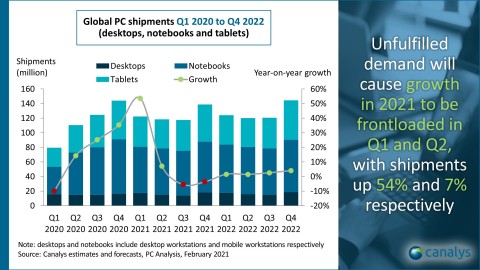

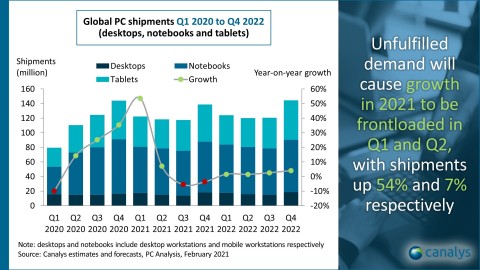

SINGAPORE--(BUSINESS WIRE)--According to Canalys’ latest forecasts, the global PC market (including desktops, notebooks and tablets) will grow 8% in 2021, on top of what was a blockbuster year for the industry in 2020. Total shipments in 2021 are expected to hit 496.8 million units, with all categories enjoying growth. Backlogs on device orders from last year are being boosted by continued demand from workers and students still affected by COVID-19 restrictions. But supply issues will persist throughout this year and be the main restriction on higher growth levels. Growth in 2021 is expected to be frontloaded in the first half of the year, with shipments up 54% in Q1 and 7% in Q2. Chromebooks and tablets will be bright spots for the industry in 2021, achieving growth of 30% and 8% respectively.

| Canalys Worldwide PC forecasts (shipment volume and annual growth) | ||||||||

| Product category | 2020 |

2021 |

2022 |

2025 |

Annual

|

Annual

|

CAGR

|

|

| Desktops | 61.6m |

64.4m |

67.1m |

76.1m |

4.4% |

4.3% |

4.3% |

|

| Notebooks | 236.0m |

258.2m |

266.3m |

287.6m |

9.4% |

3.1% |

4.0% |

|

| Tablets | 160.9m |

174.2m |

175.5m |

181.7m |

8.3% |

0.8% |

2.5% |

|

| Total | 458.5m |

496.8m |

509.0m |

545.3m |

8.4% |

2.5% |

3.5% |

|

Note: desktop, notebook and tablet shipments. Percentages may not add up to 100% due to rounding.

|

||||||||

“Following the boom in 2020, the PC industry is set to grow for years to come,” said Canalys Research Director Rushabh Doshi. “Order backlogs and ongoing strong demand present a great short-term opportunity, while the ballooned installed base of PC users presents significant future opportunities for refreshes and upgrades. But Canalys is taking a relatively conservative view, projecting single-digit growth for this year and next due to prevailing uncertainty around supply and distribution. Crucial components, such as displays, GPUs and other smaller chips that drive PC internals, will face a squeeze for most of 2021 and well into 2022, leaving a significant amount of demand unfulfilled. Competition for components from the automotive, smart manufacturing and smart IoT industries will also put pressure on PC vendors, which will see their prioritization fall. Logistics and transportation are also a limiting factor in meeting demand, with vendors turning to more expensive air freight to help cut delivery times. If the industry can overcome these persistent issues, we could see higher growth levels.”

“Chromebooks and tablets were both big winners in 2020, and Canalys forecasts a rosy future for both product categories this year and beyond,” said Ishan Dutt, Analyst at Canalys. “Both are value-for-money alternatives to more expensive Windows devices, catering to segments that are underserved by Wintel. The education segment will continue to be a key driver, with Chromebooks facing some of the most severe order backlogs of any PC category. In addition, Canalys also expects the broader commercial segment to expand deployments of Chromebooks and tablets. As economies begin to open up, restricting human-to-human interaction remains important and tablets allow for simple tasks in retail, hospitality and travel to be undertaken more easily. And in developing markets, Android slate tablets will be of particular importance as they support affordable moves to digital education. Vendors with healthy Chromebook and tablet portfolios will be well placed to achieve growth in the coming years.”

For more information, please contact us.