BOSTON--(BUSINESS WIRE)--State Street Global Advisors, the asset management business of State Street Corporation (NYSE: STT), today announced the findings of its Low-Cost Investing Survey, which reveals a lack of general understanding persists about the management costs and advisory fees investors pay, despite the financial industry’s efforts to make fees more transparent.

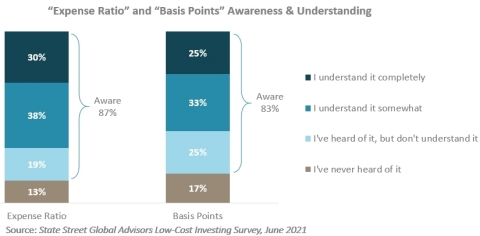

Confusion exists about how investors pay for both investment products and the guidance they receive from an advisor. An overwhelming majority indicate they are at least aware of what expense ratios and basis points are, however less than one-third feel they understand each “completely.”

“Comprehension of investment product fees – and fees in general – is low even among those working with an advisor. This underscores how much work our industry has to do when it comes to price transparency and investor education,” said Brie Williams, Head of Practice Management at State Street Global Advisors. “There’s a clear opportunity for advisors to talk to clients about what they own, why they own it, and how much it costs.”

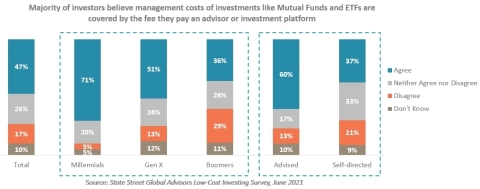

Furthermore, nearly half (47 percent) of investors believe the management costs of investments like mutual funds and ETFs are already included in the fee they pay their advisors or investment platform. Notably, investors currently working with an advisor (60 percent) are more likely to agree with this, versus 37 percent of self-directed investors.

The younger the investor, the more likely they are to agree with this false statement: 71 percent of Millennials agree versus 51 percent in Generation X and 36 percent of Boomers, who presumably have had more investment experience over their lifetime.

Similarly, there is a lack of understanding about the meaning of diversification. While the vast majority of investors (85 percent) agree “a well-diversified portfolio is one with a variety of investments that reduce stock market risk,” 55 percent incorrectly believe, “a well-diversified portfolio is having investments in a variety of accounts at different firms or investment platforms.”

How Low is “Low-Cost?”

While the overall awareness of costs at the investment product level seems to be high, understanding of what the specific costs actually are is low.

The survey found an overwhelming majority of investors say they are at least aware of what expense ratios are (87 percent) and what basis points are (83 percent), however less than one-third say they understand each “completely.” More self-directed investors than advised investors say they have a complete understanding of what these terms mean (34 percent versus 24 percent respectively for expense ratio; 30 percent versus 19 percent respectively for basis points).

Furthermore, there seems to be a limited understanding of just how “low” low-cost actually is when it comes to fund expenses. Among those who think they understand expense ratio and/or basis points, the average expense ratio they consider to be no longer “low cost” is 0.61%. Meanwhile, the asset-weighted average expense ratio of U.S. open-end mutual funds is 0.51% and the average asset-weighted ETF cost is just 0.20%1.

“Cost differences vary drastically across mutual funds and ETFs. From an ETF provider’s perspective, low cost is generally considered funds with an expense ratio of 0.10% or less – this is 6x lower than the threshold of investors in the survey,” said Williams. “The bottom line is, when all other variables are equal, lower cost investments can help investors keep more of what they earn in their portfolio.”

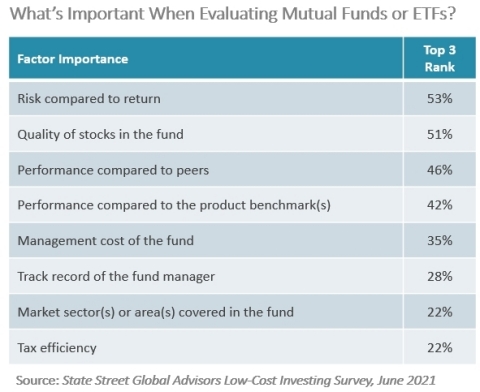

When asked to rank order factors in terms of importance when evaluating investments like mutual funds and ETFs, the majority of investors prioritize “risk compared to return” (53 percent), “quality of stocks in the fund” (51 percent), “performance compared to peers” (46 percent) and “performance compared to the benchmark(s)” (42 percent) over “management cost of the fund” (35 percent).

Surprisingly, “track record of the fund manager” (28 percent), “market sectors covered in the fund” (22 percent) and “tax efficiency” (22 percent) are ranked among the least important factors.

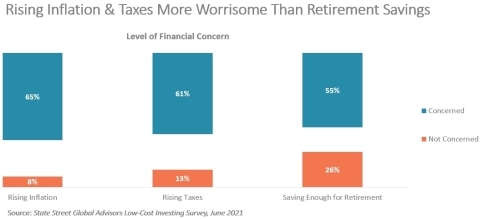

Inflation & Taxes Outrank Retirement Savings As Top Concerns

When it came to concern over some of the financial unknowns or variables investors commonly worry about, taxes and inflation rose to the top. Notably, more investors are concerned with rising inflation (65 percent) and rising taxes (61 percent) than saving enough for retirement (55 percent).

Millennials and Generation X are more concerned than Boomers about saving enough for retirement (66 percent and 68 percent versus 44 percent respectively).

The survey also found awareness of the negative impact taxes could have on overall investment returns is high. About two-thirds of investors (62 percent) consider how much taxes could deplete their returns when they think about investments. Millennials (78 percent) seem the most concerned about the bite taxes could take out of their returns, with Generation X not far behind at 69 percent, compared to 51 percent of Boomers.

“We expect to see record high flows into low-cost, tax-efficient ETFs, especially if tax rates increase and the low-yield interest rate environment persists,” said Williams. “Investors should be talking to their advisor about strategies for minimizing the impact that cost, taxes and inflation can have on their overall portfolio.”

Earlier this year, State Street Global Advisors reduced the expense ratios of the following fixed income ETFs: SPDR Portfolio Mortgage Backed Bond ETF (SPMB), SPDR Portfolio High Yield Bond ETF (SPHY), SPDR Portfolio Aggregate Bond ETF (SPAB), and SPDR Portfolio Corporate Bond ETF (SPBO). Fixed income ETFs can help investors reduce their total cost of ownership versus comparable mutual funds; for more on State Street’s point of view on this topic read Keep More of What You Earn with Fixed Income ETFs on ssga.com.

To learn more about how investors are using low-cost ETFs to achieve a variety of investment objectives, read Build a Low-Cost Core Portfolio with SPDR ETFs.

Launched in 2017, SPDR® Portfolio ETFs™ are designed to provide investors greater choice in low-cost ETFs. The suite includes 22 SPDR ETFs spanning US equity, international equity and fixed income asset classes to help investors build a diversified core portfolio of stocks and bonds with ETFs priced as low as three basis points. Widely embraced by investors, SPDR Portfolio ETFs have more than $111 billion of assets.2

For more information on the SPDR ETF suite, visit www.ssga.com/etfs.

For more information on ETF basics, visit our ETF education landing page.

About State Street Global Advisors Low-Cost Investing Survey

State Street Global Advisors, in partnership with A2B Planning and our field partner, Prodege, conducted an online survey among a nationally representative sample of adults. Data was collected from June 18 – June 20, 2021. For our Custom “Low Cost” Analysis, we analyze 224 adults with Investable Assets (IA) of $250K or more.

About SPDR Exchange Traded Funds

SPDR ETFs are a comprehensive family spanning an array of international and domestic asset classes. SPDR ETFs are sponsored by affiliates of State Street Global Advisors. The funds provide investors with the flexibility to select investments that are aligned to their investment strategy. For more information, visit www.ssga.com/etfs.

About State Street Global Advisors

For four decades, State Street Global Advisors has served the world’s governments, institutions and financial advisors. With a rigorous, risk-aware approach built on research, analysis and market-tested experience, we build from a breadth of active and index strategies to create cost-effective solutions. As stewards, we help portfolio companies see that what is fair for people and sustainable for the planet can deliver long-term performance. And, as pioneers in index, ETF, and ESG investing, we are always inventing new ways to invest. As a result, we have become the world’s fourth-largest asset manager* with US $3.90 trillion† under our care.

*Pensions & Investments Research Center, as of 12/31/20. |

|

†This figure is presented as of June 30, 2021 and includes approximately $63.59 billion of assets with respect to SPDR products for which State Street Global Advisors Funds Distributors, LLC (SSGA FD) acts solely as the marketing agent. SSGA FD and State Street Global Advisors are affiliated. |

|

1. |

Morningstar data as of July 19, 2021, based on SPDR Americas Research Calculations |

2. |

Bloomberg Finance L.P. data as of June 30, 2021 |

Important Risk Disclosures

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing involves risk, including the risk of loss of principal.

This communication is not intended to be an investment recommendation or investment advice and should not be relied upon as such.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns.

While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

Foreign investments involve greater risks than U.S. investments, including political and economic risks and the risk of currency fluctuations, all of which may be magnified in emerging markets.

Bond funds contain interest rate risk (as interest rates rise bond prices usually fall). There are additional risks for funds that invest in mortgage-backed and asset-backed securities including the risk of issuer default; credit risk and inflation risk.

Non-diversified funds that focus on a relatively small number of securities tend to be more volatile than diversified funds and the market as a whole.

Passively managed funds hold a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics. This may cause the fund to experience tracking errors relative to performance of the index.

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third-party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

Before investing, consider the funds’ investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 1-866-787-2257 or visit ssga.com. Read it carefully.

Not FDIC Insured · No Bank Guarantee · May Lose Value

© 2021 State Street Corporation.

All Rights Reserved.

3667257.1.1.AM.RTL Exp. Date: 08/31/2022