VANCOUVER, British Columbia--(BUSINESS WIRE)--Hawkmoon Resources Corp. (CSE:HM) (“Hawkmoon” or the “Company”) has signed an option agreement to acquire a 100% interest in the Lava gold property (“Lava” or the “Property”) from two arms-length vendors (the “Vendors”). The Property is comprised of 41 mineral claims totaling approximately 2061 hectares. The Property is situated in the Latulipe-et-Gaboury Township of Western Québec, 15 kilometres east of the village of Belleterre and 105 kilometres northeast of the city of Val d’Or.

Gold Showings and Mineralization

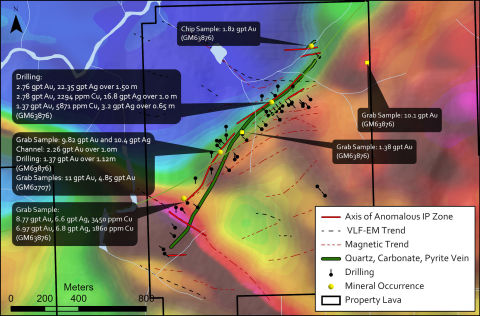

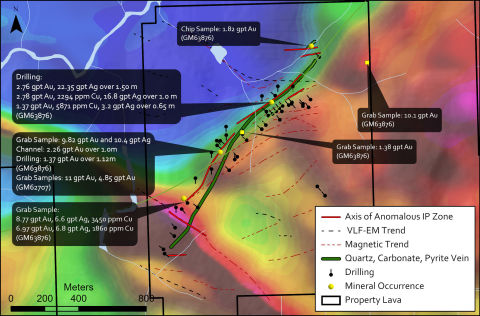

The Property covers the Lavallée number 38, 39, 40 and 41 gold showings (the “Showings”). The Showings are a series of gold-bearing quartz-carbonate veins (the “Veins”) which often contain sulphide minerals (“Sulphides”). Gold can be associated with Sulphides in the Belleterre area. The Veins occur within a ten kilometre long, northeast-trending corridor marked by numerous shear zones. This corridor is commonly referred to as the Lavallée Shear Zone (“LSZ”). The LSZ is displays a strong chargeability anomaly as outlined in Figure 1. Shallow drilling in 2007 identified intercepts of 2.16 grams per tonne (“GPT”) gold over 1.5 metres and 2.78 GPT over 1 metre1. These sampling values are “historical estimates” as defined under NI 43-101. The reader is cautioned that a qualified person has not done sufficient work to classify these historical estimates as current resources and Hawkmoon is not treating these historical estimates as a current mineral resource. While these estimates were prepared in accordance with NI 43-101 and the “Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves Definition Guidelines” in effect at the time, there is no guarantee that they would be consistent with current standards and they should not be regarded as consistent with current standards.

The Vendors recently collected six float samples at the number 38 and 39 showings of the LSZ. These samples have gold grades ranging from 0.12 to 3.42 GPT gold as shown in figure 4. These sampling values are “historical estimates” as defined under NI 43-101. The reader is cautioned that a qualified person has not done sufficient work to classify these historical estimates as current resources and Hawkmoon is not treating these historical estimates as a current mineral resource. While these estimates were prepared in accordance with NI 43-101 and the “Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves Definition Guidelines” in effect at the time, there is no guarantee that they would be consistent with current standards and they should not be regarded as consistent with current standards.

Belleterre Gold Camp

There is a recent revival of the Belleterre Gold Camp (the “Camp”) due to Vior Inc. (TSX.V:VIO) consolidating much of the Camp including the past-producing Belleterre Mine. The Belleterre Mine produced 750,000 ounces of gold and 95,000 ounces of silver between 1936 and 19593. In addition to Vior, Osisko Mining (TSX:OSK) has acquired a significant land position in the Camp. Furthermore, Osisko has made a significant equity investment in Vior 4,5.

Proposed Work Program

Hawkmoon proposes to re-interpret previous work on the Property. This includes 2D inversion studies on the 2007 induced polarization (“IP”) and resistivity data2 and 3D modelling of historical diamond drilling on Lava. Hawkmoon intends to conduct a trenching and rock sampling program to develop drill targets along the LSZ. This work is expected to commence this summer.

Property Purchase Terms

Under the terms of the agreement with the Vendors, Hawkmoon has the exclusive option to earn a 100% interest in Lava by paying $115,500 cash, issuing 1,320,000 Hawkmoon common shares to the Vendors and completing $500,000 of work expenditures over three years. Upon exercise of the option, the Vendors will retain a 3% net smelter return (“NSR”) royalty. One percent of the NSR may be purchased by Hawkmoon for $1 million.

About Hawkmoon Resources

Hawkmoon recently completed its initial public offering and is focused on its three Quebec gold projects. Two of these projects are in the Abitibi Greenstone Belt, one of the most prolific gold districts in the world.

Qualified Person

The technical information in this news release has been reviewed and approved by Thomas Clarke P.Geo., Pr.Sci.Nat. Mr. Clarke is a “Qualified Person” under NI 43-101 and a director and the Vice President Exploration of Hawkmoon.

HAWKMOON RESOURCES CORP.,

ON BEHALF OF THE BOARD

“Branden Haynes”

Branden Haynes, Chief Executive Officer

Forward Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the Company’s option to acquire the Lava gold property; potential mineralization; the scope and focus of the planned summer 2021 exploration program for the Lava property and the results of such activities, including the continuity or extension of any mineralization; and any other information herein that is not a historical fact may be “forward-looking information”. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “managements view”, “anticipates” or “does not anticipate”, “plans”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information. This “forward-looking information” is based on the reasonable assumptions and estimates of management of the Company at the time such assumptions and estimates were made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such “forward-looking information”. Such factors include, among others, risks relating to the ability of the Company to satisfy its obligations to earn an interest in the Lava property; the ability of the Company to complete exploration activities, the ability of the Company to raise funds as required to carry out its business plans and exploration activities; the results of exploration activities; risks relating to mining activities; the global economic climate; metal prices; dilution; environmental risks; and community and non-governmental actions. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions. The Company cannot provide any assurance that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended. The Company does not intend to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

References

1. |

Beauregard, A-J. and Gaudreault, D. (2007): SIGÉOM GM 63876 |

|

2. |

Boileau, P. (2007): SIGÉOM GM 63427 |

|

3. |

Vior Inc. (n.d.): www.vior.ca/projects/belleterre/ |

|

4. |

O3 Mining Corp. (2021): O3 Mining announces sale of Blondeau-Guillet Property, News Release January 8, 2021. |

|

5. |

Vior Inc. (2021): Vior closes “Strategic Investment” with Osisko Mining Inc., News Release March 23, 2021. |