NEW YORK--(BUSINESS WIRE)--Snappy, the New York-based tech platform revolutionizing gifting, today announced it has completed a $70 million Series C funding round, bringing total funding for the company to over $100 million. This latest investment was led by GGV Capital with participation from existing investors 83North, Saban Ventures and Hearst Ventures. The company will use these funds to continue to invest in world class talent and innovation as it expands into additional segments and markets, explores acquisitions and continues to redefine the category.

Hans Tung, managing partner at GGV Capital, whose portfolio includes the likes of Affirm, Airbnb, Coinbase, Peloton, Slack, StockX, TikTok and Wish, will join Snappy’s board as part of the round. The company has also added two new Executives to its leadership team -- Alison Sagar, former UK CMO from PayPal and Amy Stoldt, former SVP of people from Peloton.

Co-founders, Hani Goldstein and Dvir Cohen, set out to build a gifting platform that would overcome the difficulties of sending personal gifts in a simple, fun and stress-free way. Snappy has become the trusted partner to over 1,000 enterprise customers including Microsoft, Adobe, Comcast, and Uber, and has sent more than 1 million gifts in the last six months alone. Snappy’s 800% year-over-year revenue growth and five-star customer ratings signal huge potential for this New York-based startup.

“Our customers are looking for innovative and effective ways to show appreciation for their employees in an increasingly digital world. Part of our success is our focus on the fun of the experience and creating magical moments that will surprise and delight recipients. Our goal is to become the go-to global gifting hub for anyone who wants to send a gift,” said Snappy CEO, Hani Goldstein.

“We work with some of the top entrepreneurs and disruptors across the globe, and Snappy is a natural fit for our portfolio,” said Hans Tung, managing partner at GGV Capital and Snappy board member. “We have been so impressed by the team and the incredible growth trajectory they are on. Snappy is emerging as a clear leader in this category, and we’re excited to have been a part of their journey over the last four years. We look forward to seeing their continued success.”

Companies in the US spend more than $125 billion on gifts for both employees and customers, with a further $375 billion spent by individuals. Yet, gift-giving is an inefficient process with over $100 billion in returns processed every year in the U.S. alone. Snappy’s unique approach to curated gift collections allows recipients to choose the gift they love before it’s delivered, making environmental and logistical sense.

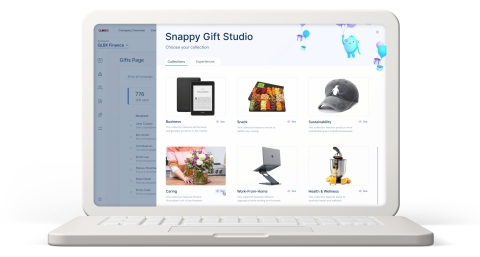

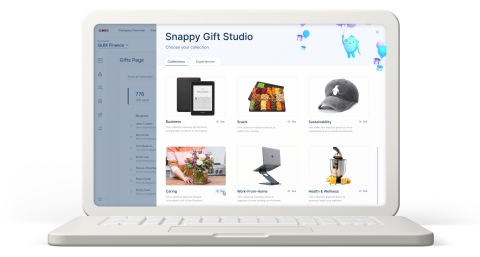

The platform offers high-quality gifts from top brands and retailers, handpicked by professionals using a proprietary gift-trends algorithm and real-time stock availability. It’s simple to set up and can also be integrated with human resources platforms to trigger automated gift sends for occasions like employees birthdays or work anniversaries. Snappy’s clients also have access to real-time recipient feedback and gift insights to help understand the positive impact of their programs. As corporations think through the future of work and the impact of digitalization & globalization on the workplace, it’s clear that engaging employees and customers, wherever they are located, is top of mind for leaders across the US.

Snappy is part of an increasing trend within the tech industry to weave social responsibility into its core DNA. The company offers gifts from a variety of minority-owned businesses, and charitable gift-giving is a key component of its platform. Snappy partners with GlobalGiving and GoFundMe to allow recipients to donate to their preferred charity in lieu of a physical gift, and has helped raise over $250,000 in the last year alone.

About Snappy

Founded in 2015, Snappy is an award-winning, all-in-one gifting platform that combines fun, personal gifting experiences with advanced technology that takes the guesswork out of gifting. We help companies show true appreciation to their employees and customers, spreading smiles and boosting loyalty and productivity at the touch of a button. Snappy is headquartered in New York and employs 130 people across four countries. Snappy was named to Inc.’s 2021 Best Workplaces list as well as Fortune’s “Best Small & Medium Workplaces.” Snappy's stance on diversity and inclusion, its active focus on give-back programs and its fundamental mission to spread happiness through fun, thoughtful gifts lead the way in unlocking the power of human kindness at work. For more information, visit www.snappy.com or contact press@snappy.com

About GGV

GGV Capital is a global venture capital firm that invests in seed-to-growth stage investments across Consumer/New Retail, Social/Internet, Enterprise/Cloud and Smart Tech sectors. The firm was established in 2000 in Singapore and Silicon Valley, and manages $9.2 billion in capital across 17 funds.

About 83North

83North is a global venture capital firm with over $1.8 billion under management. The fund invests across all stages, in exceptional entrepreneurs, whose focus is to build global category leading companies. 83North has backed more than 70 companies including AeroScout (acquired by Stanley Black & Decker), Celonis, Ebury, Hybris (acquired by SAP), IronSource, iZettle (acquired by PayPal), Just Eat (LSE:JE), Marqeta, Mirakl, ScaleIO (acquired by EMC), SocialPoint (acquired by Take2), Vast, Via and Wolt.

About Saban Ventures

Saban Ventures is focused on identifying, investing in and partnering with the most promising start-ups in stages that range from post-seed to growth. The fund invests in consumer and enterprise technology companies, across multiple domains, including Software, Consumer Internet and Technology Enabled Services.

About Hearst Ventures

Hearst Ventures is the global venture capital division of Hearst, a leading global, diversified media, information and services company with more than 360 businesses. Founded in 1995, the group has grown to become one of the most active and successful corporate venture funds with more than $1 billion invested to date. Notable current investments include 3D Hubs, Buzzfeed, Duality, FlashEx, GeoPhy, Kujiale, Otonomo and Via.