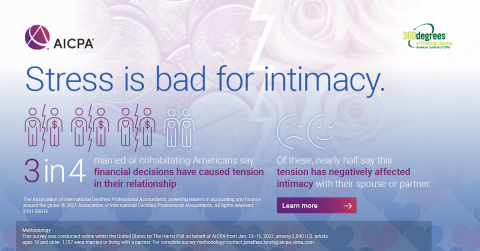

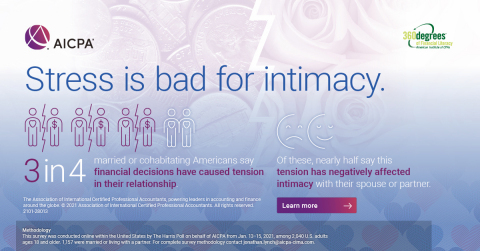

NEW YORK--(BUSINESS WIRE)--Love is in the air, but so are financial problems. Nearly three in four (73 percent) married or cohabitating Americans say financial decisions are ever a source of tension in their relationship. Of these, nearly half (47 percent) admit this tension has negatively impacted intimacy with their partner. Intimacy issues are more often experienced by men (52 percent) than women (41 percent), and especially for those who have children in their household (60 percent). This all according to new research conducted by The Harris Poll on behalf of the American Institute of CPAs (AICPA).

“Investing in financial compatibility early on pays dividends in the long run. If left ignored, financial stressors can tear through a relationship and ruin more than just your bank balances,” Gregory J. Anton, CPA, CGMA, chairman of the AICPA’s National CPA Financial Literacy Commission. “It’s important to talk and have a strong sense of financial familiarity in a relationship. When you share your money values and set joint-financial goals together, you help to set your relationship up for success.”

For Richer, For Poorer: Money & Spousal Conflict

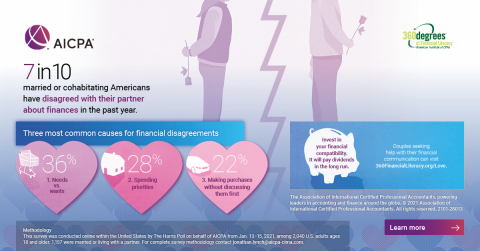

The survey found that 7 in 10 Americans married or living with a partner (69 percent) have had a disagreement with their companion about finances in the past year. Those disagreements most often revolve around needs vs. wants (36 percent), spending priorities (28 percent), and making purchases without discussing them first (22 percent). Paying off debt (21 percent) and saving for larger purchases (19 percent) round out the top 5.

“Talking about money can certainly be uncomfortable, but candid discussions about your financial situation and goals are critical,” said David Almonte, CPA/CGMA member of the AICPA Financial Literacy Commission. “Both personal and financial benefits can come from scheduling regular financial check-ins with your partner. Discussing a shared financial outlook will not only bring you closer to your joint-financial goals but can help to bring you closer together as a couple as well.”

Only 56 percent of married or cohabitating Americans say they are very comfortable talking to their partner about finances. Lack of communication and financial problems are both common issues that contribute to divorce. Couples looking for help strengthening their financial compatibility can visit 360FinancialLiteracy.org/Love.

Financial Infidelity Enough for Some to Throw in the Towel

Cheating is often cited as a major contributing factor to divorce. It may not be limited to physical and emotional affairs but also financial betrayal. Whether it’s a large amount of debt or assets that have been kept concealed or a secret bank account– financial infidelity is destructive to trust, and for some, that is enough to end their relationship. The survey found that 2 in 5 Americans who are married or living with their partner (41 percent) would be at least somewhat likely to end their relationship if they discovered their partner was dishonest with them about their finances. This includes one in five (20 percent) who would be extremely/very likely to call it quits.

Financial infidelity fast facts:

-

Younger adults are more likely to end the relationship:

- More than half of Americans age 18-34 (55 percent) said they would likely end their relationship over financial infidelity, whereas less than 1 in 4 of those 65+ (22 percent) said they would.

-

Most likely to end their relationship due to financial infidelity:

- Males between 30-45 at 60 percent, with Females 18-34 just behind them at 57 percent.

-

Least likely to end their relationship due to financial infidelity:

- Males 65+ at 13 percent, followed by Females 65+ at 33 percent.

Parents with Children in the Household Having a Rough Time

One third of Americans living with finance-driven relationship tension (34 percent) say the tension has been more frequent since the start of the pandemic. For parents with children in their homes, it is even higher. Those with kids in the home were twice as likely to say financial decisions have caused relationship tension more frequently since the pandemic began (47 percent of those with children in household vs. 22 percent of those without). Further, three in five of those with children in their home (60 percent) admit that their financially driven relationship tension has had a negative impact on intimacy with their partner, far outpacing the 34 percent of Americans without children at home.

Additional Survey Findings:

- For one in four Americans married or living with a partner (26 percent), financial decisions are a source of tension in their relationship at least once a month.

- Just over a quarter of married or cohabitating Americans (27 percent) claim they have not had a disagreement with their spouse about any aspects of finances in the past year.

Throughout 2021, the AICPA will be exploring the impact of COVID-19 on consumers, businesses and the accounting and finance profession through a series of surveys, reports and other content. For more information, please contact Jon Lynch jonathan.lynch@aicpa-cima.com or James Schiavone james.schiavone@aicpa-cima.com.

Methodology

This survey was conducted online within the United States by The Harris Poll on behalf of AICPA from January 13-15, 2021 among 2,040 U.S. adults ages 18 and older. 1,157 were married or living with a partner. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact jonathan.lynch@aicpa-cima.com.

About the AICPA’s 360 Degrees of Financial Literacy Program

The AICPA’s 360 Degrees of Financial Literacy Program is a nation-wide, volunteer grass-roots effort to help Americans develop a better understanding of money management and take control of their financial lives. Since 2005, the AICPA has been empowering people to make better decisions with the tools and resources on the 360 Degrees of Financial Literacy website. Financial Literacy is the cause of the CPA profession and the 360 Degrees of Financial Literacy program is the AICPA’s flagship corporate social responsibility effort. These efforts are focused on financial education as a public service and are completely free from all advertising, sales, and promotions. Connect on Facebook for tips, insights and motivation to keep your finances on track.

About the American Institute of CPAs

The American Institute of CPAs (AICPA) is the world’s largest member association representing the CPA profession, with more than 431,000 members in the United States and worldwide, and a history of serving the public interest since 1887. AICPA members represent many areas of practice, including business and industry, public practice, government, education and consulting. The AICPA sets ethical standards for its members and U.S. auditing standards for private companies, nonprofit organizations, and federal, state and local governments. It develops and grades the Uniform CPA Examination, offers specialized credentials, builds the pipeline of future talent and drives professional competency development to advance the vitality, relevance and quality of the profession.