LOUISVILLE, Ky.--(BUSINESS WIRE)--Yum! Brands, Inc. (NYSE: YUM) today reported results for the first-quarter ended March 31, 2021. Worldwide system sales excluding foreign currency translation grew 11%, with 9% same-store sales and 1% unit growth. First-quarter GAAP EPS was $1.07. First-quarter EPS excluding Special Items was also $1.07, an increase of 67% over the prior year quarter.

DAVID GIBBS COMMENTS

David Gibbs, CEO, said “First-quarter results reflect encouraging momentum across our business, including solid 2-year same-store sales growth and a meaningful uplift in unit development, underpinned by the focus and collaboration of our franchise partners and restaurant teams around the world. During the quarter we took important steps to further boost our digital and marketing capabilities through the acquisitions of two technology-focused companies that will enhance our ability to grow our sales overnight and our brands over time. Our foundation is strong and our path forward is clear. While uncertainties remain due to the ongoing impact of COVID-19 in many geographies, with our iconic brands, world-class talent and a healthy franchise system we are poised to enter a post-COVID world with a long runway of growth ahead of us.”

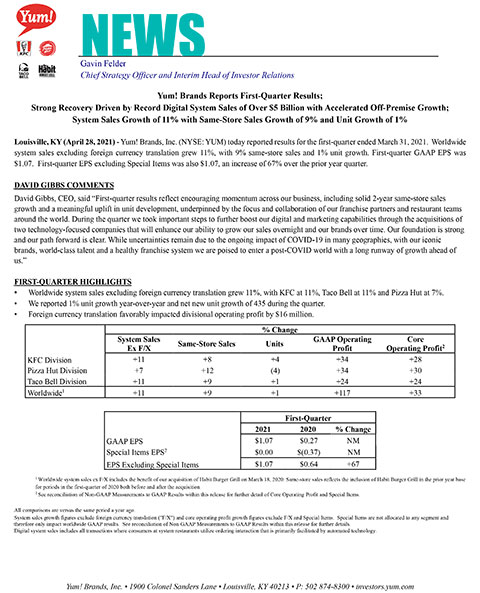

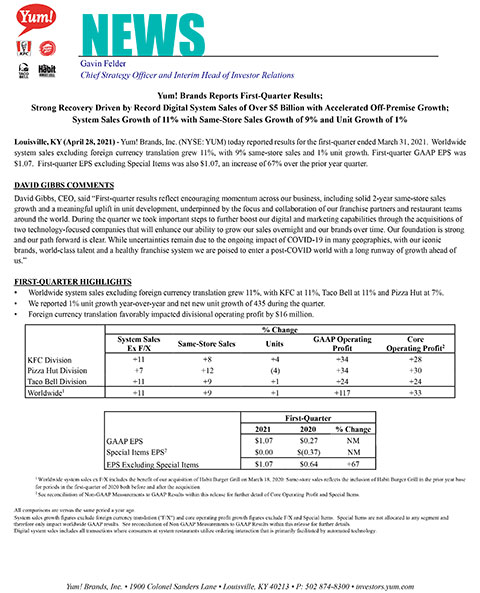

FIRST-QUARTER HIGHLIGHTS

- Worldwide system sales excluding foreign currency translation grew 11%, with KFC at 11%, Taco Bell at 11% and Pizza Hut at 7%.

- We reported 1% unit growth year-over-year and net new unit growth of 435 during the quarter.

- Foreign currency translation favorably impacted divisional operating profit by $16 million.

|

% Change |

||||

|

System Sales

|

Same-Store Sales |

Units |

GAAP Operating

|

Core Operating Profit2 |

KFC Division |

+11 |

+8 |

+4 |

+34 |

+28 |

Pizza Hut Division |

+7 |

+12 |

(4) |

+34 |

+30 |

Taco Bell Division |

+11 |

+9 |

+1 |

+24 |

+24 |

Worldwide1 |

+11 |

+9 |

+1 |

+117 |

+33 |

|

First-Quarter |

||

|

2021 |

2020 |

% Change |

GAAP EPS |

$1.07 |

$0.27 |

NM |

Special Items EPS2 |

$0.00 |

$(0.37) |

NM |

EPS Excluding Special Items |

$1.07 |

$0.64 |

+67 |

1 Worldwide system sales ex F/X includes the benefit of our acquisition of Habit Burger Grill on March 18, 2020. Same-store sales reflects the inclusion of Habit Burger Grill in the prior year base for periods in the first-quarter of 2020 both before and after the acquisition. |

2 See reconciliation of Non-GAAP Measurements to GAAP Results within this release for further detail of Core Operating Profit and Special Items. |

|

All comparisons are versus the same period a year ago. |

System sales growth figures exclude foreign currency translation ("F/X") and core operating profit growth figures exclude F/X and Special Items. Special Items are not allocated to any segment and therefore only impact worldwide GAAP results. See reconciliation of Non-GAAP Measurements to GAAP Results within this release for further details. |

Digital system sales includes all transactions where consumers at system restaurants utilize ordering interaction that is primarily facilitated by automated technology. |

|

KFC DIVISION

|

First-Quarter |

|||

|

|

|

%/ppts Change |

|

|

2021 |

2020 |

Reported |

Ex F/X |

Restaurants |

25,292 |

24,304 |

+4 |

N/A |

System Sales ($MM) |

7,273 |

6,287 |

+16 |

+11 |

Same-Store Sales Growth (%) |

+8 |

(8) |

NM |

NM |

Franchise and Property Revenues ($MM) |

354 |

315 |

+12 |

+8 |

Operating Profit ($MM) |

300 |

224 |

+34 |

+28 |

Operating Margin (%) |

48.1 |

39.7 |

8.4 |

8.4 |

|

First-Quarter (% Change) |

|

|

International |

U.S. |

System Sales Growth Ex F/X |

+11 |

+13 |

Same-Store Sales Growth |

+7 |

+14 |

|

||

- KFC Division opened 409 gross new restaurants in 50 countries.

- Operating margin increased 8.4 percentage points driven by same-store sales growth, lower bad debt expense, and unit growth.

- Foreign currency translation favorably impacted operating profit by $13 million.

-

For the division, same-store sales were even on a 2-year basis, which includes the impact of about 1% of our stores being temporarily closed as of the end of the first-quarter 2021.

- For KFC International, same-store sales declined 2% on a 2-year basis, which includes the impact of about 2% of our stores being temporarily closed as of the end of the first-quarter 2021.

- For KFC U.S., same-store sales grew 11% on a 2-year basis, which includes the impact of less than 1% of our stores being temporarily closed as of the end of the first-quarter 2021.

KFC Markets1 |

Percent of KFC

|

System Sales Growth

|

First-Quarter

|

||

China |

27% |

+24 |

United States |

18% |

+13 |

Asia |

12% |

(1) |

Russia, Central & Eastern Europe |

7% |

+5 |

Australia |

7% |

+12 |

United Kingdom |

6% |

+16 |

Western Europe |

5% |

+2 |

Latin America |

5% |

(1) |

Africa |

4% |

+8 |

Middle East / Turkey / North Africa |

4% |

+13 |

Canada |

2% |

+10 |

Thailand |

2% |

(18) |

India |

1% |

+15 |

1Refer to investors.yum.com/financial-information/financial-reports/ for a list of the countries within each of the markets. 2Reflects Full Year 2020. |

||

PIZZA HUT DIVISION

|

First-Quarter |

|||

|

|

|

%/ppts Change |

|

|

2021 |

2020 |

Reported |

Ex F/X |

Restaurants |

17,710 |

18,533 |

(4) |

N/A |

System Sales ($MM) |

3,096 |

2,801 |

+11 |

+7 |

Same-Store Sales Growth (%) |

+12 |

(11) |

NM |

NM |

Franchise and Property Revenues ($MM) |

141 |

133 |

+7 |

+4 |

Operating Profit ($MM) |

102 |

76 |

+34 |

+30 |

Operating Margin (%) |

40.7 |

32.7 |

8.0 |

7.7 |

|

First-Quarter (% Change) |

|

|

International |

U.S. |

System Sales Growth Ex F/X |

+7 |

+8 |

Same-Store Sales Growth |

+8 |

+16 |

- Pizza Hut Division opened 172 gross new restaurants in 33 countries.

- Operating margin increased 8 percentage points driven by same-store sales growth, lower bad debt expense, and lower general and administrative expenses, partially offset by the impact of prior year permanent unit closures.

- Foreign currency translation favorably impacted operating profit by $3 million.

- Pizza Hut U.S. off-premise channel generated 23% same-store sales growth.

-

For the division, same-store sales declined 1% on a 2-year basis, which includes the impact of about 3% of our stores being temporarily closed as of the end of the first-quarter 2021.

- For Pizza Hut International, same-store sales declined 7% on a 2-year basis, which includes the impact of about 3% of our stores being temporarily closed as of the end of the first-quarter 2021.

- For Pizza Hut U.S., same-store sales grew 8% on a 2-year basis, which includes the impact of about 3% of our stores being temporarily closed as of the end of the first-quarter 2021.

Pizza Hut Markets1 |

Percent of Pizza Hut

|

System Sales Growth

|

First-Quarter

|

||

United States |

45% |

+8 |

China |

15% |

+57 |

Asia |

15% |

Even |

Latin America / Spain / Portugal |

10% |

(6) |

Europe (excluding Spain & Portugal) |

8% |

(23) |

Middle East / Turkey / North Africa |

3% |

(12) |

Canada |

3% |

+18 |

India |

1% |

+9 |

Africa |

<1% |

+9 |

1Refer to investors.yum.com/financial-information/financial-reports/ for a list of the countries within each of the markets. 2Reflects Full Year 2020. |

||

TACO BELL DIVISION

|

First-Quarter |

|||

|

|

|

%/ppts Change |

|

|

2021 |

2020 |

Reported |

Ex F/X |

Restaurants |

7,493 |

7,398 |

+1 |

N/A |

System Sales ($MM) |

2,880 |

2,596 |

+11 |

+11 |

Same-Store Sales Growth (%) |

+9 |

+1 |

NM |

NM |

Franchise and Property Revenues ($MM) |

162 |

148 |

+9 |

+9 |

Operating Profit ($MM) |

178 |

144 |

+24 |

+24 |

Operating Margin (%) |

36.4 |

31.7 |

4.7 |

4.7 |

- Taco Bell Division opened 73 gross new restaurants in 9 countries.

- Operating margin increased 4.7 percentage points due to same-store sales growth and lower general and administrative expenses.

- For the division, same-store sales grew 10% on a 2-year basis, which includes the impact of less than 1% of stores being temporarily closed as of the end of the first-quarter 2021.

HABIT BURGER GRILL DIVISION

- The Habit Burger Grill Division opened 6 gross new restaurants in the U.S and Cambodia.

- During the quarter, The Habit Burger Grill Division same-store sales grew 13%.

- For the division, same-store sales grew 3% on a 2-year basis, which includes the impact of about 2% stores that were temporarily closed as of the end of the first-quarter 2021.

OTHER ITEMS

- Same-store sales growth on a 2-year basis is calculated using the geometric method as follows: (1 + Q1 2020 reported same-store sales growth) * (1 + Q1 2021 reported same-store sales growth) - 1.

- On March 15, we refinanced our existing Term Loan A facility (approximately $431 million), Term Loan B facility (approximately $1.9 billion), and $1.0 billion revolving facility through the issuance of a $750 million Term Loan A facility maturing March 15, 2026, $1.5 billion Term Loan B facility maturing March 15, 2028 and a $1.25 billion revolving credit facility maturing March 15, 2026 pursuant to an amendment to the underlying credit agreement.

- On April 1, subsequent to the end of our first quarter, we issued $1.1 billion of YUM Senior Unsecured Notes with a coupon of 4.625% due in 2032. The proceeds from this transaction are being used to repay $1.05 billion of 5.25% Subsidiary Senior Unsecured Notes (due in 2026), including the applicable prepayment premium.

- Disclosures pertaining to outstanding debt in our Restricted Group capital structure will be provided at the time of the filing of the first-quarter Form 10-Q.

CONFERENCE CALL

Yum! Brands, Inc. will host a conference call to review the company's financial performance and strategies at 8:15 a.m. Eastern Time April 28, 2021. The number is 877/871-3172 for U.S. callers, 412/902-6603 for international callers, conference ID 6290180.

The call will be available for playback beginning at 10:00 a.m. Eastern Time April 28, 2021 through May 5, 2021. To access the playback, dial 877/344-7529 in the U.S., 855/669-9658 in Canada, and 412/317-0088 internationally, conference ID 10153502.

The webcast and the playback can be accessed by visiting Yum! Brands' website, investors.yum.com/events-and-presentations and selecting “Q1 2021 Yum! Brands, Inc. Earnings Call.”

ADDITIONAL INFORMATION ONLINE

Quarter end dates for each division, restaurant count details, definitions of terms and Restricted Group financial information are available at investors.yum.com. Reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures are included within this release.

FORWARD-LOOKING STATEMENTS

This announcement may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. We intend all forward-looking statements to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally can be identified by the fact that they do not relate strictly to historical or current facts and by the use of forward-looking words such as “expect,” “expectation,” “believe,” “anticipate,” “may,” “could,” “intend,” “belief,” “plan,” “estimate,” “target,” “predict,” “likely,” “seek,” “project,” “model,” “ongoing,” “will,” “should,” “forecast,” “outlook” or similar terminology. These statements are based on and reflect our current expectations, estimates, assumptions and/or projections, our perception of historical trends and current conditions, as well as other factors that we believe are appropriate and reasonable under the circumstances. Forward-looking statements are neither predictions nor guarantees of future events, circumstances or performance and are inherently subject to known and unknown risks, uncertainties and assumptions that could cause our actual results to differ materially from those indicated by those statements. There can be no assurance that our expectations, estimates, assumptions and/or projections, including with respect to the future earnings and performance or capital structure of Yum! Brands, will prove to be correct or that any of our expectations, estimates or projections will be achieved.

Numerous factors could cause our actual results and events to differ materially from those expressed or implied by forward-looking statements, including, without limitation: the severity and duration of the COVID-19 pandemic, food safety and food borne-illness issues; health concerns arising from outbreaks of a significant health epidemic; the success of our franchisees and licensees; our significant exposure to the Chinese market; changes in economic and political conditions in countries and territories outside of the U.S. where we operate; our ability to protect the integrity and security of personal information of our customers and employees; our ability to successfully implement technology initiatives; our increasing dependence on multiple digital commerce platforms; the impact of social media; our ability to secure and maintain distribution and adequate supply to our restaurants; the loss of key personnel, or labor shortages or difficulty finding qualified employees; the success of our development strategy in emerging markets; changes in commodity, labor and other operating costs; harm or dilution to our brands caused by franchisee and third party activity; pending or future litigation and legal claims or proceedings; changes in or noncompliance with government regulations, including labor standards and anti-bribery or anti-corruption laws; tax matters, including changes in tax laws or disagreements with taxing authorities; consumer preferences and perceptions of our brands; failure to protect our service marks or other intellectual property; changes in consumer discretionary spending and general economic conditions; competition within the retail food industry; not realizing the anticipated benefits from past or potential future acquisitions, investments or other strategic transactions, and risks relating to our significant amount of indebtedness. In addition, other risks and uncertainties not presently known to us or that we currently believe to be immaterial could affect the accuracy of any such forward-looking statements. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty.

The forward-looking statements included in this announcement are only made as of the date of this announcement and we disclaim any obligation to publicly update any forward-looking statement to reflect subsequent events or circumstances. You should consult our filings with the Securities and Exchange Commission (including the information set forth under the captions “Risk Factors” and “Forward-Looking Statements” in our most recently filed Annual Report on Form 10-K and Quarterly Report on Form 10-Q) for additional detail about factors that could affect our financial and other results.

Yum! Brands, Inc., based in Louisville, Kentucky, has over 50,000 restaurants in more than 150 countries and territories primarily operating the company’s brands – KFC, Pizza Hut and Taco Bell – global leaders of the chicken, pizza and Mexican-style food categories. The Company’s family of brands also includes The Habit Burger Grill, a fast-casual restaurant concept specializing in made-to-order chargrilled burgers, sandwiches and more. Yum! Brands was included on the 2021 Bloomberg Gender-Equality Index and in 2020, Yum! Brands was named to the Dow Jones Sustainability Index North America and was ranked among the top 100 Best Corporate Citizens by 3BL Media.

YUM! Brands, Inc. Condensed Consolidated Summary of Results (amounts in millions, except per share amounts) (unaudited) |

|||||||||

|

Quarter ended |

|

% Change |

||||||

|

3/31/21 |

|

3/31/20 |

|

B/(W) |

||||

Revenues |

|

|

|

|

|

||||

Company sales |

$ |

476 |

|

|

$ |

355 |

|

|

34 |

Franchise and property revenues |

658 |

|

|

596 |

|

|

10 |

||

Franchise contributions for advertising and other services |

352 |

|

|

312 |

|

|

13 |

||

Total revenues |

1,486 |

|

|

1,263 |

|

|

18 |

||

|

|

|

|

|

|

||||

Costs and Expenses, Net |

|

|

|

|

|

||||

Company restaurant expenses |

392 |

|

|

298 |

|

|

(32) |

||

General and administrative expenses |

206 |

|

|

208 |

|

|

1 |

||

Franchise and property expenses |

23 |

|

|

58 |

|

|

61 |

||

Franchise advertising and other services expense |

343 |

|

|

310 |

|

|

(10) |

||

Refranchising (gain) loss |

(15 |

) |

|

(13 |

) |

|

15 |

||

Other (income) expense |

(6 |

) |

|

152 |

|

|

NM |

||

Total costs and expenses, net |

943 |

|

|

1,013 |

|

|

7 |

||

|

|

|

|

|

|

||||

Operating Profit |

543 |

|

|

250 |

|

|

117 |

||

Investment (income) expense, net |

— |

|

|

34 |

|

|

NM |

||

Other pension (income) expense |

3 |

|

|

3 |

|

|

(12) |

||

Interest expense, net |

131 |

|

|

118 |

|

|

(11) |

||

Income before income taxes |

409 |

|

|

95 |

|

|

NM |

||

Income tax provision |

83 |

|

|

12 |

|

|

NM |

||

Net Income |

$ |

326 |

|

|

$ |

83 |

|

|

NM |

|

|

|

|

|

|

||||

Basic EPS |

|

|

|

|

|

||||

EPS |

$ |

1.09 |

|

|

$ |

0.28 |

|

|

NM |

Average shares outstanding |

301 |

|

|

302 |

|

|

1 |

||

|

|

|

|

|

|

||||

Diluted EPS |

|

|

|

|

|

||||

EPS |

$ |

1.07 |

|

|

$ |

0.27 |

|

|

NM |

Average shares outstanding |

305 |

|

|

307 |

|

|

1 |

||

|

|

|

|

|

|

||||

Dividends declared per common share |

$ |

0.50 |

|

|

$ |

0.47 |

|

|

|

See accompanying notes. Percentages may not recompute due to rounding. |

|||||||||

YUM! Brands, Inc. KFC DIVISION Operating Results (amounts in millions) (unaudited) |

|||||||||

|

Quarter ended |

|

% Change |

||||||

|

3/31/21 |

|

3/31/20 |

|

B/(W) |

||||

|

|

|

|

|

|

||||

Company sales |

$ |

133 |

|

|

$ |

130 |

|

|

2 |

Franchise and property revenues |

354 |

|

|

315 |

|

|

12 |

||

Franchise contributions for advertising and other services |

138 |

|

|

121 |

|

|

14 |

||

Total revenues |

625 |

|

|

566 |

|

|

10 |

||

|

|

|

|

|

|

||||

Company restaurant expenses |

111 |

|

|

115 |

|

|

3 |

||

General and administrative expenses |

73 |

|

|

73 |

|

|

— |

||

Franchise and property expenses |

14 |

|

|

33 |

|

|

59 |

||

Franchise advertising and other services expense |

133 |

|

|

120 |

|

|

(11) |

||

Other (income) expense |

(6 |

) |

|

1 |

|

|

NM |

||

Total costs and expenses, net |

325 |

|

|

342 |

|

|

5 |

||

Operating Profit |

$ |

300 |

|

|

$ |

224 |

|

|

34 |

|

|

|

|

|

|

||||

Restaurant margin |

16.6 |

% |

|

11.7 |

% |

|

4.9 ppts. |

||

|

|

|

|

|

|

||||

Operating margin |

48.1 |

% |

|

39.7 |

% |

|

8.4 ppts. |

||

See accompanying notes. Percentages may not recompute due to rounding. |

|||||||||

YUM! Brands, Inc. PIZZA HUT DIVISION Operating Results (amounts in millions) (unaudited) |

|||||||||

|

Quarter ended |

|

% Change |

||||||

|

3/31/21 |

|

3/31/20 |

|

B/(W) |

||||

|

|

|

|

|

|

||||

Company sales |

$ |

14 |

|

|

$ |

18 |

|

|

(24) |

Franchise and property revenues |

141 |

|

|

133 |

|

|

7 |

||

Franchise contributions for advertising and other services |

96 |

|

|

84 |

|

|

14 |

||

Total revenues |

251 |

|

|

235 |

|

|

7 |

||

|

|

|

|

|

|

||||

Company restaurant expenses |

13 |

|

|

19 |

|

|

31 |

||

General and administrative expenses |

40 |

|

|

46 |

|

|

11 |

||

Franchise and property expenses |

2 |

|

|

12 |

|

|

84 |

||

Franchise advertising and other services expense |

94 |

|

|

84 |

|

|

(12) |

||

Other (income) expense |

— |

|

|

(2 |

) |

|

NM |

||

Total costs and expenses, net |

149 |

|

|

159 |

|

|

6 |

||

Operating Profit |

$ |

102 |

|

|

$ |

76 |

|

|

34 |

|

|

|

|

|

|

||||

Restaurant margin |

6.7 |

% |

|

(3.0 |

)% |

|

9.7 ppts. |

||

|

|

|

|

|

|

||||

Operating margin |

40.7 |

% |

|

32.7 |

% |

|

8.0 ppts. |

||

See accompanying notes. Percentages may not recompute due to rounding. |

|||||||||

YUM! Brands, Inc. TACO BELL DIVISION Operating Results (amounts in millions) (unaudited) |

|||||||||

|

Quarter ended |

|

% Change |

||||||

|

3/31/21 |

|

3/31/20 |

|

B/(W) |

||||

|

|

|

|

|

|

||||

Company sales |

$ |

208 |

|

|

$ |

198 |

|

|

5 |

Franchise and property revenues |

162 |

|

|

148 |

|

|

9 |

||

Franchise contributions for advertising and other services |

118 |

|

|

107 |

|

|

10 |

||

Total revenues |

488 |

|

|

453 |

|

|

8 |

||

|

|

|

|

|

|

||||

Company restaurant expenses |

158 |

|

|

153 |

|

|

(3) |

||

General and administrative expenses |

31 |

|

|

38 |

|

|

17 |

||

Franchise and property expenses |

7 |

|

|

11 |

|

|

36 |

||

Franchise advertising and other services expense |

116 |

|

|

106 |

|

|

(9) |

||

Other (income) expense |

(2 |

) |

|

1 |

|

|

NM |

||

Total costs and expenses, net |

310 |

|

|

309 |

|

|

— |

||

Operating Profit |

$ |

178 |

|

|

$ |

144 |

|

|

24 |

|

|

|

|

|

|

||||

Restaurant margin |

24.1 |

% |

|

22.4 |

% |

|

1.7 ppts. |

||

|

|

|

|

|

|

||||

Operating margin |

36.4 |

% |

|

31.7 |

% |

|

4.7 ppts. |

||

See accompanying notes. Percentages may not recompute due to rounding. |

|||||||||

YUM! Brands, Inc. Condensed Consolidated Balance Sheets (amounts in millions) |

|||||||

|

(unaudited) 3/31/21 |

|

12/31/20 |

||||

ASSETS |

|

|

|

||||

Current Assets |

|

|

|

||||

Cash and cash equivalents |

$ |

561 |

|

|

$ |

730 |

|

Accounts and notes receivable, less allowance: $37 in 2021 and $45 in 2020 |

508 |

|

|

534 |

|

||

Prepaid expenses and other current assets |

385 |

|

|

425 |

|

||

Total Current Assets |

1,454 |

|

|

1,689 |

|

||

|

|

|

|

||||

Property, plant and equipment, net of accumulated depreciation of $1,251 in 2021 and $1,230 in 2020 |

1,215 |

|

|

1,235 |

|

||

Goodwill |

597 |

|

|

597 |

|

||

Intangible assets, net |

354 |

|

|

343 |

|

||

Other assets |

1,416 |

|

|

1,435 |

|

||

Deferred income taxes |

514 |

|

|

553 |

|

||

Total Assets |

$ |

5,550 |

|

|

$ |

5,852 |

|

|

|

|

|

||||

LIABILITIES AND SHAREHOLDERS' DEFICIT |

|

|

|

||||

Current Liabilities |

|

|

|

||||

Accounts payable and other current liabilities |

$ |

1,061 |

|

|

$ |

1,189 |

|

Income taxes payable |

24 |

|

|

33 |

|

||

Short-term borrowings |

394 |

|

|

453 |

|

||

Total Current Liabilities |

1,479 |

|

|

1,675 |

|

||

|

|

|

|

||||

Long-term debt |

10,229 |

|

|

10,272 |

|

||

Other liabilities and deferred credits |

1,754 |

|

|

1,796 |

|

||

Total Liabilities |

13,462 |

|

|

13,743 |

|

||

|

|

|

|

||||

Shareholders' Deficit |

|

|

|

||||

Common Stock, no par value, 750 shares authorized; 298 shares issued in 2021 and 300 issued in 2020 |

— |

|

|

— |

|

||

Accumulated deficit |

(7,566 |

) |

|

(7,480 |

) |

||

Accumulated other comprehensive loss |

(346 |

) |

|

(411 |

) |

||

Total Shareholders' Deficit |

(7,912 |

) |

|

(7,891 |

) |

||

Total Liabilities and Shareholders' Deficit |

$ |

5,550 |

|

|

$ |

5,852 |

|

See accompanying notes. |

|||||||

YUM! Brands, Inc. Condensed Consolidated Statements of Cash Flows (amounts in millions) (unaudited) |

|||||||

|

Quarter ended |

||||||

|

3/31/21 |

|

3/31/20 |

||||

Cash Flows - Operating Activities |

|

|

|

||||

Net Income |

$ |

326 |

|

|

$ |

83 |

|

Depreciation and amortization |

39 |

|

|

27 |

|

||

Impairment and closure expense |

1 |

|

|

140 |

|

||

Refranchising (gain) loss |

(15 |

) |

|

(13 |

) |

||

Investment (income) expense, net |

— |

|

|

34 |

|

||

Contributions to defined benefit pension plans |

(2 |

) |

|

(1 |

) |

||

Deferred income taxes |

14 |

|

|

(31 |

) |

||

Share-based compensation expense |

21 |

|

|

18 |

|

||

Changes in accounts and notes receivable |

27 |

|

|

25 |

|

||

Changes in prepaid expenses and other current assets |

(9 |

) |

|

(17 |

) |

||

Changes in accounts payable and other current liabilities |

(123 |

) |

|

(51 |

) |

||

Changes in income taxes payable |

5 |

|

|

(11 |

) |

||

Other, net |

40 |

|

|

35 |

|

||

Net Cash Provided by Operating Activities |

324 |

|

|

238 |

|

||

|

|

|

|

||||

Cash Flows - Investing Activities |

|

|

|

||||

Capital spending |

(45 |

) |

|

(35 |

) |

||

Acquisition of The Habit Restaurants, Inc. |

— |

|

|

(408 |

) |

||

Proceeds from refranchising of restaurants |

20 |

|

|

2 |

|

||

Other, net |

39 |

|

|

— |

|

||

Net Cash Provided by (Used in) Investing Activities |

14 |

|

|

(441 |

) |

||

|

|

|

|

||||

Cash Flows - Financing Activities |

|

|

|

||||

Proceeds from long-term debt |

800 |

|

|

— |

|

||

Repayments of long-term debt |

(912 |

) |

|

(20 |

) |

||

Revolving credit facilities, three months or less, net |

— |

|

|

950 |

|

||

Short-term borrowings by original maturity |

|

|

|

||||

More than three months - proceeds |

— |

|

|

66 |

|

||

More than three months - payments |

— |

|

|

(44 |

) |

||

Three months or less, net |

— |

|

|

— |

|

||

Repurchase shares of Common Stock |

(286 |

) |

|

— |

|

||

Dividends paid on Common Stock |

(150 |

) |

|

(141 |

) |

||

Debt issuance costs |

(5 |

) |

|

— |

|

||

Other, net |

(10 |

) |

|

(13 |

) |

||

Net Cash Provided by (Used in) Financing Activities |

(563 |

) |

|

798 |

|

||

Effect of Exchange Rate on Cash and Cash Equivalents |

3 |

|

|

(53 |

) |

||

Net Increase (Decrease) in Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents |

(222 |

) |

|

542 |

|

||

Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents - Beginning of Period |

1,024 |

|

|

768 |

|

||

Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents - End of Period |

$ |

802 |

|

|

$ |

1,310 |

|

|

|

|

|

||||

See accompanying notes. |

|||||||

Reconciliation of Non-GAAP Measurements to GAAP Results

(amounts in millions, except per share amounts)

(unaudited)

In addition to the results provided in accordance with Generally Accepted Accounting Principles in the United States of America ("GAAP"), the Company provides the following non-GAAP measurements.

- Diluted Earnings Per Share ("EPS") excluding Special Items (as defined below);

- Effective Tax Rate excluding Special Items;

- Core Operating Profit. Core Operating Profit excludes Special Items and FX and we use Core Operating Profit for the purposes of evaluating performance internally.

These non-GAAP measurements are not intended to replace the presentation of our financial results in accordance with GAAP. Rather, the Company believes that the presentation of these non-GAAP measurements provide additional information to investors to facilitate the comparison of past and present operations.

Special Items are not included in any of our Division segment results as the Company does not believe they are indicative of our ongoing operations due to their size and/or nature. Our chief operating decision maker does not consider the impact of Special Items when assessing segment performance. The Special Items are described in (a) - (d) in the accompanying notes.

Certain non-GAAP measurements are presented excluding the impact of FX. These amounts are derived by translating current year results at prior year average exchange rates. We believe the elimination of the FX impact provides better year-to-year comparability without the distortion of foreign currency fluctuations.

|

|

Quarter ended |

||||||

|

|

3/31/21 |

|

3/31/20 |

||||

Detail of Special Items |

|

|

|

|

||||

Refranchising gain (loss)(a) |

|

$ |

2 |

|

|

$ |

3 |

|

Costs associated with acquisition and integration of Habit Burger Grill(b) |

|

— |

|

|

(6 |

) |

||

Impairment of Habit Burger Grill goodwill(c) |

|

— |

|

|

(139 |

) |

||

Other Special Items Income (Expense) |

|

— |

|

|

(3 |

) |

||

Special Items Income (Expense) - Operating Profit |

|

2 |

|

|

(145 |

) |

||

Tax (Expense) Benefit on Special Items(d) |

|

(1 |

) |

|

33 |

|

||

Special Items Income (Expense), net of tax |

|

$ |

1 |

|

|

$ |

(112 |

) |

Average diluted shares outstanding |

|

305 |

|

|

307 |

|

||

Special Items diluted EPS |

|

$ |

— |

|

|

$ |

(0.37 |

) |

|

|

|

|

|

||||

Reconciliation of GAAP Operating Profit to Core Operating Profit |

|

|

|

|

||||

|

|

|

|

|

||||

Consolidated |

|

|

|

|

||||

GAAP Operating Profit |

|

$ |

543 |

|

|

$ |

250 |

|

Special Items Income (Expense) |

|

2 |

|

|

(145 |

) |

||

Foreign Currency Impact on Divisional Operating Profit |

|

16 |

|

|

|

N/A |

|

|

Core Operating Profit |

|

$ |

525 |

|

|

$ |

395 |

|

|

|

|

|

|

||||

KFC Division |

|

|

|

|

||||

GAAP Operating Profit |

|

$ |

300 |

|

|

$ |

224 |

|

Foreign Currency Impact on Divisional Operating Profit |

|

13 |

|

|

|

N/A |

|

|

Core Operating Profit |

|

$ |

287 |

|

|

$ |

224 |

|

|

|

|

|

|

||||

Reconciliation of Non-GAAP Measurements to GAAP Results (Continued) (amounts in millions, except per share amounts) (unaudited) |

||||||||

|

|

Quarter ended |

||||||

|

|

3/31/21 |

|

3/31/20 |

||||

Pizza Hut Division |

|

|

|

|

||||

GAAP Operating Profit |

|

$ |

102 |

|

|

$ |

76 |

|

Foreign Currency Impact on Divisional Operating Profit |

|

3 |

|

|

N/A |

|

||

Core Operating Profit |

|

$ |

99 |

|

|

$ |

76 |

|

|

|

|

|

|

||||

Taco Bell Division |

|

|

|

|

||||

GAAP Operating Profit |

|

$ |

178 |

|

|

$ |

144 |

|

Foreign Currency Impact on Divisional Operating Profit |

|

— |

|

|

|

N/A |

|

|

Core Operating Profit |

|

$ |

178 |

|

|

$ |

144 |

|

|

|

|

|

|

||||

Habit Burger Grill Division |

|

|

|

|

||||

GAAP Operating Profit (Loss) |

|

$ |

— |

|

|

$ |

(2 |

) |

Foreign Currency Impact on Divisional Operating Profit |

|

— |

|

|

|

N/A |

|

|

Core Operating Profit |

|

$ |

— |

|

|

$ |

(2 |

) |

|

|

|

|

|

||||

Reconciliation of Diluted EPS to Diluted EPS excluding Special Items |

|

|

|

|

||||

Diluted EPS |

|

$ |

1.07 |

|

|

$ |

0.27 |

|

Special Items Diluted EPS |

|

— |

|

|

(0.37 |

) |

||

Diluted EPS excluding Special Items |

|

$ |

1.07 |

|

|

$ |

0.64 |

|

|

|

|

|

|

||||

Reconciliation of GAAP Effective Tax Rate to Effective Tax Rate excluding Special Items |

|

|

|

|

||||

GAAP Effective Tax Rate |

|

20.2 |

% |

|

12.5 |

% |

||

Impact on Tax Rate as a result of Special Items |

|

— |

% |

|

(6.2 |

)% |

||

Effective Tax Rate excluding Special Items |

|

20.2 |

% |

|

18.7 |

% |

||

YUM! Brands, Inc. Segment Results (amounts in millions) (unaudited) |

|||||||||||||||||||||||

Quarter Ended 3/31/2021 |

KFC |

|

Pizza Hut |

|

Taco Bell |

|

Habit

|

|

Corporate

|

|

Consolidated |

||||||||||||

Total revenues |

$ |

625 |

|

|

$ |

251 |

|

|

$ |

488 |

|

|

$ |

122 |

|

|

$ |

— |

|

|

$ |

1,486 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Company restaurant expenses |

111 |

|

|

13 |

|

|

158 |

|

|

110 |

|

|

— |

|

|

392 |

|

||||||

General and administrative expenses |

73 |

|

|

40 |

|

|

31 |

|

|

12 |

|

|

50 |

|

|

206 |

|

||||||

Franchise and property expenses |

14 |

|

|

2 |

|

|

7 |

|

|

— |

|

|

— |

|

|

23 |

|

||||||

Franchise advertising and other services expense |

133 |

|

|

94 |

|

|

116 |

|

|

— |

|

|

— |

|

|

343 |

|

||||||

Refranchising (gain) loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(15 |

) |

|

(15 |

) |

||||||

Other (income) expense |

(6 |

) |

|

— |

|

|

(2 |

) |

|

— |

|

|

2 |

|

|

(6 |

) |

||||||

Total costs and expenses, net |

325 |

|

|

149 |

|

|

310 |

|

|

122 |

|

|

37 |

|

|

943 |

|

||||||

Operating Profit (Loss) |

$ |

300 |

|

|

$ |

102 |

|

|

$ |

178 |

|

|

$ |

— |

|

|

$ |

(37 |

) |

|

$ |

543 |

|

Quarter Ended 3/31/2020 |

KFC |

|

Pizza Hut |

|

Taco Bell |

|

Habit

|

|

Corporate

|

|

Consolidated |

||||||||||||

Total revenues |

$ |

566 |

|

|

$ |

235 |

|

|

$ |

453 |

|

|

$ |

9 |

|

|

$ |

— |

|

|

$ |

1,263 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Company restaurant expenses |

115 |

|

|

19 |

|

|

153 |

|

|

10 |

|

|

1 |

|

|

298 |

|

||||||

General and administrative expenses |

73 |

|

|

46 |

|

|

38 |

|

|

1 |

|

|

50 |

|

|

208 |

|

||||||

Franchise and property expenses |

33 |

|

|

12 |

|

|

11 |

|

|

— |

|

|

2 |

|

|

58 |

|

||||||

Franchise advertising and other services expense |

120 |

|

|

84 |

|

|

106 |

|

|

— |

|

|

— |

|

|

310 |

|

||||||

Refranchising (gain) loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(13 |

) |

|

(13 |

) |

||||||

Other (income) expense |

1 |

|

|

(2 |

) |

|

1 |

|

|

— |

|

|

152 |

|

|

152 |

|

||||||

Total costs and expenses, net |

342 |

|

|

159 |

|

|

309 |

|

|

11 |

|

|

192 |

|

|

1,013 |

|

||||||

Operating Profit (Loss) |

$ |

224 |

|

|

$ |

76 |

|

|

$ |

144 |

|

|

$ |

(2 |

) |

|

$ |

(192 |

) |

|

$ |

250 |

|

The above tables reconcile segment information, which is based on management responsibility, with our Condensed Consolidated Summary of Results. Corporate and unallocated expenses comprise items that are not allocated to segments for performance reporting purposes.

The Corporate and Unallocated column in the above tables includes, among other amounts, all amounts that we have deemed Special Items. See Reconciliation of Non-GAAP Measurements to GAAP Results.

Notes to the Condensed Consolidated Summary of Results, Condensed Consolidated Balance Sheets

and Condensed Consolidated Statements of Cash Flows

(amounts in millions)

(unaudited)

Amounts presented as of and for the quarter ended March 31, 2021 are preliminary. |

|

|

|

(a) |

Due to their size and volatility, we have reflected as Special Items those refranchising gains and losses that were recorded in connection with our previously announced plans to have at least 98% franchise restaurant ownership by the end of 2018. As such, refranchising gains and losses recorded during the quarters ended March 31, 2021 and 2020 as Special Items directly relate to refranchising gains and losses recorded prior to December 31, 2018. |

|

|

|

During the quarters ended March 31, 2021 and 2020, we recorded net refranchising gains of $2 million and $3 million, respectively, that have been reflected as Special Items. |

|

|

|

Additionally, during the quarters ended March 31, 2021 and 2020, we recorded net refranchising gains of $13 million and $10 million, respectively, that have not been reflected as Special Items and that we believe are more indicative of our ongoing operations. These gains relate to the refranchising of restaurants in 2021 and 2020 that were not part of our aforementioned plans to achieve 98% franchise ownership. |

|

|

(b) |

During the quarter ended March 31, 2020, we recorded Special Item charges of $6 million related to the acquisition and integration of The Habit Restaurants, Inc. ("Habit"). |

|

|

(c) |

On March 18, 2020 we acquired all of the issued and outstanding common shares of Habit for total cash consideration of $408 million, net of cash acquired. During the first-quarter of 2020 the operation of substantially all Habit restaurants was impacted by government recommendations and mandates arising from containment and mitigation measures related to the COVID-19 global pandemic. As a result of the impacts of the COVID-19 pandemic on Habit’s results through March 31, 2020 as well as general market conditions, during the quarter ended March 31, 2020 we recorded a goodwill impairment charge of $139 million to Other (income) expense, which has been reflected as a Special Item. We reflected the tax benefit of this impairment charge of $32 million as a Special Item. |

|

|

(d) |

Tax (Expense) Benefit on Special Items was determined based upon the impact of the nature, as well as the jurisdiction of the respective individual components within Special Items. |

Category: Earnings