BOSTON--(BUSINESS WIRE)--With 44 million Americans owing an estimated $1.67 trillion in student debt, there has been much focus on how to help individuals pay down their balances. The pause on federal student loan payments has been extended into September 2021, and this past December’s stimulus package included the extension of a provision for employers to help their employees pay down student loan debt. Interest in the new provision has been strong, including within the health care industry, whose workers are not only feeling great stress from the pandemic, but according to Fidelity Investments® research, are burdened with the most student loan debt—almost $10,000 more than the nearest industry, on average.

Originally introduced as part of the CARES Act in April, the provision was slated to expire at the end of 2020 and has been extended for five years, until December 31, 2025. It allows employers to contribute up to $5,250 tax-free to an employee’s student loans each year, meaning the money paid is considered tax-free to both employee and employer. The provision modernizes a longstanding tax exclusion for tuition reimbursement by now offering the $5,250 as a combined tax-free limit, one that can be applied for student debt repayment, tuition reimbursement—or both.

The extension provides a great opportunity for employers to get involved, and some of the earliest adopters working with Fidelity’s Student Debt program are seeing an impact. This includes Fidelity’s own benefits team, which adopted the new tax treatment in April 2020 and estimates the provision will save each Fidelity employee participant an average of about $500 in tax relief, totaling more than $2 million in estimated annual savings cumulatively across approximately 4,500 employees. Several of the program’s participants also receive tuition reimbursement benefits.

“Our employees told us they were putting off major life decisions such as buying a home, saving for retirement and even having a family due to their student loan debt,” said Tom Vogel, head of financial benefits for Fidelity Investments. “Since our student loan assistance program began in 2016, more than 12,000 Fidelity employees have saved $58 million in principal plus about $27 million in interest payments with an average savings of $7,000 per person. We’ve heard some employees have been able to move up their planning because of the benefit, which is exactly what we wished to achieve. We are pleased our employees will benefit as well from the extended tax relief.”

“Having the ability to work on various other life savings goals in addition to paying down student debt is a primary reason we’re seeing many plan sponsors adopt this program,” added Asha Srikantiah, head of Fidelity Investments’ student debt program for Workplace Investing. “Student debt repayment benefits from an employer allows employees to breathe easier, knowing they have help tackling stressful debt, and with this provision, they’re not getting taxed for it. For employers, the tax savings offers another compelling reason to offer a student debt benefit, in addition to possible improved retention, as we’ve seen that employees taking advantage of the program had a turnover rate 52% lower than those that were eligible, but not enrolled1.”

2020 Data Reveals Depth of Student Debt Problem, Particularly for Health Care Workers

Already, leading benefits provider Fidelity has seen a spike in the number of plan sponsors interested in adopting a Student Debt Benefit, especially health care employers. This is perhaps no surprise, as year-end data from Fidelity shows employees working in the health care industry have high student debt burdens—$690 a month, $100 a month greater than the closest industry. This data is derived from nearly 200,000 loans reported using Fidelity’s Student Debt Tool2.

“Health care workers are on the front line every day taking care of us during this pandemic, but also struggling the most with student debt,” said Srikantiah. “Our research suggests women and people of color are also disproportionately impacted. Given the heightened stress we’re all experiencing, it’s important to recognize how tightly tied financial stress is to emotional well-being. Paying off debt can have a positive impact financially, as well as with health, work and life overall.”

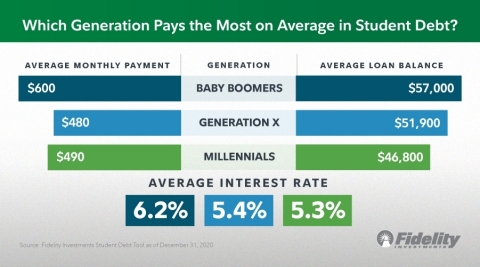

Fidelity data also show student debt impacts all generations and occupations. Perhaps surprisingly, Baby Boomers with student debt actually lead the pack over other generations, owing in part to Parents Plus loans secured for their children. Of note, the extended tax-free provision does not aid individuals with Parents Plus loans, as the debt must be incurred for one’s own education.

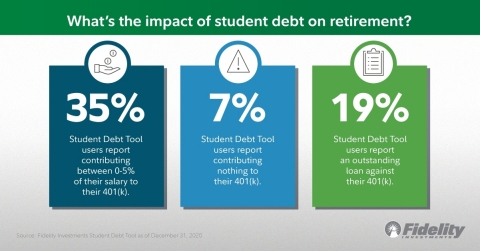

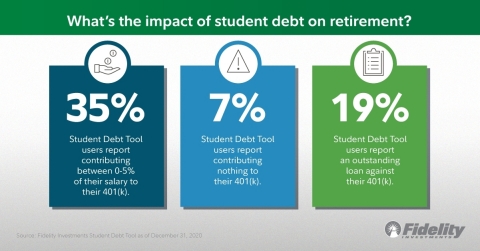

Unfortunately, Fidelity research also shows many individuals are delaying contributing to retirement or are taking out loans against their 401(k), an action that is literally borrowing against one’s future to pay for the past. These loans can have a negative impact on 401(k) balances—particularly among younger retirement savers, who have a longer time horizon and greater potential to save more.

Fidelity Offers Multiple Student Debt Solutions

Understanding that the problem of student debt is not a “once and done” solution, Fidelity offers a holistic range of student debt solutions, including:

- A Student Debt Benefits program that allows companies to design a program that best serves the needs of their specific workforce, which can help with recruiting, improve retention and boost productivity, including three options: Student Debt: Direct℠, which helps employees with monthly payments toward their loans—now tax free and integrated with Tuition Reimbursement based on client need; Student Debt: Benefit Choice℠, which give employees flexibility by letting them apply the value of other benefits (such as PTO) toward student loans; and Student Debt: Retirement℠, which allows employers to make 401(k) contributions based on student loan payments.

- Fidelity’s Student Debt Tool, which is completely free and enables borrowers to have a singular view of federal and private loan options by aggregating all of their student debt loans in one place, along with options available for repayment.

- Access to a student debt refinancing platform, Credible.com3, through its Student Debt Tool, giving users the ability to compare pre-qualified rates from up to ten refinancing lenders without affecting their credit score.

- Finally, to help people avoid accumulating debt in the first place, Pre-College Planning Resources to help families plan, save and pay for college.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $9.8 trillion, including discretionary assets of $3.8 trillion as of December 31, 2020, we focus on meeting the unique needs of a diverse set of customers: helping more than 35 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 institutions with investment and technology solutions to invest their own clients’ money. Privately held for more than 70 years, Fidelity employs more than 47,000 associates who are focused on the long-term success of our customers. For more information, visit https://www.fidelity.com/about-fidelity/our-company.

Fidelity Investments and Fidelity are registered service marks of FMR LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

200 Seaport Boulevard, Boston, MA 0211

964775.1.0

© 2021 FMR LLC. All rights reserved.

1 Fidelity analysis of 24 early adopters of the Student Debt: Direct Benefit, representing more than 100,000 participants. The overall turnover results were calculated from January 2019–January 2020.

2 The data is derived from nearly 54,000 Fidelity tool users who shared student loan information representing nearly 6,000 companies, as of December 31, 2020.

3 Credible Operations, Inc. is not affiliated with Fidelity Brokerage Services, member NYSE, SIPC or its affiliates. Credible is solely responsible for the information and services it provides. Fidelity disclaims any liability arising from use of this information.