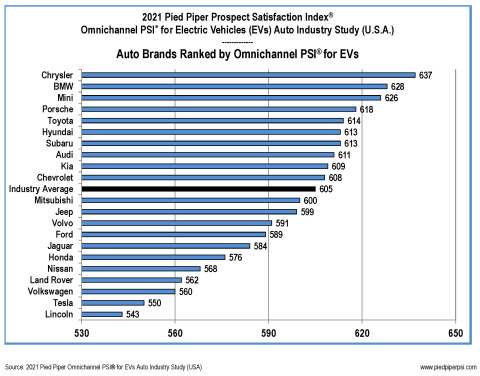

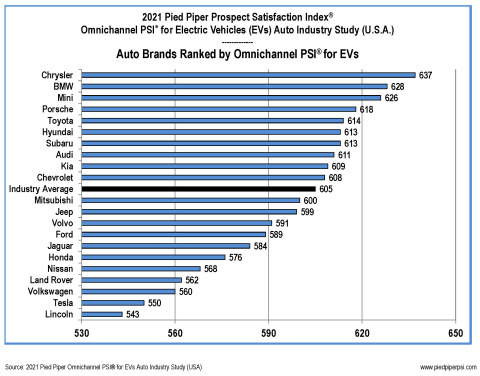

MONTEREY, Calif.--(BUSINESS WIRE)--Stellantis NV's Chrysler brand ranked highest in the 2021 Pied Piper Omnichannel PSI® for Electric Vehicles (EVs) Auto Industry Study, which answered the question, “What happens when EV customers shop for a vehicle by first visiting the brand’s website, or a dealership website, and then visiting a dealership in person?” BMW was ranked second of the twenty-one battery electric or plug-in hybrid EV brands evaluated, followed by BMW’s Mini brand.

How customers shop completely changed in the late 2000s with widespread acceptance and use of smart phones. As an example, in 2007, the year the iPhone was introduced, online retailer Amazon did $15 billion in sales. Last year, Amazon’s revenues exceeded $300 billion, and today customers almost always begin their shopping online, even if they eventually visit a store in-person. More recently, brands that traditionally relied only on in-person sales have embraced new online digital retail tools. For the auto industry this has meant the appearance of “Buy Now,” or “Buy from Home” buttons on brand and dealer websites, along with other online digital retail tools like inventory search, payment calculator, trade-in value estimator, test-drive request and others.

This new approach to shopping and purchase, which combines and integrates the online and in-store experience, is called “Omnichannel Selling,” and for the auto industry it results in the following customer path:

- A customer moves from a brand website

- to a dealership website and start of communication with the dealership,

- to visiting the dealership in-person,

- and the customer may then go back home again and back onto the websites before committing to buy either online or back at the dealership in person.

For 21 different auto brands selling EVs, Pied Piper measured whether their customer’s omnichannel path was intuitive, simple to use, and easy to navigate, as well as effective at showcasing products and making it easy to purchase. Measurements from the following four subcategories were combined into a brand score out of 1,000 points:

- Brand Website – Useful Digital Retail Tools Provided (11% total score): Were useful online digital retail tools provided for the customer? Top brands: Jeep, Chrysler, Nissan, Mini, Subaru

- Brand Website – Ease of Transition to Local Dealership (7% total score): Could customers on the brand website easily transition from viewing a desired vehicle over to communicating with a local dealership to take the next step? Top brands: Hyundai, Ford, Mitsubishi, Kia, Porsche

- Dealership Response to Website Customer Inquiries (38% total score): Did the local dealership quickly respond to website customer inquiries? Top brands: Subaru, Chrysler, Toyota, Porsche, Volvo

- Dealership Sales Effectiveness In-Person at Dealership (44% total score): Did the dealership employees and in-dealership processes build upon what the customer has already accomplished online, to provide a seamless, consistent, efficient, and effective customer experience in-person at the dealership? Top brands: Audi, Tesla, Chevrolet, Porsche, BMW

Pied Piper measured dealer response to EV website customers by submitting customer inquiries through a combination of brand websites and local dealership websites, asking a question about a vehicle in inventory, and providing a customer name, email address and local telephone number. Pied Piper then evaluated how the dealerships responded by email, telephone and text message over the next 24 hours. Pied Piper also sent in-person “mystery shoppers” into EV dealerships nationwide, measuring how effectively the dealership interacted in-person, as well as whether the dealership acknowledged and built upon the online shopping that the customer had already completed.

“The shopping path from website to dealership plays an even more critical role for EV customers,” said Fran O’Hagan, President & CEO of Pied Piper. “EV customers need to understand how they can benefit from EV ownership, and two-thirds of these customers are first-time EV buyers.” Pied Piper’s Omnichannel PSI for EVs study shows that EV customers today find much variation in helpfulness between brands along their shopping path. Only by paying careful attention to all four subcategories of omnichannel selling will auto brands and their dealers be able to sell effectively to today’s customers.

2021 is the first year for the Omnichannel PSI® for EVs Auto Industry Study, but Pied Piper has been providing other motor vehicle industry benchmarking studies since 2007. The 2021 Omnichannel PSI for EVs Auto Industry Study (U.S.A.) was conducted between January 2021 and May 2021 by completing a combination of website inquiries and in-person sales effectiveness measurements for a sample of 3,101 dealerships nationwide representing all major EV brands. Examples of other recent PSI studies are the 2021 PSI-Internet Lead Effectiveness® (ILE®) U.S. Motorcycle/UTV Industry Study (Harley-Davidson brand was ranked first for dealer response to web inquiries), and the 2019 “PSI for EVs” U.S. Auto Industry Study (Tesla brand was ranked first for selling EVs in-person). Complete PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI evaluations—in-person, website or telephone—as tools to measure and improve the omnichannel sales effectiveness of their dealerships. For more information about how Prospect Satisfaction Index® (PSI®) measurement and reporting is used to improve performance, go to www.piedpiperpsi.com.

About Pied Piper Management Company, LLC

Founded in 2003, Pied Piper Management Company, LLC is a Monterey, California, USA company that helps brands & manufacturers improve the omnichannel performance of their retail networks. Go to www.piedpipermc.com.