Green, Social and Sustainability Bonds Market 2021 Outlook: The New Sustainable Borders

Green, Social and Sustainability Bonds Market 2021 Outlook: The New Sustainable Borders

PARIS--(BUSINESS WIRE)--2020 was another strong year for sustainable finance, mostly supported by the issuance of social bonds and the rise of Sustainability-linked bonds. It was driven by 2 main factors: the Covid-19 crisis, which has highlighted the need to develop resilience to risks and shocks, including those related to climate and the environment, and the climate neutrality commitments, which are spreading in several countries, with some already backed by investment plans.

In 2021, Crédit Agricole CIB sees a continuation of this momentum. According to Damien de Saint Germain, Head of Credit Research & Strategy at Crédit Agricole CIB: “We expect the green, social and sustainability supply to accelerate in 2021. We estimate that it could reach EUR600bn, an increase corresponding to 55% as compared to the amount issued in 2020.”

Evolution of Green, Social and Sustainable Bonds issuance volume and 2021 forecast: |

|||||

| In EUR bn | 2018 |

2019 |

2020 |

2021F |

YoY % |

| Corporate - Non-financials | 30 |

80 |

111 |

180 |

63% |

| Corporate - Financials | 47 |

64 |

60 |

70 |

16% |

| SSA excl. sov | 35 |

69 |

137 |

190 |

38% |

| Sovereign | 15 |

22 |

77 |

159 |

106% |

| Grand total | 127 |

236 |

386 |

599 |

55% |

*Cumulated issuances as of end of November 2020 and published in CA CIB ESG 2021 Outlook on December 16th, 2020

Source: Bloomberg, Crédit Agricole CIB

This growth should be largely helped by both individual European countries and the EU which could issue EUR140bn in sustainable supply though green and social bonds according to our estimations. Agencies and supras should remain the larger source of supply with large names shifting the majority of their issuance to a sustainable format.

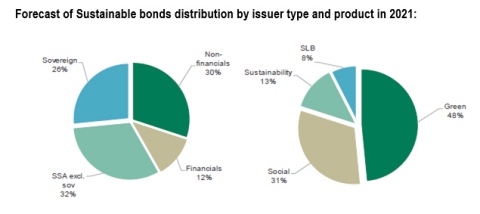

On the product side, the diversification is expected to continue with Sustainability-linked bonds and Sustainability bonds which could account for around 20% of the sustainable supply. Sustainability-linked bonds and Transition bonds can bring new issuers and sectors on board. And the issuances in EUR are still expected to account for 60% of the coming supply.

According to Tanguy Claquin, Global Head of Sustainable Banking: “The development of sustainability-linked instruments, the emergence of social bonds alongside green bonds and the upcoming EU Taxonomy regulation are strong trends and excellent news in sustainable financial markets. Issuers now have in hand a range of instruments responding to different responsible investment strategies and we will continue to advise them in their Sustainable journey.”

With 6.5% market share at the end of 2020 (Bloomberg), Crédit Agricole CIB is one of the leaders of the Green, Social and Sustainability bonds market. In 2020, the bank was bookrunner for more than 100 benchmark transactions, amongst them the Germany inaugural Green Bund, EDF first Green Convertible Bond, Suzano Inaugural Sustainability-Linked Bond as well as numerous pandemic related bonds (e.g. UNEDIC, European Union issues).Crédit Agricole CIB has a long-term commitment to promote green finance with a consistent organisation across the teams, from origination to distribution.

About Crédit Agricole Corporate and Investment Bank (Crédit Agricole CIB)

Crédit Agricole CIB is the corporate and investment banking arm of Credit Agricole Group, the 12th largest banking group worldwide in terms of tier 1 capital (The Banker, July 2020). Nearly 8,400 employees across Europe, the Americas, Asia-Pacific, the Middle East and Africa support the Bank's clients, meeting their financial needs throughout the world. Crédit Agricole CIB offers its large corporate and institutional clients a range of products and services in capital markets activities, investment banking, structured finance, commercial banking and international trade. The Bank is a pioneer in the area of climate finance, and is currently a market leader in this segment with a complete offer for all its clients.

For many years Crédit Agricole CIB has been committed to sustainable development. The Bank was the first French bank to sign the Equator Principles in 2003. It has also been a pioneer in Green Bond markets with the arrangement of public transactions from 2012 for a wide array of issuers (supranational banks, corporates, local authorities, banks) and was one of the co-drafter of Green Bond Principles and of the Social Bond Guidance. Relying on the expertise of a dedicated sustainable banking team and on the strong support of all bankers, Crédit Agricole CIB is one of the most active banks in the Green bonds market.

For more information, please visit www.ca-cib.com

Contacts

Press:

Paris – Maryse Dournes 33 (0)1 41 89 89 38 / maryse.dournes@ca-cib.com