E*TRADE Corporate Services Study Reveals Employees Place Greater Emphasis on Equity Compensation Amid Pandemic

E*TRADE Corporate Services Study Reveals Employees Place Greater Emphasis on Equity Compensation Amid Pandemic

In a challenging year, participants are increasingly engaged with their stock plans

ARLINGTON, Va.--(BUSINESS WIRE)--E*TRADE Corporate Services, a division of Morgan Stanley at Work, today announced results from its annual survey of equity compensation plan participants.1

E*TRADE interviewed 53,512 stock plan participants from September 8–18, 2020, seeking their views on how they engage with, and feel about, their equity compensation. Results show that in this volatile and uncertain year participants across all ages and categories placed higher importance on—and satisfaction with—their stock plan benefits:

- As the workplace goes digital, participants are more plugged in: With many working remote, more participants are checking in on their stock plans weekly, up 7 percentage points, and logging in more on mobile, up 5 percentage points. The increased engagement conforms with recent data from Shareworks (also a part of Morgan Stanley at Work), which found that more companies are digitizing their equity plans.2

- And they are in it for the long haul: More view their equity compensation as a long-term investment, up 3 percentage points, and also hold their equity long-term because they believe in their company’s future and performance, up 5 percentage points.

- Stock plan benefits increasingly motivate key career decisions: More participants said equity awards are an important factor when deciding to remain with their company, up 5 percentage points. This view aligns with the recent Shareworks study, where plan decision-makers believe equity comp will increase in importance for compensation, recruiting, and retainment in the next five years.2

- And some employees are seeking out student loan benefits: One third said their decision to accept or leave a job would be affected “quite a bit” or “very much” if their employer contributed to paying off their student loans.

- Pain points persist: Taxes and achieving the maximum value of benefits are topics that continue to confound, even though understanding increased by 2 to 3 percentage points. The Shareworks study also found that understanding tax consequences is a top concern among plan decision-makers when it comes to their participants.2

- Despite this year’s challenges, participants are more satisfied: Participant satisfaction with their equity compensation increased 2 percentage points, while E*TRADE’s net promoter score increased 13 percentage points.

“In a year of disruption that’s changed the nature of how many of us live and work, employees of all ages and experience levels are finding more value in their equity compensation, and in doing so are forging closer connections with their employer,” said Kate Winget, Managing Director, Head of Participant Engagement and Experience for Morgan Stanley at Work. “As we chart a path forward for economic recovery, equity compensation is emerging as a game-changing tool that can help companies create a culture of ownership and collaboration, provide traction for their workforce, and secure their teams’ actual skin in the game.”

For news and thought leadership on equity compensation, follow E*TRADE Corporate Services, on LinkedIn.

Morgan Stanley at Work and E*TRADE Corporate Services recently joined forces to further raise the bar for equity compensation, retirement solutions, and financial wellness. To learn more about E*TRADE’s equity compensation offering, visit etrade.com/corporateservices.

- E*TRADE Financial Corporate Services, Inc. annual survey fielded from September 8, 2020, to September 18, 2020, to current stock plan participants of E*TRADE’s corporate clients.

- Shareworks by Morgan Stanley presented the results of the 2020 State of the Equity Plan Management at Private Companies Report in a virtual event on October 21, 2020. To get a copy of the report, including full results and for more information about Shareworks by Morgan Stanley, please visit www.Shareworks.com.

About E*TRADE Financial and Important Notices

The E*TRADE Financial family of companies provides financial services, including trading, investing, banking, and managing employee stock plans. Employee stock plan solutions are offered by E*TRADE Financial Corporate Services, Inc. Securities products and services are offered by E*TRADE Securities LLC (Member FINRA/SIPC). Commodity futures products and services are offered by E*TRADE Futures LLC (Member NFA). Managed Account Solutions are offered through E*TRADE Capital Management, LLC, a Registered Investment Adviser. Bank products and services are offered by E*TRADE Bank, a Federal savings bank, Member FDIC, or its subsidiaries. More information is available at www.etrade.com.

In connection with stock plan solutions offered by E*TRADE Financial Corporate Services, Inc., E*TRADE Securities LLC provides brokerage services to stock plan participants.

E*TRADE Financial, E*TRADE, and the E*TRADE logo are trademarks or registered trademarks of E*TRADE Financial, LLC. ETFC-G

ETFC

© 2020 E*TRADE Financial, LLC, a business of Morgan Stanley. All rights reserved.

Referenced Data

How often do you log into E*TRADE (etrade.com) to view and manage your stock plan account? |

||||||

|

At least once a week |

Bi-weekly |

Monthly |

Quarterly |

Semi-annually or less often |

|

2020 |

23% |

12% |

27% |

23% |

13% |

|

2019 |

16% |

12% |

29% |

26% |

16% |

|

2018 |

15% |

11% |

29% |

27% |

16% |

|

Which of the following best describes you when accessing your account using the E*TRADE Mobile application? |

|||||

|

2020 |

|

2019 |

|

2018 |

I prefer viewing my stock plan benefit information on the E*TRADE Mobile app |

25% |

|

20% |

|

17% |

I sometimes view stock plan benefit information on the E*TRADE Mobile app, but prefer using the E*TRADE website |

27% |

|

25% |

|

28% |

I don't currently use the E*TRADE Mobile app, and only view stock plan benefit information through the E*TRADE website |

47% |

|

55% |

|

55% |

Which one of the following best describes your approach toward selling shares or exercising options from your stock plan account? |

|||

|

2020 |

2019 |

2018 |

Hold stock as a long-term investment |

20% |

17% |

22% |

Sell or exercise when money is needed for a large expense |

19% |

21% |

19% |

I have never sold shares |

18% |

18% |

15% |

Sell or exercise as needed when stock reaches my targeted sell price |

14% |

14% |

17% |

Sell or exercise after waiting period to get the long-term capital gains tax rate |

8% |

7% |

8% |

Sell or exercise in increments over time |

6% |

6% |

5% |

Sell or exercise immediately upon purchase |

6% |

8% |

10% |

Do nothing |

6% |

6% |

3% |

Other |

1% |

1% |

1% |

Why did you decide to hold your shares instead of selling them? |

|||||

|

2020 |

|

2019 |

|

2018 |

I believe in the company's future performance |

35% |

|

30% |

|

72% |

Hold stock as a long-term investment (e.g., retirement) |

26% |

|

27% |

|

57% |

I don't currently have plans for (or need) the cash |

20% |

|

22% |

|

39% |

Sell or exercise when need money for a large expense (e.g., college savings) |

8% |

|

9% |

|

15% |

The company stock pays dividends |

5% |

|

5% |

|

|

Other |

6% |

|

8% |

|

2% |

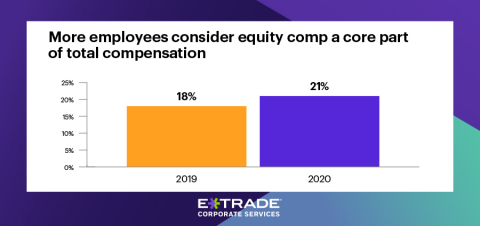

Which one of the following best describes the way you think about your stock plan benefits? |

|||||

|

A core part of my compensation, like my salary |

Extra pay, like a bonus |

A gamble that may or may not be worth something – I don’t count on it |

I don't think about my stock plan benefits |

|

2020 |

21% |

53% |

18% |

8% |

|

2019 |

18% |

53% |

20% |

9% |

|

2018 |

21% |

54% |

16% |

8% |

|

How well do you understand each of the following about your company’s stock plan benefits? (%Quite/Extremely Well shown) |

|||

*Asked only for those who receive Stock Options or Stock Appreciation Rights |

|||

|

2020 |

2019 |

2018 |

How to access my stock plan benefits account |

73% |

71% |

70% |

How my vesting schedule works |

62% |

59% |

59% |

How to sell my stock plan shares |

57% |

|

|

How my company's stock plan benefits work |

56% |

53% |

54% |

Expiration date of my stock plan benefits* |

52% |

|

|

My potential gain or loss if I sell my stock plan shares |

50% |

|

|

How to find information/education about my stock plan benefits |

48% |

46% |

45% |

How to determine when to take action on my stock plan benefits |

42% |

41% |

41% |

How taxes may impact my specific type of stock plan benefits |

33% |

31% |

31% |

How to potentially maximize the financial benefit from my stock plan benefits |

33% |

30% |

31% |

How much did your stock plan benefits factor into the following? |

|||||||

|

Not at all |

A little |

Somewhat |

Quite a bit |

Very much |

||

Your decision to accept your job

|

2020 |

41% |

13% |

22% |

15% |

9% |

|

2019 |

46% |

13% |

20% |

13% |

7% |

||

2018 |

45% |

13% |

21% |

13% |

7% |

||

|

|||||||

Your decision to stay in your job

|

2020 |

24% |

13% |

22% |

24% |

17% |

|

2019 |

27% |

14% |

23% |

22% |

14% |

||

2018 |

28% |

14% |

23% |

21% |

14% |

||

If your employer contributed to paying off your student loans, how much do you think it would factor into the following? |

|||||

|

Not at all |

A little |

Somewhat |

Quite a bit |

Very much |

Your decision to accept your job |

42% |

10% |

19% |

16% |

13% |

Your decision to stay in your job |

42% |

10% |

18% |

16% |

14% |

Overall, how satisfied are you with your company's stock plan offering? |

||||||

(% = Agree/Strongly agree) |

||||||

|

|

Very dissatisfied |

Dissatisfied |

Neither satisfied nor dissatisfied |

Satisfied |

Very satisfied |

2020 |

|

2% |

3% |

12% |

48% |

35% |

2019 |

|

2% |

3% |

14% |

49% |

32% |

2018 |

|

3% |

3% |

14% |

49% |

31% |

Contacts

E*TRADE Media Relations

646-521-4418

mediainq@etrade.com