SEOUL, South Korea--(BUSINESS WIRE)--The online meet-up '10X Extension in Luxembourg' held by the Seoul Fintech Lab on November 26 was ended in great success.

The meet-up was organized for the purpose of business matching between the startups of the Seoul Fintech Lab that wish to enter the European market and investors and financiers in Europe.

Luxembourg is a country where the European headquarters of multinational corporations, such as Amazon and PayPal, are located. Considered a fintech capital of the world and a country that issues the passport for business in the European Union member nations, Luxembourg is recognized as the starting point for financial and fintech companies’ entry to the European market.

BC Labs, Spiceware, XQuant, Quotabook, and Finhaven, the participating startups of the Seoul Fintech Lab, also targeted Luxembourg as the foundation stone for their European market entry.

The online meet-up was started with a welcoming speech by the CEO of the Luxembourg Private Equity & Venture Capital Association (LPEA), followed by a session to enhance understanding about the Luxembourg industry, such as an introduction to the ecosystem of Luxembourg’s financial industry by the Luxembourg for Finance (LFF) and the fintech ecosystem by the Luxembourg House of Financial Technology (LHoFT).

Then, Alexander Tkachenko, Managing Partner of 2be.lu VC, and Professor Youngju Nielsen at Sungkyunkwan University led a panel discussion on the subject of “Collaboration between traditional financial institutions and fintech,” and HoHyun Ko, Managing Director of Seoul Fintech Lab, gave a message of support and appreciation.

The Q&A session that followed the pitch by the five participating startups continued on for approximately two hours during which the speakers and Luxembourg participants engaged in a heated exchange of questions and answers.

“It was a valuable and meaningful opportunity to meet up with Luxembourg’s financial leaders and fintech businesses at one place,” said Andy Choi, CEO of Quotabook (Quota Lab), one of the participating Korean startups. He added, “The participants showed a great level of interest in Korea’s startup ecosystem and, as much as so, we will strive to live up to their expectations.”

This event was organized by the Seoul Fintech Lab in cooperation with LUXKO, a business accelerator and 2be.lu, a venture capital firm. Having been meticulously prepared, the meet-up successfully drew the attention of the participants from the local financial industry and fintech businesses by making full use of the partnership network.

With over 130 pre-registrations made for this event, a large number of participants also came from the neighboring European countries of Luxembourg, such as Norway, Germany, France, and Switzerland.

Participating Startups in 10X Extension in Luxembourg

1. BC Labs (http://volta.link/)

VOLTA provides a trading strategy open marketplace that connects retail investors and professional traders so that retail investors can trade like professionals with the aid from professional traders.

There are many teams consisting of just one or two talented programmers who make high profits just by running a few trading strategy algorithms. However, these groups lack the resources such as the brand, organization, capital for marketing, funding and customer services, and they are looking for an automated platform so that they can solely focus on trading.

2. Spiceware (https://www.spiceware.io/)

Spiceware on Cloud is SaaS that securely protects all data operated by enterprises in finance, public, telecommunications and healthcare sectors by providing data security and PII (Personally Identifiable Information) protection services for building infrastructure utilizing cloud, big data, and AI.

It is a cloud-native PII Protection Service with the following features: Encryption, Access Log Management, PII Deletion, Anonymization & Pseudonymization.

Established in 2017, the company is invested by AhnLab, a major IT security company in South Korea, along with other VC’s in Korea. Spiceware is an Amazon APN Select Technology Partner in the category of DB Encryption since 2018.

3. XQuant (https://www.xquant-ai.com/)

XQuant is a Korean leading specialist for the processing and analysis of unstructured data for financial institutions. Our products TS-Expert and ESG-Analytics will help your organization extract the relevant information and improve the efficiency of your team. www.xquant-ai.com

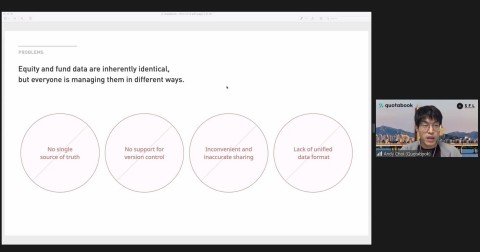

4. Quotabook (https://quotabook.com/)

Quotabook is an equity management platform for both companies and investors. Startups and VCs can sync crucial equity data and corporate governance issues through an online equity platform so that every shareholder and portfolio company can communicate through a single source of truth. Quotabook is being used by most of the top-tier VCs and Startups in Korea while also having partnerships with 33% of the transfer agents in Korea. The company was incorporated in late 2019 and was funded by almost 20 VCs, accelerators, and banks ever since.

5. Finhaven (https://www.finhaven.com/)

Finhaven is a capital markets technology company that offers a simple, safe and secure paperless custodial and settlement solution for all market participants. Our technology platform leverages distributed ledger technology and covers KYC, AML, suitability, capital raise, primary distribution, marketplace, settlement, depository, investor relations, and corporate action management. This new digital capital market system will have real time settlement that eliminates the need for clearing agencies, central depositories, and custodians. Finhaven Capital, a wholly owned subsidiary of Finhaven Technology Inc. is a registered exempt market dealer in six jurisdictions from BC to QC in Canada (Finhaven Capital is operating as “Finhaven Private Markets”). Finhaven Asia, another Finhaven subsidiary, is located in Seoul to expand the Company’s business in Asian markets.

About Seoul Fintech Lab

Seoul Fintech Lab was established in 2018 by the Seoul Metropolitan City. In October 2019, the Lab moved its office to Seoul's Yoido so that it can raise its competitiveness by strengthening interactions with financial firms in the area. The Lab provides spaces to fintech startups for up to two years while providing accelerator programs which are startup custom-tailored to their growth needs. The Lab plans to increase the number of startups within it to 100 in 2020.