code, the Quantified Financial Benefits Statement is the responsibility of NortonLifeLock and the NortonLifeLock Directors.

1 Following completion of the merger. Synergies presented pre-tax, excluding one-off costs to achieve synergies and potential reinvestment

Note: This statement includes a quantified financial benefits statement made by the NortonLifeLock Directors which has been reported on for the purposes of the City Code.

Note: All numbers presented are non-GAAP unless otherwise indicated.