Life360 Deepens Foothold in Family Safety Space with Proposed Acquisition of Jiobit

Life360 Deepens Foothold in Family Safety Space with Proposed Acquisition of Jiobit

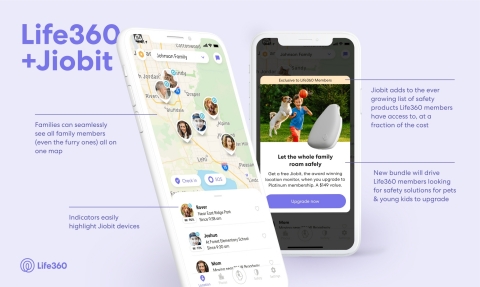

Proposed acquisition would strengthen Life360’s position as the leading family safety platform; offering protection for young children, pets, and seniors

SAN FRANCISCO--(BUSINESS WIRE)--Life360 (ASX:360) today announced the signing of a non-binding term sheet for the potential acquisition of Jiobit, the Chicago-based provider of wearable location devices for young children, pets, and seniors. The consideration for the potential acquisition is $37 million primarily in stock and debt, with the possibility that the price could increase to up to $54.5 million if certain performance metrics are achieved in the two full calendar years following completion of the deal. The potential acquisition would strengthen Life360’s position as the leading family safety platform and accelerate its entrance into fast growing new markets, including children under ten, the multi-billion dollar pet supplies and services, and the elder care market.

Jiobit’s wearable devices would be incorporated into Life360’s family safety membership, which provides holistic protection for driving, physical, and digital safety. Premium Life360 members would get discounted access to Jiobit devices, and post-integration, family members and pets wearing Jiobit devices would appear on a single unified family map interface.

“We’ve long wanted to expand beyond the smartphone into wearable devices, and Jiobit offers the market leading device for pets, younger children, and seniors,” said Chris Hulls, CEO and co-founder of Life360. “With Jiobit, Life360 would be the market leader in both hardware and software products for families once the deal closes. We will continue to seek out additional opportunities that could further cement our position as the leading digital safety brand for families.”

“Life360, as the leading smartphone platform for families, is the natural home for Jiobit. We have the same shared long-term vision around the future of the digitally native family, and this rollup is a natural accelerator,” said John Renaldi, CEO and co-founder of Jiobit. “We’re excited to gain access to Life360’s large user base and have access to new resources that will let us ramp up our growth, new product development, and expansion into additional verticals.”

The final transaction is subject to the approval of the Boards of Directors of both Life360 and Jio, Inc., as well as the stockholders of Jio, Inc.. Visit www.life360.com to learn more about Life360. The Life360 app can be downloaded from the Apple App Store and Google Play.

About Life360

Life360 operates a platform for today’s busy families, bringing them closer together by helping them better know, communicate with and protect the people they care about most. The Company’s core offering, the Life360 mobile app, is a market leading app for families, with features that range from communications to driving safety and location sharing. Life360 is based in San Francisco and had more than 26 million monthly active users (MAU) as at December 2020, located in 195 countries.

Life360’s CDIs are issued in reliance on the exemption from registration contained in Regulation S of the US Securities Act of 1933 (Securities Act) for offers of securities which are made outside the US. Accordingly, the CDIs, have not been, and will not be, registered under the Securities Act or the laws of any state or other jurisdiction in the US. As a result of relying on the Regulation S exemption, the CDIs are ‘restricted securities’ under Rule 144 of the Securities Act. This means that you are unable to sell the CDIs into the US or to a US person who is not a QIB for the foreseeable future except in very limited circumstances until after the end of the restricted period, unless the re-sale of the CDIs is registered under the Securities Act or an exemption is available. To enforce the above transfer restrictions, all CDIs issued bear a FOR Financial Product designation on the ASX. This designation restricts any CDIs from being sold on ASX to US persons excluding QIBs. However, you are still able to freely transfer your CDIs on ASX to any person other than a US person who is not a QIB. In addition, hedging transactions with regard to the CDIs may only be conducted in accordance with the Securities Act.

Contacts

Kat Madariaga

(415) 602-4395

Kat@thekeypr.com