CALGARY, Alberta--(BUSINESS WIRE)--Blackline Safety Corp. (TSX.V: BLN), a global leader in connected safety technology with a recurring revenue business model, announced $11.6M in record fourth-quarter revenue and $38.4M in annual revenue for its fiscal year ended October 31, 2020. Recurring service revenue growth drove positive performance for both the quarter and fiscal year. Compared to the prior year, quarterly recurring revenue was up 31% to $6.7M from $5.1M. For the year, recurring services closed at $25.5M, up 42% compared to the prior year.

“Around the world, the year 2020 began with optimism for the decade ahead but quickly shifted to managing sustainability due to the global COVID-19 pandemic. With every business and individual adjusting to a new reality, the focus across industries became managing continuity while ensuring the health and safety of workers,” said Cody Slater, CEO and Chairman at Blackline Safety. “At Blackline, our priority was to quickly develop solutions that our customers could implement to maintain operations while keeping their people safe. In a matter of weeks our product development team delivered the world’s only industrial contact tracing solution combined with gas detection, followed by Bluetooth-based close contact detection for proactive social distancing. In parallel, we completed the development and launch of a new product line in Europe — our new G7 EXO direct-to-cloud area gas monitor.”

Mr. Slater added, “Despite the impact of Coronavirus, Blackline has proven its global presence as a key sustainability stakeholder. This was strongly underscored by client service commitments with annual recurring service revenue up by 42% at $25.5M. While the pandemic interrupted sales cycles with fewer products shipped compared to the prior year, our strong client retention enabled our teams to deliver double-digit overall growth of 15% and $38.4M in revenue.”

Blackline closed the year with a strong working capital position with cash and short-term investments of $51.5M, bolstered by the Brokered Private Placement completed in September 2020. Overall gross margin for the year was 53%, a 6% increase over the prior year with improvements in both product and service margin year-over-year. Blackline achieved its eighth successive quarter of positive Adjusted EBITDA, and the sixth successive quarter of improvement in this non-GAAP metric, which management believes is a valuable metric for investors to track corporate performance.

During the fourth quarter, Blackline completed its product development efforts and certification for G7 EXO area gas monitor in Europe, the first of its kind, which features integrated 4G cellular direct-to-cloud communication. G7 EXO shipments that began during this period contributed to the improved quarterly product margin.

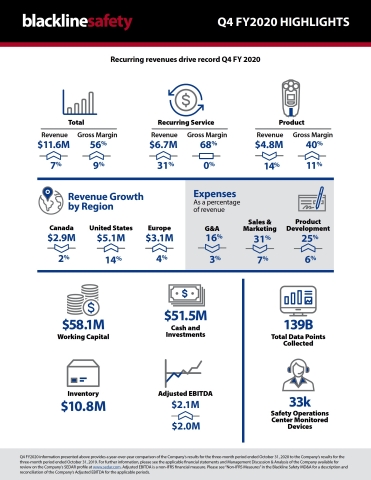

Fourth quarter highlights

- Fifteenth consecutive quarter of year-over-year revenue growth

- Eighth consecutive quarter of positive Adjusted EBITDA

- Total revenue of $11.6M, a 7% increase over the prior year’s Q4

- Recurring service revenue of $6.7M, a 31% increase over the prior year’s Q4

- Product revenue of $4.8M, a 14% decrease from the prior year’s Q4

- Total revenue grew by 14% in the United States, 4% in Europe and decreased 2% in Canada compared to the prior year’s Q4

- Overall gross margin percentage was 56%, a 9% increase over the percentage achieved in the prior year’s Q4

- First shipments of the G7 EXO area gas monitor began across Europe

- Blackline closed a bought deal financing for gross proceeds of $36M

- Blackline ranked 321 on Deloitte’s Technology Fast 500™, a ranking of the 500 fastest growing technology companies in North America

Annual highlights

- Total revenue of $38.4M, a 15% increase over the prior year

- Positive Adjusted EBITDA of $5.5M, up $4.9M over the prior year

- Recurring service revenue of $25.5M, a 42% increase over the prior year

- Product revenue of $12.9M, a 16% decrease from the prior year

- Total revenue grew by 25% in the United States, 17% in Europe and 4% in Canada over the prior year

- Overall gross margin percentage was 53%, a 6% increase over the percentage achieved in the prior year

- Contracted future service revenue (G7 operating lease commitments) was $4.0M at October 31, 2020

- Total cash and short-term investments of $51.5M at October 31, 2020

Post-quarter highlights

- Blackline Safety appointed Cheemin Bo-Linn to the Board of Directors

- Barbara Holzapfel joined the Board in an advisory role

- Sean Stinson was appointed to the newly created role of Chief Revenue Officer

- Launched Blackline Catalyst, a global partner program to accelerate growth and innovation

- Brendon Cook was appointed to the new role of Chief Partnership Officer

- Launched G7c close contact detection for North America and International markets

- First shipments of the G7 EXO area gas monitor began in North America

Financial highlights

The subsequent values in this release are in thousands, except for percentages and per share data.

|

Quarter Ended October 31 |

Year Ended October 31 |

||||||||||||||||||

2020 |

|

2019 |

|

Change |

2020 |

|

2019 |

|

Change |

|||||||||||

Revenue |

$ |

11,550 |

|

$ |

10,746 |

|

7 |

% |

$ |

38,377 |

|

$ |

33,271 |

|

15 |

% |

||||

Gross Margin |

$ |

6,510 |

|

$ |

5,099 |

|

28 |

% |

$ |

20,188 |

|

$ |

15,502 |

|

30 |

% |

||||

Gross Margin Percentage |

|

56 |

% |

|

47 |

% |

9 |

% |

|

53 |

% |

|

47 |

% |

5 |

% |

||||

Net Loss |

($ |

1,804 |

) |

($ |

2,924 |

) |

38 |

% |

($ |

8,021 |

) |

($ |

9,924 |

) |

23 |

% |

||||

Net Loss per Share |

($ |

0.04 |

) |

($ |

0.06 |

) |

|

($ |

0.16 |

) |

($ |

0.21 |

) |

|

||||||

Net Loss excluding stock- based compensation expense |

($ |

1,615 |

) |

($ |

2,774 |

) |

42 |

% |

($ |

7,302 |

) |

($ |

8,342 |

) |

14 |

% |

||||

Adjusted EBITDA |

$ |

2,149 |

|

$ |

155 |

|

1,286 |

% |

$ |

5,486 |

|

$ |

554 |

|

890 |

% |

||||

Adjusted EBITDA per Share |

$ |

0.05 |

|

$ |

0.00 |

|

|

$ |

0.12 |

|

|

0.01 |

|

|

||||||

Key Financial Information

Annual revenue for fiscal 2020 was $38,377 compared to $33,271 in the prior year, an increase of 15%. Service revenue was $25,517, an increase of 42% compared to $17,983 in the year prior. This growth was driven by new and recurring customer renewals of the Company’s connected safety monitoring services. Sales of Blackline’s connected safety hardware were $12,860 in the year compared to $15,288 for the prior fiscal year.

Fourth quarter revenue was $11,550, an increase of 7% from $10,746 in the comparable quarter of the prior fiscal year with the United States up 14%, being the largest geographic growth region quarter-over-quarter.

Service revenue during the fourth quarter was $6,712, an increase of 31% compared to $5,131 in the same period last year. This growth in service revenue was primarily driven during the fourth quarter by increased adoption throughout international and diversified industrial markets of Blackline’s connected safety devices. Device renewals remain robust with some impact seen in the fourth quarter from COVID-19 impacted energy project deferrals.

Product revenue during the fourth quarter was $4,838, a decrease of 14% compared to $5,615 in the same period last year. The decrease was due to the continuing impact of COVID-19 on the ability of the company to generate new sales during the quarter with the prior year quarter containing a major delivery to a UK water/wastewater customer.

Gross margin percentage for the fourth quarter was 56%, a 9% improvement to that achieved in the comparable quarter of the prior year. Product margin improved to 40% from 29% due to the product sales mix, including the initial G7 EXO sales in Europe. Service margin of 68% was consistent quarter-over-quarter.

Adjusted EBITDA was $2,149 for the fourth quarter compared to $155 in the comparable quarter of the prior year. The increase in the Adjusted EBITDA for the quarter was attributable to increased revenues and gross margin and decreased general and administrative expenses and selling and marketing expenses quarter-over-quarter.

Blackline’s audited consolidated interim financial statements and management’s discussion and analysis on financial condition and results of operations for the period ended October 31, 2020 (including the reconciliation of non-GAAP measures) are available at www.sedar.com. All results are reported in Canadian dollars.

About Blackline Safety: Blackline Safety is a global connected safety leader that helps to ensure every worker gets their job done and returns home safely each day. Blackline provides wearable safety technology, personal and area gas monitoring, cloud-connected software and data analytics to meet demanding safety challenges and increase productivity of organizations in more than 100 countries. Blackline Safety wearables provide a lifeline to tens of thousands of men and women, having reported over 140 billion data-points and initiated over 5.5 million emergency responses. Armed with cellular and satellite connectivity, we ensure that help is never too far away. For more information, visit BlacklineSafety.com and connect with us on Facebook, Twitter, LinkedIn and Instagram.

Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively "forward-looking information") within the meaning of applicable securities laws relating to, among other things, Blackline Safety's expectation to realize potential from its intended investment in organic growth opportunities in 2020, Blackline's intention to expand its product offerings to total workplace connectivity and management's expectation that Blackline will continue to focus on its comprehensive approach to connected devices, live monitoring, consulting and integration services. Blackline provided such forward-looking statements in reliance on certain expectations and assumptions that it believes are reasonable at the time, including expectations and assumptions concerning business prospects and opportunities; customer demands, the availability and cost of financing, labor and services and the impact of increasing competition. Although Blackline believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Blackline can give no assurance that they will prove to be correct. Forward-looking information addresses future events and conditions, which by their very nature involve inherent risks and uncertainties, including the risks discussed in Blackline's Management's Discussion and Analysis. Blackline's actual results, performance or achievement could differ materially from those expressed in, or implied by, the forward-looking information and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits Blackline will derive therefrom. Management has included the above summary of assumptions and risks related to forward-looking information provided in this press release in order to provide readers with a more complete perspective on Blackline's future operations and such information may not be appropriate for other purposes. Readers are cautioned that the foregoing lists of factors are not exhaustive. These forward-looking statements are made as of the date of this press release and Blackline disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.