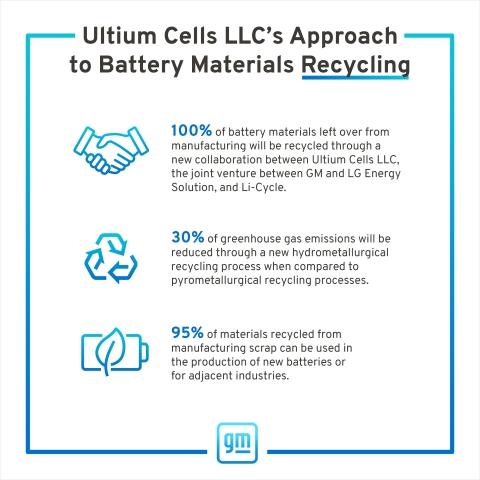

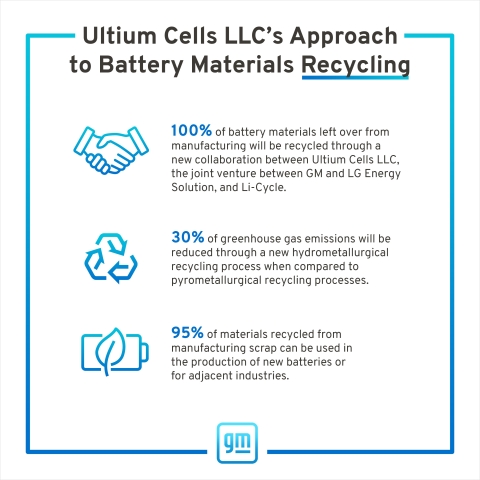

TORONTO--(BUSINESS WIRE)--Li-Cycle Corp. (“Li-Cycle” or “the Company”), an industry leader in lithium-ion battery resource recovery and the leading lithium-ion battery recycler in North America, today announced an agreement with Ultium Cells LLC (“Ultium”), a joint venture of General Motors (“GM”) and LG Energy Solution (“LGES”), to recycle up to 100% of the scrap generated by battery cell manufacturing at Ultium’s Lordstown, Ohio battery cell plant. Li-Cycle will recover the raw materials contained in the scrap, transforming them into valuable products and helping contribute to the circular economy.

As North America’s electric vehicle (EV) production ramps up, Li-Cycle believes this recycling partnership will be an essential piece in closing the battery supply chain loop and enabling sustainable production of new EV batteries. When fully operational in 2022, the $2.3 billion Ultium Cells LLC plant in Lordstown will span three million-square-feet, with annual capacity of approximately 35 gigawatt hours. Li-Cycle will enable Ultium Cells LLC to expand the materials it currently recycles and will play a key role in recycling efforts similar to joint venture partner GM’s zero-waste initiative by rerouting battery manufacturing scrap back into the supply chain through this multi-year contract.

"We strive to make more with less waste and energy expended," said Thomas Gallagher, chief operating officer, Ultium Cells LLC. "This is a crucial step in improving the sustainability of our components and manufacturing processes."

"Our efforts with Ultium Cells LLC will be instrumental in redirecting battery manufacturing scrap from landfills and returning a substantial amount of valuable battery grade materials back into the battery supply chain," said Ajay Kochhar, Li-Cycle’s president, CEO, and co-founder. "This partnership is a critical step forward in advancing our proven lithium-ion resource recovery technology as a more sustainable alternative to mining."

Using Li-Cycle’s patented Spoke & Hub Technologies at facilities in the United States, Li-Cycle will transform Ultium’s battery manufacturing scrap into new battery-grade materials, including lithium carbonate, cobalt sulphate, and nickel sulphate, as well as other recycled materials that can be returned to the economy.

"GM's zero-waste initiative aims to divert more than 90 percent of its manufacturing waste from landfills and incineration globally by 2025," said Ken Morris, GM vice president of Electric and Autonomous Vehicles. "Now, we're going to work closely with Ultium Cells and Li-Cycle to help the industry get even better use out of the materials."

On February 16, 2021, Li-Cycle announced its entry into a definitive business combination agreement with Peridot Acquisition Corp. (NYSE: PDAC) (“Peridot”). Upon the closing of the business combination, which is expected in the second quarter of 2021, the combined company will be named Li-Cycle Holdings Corp. (“Newco”). Li-Cycle intends to apply to list the common shares of the combined company on the New York Stock Exchange under the new ticker symbol, “LICY.”

About Li-Cycle

Li-Cycle is on a mission to leverage its innovative Spoke & Hub Technologies™ to provide a customer-centric, end-of-life solution for lithium-ion batteries, while creating a secondary supply of critical battery materials. Lithium-ion rechargeable batteries are increasingly powering our world in automotive, energy storage, consumer electronics, and other industrial and household applications. The world needs improved technology and supply chain innovations to better manage battery manufacturing waste and end-of-life batteries and to meet the rapidly growing demand for critical and scarce battery-grade raw materials through a closed-loop solution. For more information, visit https://li-cycle.com/.

About Ultium Cells

Ultium Cells LLC, a joint venture between General Motors and LG Energy Solution, will mass-produce Ultium battery cells at its Lordstown, Ohio facility to advance the push for a zero-emission, all-electric future. GM and LG Energy Solution are investing $2.3 billion in the facility to support EV manufacturing in the United States, and in turn, local jobs, education, career training and infrastructure. The plant will equal the size of 30 football fields and will have annual capacity of over 30 gigawatt hours with room to expand. Job seekers interested in challenging and rewarding careers in battery cell manufacturing can apply for open positions on the Ultium Cells website.

About General Motors

General Motors (NYSE:GM) is a global company focused on advancing an all-electric future that is inclusive and accessible to all. At the heart of this strategy is the Ultium battery platform, which powers everything from mass-market to high-performance vehicles. General Motors, its subsidiaries and its joint venture entities sell vehicles under the Chevrolet, Buick, GMC, Cadillac, Baojun and Wuling brands. More information on the company and its subsidiaries, including OnStar, a global leader in vehicle safety and security services, can be found at https://www.gm.com.

Additional Information and Where to Find It

In connection with the proposed business combination involving Li-Cycle and Peridot, Newco has prepared and filed with the SEC a registration statement on Form F-4 that will include a document that will serve as both a prospectus of Newco and a proxy statement of Peridot (the “Proxy Statement/Prospectus”). Li-Cycle, Peridot and Newco will prepare and file the Proxy Statement/Prospectus with the SEC and Peridot will mail the Proxy Statement/Prospectus to its shareholders and file other documents regarding the proposed transaction with the SEC. This communication is not a substitute for any proxy statement, registration statement, proxy statement/prospectus or other documents Peridot or Newco may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, ANY AMENDMENTS OR SUPPLEMENTS TO THE PROXY STATEMENT/PROSPECTUS, AND OTHER DOCUMENTS FILED BY PERIDOT OR NEWCO WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of the Proxy Statement/Prospectus and other documents filed with the SEC by Peridot or Newco through the website maintained by the SEC at www.sec.gov.

Investors and securityholders will also be able to obtain free copies of the documents filed by Peridot and/or Newco with the SEC on Peridot’s website at www.peridotspac.com or by emailing investors@li-cycle.com.

PARTICIPANTS IN THE SOLICITATION

Li-Cycle, Peridot, Newco, and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Proxy Statement/Prospectus and other relevant materials when it is filed with the SEC. Information regarding the directors and executive officers of Peridot is contained in Peridot’s final prospectus for its initial public offering, filed with the SEC on September 24, 2020 and certain of its Current Reports filed on Form 8-K. These documents can be obtained free of charge from the sources indicated above.

NO OFFER OR SOLICITATION

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities of Peridot or Newco or a solicitation of any vote or approval. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements contained in this communication may be considered forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21 of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed transaction involving Li-Cycle and Peridot and the ability to consummate the proposed transaction. Forward-looking statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include words such as “may,” “will,” “should,” “would,” “expect,” “anticipate,” “plan,” “likely”, “believe,” “estimate,” “project,” “intend,” and other similar expressions among others. Statements that are not historical facts are forward-looking statements. Forward-looking statements are based on current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation: (i) the risk that the conditions to the closing of the proposed transaction with Peridot are not satisfied, including the failure to timely or at all obtain shareholder approval for the proposed transaction or the failure to timely or at all obtain any required regulatory clearances, including under the Hart-Scott Rodino Antitrust Improvements Act; (ii) uncertainties as to the timing of the consummation of the proposed transaction with Peridot and the ability of each of Li-Cycle and Peridot to consummate the proposed transaction; (iii) the possibility that other anticipated benefits of the proposed transaction with Peridot will not be realized, and the anticipated tax treatment of the combination; (iv) the possibility that anticipated benefits of Li-Cycle’s agreement with Ultium will not be realized; (v) the occurrence of any event that could give rise to termination of the proposed transaction with Peridot; (vi) the risk that stockholder litigation in connection with the proposed transaction with Peridot or other settlements or investigations may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability; (vii) changes in general economic and/or industry specific conditions; (viii) possible disruptions from the proposed transaction with Peridot that could harm Li-Cycle’s business; (ix) the ability of Li-Cycle to retain, attract and hire key personnel; (x) potential adverse reactions or changes to relationships with customers, employees, suppliers or other parties resulting from the announcement or completion of the proposed transaction with Peridot or Li-Cycle’s agreement with Ultium; (xi) potential business uncertainty, including changes to existing business relationships, during the pendency of the proposed transaction with Peridot that could affect Li-Cycle’s financial performance; (xii) legislative, regulatory and economic developments; (xiii) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism, outbreak of war or hostilities and any epidemic, pandemic or disease outbreak (including COVID-19), as well as management’s response to any of the aforementioned factors; and (xiv) other risk factors as detailed from time to time in Peridot’s reports filed with the SEC, including Peridot’s annual report on Form 10-K, periodic quarterly reports on Form 10-Q, periodic current reports on Form 8-K and other documents filed with the SEC. The foregoing list of important factors is not exclusive. Neither Li-Cycle nor Peridot can give any assurance that the conditions to the proposed transaction with Peridot will be satisfied. Except as required by applicable law, neither Li-Cycle nor Peridot undertakes any obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.