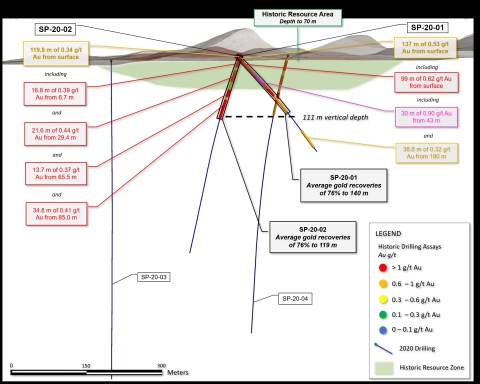

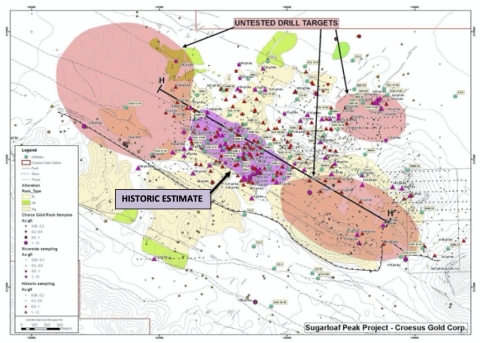

TORONTO--(BUSINESS WIRE)--Arizona Metals Corp. (TSX.V:AMC, OTCQX:AZMCF) (the “Company” or “Arizona Metals”) announces that metallurgical testing at its Sugarloaf Peak Project demonstrates gold recoveries averaging 76%, from surface to approximately 111 m, with oxidized zones reaching recoveries up to 95%. The Sugarloaf historic estimate of “100 million tons containing 1.5 million ounces gold”* at a grade of 0.5 g/t (Dausinger, 1983, Westworld Resources), was estimated to a depth of only approximately 70 m.

Two of the drill holes completed in the 2020 Sugarloaf Phase 1 exploration program first underwent detailed hydrothermal alteration analyses, and composite samples from these holes were then submitted to Kappes Cassiday and Associates’ facilities in Reno, Nevada for metallurgical testing. Table 1 below shows results of recently completed bottle-roll testing on holes SP-20-01 and SP-20-02. Column testing is currently underway on additional samples from these holes, with results expected in Q4 2021.

Highlights of Sugarloaf Metallurgical Testing:

- Gold recoveries averaging 76%, with oxide recoveries reaching 95%

- Excellent gold recoveries in both oxide and sulphide mineralization, to 111 m deep

- Gold recoveries not significantly impacted by sulphide content, indicating not refractory

Drill hole SP-20-01 intersected 137 m of 0.53 g/t gold from surface, including, 99 m of 0.62 g/t gold, and 30 m of 0.90 g/t gold. Gold recoveries in this hole averaged 76%, from surface to a down-hole depth of 137 m (vertical depth of 97 m). Recoveries reached 95% in oxidized zones.

Drill hole SP-20-02 intersected 119.8 m of 0.34 g/t gold from surface, including 21.6 m of 0.44 g/t gold, and 34.8 m of 0.41 g/t gold. Gold recoveries in this hole also averaged 76%, from surface to a down-hole depth of 119.8 m (vertical depth of 111 m). Recoveries reached 94% in oxidized zones.

Marc Pais, CEO, commented “Today’s results have demonstrated the potential for excellent gold recoveries, at depths well below the historic resource estimate, which was defined down to only 70 m. We note that gold recoveries average 76%, which compares very favourably to similar heap-leach deposits currently in operation. Importantly, we observe excellent recoveries in both oxide and sulphide mineralization, indicating that the gold is not refractory. We also note that our recent drilling has shown that mineralization can continue well below the 111 m depth of this metallurgical testing, with hole SP-20-01 intersecting 38.8 m of 0.32 g/t, from 127 m to 155 m, more than twice the historic estimate depth. Based on the success of these initial tests, we plan to undertake additional metallurgical testing on deeper mineralization. Reagent consumption was also typical of rates observed in producing mines. This initial metallurgical work indicates excellent potential to recover both sulphide and oxide material in deeper mineralization, with the deposit also remaining open for expansion on strike to both the northwest and southeast.”

Table 1. Sugarloaf Phase 1 Drill Program Metallurgical Test Results |

|||||||||||

| Hole | From meters | To meters |

Length, meters |

Type | Target p80 Size, mm |

Calculated Head, gms Au/MT |

Extracted, gms Au/MT |

Au Extracted, % |

Leach Time, hours |

Consumption NaCN, kg/MT |

Addition Ca(OH)2, kg/MT |

| SP-20-01 | 0.0 |

12.8 |

12.8 |

Oxide |

0.15 |

0.795 |

0.754 |

95% |

96 |

0.35 |

4.03 |

| SP-20-01 | 12.8 |

20.0 |

7.2 |

Sulfide |

0.15 |

0.716 |

0.556 |

78% |

96 |

0.56 |

4.00 |

| SP-20-01 | 20.0 |

43.5 |

23.5 |

Sulfide |

0.15 |

0.475 |

0.352 |

74% |

96 |

0.41 |

1.50 |

| SP-20-01 | 43.5 |

49.1 |

5.6 |

Sulfide |

0.15 |

1.221 |

0.959 |

79% |

96 |

0.17 |

1.00 |

| SP-20-01 | 49.1 |

63.1 |

14.0 |

Sulfide |

0.15 |

0.776 |

0.576 |

74% |

96 |

0.10 |

1.01 |

| SP-20-01 | 63.1 |

73.5 |

10.4 |

Sulfide |

0.15 |

1.050 |

0.714 |

68% |

96 |

0.28 |

0.50 |

| SP-20-01 | 73.5 |

98.8 |

25.3 |

Sulfide |

0.15 |

0.541 |

0.380 |

70% |

96 |

0.22 |

0.50 |

| SP-20-01 | 107.3 |

137.6 |

30.3 |

Sulfide |

0.15 |

0.338 |

0.243 |

72% |

96 |

0.25 |

0.75 |

| SP-20-02 | 6.7 |

15.8 |

9.1 |

Oxide |

0.15 |

0.430 |

0.403 |

94% |

96 |

0.73 |

3.75 |

| SP-20-02 | 29.4 |

51.1 |

21.7 |

Sulfide |

0.15 |

0.443 |

0.293 |

66% |

96 |

0.46 |

1.25 |

| SP-20-02 | 65.5 |

79.2 |

13.7 |

Sulfide |

0.15 |

0.355 |

0.216 |

61% |

96 |

0.30 |

0.50 |

| SP-20-02 | 85.0 |

119.8 |

34.8 |

Sulfide |

0.15 |

0.337 |

0.274 |

81% |

96 |

0.25 |

0.75 |

|

Average |

0.62 |

0.48 |

76% |

96 |

0.34 |

1.63 |

||||

Sugarloaf Peak Highlights

- Project is 100% owned by Arizona Metals Corp. with no future payments

- Located on 4,400 acres of BLM claims in mining-friendly La Paz County, Arizona

- Historic estimate of “100 million tons containing 1.5 million ounces gold”* at a grade of 0.5 g/t (Dausinger, 1983, Westworld Resources).

- Heap-leach, open-pit target that starts at surface and is tabular with no dip

- Open for expansion at depth and on strike

Analytical Method

Sugarloaf Peak metallurgical samples were subject to 96-hour cyanide bottle roll tests. Samples were composited from ¼ PQ-size (8.5-cm diameter) drill core in storage at the company’s facility in Ehrenberg, Arizona, and shipped by commercial carrier to Kappes, Cassiday, and Associates’ laboratory in Reno, Nevada. Samples were prepared by crushing to 80% passing 0.15 mm. One kilogram of ground sample was combined with 1.5 liters of sodium cyanide solution at a target concentration of 1 gram cyanide per liter of water in 2.5-liter bottles, and rolled for the duration of the 96-hour tests. Head and tail assays were performed by fire assay, and solution analyses were done by atomic absorption spectrometry, monitored at intervals of 2 to 24 hours. Kappes, Cassiday, and Associates is independent of Arizona Metals Corp.

Kay Mine Project, Arizona Update

Drilling at the fully-funded 75,000m Kay Mine Phase 2 program is underway with two drills turning and assays pending. The Company will provide an update on the timing of the additions of a third and fourth rig in a future release.

Engagement of Equity Guru Media Inc.

Arizona Metals is also pleased to announce that it has engaged Equity Guru Media Inc. (the “Contractor”) to provide media relations services pursuant to a contracting services agreement (the “Services Agreement”). The Services Agreement is dated effective May 31, 2021 and will be effective for a six-month term. Services provided by the Contractor will relate to ongoing communications and promotional support for the Company’s relations with the professional investment community. Pursuant to the Services Agreement, the Company will pay to the Contractor a fee of $40,000 (plus applicable taxes) for a six-month term. The Contractor is an arm's length party to the Company and, to the Company’s knowledge does not currently own any securities of the Company as at the date hereof but may purchase securities in the Company from time to time for investment purposes. The Services Agreement is subject to acceptance by the TSX Venture Exchange.

About Arizona Metals Corp

Arizona Metals Corp owns 100% of the Kay Mine Property in Yavapai County, which is located on a combination of patented and BLM claims totaling 1,300 acres that are not subject to any royalties. An historic estimate by Exxon Minerals in 1982 reported a “proven and probable reserve of 6.4 million short tons at a grade of 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver.” The historic estimate at the Kay Mine was reported by Exxon Minerals in 1982. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to be a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Kay Mine is a steeply dipping VMS deposit that has been defined from a depth of 60 m to at least 900 m. It is open for expansion on strike and at depth.

The Company also owns 100% of the Sugarloaf Peak Property, in La Paz County, which is located on 4,400 acres of BLM claims. Sugarloaf is a heap-leach, open-pit target and has a historic estimate of “100 million tons containing 1.5 million ounces gold” at a grade of 0.5 g/t (Dausinger, 1983, Westworld Resources).

*The historic estimate at the Sugarloaf Peak Property was reported by Westworld Resources in 1983. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Qualified Person who reviewed and approved the technical disclosure in this release is David Smith, CPG.

Quality Assurance/Quality Control

All of Arizona Metals’ drill sample assay results have been independently monitored through a quality assurance/quality control (“QA/QC”) protocol which includes the insertion of blind standard reference materials and blanks at regular intervals. Logging and sampling were completed at Arizona Metals’ core handling facilities located in Quartzite, Arizona. Drill core was diamond sawn on site and half drill-core samples were securely transported to ALS Laboratories’ (“ALS”) sample preparation facility in Tucson, Arizona. Sample pulps were sent to ALS’s labs in Vancouver, Canada, for analysis.

Gold content was determined by fire assay of a 30-gram charge with ICP finish (ALS method Au-AA23). Silver and 47 other elements were analyzed by ICP methods with four-acid digestion (ALS method ME-MS61). ALS Laboratories is independent of Arizona Metals Corp. and its Vancouver facility is ISO 17025 accredited. ALS also performed its own internal QA/QC procedures to assure the accuracy and integrity of results. Parameters for ALS’ internal and Arizona Metals’ external blind quality control samples were acceptable for the samples analyzed. Arizona Metals is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to herein.

The qualified person who reviewed and approved the technical disclosure in this release is David Smith, CPG, a qualified person as defined in National Instrument 43-101–Standards of Disclosure for Mineral Projects. Mr. Smith supervised the preparation of the scientific and technical information that forms the basis for this news release and has reviewed and approved the disclosure herein. Mr. Smith is the Vice-President, Exploration of the Company. Mr. Smith supervised the drill program and verified the data disclosed, including sampling, analytical and QA/QC data, underlying the technical information in this news release, including reviewing the reports of ALS, methodologies, results, and all procedures undertaken for quality assurance and quality control in a manner consistent with industry practice, and all matters were consistent and accurate according to his professional judgement. There were no limitations on the verification process.

Disclaimer

This press release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation, All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements contained in this press release include, without limitation, statements regarding the resumption of drilling and the effects of the COVID-19 pandemic on the business and operations of the Company. In making the forward- looking statements contained in this press release, the Company has made certain assumptions. Although the Company believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: availability of financing; delay or failure to receive required permits or regulatory approvals; and general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward- looking statements or otherwise.

NEITHER THE TSX VENTURE EXCHANGE (NOR ITS REGULATORY SERVICE PROVIDER) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

Not for distribution to US newswire services or for release, publication, distribution or dissemination directly, or indirectly, in whole or in part, in or into the United States