JENKINTOWN, Pa.--(BUSINESS WIRE)--The 2020 Donor-Advised Fund Report, the most comprehensive data on donor-advised funds (DAFs) in the U.S., reveals growth in all key metrics for the 10th consecutive year. Also released today, the Donor-Advised Fund COVID Grantmaking Survey, the DAF sector’s first review of DAF donor response to COVID-19, which found historic DAF donor philanthropy.

“The 2020 Donor-Advised Fund Report reflects heightened philanthropic engagement, financial market fluctuations, increased interest in illiquid asset contributions, and longer-term impact of the Tax Cuts and Jobs Act of 2017,” said Eileen Heisman, CEO of National Philanthropic Trust. “Grants from DAFs to qualified charities have grown twice as fast as contributions to DAFs and have increased more than 90 percent over the last four years. The majority of DAFs reflect their donors’ wish to be active philanthropists who give generously and regularly. Donors continue making contributions to their DAFs because they experience how easy it is to support the causes most important to them.”

Continued Heisman, “This year, NPT is also proud to publish the DAF sector’s first look at grantmaking in response to the coronavirus pandemic. All eight charitable subsectors received more grants in the first half of 2020 than they did in the same period of 2019. This is particularly interesting because it signals that DAF donors did not necessarily shift their giving priorities amid the global pandemic, rather they continued to support the same causes and amplified their giving by granting to the urgent needs created by the pandemic.”

2020 Donor-Advised Fund Report Key Findings

National Philanthropic Trust’s 14th annual Donor-Advised Fund Report identified growth in all key metrics for the 10th consecutive year.

- Value of grants from DAF accounts to qualified charities totaled $27.37 billion in 2019, a 15.4% increase from $23.72 billion in 2018. This is the first year grants from DAFs exceeded $25 billion and the second year grants exceeded $20 billion. Since 2010, the value of grants to qualified charities from DAFs has increased 198.8%.

- Contributions to DAF accounts totaled $38.81 billion, a 7.5% increase from $36.10 billion in 2018. All contributions are irrevocable and destined for qualified charities.

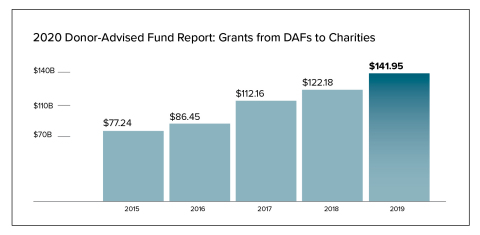

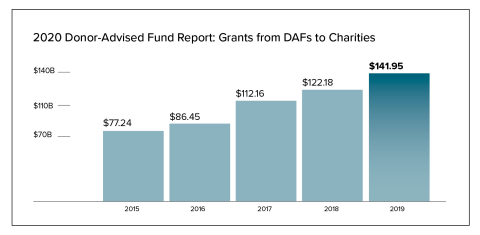

- Charitable assets in all DAF accounts totaled $141.95 billion, a 16.2% increase from $122.18 billion in 2018. Continued growth of charitable assets under management reflects increases in the number of DAFs, contributions from donors, and investment gains.

- Number of DAF accounts in the U.S. totaled 873,228, a 19.4% increase compared to 731,607 in 2018. In the past 10 years, the number of DAF accounts grew almost 300%. The ease of management and flexibility of DAFs as well as the emergence of workplace giving accounts and lower contribution minimums contributed to this increase.

- Value of DAF accounts averaged $162,556, a 2.7% decrease compared to $167,005 in 2018. As DAFs continue to grow in popularity, and the number of accounts increase, the average account value decreases.

- Grant payout rate to qualified charities increased to 22.4% compared to 21.2% in 2018. Using the Standard Method (Foundation Center) of calculation, DAFs continue to have a payout rate nearly four times higher than private foundations. The DAF grant payout rate has exceeded 20% for every year on record, demonstrating that DAF donors are a consistent, sustainable resource for charitable support.

Donor-Advised Fund COVID Grantmaking Survey Key Findings

This analysis is the first sector-wide review of grantmaking from DAFs to charities in response to COVID-19; January 1 to June 30, 2020 as compared to same period in 2019.

- Value of DAF grantmaking to qualified charities reached $8.32 billion, a 29.8% increase compared to 2019. Human Services and Health charities saw the most significant increase in dollar value of grants, 78.9% and 54.2% respectively; Arts saw a decline of 9.0%.

- Number of DAF grants to charities totaled 1,298,787 million, a 37.4% increase compared to the same period in 2019. This represents a significant increase attributable to donor COVID-19 response.

- Number of DAF grants in all eight charitable subsectors increased: Human Services 78%, Public / Societal Benefit 58%, International 42%, Environment / Animal Welfare 31%, Health 30%, Arts and Culture 29%, Religion 26%, Education 11%.

The full 2020 Donor-Advised Fund Report and Donor-Advised Fund COVID-19 Grantmaking Survey are available with no login requirement, and upon request. Content attribution: National Philanthropic Trust, NPTrust.org.

The Donor-Advised Fund Report has been published annually as a public service since 2006.

DAF Report Methodology

The DAF Report primarily uses data from IRS Form 990 filings to provide the most up-to-date and reliable analysis of the DAF market. The 2020 report examined 993 charitable organizations that sponsor donor-advised funds, including national charities, community foundations and other sponsoring charities. A glossary of terms along with an examination of three payout rate calculations can be found in the digital report’s table of contents.

DAF COVID Grantmaking Survey Methodology

This Donor-Advised Fund COVID Grantmaking Survey was conducted among 13 DAF sponsors using self-reported data at the end of 2020. Collectively, this group represents just under 50% of total DAF charitable grant dollars annually and includes national charities and community foundation DAF sponsors. Different methodology was used for this survey than used for the annual Donor-Advised Fund Report.

About National Philanthropic Trust

Founded in 1996, National Philanthropic Trust (NPT) is the largest national, independent public charity that manages donor-advised funds and one of the leading grantmaking institutions in the U.S. NPT has raised more than $18.4 billion in charitable funding and has made more than 346,600 grants exceeding $8.8 billion to nonprofits around the world. Read more about NPT donor response to COVID here. Visit NPT’s resource library to learn more about what you can do with a DAF and NPT DAF impact investing options. More at NPTrust.org.