MIDLAND, Texas--(BUSINESS WIRE)--Colgate Energy Partners III, LLC (the “Company” or “Colgate”) announced today that it has entered into a definitive agreement under which Colgate will acquire a majority of the assets owned by Luxe Energy LLC (“Luxe”) in an all-stock transaction. Luxe will continue to own and manage certain assets including a portion of the non-operated leasehold interests that are operated by MDC Reeves Energy, LLC and its affiliates. Closing occurred simultaneously with signing of a definitive agreement on June 1, 2021.

Luxe Highlights

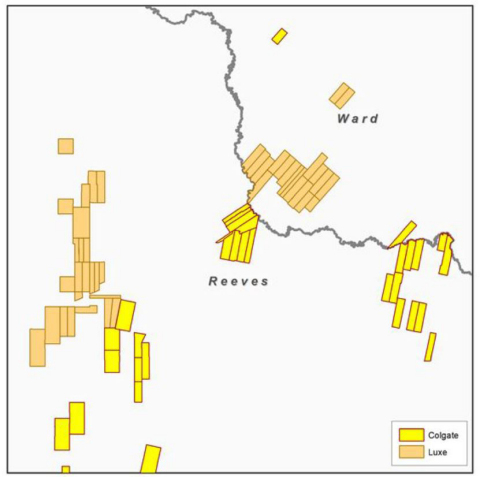

- ~22,000 net acres adjacent to Colgate’s existing position in Reeves and Ward Counties

- Current average net daily production of ~17,000 Boepd

- ~5,000 gross surface acres that support go-forward development

- 1 rig running focused on Luxe’s existing Ward County position

Transaction Highlights

- Combination creates one of the largest private companies in the Permian Basin, with ~57,000 net acres, ~45,000 Boepd and 4 rigs running as of June 1, 2021

- Adds meaningful operational scale and synergies, which will build on Colgate’s track record of successful, low-cost execution

- Adds high-quality inventory directly offset Colgate’s successful legacy development in Reeves and Ward Counties

- Transaction adds significant production and cash flow without assuming any additional debt

“The acquisition of Luxe is a transformational event that positions Colgate as one of the largest private companies in the Permian. It allows both Colgate and Luxe stakeholders to take advantage of increased scale while generating substantial free cash flow. This transaction enhances our already best-in-class balance sheet and puts us in a position of strength as we look to opportunistically pursue further consolidation,” stated James Walter, Co-Chief Executive Officer of Colgate.

Will Hickey, Co-Chief Executive Officer of Colgate, added “This acquisition is a perfect fit into the existing Colgate portfolio. The large contiguous acreage position sits right in Colgate’s backyard, and its Ward County position will compete for capital immediately. This transaction delivers the right balance of up-front production and cash flow to provide balance sheet strength, along with high-quality inventory to drive value over the coming years. The Colgate team is excited to continue our operational success on the Luxe assets.”

Conference Call

Colgate will host a conference call for investors and analysts to discuss the transaction on Wednesday, June 2, 2021 at 10:00 a.m. EST / 9:00 a.m. CDT. To participate in the Conference Call, register using this link or at https://www.colgateenergyir.com/irinfo.

About Colgate

Colgate is a privately held, independent oil and natural gas company headquartered in Midland, Texas that is engaged in the acquisition, exploration and development of oil and natural gas assets in the Delaware Basin, with operations principally focused in Reeves County, Ward County, and Eddy County. For more information regarding Colgate, please visit our Investor Relations website.

Forward-Looking Statements

This press release contains forward-looking statements based on Colgate’s current expectations that involve a number of risks and uncertainties. Generally, forward-looking statements do not relate strictly to historical or current facts and may include words such as “believes,” “will,” “expects,” “anticipates,” “intends” or similar words or phrases. No forward-looking statement can be guaranteed. Numerous risks, uncertainties and other factors may cause actual results to differ materially from those expressed in any forward-looking statement.