TORONTO--(BUSINESS WIRE)--Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS) (“Americas” or the “Company”), a growing North American precious metals producer, reports consolidated financial and operational results for the year ended December 31, 2020 along with an operational update.

This earnings release should be read in conjunction with the Company’s Management’s Discussion and Analysis, Financial Statements and Notes to Financial Statements for the corresponding period, which have been posted on the Americas Gold and Silver Corporation SEDAR profile at www.sedar.com, and on its EDGAR profile at www.sec.gov, and which are also available on the Company’s website at www.americas-gold.com. All figures are in U.S. dollars unless otherwise noted.

Highlights

- Revenue of $27.9 million and a net loss of $30.1 million for 2020 or a loss of ($0.24) per share including a $9.0 million net loss in Q4-2020.

- Consolidated operating metrics from 2020 were generally not comparable to 2019 due to the illegal blockade at the Cosalá Operations, suspension of operating metrics during the Galena Recapitalization Plan (“Recapitalization Plan”) implementation, and the continued ramp-up of operations at Relief Canyon with commercial production declared effective January 11, 2021.

- The Galena Complex had a strong finish to the year with Q4-2020 production of 294,000 ounces of silver and 6.0 million pounds of lead (503,500 ounces AgEq [1]) compared with 160,000 ounces of silver and 2.6 million pounds of lead in Q4-2019 (293,500 ounces AgEq), a year-over-year increase of over 70% on a AgEq basis.

-

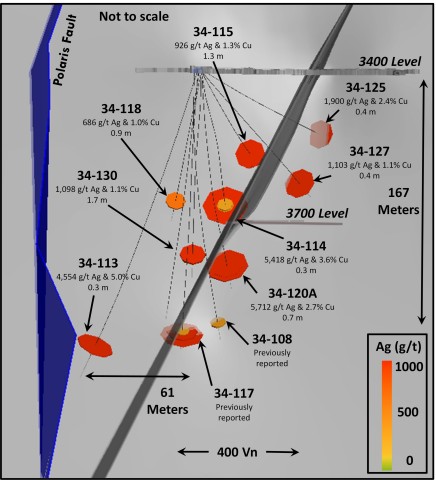

The Company continues to benefit from the success of the Phase 1 drill program as part of the Recapitalization Plan, with current results from the East Coeur drilling, targeting the area between Galena’s historically prolific West Argentine mining front and the Coeur mine, yielding several high-grade intercepts. Results include:

- Hole 34-113: 4,554 g/t silver and 5.0% copper (5,069 g/t silver equivalent [2]) over 0.3 m [3]

-

Hole 34-114: 5,418 g/t silver and 3.6% copper (5,788 g/t silver equivalent) over 0.3 m

1,205 g/t silver and 1.2% copper (1,334 g/t silver equivalent) over 1.3 m

Including: 8,642 g/t silver and 7.4% copper (9,404 g/t silver equivalent) over 0.2 m -

Hole 34-120A: 5,712 g/t silver and 2.7% copper (5,992 g/t silver equivalent) over 0.7 m

Including: 6,653 g/t silver and 2.8% copper (6,944 g/t silver equivalent) over 0.5 m

- Relief Canyon declared commercial production on January 11, 2021 and is expected to ramp-up to full production by the end of Q2-2021. The ramp-up has been challenging, most recently by the impact of a COVID-19 outbreak at site in December 2020-January 2021 and severe weather in February 2021.

- The Company remains optimistic regarding a resolution for the illegal blockade at the Cosalá Operations, with several upcoming meetings planned with senior members of the Mexican federal government at their request.

- The Company had a cash balance of $4.7 million as at December 31, 2020. On January 29, 2021, the Company closed a bought deal financing for aggregate gross proceeds of approximately $26.7 million.

“Last year was expected to be transformational for the Company but was met by a series of unexpected challenges. I would personally like to thank our stakeholders for their patience and support as we continue to meet these challenges and demonstrate to the market the tremendous value of our assets,” stated Americas Gold and Silver President & CEO Darren Blasutti. “I am confident the success at the Galena Complex will continue as indicated by the most recent drill results, the illegal blockade at our Cosalá Operations will be resolved, and Relief Canyon will reach full production following a difficult ramp-up period.”

Galena Complex

The Galena Complex is benefiting from the Recapitalization Plan that commenced in October 2019. Successful exploration drilling led to the increased mineral resource estimate as at June 30, 2020, with further increases expected based on continued strong drill results. Completion of key underground development and equipment purchases contributed to significantly increased year-over-year production in Q4-2020.

Measured and indicated silver resources on a 100% basis increased from 27.4 million ounces to 37.3 million ounces and inferred silver resources increased from 39.0 million ounces to 78.6 million ounces as at June 30, 2020. This increase represents a 36% and 101% increase, respectively, from the previously reported estimate.

Production in Q4-2020 increased to 294,000 ounces of silver and 6.0 million pounds of lead (503,500 ounces AgEq) compared with 160,000 ounces of silver and 2.6 million pounds of lead in Q4-2019 (293,500 AgEq), a year-over-year increase of over 70% on a AgEq basis.

The Company expects 2021 to be a transitional year at the Galena Complex from a production standpoint with continued exploration drilling supporting production growth toward a 2 million silver ounce per year plan. Longer term and assuming continued exploration success, the Company is confident that the operation will again reach peak historical annual production levels of approximately 5 million ounces per year.

The operation has continued to yield tremendous exploration drill results. In addition to continued success on the 4300 Level, the Company began to target mineralization at East Coeur in January 2021, targeting the area between Galena’s historically prolific West Argentine mining front and the Coeur mine. The initial drilling has been successful with several high-grade intercepts. Key results from the East Coeur drilling includes:

- Hole 34-113: 4,554 g/t silver and 5.0% copper (5,069 g/t silver equivalent) over 0.3 m

-

Hole 34-114: 5,418 g/t silver and 3.6% copper (5,788 g/t silver equivalent) over 0.3 m

1,205 g/t silver and 1.2% copper (1,334 g/t silver equivalent) over 1.3 m

Including: 8,642 g/t silver and 7.4% copper (9,404 g/t silver equivalent) over 0.2 m - Hole 34-115: 926 g/t silver and 1.3% copper (1,068 g/t silver equivalent) over 1.3 m

- Hole 34-118: 686 g/t silver and 1.0% copper (784 g/t silver equivalent) over 0.9 m

-

Hole 34-120A: 686 g/t silver and 0.7% copper (756 g/t silver equivalent) over 0.9 m

5,712 g/t silver and 2.7% copper (5,992 g/t silver equivalent) over 0.7 m

Including: 6,653 g/t silver and 2.8% copper (6,944 g/t silver equivalent) over 0.5 m - Hole 34-125: 1,900 g/t silver and 2.4% copper (2,154 g/t silver equivalent) over 0.4 m

- Hole 34-126: 6,001 g/t silver and 6.7% copper (6,697 g/t silver equivalent) over 0.1 m

-

Hole 34-127: 1,103 g/t silver and 1.1% copper (1,224 g/t silver equivalent) over 0.4 m

Including: 2,977 g/t silver and 3.5% copper (3,344 g/t silver equivalent) over 0.1 m - Hole 34-130: 1,098 g/t silver and 1.1% copper (1,214 g/t silver equivalent) over 1.7 m

Based on historical production and drilling to-date, mineralization at the Coeur mine is composed mainly of high-grade silver-copper ore. Resumption of hoisting from the Coeur shaft and processing ore at the Coeur mill would be part of the plan to increase annual production at the Galena Complex to 5 million ounces in the longer term.

A full table of drill results can be found at: https://americas-gold.com/site/assets/files/4297/dr20210322.pdf.

Development of the new drill station on the 5500 Level is complete and drift development work continues to advance further east towards the Caladay shaft. The new drill station on the 5500 Level will provide a better angle to target the Triple Point (intersection of the Silver, 175 and 185 Veins) as well as the down dip extension of the 360 Complex.

The Company is targeting further mineral resource additions at the Galena Complex from the remainder of Phase 1 drilling through June 2021. In addition to the deep drilling and success on the 4300 Level, the recent East Coeur drilling is expected to positively contribute to the updated mid-year resource estimate with the potential increase exceeding the targeted addition of 50 million ounces of silver.

Relief Canyon

The Relief Canyon mine declared commercial production effective January 11, 2021 following the return of the Company’s large radial stacker in December 2020 and meeting the target stacking rates. This was the final item required to declare commercial production.

The ramp-up at Relief Canyon has been a challenge and continues to be challenging into Q1-2021. The Company and its consultants performed extensive analysis and implemented a number of procedural changes to address the start-up challenges typical of a heap leach operation, including improved ore control, increased training, standardization of operating practices and reagent optimization. The operation was further impacted by a number of key staff contracting the COVID-19 virus in December 2020-January 2021 which was followed by severe weather challenges in February 2021.

The Company remains focused on reaching full production by the end of Q2-2021 but Q1-2021 results will be negatively impacted by the slow start to the year.

Cosalá Operations

In February 2020, the Company announced that an illegal blockade was put in place at the Cosalá Operations by a group of individuals including a small minority of the Company’s hourly workforce. As a result, the Cosalá Operations was put on care and maintenance where it currently remains.

Since the start of 2021, a number of meetings and discussions have taken place between the Company and senior members of the Mexican federal government at their request. As a result of these meetings, the Company agreed to a framework for regaining access to the operations and towards a restart of sustainable activity at the Cosalá Operations. The Company is now awaiting actions from the applicable authorities in support of this plan.

In addition, the Company released its first sustainability report for the Cosalá Operations, “Working Towards Sustainability”, which highlights the Company’s commitment to the mining industry in Mexico and to the Cosalá community in Sinaloa. The report accounts for the fulfillment of the Company’s labour commitments as well as the environmental, safety and economic impact in the community where the Cosalá Operations are located, which are in accordance with international business best practices. The report can be viewed on the sustainability section of the Company’s website at:

https://americas-gold.com/site/assets/files/5635/sus_full_eng.pdf

In regard to comments made by the Mexican President on March 17, 2020, while the reference to the Company’s Cosalá Operations concessions is concerning, the Company is confident that there is no basis in the facts or in the law that would diminish the Company’s property rights. The Company looks forward to continuing to work with the Canadian government, the Mexican Minister of Economy and the Minister of Foreign Affairs in providing the facts, providing solutions and resolving the issues to avoid an arbitration issue between Canada and Mexico. The Company looks with optimism to getting our employees back on the job as soon as possible.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious metals mining company with multiple assets in North America. The Company’s newest asset, the Relief Canyon mine in Nevada, USA, has achieved commercial production and is expected to ramp up to full production by the end of Q2-2021. The Company also owns and operates the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned Galena Complex in Idaho, USA. The Company also owns the San Felipe development project in Sonora, Mexico. For further information, please see SEDAR or www.americas-gold.com.

Qualified Persons

Niel de Bruin, P. Geo., Director of Geology, who is an employee of the Company and a “qualified person” under National Instrument 43-101, have approved the applicable contents of this news release.

Technical Information

The diamond drilling program used NQ-size core. Americas Gold and Silver’s standard QA/QC practices were utilized to ensure the integrity of the core and sample preparation at the Galena Complex through delivery of the samples to the assay lab. The drill core was stored in a secure facility, photographed, logged and sampled based on lithologic and mineralogical interpretations. Standards of certified reference materials, field duplicates and blanks were inserted as samples shipped with the core samples to the lab.

Analytical work was carried out by American Analytical Services Inc. (“AAS”) located in Osburn, Idaho. AAS is an independent, ISO-17025 accredited laboratory. Sample preparation includes a 30-gram pulp sample analyzed by atomic absorption spectrometry (“AA”) techniques to determine silver, copper, and lead, using aqua regia for pulp digestion. Samples returning values over 514g/t Ag are re-assayed using fire-assay techniques for silver. Additionally, samples returning values over 23% Pb are re-assayed using titration techniques.

Duplicate pulp samples were sent out quarterly to ALS Global, an independent, ISO-17025 accredited laboratory based in Reno, Nevada to perform an independent check analysis. A conventional AA technique was used for the analysis of silver, copper and lead at ALS Global with the same industry standard procedures as those used by AAS. The assay results listed in this report did not show any significant contamination during sample preparation or sample bias of analysis.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, Americas Gold and Silver’s expectations, intentions, plans, assumptions and beliefs with respect to, among other things, estimated and targeted production rates and results for gold, silver and other precious metals, as well as the related costs, expenses and capital expenditures; the recapitalization plan at the Galena Complex, including the replacement of the Galena hoist and associated and expected costs; the Company’s production, development plans and performance expectations at the Relief Canyon Mine and its ability to finance, develop and operate Relief Canyon, including the potential impact of the discovery of the carbonaceous material within the Relief Canyon pit and the Company’s initial analysis and determination of the extent and impact thereof and the expected timing to complete such analysis and determination, as well as its ability to address or mitigate such impacts and the extent thereof. Often, but not always, forward-looking information can be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “intend”, “potential’, “estimate”, “may”, “assume” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Americas Gold and Silver as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of Americas Gold and Silver to be materially different from those expressed or implied by such forward-looking information. With respect to the business of Americas Gold and Silver, these risks and uncertainties include risks relating to widespread epidemics or pandemic outbreak including the COVID-19 pandemic; the impact of COVID-19 on our workforce, suppliers and other essential resources and what effect those impacts, if they occur, would have on our business, including our ability to access goods and supplies, the ability to transport our products and impacts on employee productivity, the risks in connection with the operations, cash flow and results of the Company relating to the unknown duration and impact of the COVID-19 pandemic; interpretations or reinterpretations of geologic information; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms or at all; the ability to operate the Relief Canyon Project; and risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), ground conditions and other factors limiting mine access, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities, labor relations or disruptions, social and political developments and other risks of the mining industry. The potential effects of the COVID-19 pandemic on our business and operations are unknown at this time, including the Company’s ability to manage challenges and restrictions arising from COVID-19 in the communities in which the Company operates and our ability to continue to safely operate and to safely return our business to normal operations. The impact of COVID-19 on the Company is dependent on a number of factors outside of its control and knowledge, including the effectiveness of the measures taken by public health and governmental authorities to combat the spread of the disease, global economic uncertainties and outlook due to the disease, and the evolving restrictions relating to mining activities and to travel in certain jurisdictions in which it operates. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Americas Gold and Silver’s filings with the Canadian Securities Administrators on SEDAR and with the SEC. Americas Gold and Silver does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law. Americas Gold and Silver does not give any assurance (1) that Americas Gold and Silver will achieve its expectations, or (2) concerning the result or timing thereof. All subsequent written and oral forward‐looking information concerning Americas Gold and Silver are expressly qualified in their entirety by the cautionary statements above.

1 AgEq results were calculated based on average realized prices for silver and lead for Q4-2020 ($24.41/oz silver and $0.86/lb lead) and Q4 2019 ($17.40/oz silver and $0.91/lb lead). Note that AgEq is different for production results versus drill results. |

2 Silver equivalent was calculated using metal prices of $20.00/oz silver, $3.00/lb copper and $1.05/lb lead. |

3 Meters represent “True Width” which is calculated for significant intercepts only and based on orientation axis of core across the estimated dip of the vein. |