Trilliant Health Analysis Projects Flat to Declining Future Demand for Health Services, With Increasing Supply from New Market Entrants like Amazon and Walmart

Trilliant Health Analysis Projects Flat to Declining Future Demand for Health Services, With Increasing Supply from New Market Entrants like Amazon and Walmart

In its inaugural 2021 Report, Trilliant reveals data-driven macro trends shaping the post-pandemic health economy, with little impact from COVID-19.

NASHVILLE, Tenn.--(BUSINESS WIRE)--Trilliant Health, an analytics company that leverages data to transform how hospitals and health systems maximize growth, today released its inaugural 2021 Trends Shaping the Post-Pandemic Health Economy Report revealing several surprising macro trends impacting the $4T health economy post-COVID-19. Trilliant’s analysis was based on data from more than 70 billion claims representing 309 million unique patients.

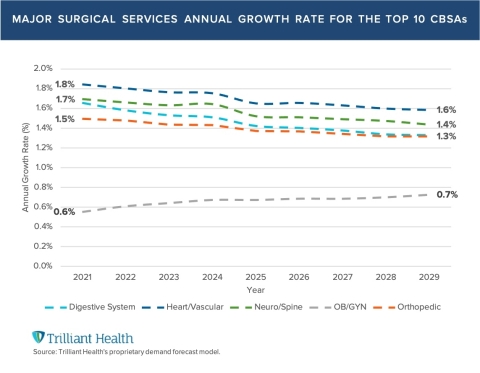

Trilliant’s key finding is that, contrary to popular belief, future demand for healthcare services will be relatively flat to declining, and is significantly lower than pricing trends. For instance, annual inpatient admissions have declined by 2008-2016, while the number of hospitalists has almost doubled in the same time period. Looking ahead, Trilliant forecasts the average rate of growth for surgical services to range between 0.7% to 1.9% year over year through 2025, which is lower than 3% annual growth assumption commonly held. Moreover, future demand will not be meaningfully impacted by COVID-19 or by the increasing obesity of Americans, but primarily by population migration.

The implications of softening demand and increasing supply suggest that pricing trends are ultimately unsustainable. In addition, these trends confirm a key, but unreported, finding of the AAMC: the projected demand for surgeons has been declining for years. “While much has been made of increasing demand and decreasing physician supply, a longitudinal analysis of the AAMC’s Physician Workforce Projections has consistently revised their surgeon demand projections, as an example, downward over time,” according to Sanjula Jain, Ph.D., Senior Vice President of Market Strategy and Chief Research Officer at Trilliant Health.

Trilliant finds telehealth demand declining as much as -37% from peak-pandemic highs.

Even though the telehealth industry grew exponentially over the last 16 months due to COVID-19, Trilliant Health’s 2021 Health Economy Trends Report found that telehealth’s peak-pandemic high has already begun to taper with the rate of decline ranging from -37% to -3% depending on the state. Delineating between total telehealth visits and the discrete number of unique individuals who used telehealth, the research concludes that only about 13% of Americans used telehealth during the pandemic; of which, most visits were for behavioral health.

“The increase in capital investments in tele-based companies and the expansion of more providers into telehealth, like Amazon, that we saw during COVID-19 is catering to very small consumer segments of corresponding demand,” according to Jain. “Within this already crowded market of telehealth suppliers, traditional providers – notably hospitals and health systems – are going to be hard pressed to compete with new market entrants that have longstanding relationships with consumers.”

Underlying Trilliant Health’s research is the premise that the U.S. healthcare economy represents the largest sector of the world’s largest economy globally but, for decades, the industry has not operated according to the basic economic principles of supply, demand and yield. Trilliant’s report highlights the inefficiencies of the health economy, reviews the impact of COVID-19, and makes data-backed forecasts of what the future for healthcare delivery will be in the years to come.

Additional key insights include:

- Patients are not brand loyal, splitting where they receive care across an average of 4.2 provider brands.

- Consumer decisions are driven by psychology more than neighborhood.

- Consumer loyalty is lowest in markets where demand is increasing; and women are less loyal than men.

- Almost all growth in demand will be from Medicare beneficiaries, not from the increasing burden of disease in America.

- Trends for telehealth and urgent care volume suggest much of the growth in utilization was attributed to forced adoption created by the pandemic, but the widespread use of digital modalities will be limited to niche population cohorts with non-acute clinical needs.

- Telehealth is primarily utilized for behavioral health, especially by commercially insured women between the ages of 20-49.

- Supply is rapidly increasing in commodity service offerings such as telehealth and urgent care, with new market entrants like Amazon and Walmart disrupting legacy delivery models.

- Walmart has established a new price floor in primary care services, offering up to 70% cheaper visits than market peers.

For access to the complete report, click here.

About Trilliant Health

Trilliant Health’s analytics platform delivers analysis of the recent past and the near future. Providing unique insights about physician and consumer behavior, as well as predictive and prescriptive analytics, Trilliant enables health systems to allocate capital resources efficiently and effectively within markets and across their service lines. For more information, please visit trillianthealth.com.

Contacts

Sam Moore

Trilliant Health

communications@trillianthealth.com