BOSTON--(BUSINESS WIRE)--As the world enters 2021, here’s one more essential item to put on your list in addition to canned goods, toilet paper, and masks: a financial checkup. According to Fidelity Investments’® 2021 New Year Financial Resolutions Study, more than two-thirds of Americans experienced financial setbacks in 2020, often from the loss of a job or household income or another emergency expense. Even those lucky enough to maintain their income still may have had to tap savings to help others, as nearly one-in-five attribute their financial setback to providing “unexpected financial assistance to family members or friends.” Despite this, many Americans remain optimistic and determined to make their money work harder in the New Year, with 72% confident they’ll be in a better financial position in 2021.

“Americans are clearly ready to leave 2020 behind and start 2021 off on the right foot, including when it comes to their finances,” said Stacey Watson, senior vice president with oversight for Life Event Planning at Fidelity Investments. “This year’s top financial resolutions are consistent with what we’ve seen in the past; however, what makes 2021 unique is how people will achieve them, given the financial pressures and major life events many continue to experience throughout the pandemic.”

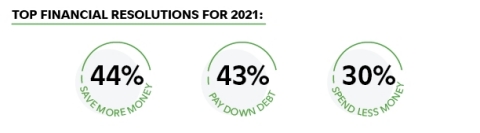

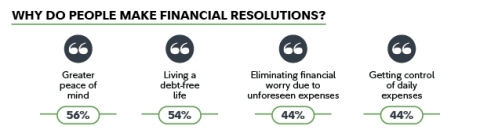

This year, 65% of Americans are considering a financial resolution for 2021, which is down marginally from last year (67%), but still quite strong given the headwinds experienced by so many families. Younger generations appear to be more committed to actively improving their finances in the new year, with 78% of all Gen Z and Millennial respondents considering a financial resolution compared to 59% of all Gen X and Boomers.

“Younger generations are building up their careers, families, and finances, so it makes sense they have important financial resolutions to make. Still, Gen-X-ers and Boomers also experienced significant financial challenges in 2020 and may want to consider making some resolutions of their own to build a stronger financial future, particularly when it comes to retirement readiness,” continued Watson.

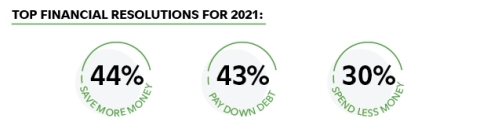

The fact Americans’ top financial resolutions are consistent with prior years is a reminder that the fundamentals of building financial stability remain consistent in all types of environments. Notably, though, one-in-six respondents this year listed recovering from “financial losses due to the COVID-19 pandemic” as among their top financial resolutions for 2021. When asked what motivates them to make financial resolutions, 56% indicated “greater peace of mind,” demonstrating the critical link between financial and emotional wellness.

Making a Resolution, and Checking it Twice

Resolutions are an important start, but the key is to keep good financial routines going strong well beyond January—and ultimately have them become life-long habits. The study reveals the key to a successful resolution is the good feeling of making progress and setting clear and specific financial goals. Having someone to help keep you on track and hold you accountable also plays a role, as nearly one-in-five indicated this was a major reason they were able to stick to a financial resolution last year. In fact, more than three-quarters (77%) of people working with a financial professional were able to stick to their financial resolution in 2020, compared to just half (50%) of those who did not work with one.

How Americans Cope with Financial Uncertainty Related to Major Life Events

The study also provided additional proof regarding the impact COVID-19 has had on families’ financial stability, as nearly one-third (29%) of Americans indicate they are in a “worse” financial situation compared to last year, versus only 19% who said the same in 2019 about the year prior. When faced with financial setbacks in 2020, the most common solutions were to “cut back on other expenses” (45%), “use my emergency savings” (37%), or “take on debt using credit cards or personal loans” (23%). One-in-five “borrowed from friends or family,” with Gen-Z and Millennials most likely to either borrow from or move in with family members.

Looking ahead to the New Year, nearly four-in-ten (38%) say they’ll spend 2021 in “Survival Mode,” meaning they’ll focus on the day-to-day to try to get themselves and their families through the next year. This outlook is more common among older generations (42% and 43% of Gen-X and Boomers, vs. 25% of Gen-Z and 34% of Millennials) and women (42% vs. 34% of men).

Putting 2020 in the Rearview

Even with these concerns, most Americans display an enduring hope of brighter days, with nearly three-quarters (72%) believing they will be better off financially in 2021 than they were in 2020. To help build a better financial future, Fidelity offers three things you can do to move forward:

-

Begin with a budget

- Of those who said they were in a "better" financial situation this year compared to last, more than one-in-five attributed the success to budgeting better. With so many online tools to make tracking your spending and savings easier, including Fidelity’s Budget Checkup, there are simple ways to create and stick to a budget aligned with a "50-15-5" guideline.

-

Replenish that Rainy-Day Fund

- More than 8-in-10 Americans say they’ll build up their emergency savings in 2021, an important money move considering that many may have tapped into their stash of cash due to financial setbacks in 2020. Fidelity Goal BoosterSM was purpose-built to help save for specific short-term goals, including emergency savings. Its Rainy Day Fast Track feature provides a short-cut for setting, funding, and achieving an emergency savings goal.

-

Find new sources of income

- Nearly two-thirds say they plan to find new ways to make money in the new year, whether with a side hustle, selling items online, or getting a part-time job. And with 30% of Americans planning to "declutter" their homes in 2021, there’s a good opportunity to find more than just loose change in those cushions and closets!

Fidelity offers additional resources to help set and keep financial resolutions, including:

- Fidelity’s Planning and Guidance Center helps those who want to create a financial plan, check up and update plans they’ve already created.

- The Life Events hub on Fidelity.com is designed to help you and your family navigate life’s big changes – whether they are expected or unexpected. The experience covers more than 30 major life events, such as a major illness, marriage and partnering, having a baby/adopting, losing or changing a job, caring for aging loved ones, or getting divorced.

- For those just getting started on their financial journey, the Fidelity Spire App is designed to inspire young adults to stay focused, motivated and informed when making money decisions by enabling users to plan, save and invest for short- and long-term goals.

- Tips to help keep financial resolutions going strong throughout the year can be found in this Fidelity Viewpoints article: How to keep your 2021 money resolutions.

- For those who want more hands-on help, Fidelity representatives are available at no cost to answer questions 24/7 at 1-800-FIDELITY, or online at Fidelity.com.

For more information on Fidelity Investments’® 2021 New Year Financial Resolutions Study, visit: https://go.fidelity.com/Res21fc

About Fidelity Investments’ 12th Annual New Year Financial Resolutions Study

This study presents the findings of a national online survey, consisting of 3,011 adults,18 years of age and older. The generations are defined as: Baby Boomers (ages 56-74), Gen X (ages 40-55), millennials (ages 24-39), and Gen Y (ages 18-23; although this generation has a wider range, we only surveyed adults for the purposes of this survey). Interviewing for this CARAVAN® Survey was conducted October 14-21, 2020 by Engine Insights, which is not affiliated with Fidelity Investments. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $8.7 trillion, including discretionary assets of $3.4 trillion as of October 31, 2020, we focus on meeting the unique needs of a diverse set of customers: helping more than 32 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 institutions with investment and technology solutions to invest their own clients’ money. Privately held for more than 70 years, Fidelity employs more than 47,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

200 Seaport Boulevard, Boston, MA 02110

958290.1.0

© 2020 FMR LLC. All rights reserved.