NEW YORK--(BUSINESS WIRE)--Over the past year, US banks built up a consumer trust advantage over competitors such as neobanks and tech companies, according to our second annual “Banking Digital Trust Report” from Insider Intelligence. The largest US banks have come to customers’ aid in a time of crisis, and customers have rewarded that flexibility with greater trust in their primary financial institutions.

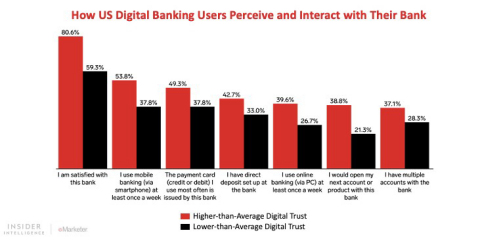

Digital trust is essential to retaining customers and boosting revenues, while also giving banks a big advantage over their nonbank rivals. US digital banking users with higher-than-average levels of digital trust are more satisfied and engaged with their bank—and they are more likely than digital banking users with below-average trust to open their next account or product with their current bank. In our survey, the highest proportion of respondents named their primary bank or credit union as the company they would trust most to provide them with financial services, far ahead of competitors like PayPal, Visa, and Amazon.

Security is the top factor that determines digital trust—and the lingering effects of pandemic-related fraud will only escalate consumers’ security concerns. TD Bank had the highest perceived security of the 10 banks in our study, while Capital One came in second.

Privacy is the second-most crucial factor influencing trust in digital banking, and it will become more important in the face of tighter regulations and the discontinuation of cookies. PNC placed first in Privacy, followed by TD Bank in second.

Capital One had the highest digital trust score overall out of the 10 largest US retail banks, while PNC and TD Bank tied for second place. Capital One ranked first in three of the six categories of trust: Reliability, Ease of Use, and Feature Breadth. It also placed in the top three in each of the heaviest-weighted trust categories: Security, Privacy, and Reputation.

Please reach out if you wish to view the full report.

REPORT METHODOLOGY

Insider Intelligence’s second annual “Banking Digital Trust Report” evaluates consumer perceptions of the 10 largest US banks across six key factors that influence banking digital trust: Security, Privacy, Reputation, Reliability, Ease of Use, and Feature Breadth. We surveyed 2,412 US consumers (digital banking users, via PC or smartphone) to determine how they perceive the digital trustworthiness of the top 10 US banks across the six dimensions. The survey was designed by Insider Intelligence and fielded by a third-party provider from February to March 2021.