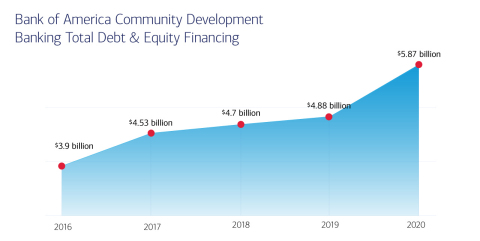

Bank of America Community Development Banking Provided Record $5.87 Billion in Lending and Investing in 2020, Shattering Previous Year’s Record $4.88 Billion

Bank of America Community Development Banking Provided Record $5.87 Billion in Lending and Investing in 2020, Shattering Previous Year’s Record $4.88 Billion

NEW YORK--(BUSINESS WIRE)--Bank of America Community Development Banking (CDB) provided a record $5.87 billion in loans, tax credit equity investments, and other real estate development solutions, surpassing last year’s record of $4.88 billion.

CDB deployed $3.62 billion in debt commitments and $2.25 billion in investments to help build strong, sustainable communities through affordable housing and economic development across the country.

“In the face of a very challenging year, Bank of America Community Development Banking continued to serve its clients, adapting to their changing needs throughout this health crisis,” said Maria Barry, Community Development Banking national executive at Bank of America. “We worked closely with our clients to proactively mitigate risk and identify opportunities. The strength of the bank and the steadiness of CDB gave them confidence that we would deliver for them.”

In 2020, CDB-financed developments produced more than 13,800 housing units, of which more than 13,000 were affordable, including:

- 6,000 green housing units.

- 2,400 housing units for seniors.

- 1,600 housing units for veterans, special needs and the formerly homeless.

This included 1,650 affordable housing units developed by Minority and Women-Owned Business Enterprises, using $506 million in debt and equity financed by CDB.

Bank of America Global Corporate and Investment Banking also provided $301 million in tax credit investments, for a total of $6.17 billion in affordable housing and economic development financing.

“Our business has consistently grown for five consecutive years, demonstrating our continued commitment to producing safe, affordable housing and supporting the communities in which we work and live,” continued Barry.

From 2005 to 2020, Community Development Banking has financed more than 250,000 housing units, of which more than 215,000 are affordable housing.

This commitment complements Bank of America’s $1 billion, four-year commitment to help advance racial equality and economic opportunity. The work focuses on closing the racial wealth gap in Black and Hispanic-Latino communities with a focus on affordable housing, health and healthcare, jobs/reskilling and small business.

CDB delivers innovative financing solutions to help create affordable housing for individuals, families, seniors, students, veterans, the formerly homeless, and those with special needs. These efforts are part of the company’s commitment to deploying capital to address global issues outlined in the United Nations Sustainable Development Goals (SDGs).

Bank of America

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 66 million consumer and small business clients with approximately 4,300 retail financial centers, including approximately 2,700 lending centers, 2,600 financial centers with a Consumer Investment Financial Solutions Advisor and approximately 2,400 business centers; approximately 17,000 ATMs; and award-winning digital banking with approximately 39 million active users, including approximately 31 million mobile users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and approximately 35 countries. Bank of America Corporation stock (NYSE: BAC) is listed on the New York Stock Exchange.

For more Bank of America news, including dividend announcements and other important information, visit the Bank of America newsroom and register for news email alerts.

Contacts

Reporters may contact:

Anu Ahluwalia, Bank of America

Phone: 1.646.855.3375

anu.ahluwalia@bofa.com