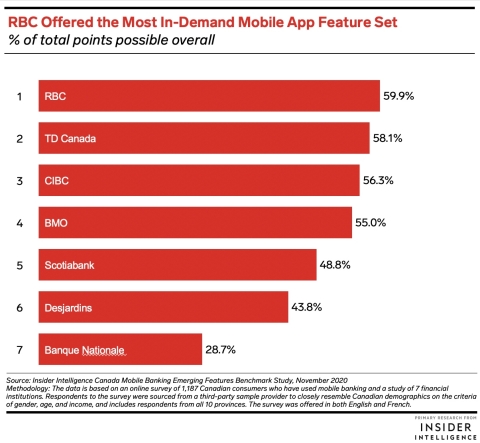

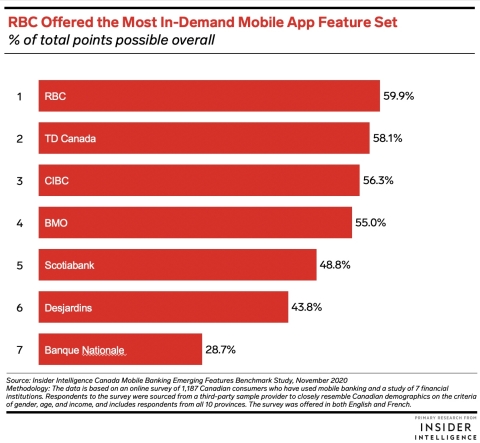

NEW YORK--(BUSINESS WIRE)--Royal Bank of Canada (RBC) ranked first overall among Canada’s seven largest financial institutions (FIs) by assets, according to Insider Intelligence’s inaugural “Canada Mobile Banking Emerging Features Benchmark” report. This study is designed to help FIs compete in an intensifying battle for this shrinking slice of new users, attract competitors’ customers when they shop for new financial products, and engage existing users by offering mobile banking features that consumers demand most.

Canada is one of three countries covered by Insider Intelligence benchmarks. This report joins US (25 FIs) and UK (10 FIs) studies and two reports for each country on top neobanks. In this annual study, seven Canadian FIs by assets are ranked according to two proprietary data sets: an assessment of FIs’ mobile features and a consumer survey fielded to more than 1,100 Canadians gauging their demand for 42 features. By combining these sources, Insider Intelligence offers a unique, data-driven benchmark trusted by digital channels executives to inform enhancements to their mobile offerings.

Here are the steps in the Insider Intelligence study:

- Identify 42 features that will differentiate FIs’ mobile banking lineups—based on their rarity, utility, or novelty—within six categories.

- Weight features based on how much respondents to a November online survey of 1,187 consumers in Canada say they value them.

- Rank the top 7 Canadian FIs overall and in each category using a weighted scorecard.

Here are the top performers within six categories, which are ordered according to survey respondents’ demand:

- Security and control: Canadian Imperial Bank of Commerce (CIBC) demonstrated a superior set of in-demand card controls. A small gap—travel notifications—kept runners-up Bank of Montreal (BMO) and TD Canada from also reaching the top score.

- Transfers: RBC and Scotiabank tied as leaders in a hotly contested category. Both offer the top six in-demand features but lack the ability to order foreign currency, the least in-demand feature.

- Account management: CIBC and RBC demonstrated the strongest command of account management. They offer the two most in-demand features—the ability to change mobile and online banking passwords from within the app and activate a new credit/debit card.

- Alerts: BMO and RBC scored highest, missing only the rarest features. Purchase alerts and channel choices, in addition to three moderately in-demand features, drove performance.

- Digital money management: TD Canada scored the best, having the most complete feature set by far. TD checked off four features, primarily based on its MySpend tools.

- Customer service: TD led the customer service category with a robust set of in-demand tools. Runner-up CIBC rose to second by offering live chat.

If you are interested in reading the full report, please reach out directly.

To sign up for our upcoming webinar on this topic, click here.