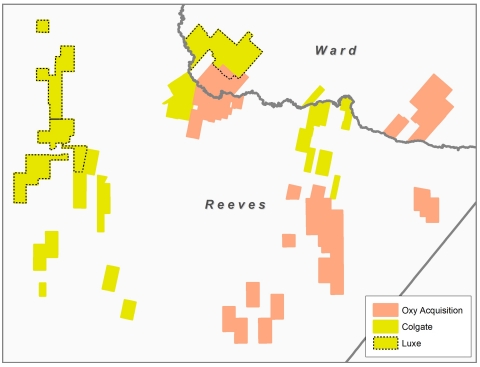

MIDLAND, Texas--(BUSINESS WIRE)--Colgate Energy Partners III, LLC (the “Company” or “Colgate”) announced today that it has entered into a definitive agreement with Occidental to purchase approximately 25,000 net acres and 10,000 Boepd in Reeves and Ward Counties, TX for approximately $508 million, subject to customary closing adjustments. The effective date of the transaction is April 1, 2021, with closing expected to occur in Q3 of 2021.

Transaction Highlights

-

~25,000 net acres adjacent to Colgate’s existing position in Reeves and Ward Counties

- Acreage is ~99% operated; ~99% held by production; ~82% average working interest; ~79% 8/8ths NRI

- Current average net daily production of ~10,000 Boepd

- Adds high-quality inventory directly adjacent to two of Colgate’s most economic operating areas, with high NRIs further enhancing returns

- Legacy wells add low-decline production and cash flow, helping to maintain Colgate’s best-in-class balance sheet

Pro Forma Business Highlights

- ~83,000 net acres located primarily in Reeves, Ward and Eddy Counties

- Estimated average net daily production of ~55,000 Boepd

- Anticipate running a 5-6 rig program by year end 2021

- Estimated 2022 production of ~75,000 Boepd

- Estimated 2022 EBITDAX of ~$750 million at NYMEX pricing (~$875 million excluding projected hedge settlements)

- Strong high yield market conditions, anticipated pro forma borrowing base of over $550 million and potential further equity funding provide optionality for ultimate financing of transaction

Will Hickey, Co-CEO of Colgate, commented, “The acquisition of these assets in the core of the Southern Delaware Basin is a transformational deal for Colgate that checks all of the boxes of our acquisition criteria. It is a great mix of low decline production and high rate of return locations that will immediately compete for capital with our existing portfolio. Given the proximity to our current assets, we are confident that we can leverage our ongoing operations to maximize the value of this acquisition for our investors.”

“This acquisition, along with the recently acquired Luxe assets, truly puts Colgate in a differentiated position. These two transactions complement each other perfectly, creating a scaled business with increased relevance in public markets, and ample liquidity to execute on our highly accretive development program. The equity contribution from the Luxe transaction has put us in a place where we can fund a cash acquisition of this size while remaining squarely within our debt parameters,” added James Walter, Co-CEO of Colgate.

Conference Call

Colgate will host a conference call for investors and analysts to discuss the transaction on Thursday, June 10, 2021, at 10:00 a.m. EST / 9:00 a.m. CDT. To participate in the Conference Call, register at https://www.colgateenergyir.com.

About Colgate

Colgate is a privately held, independent oil and natural gas company headquartered in Midland, Texas that is engaged in the acquisition, exploration and development of oil and natural gas assets in the Delaware Basin, with operations principally focused in Reeves County, Ward County, and Eddy County. For more information regarding Colgate, please visit our Investor Relations website.

Forward-Looking Statements

This press release contains forward-looking statements based on Colgate’s current expectations that involve a number of risks and uncertainties. Generally, forward-looking statements do not relate strictly to historical or current facts and may include words such as “believes,” “will,” “expects,” “anticipates,” “intends” or similar words or phrases. No forward-looking statement can be guaranteed. Numerous risks, uncertainties and other factors may cause actual results to differ materially from those expressed in any forward-looking statement. In particular, this press releases includes certain guidance with respect to future production and Adjusted EBITDAX on a pro forma basis giving effect to this transaction. This forward-looking guidance represents our management’s estimates as of the date of this press release, based on numerous assumptions that are subject to adjustment upon further review, and we undertake no duty to update these estimates in the future. Achieving these estimates will depend on the impacts of COVID-19, the availability of capital, regulatory approvals, commodity prices, drilling and completion costs, actual drilling results, business, economic, competitive, financial and regulatory risks and other factors, many of which are beyond our control. If any of these risks and uncertainties actually occur or the assumptions underlying our guidance are incorrect, our actual operating results may be materially and adversely different from our guidance.

Non-GAAP Financial Measure

This press release includes the financial measure Adjusted EBITDAX. We define Adjusted EBITDAX as net income (loss) before interest expense, net, depletion, depreciation and amortization, accretion expense on asset retirement obligation, exploration expense, gain (loss) on sale of assets and unrealized gain (loss) on derivatives. Adjusted EBITDAX is a supplemental measure of our performance that is not required by or presented in accordance with U.S. generally accepted accounting principles (“GAAP”). We believe that Adjusted EBITDAX may provide additional information about our ability to meet our future requirements for debt service, capital expenditures and working capital. Adjusted EBITDAX is a financial measure commonly used in the oil and natural gas industry. Adjusted EBITDAX should not be considered in isolation or as a substitute for net income, operating income, cash flows from operating activities or any other measure of financial performance presented in accordance with GAAP, or as a measure of a company’s profitability or liquidity. Because Adjusted EBITDAX excludes some, but not all, items that affect net income, the Adjusted EBITDAX presented by us may not be comparable to similarly titled measures of other companies. The GAAP measure most directly comparable to Adjusted EBITDAX is net income. However, we have not included a reconciliation of Adjusted EBITDAX to net income (loss) for the year ended December 31, 2022 because we cannot do so without unreasonable effort and any attempt to do so would be inherently imprecise.