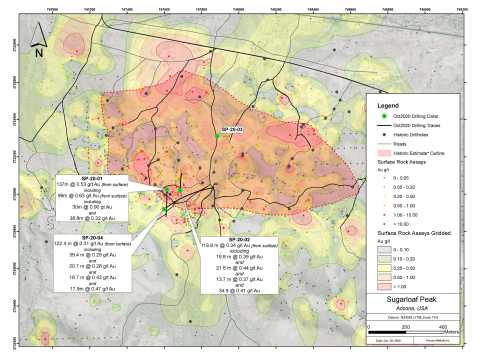

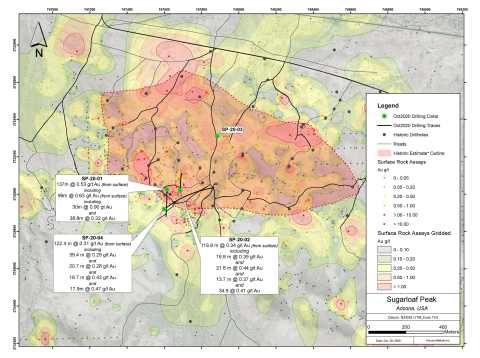

TORONTO--(BUSINESS WIRE)--Arizona Metals Corp. (TSX.V:AMC, OTCQB:AZMCF) (the “Company” or “Arizona Metals”) announces drill results of the final three drill holes of the 1,748 m Phase 1 drill program at its Sugarloaf Peak Project in La Paz County, Arizona.

A total of four holes were drilled primarily to provide core for metallurgical testing, to test geophysical targets at depth, and also to provide infill data towards incorporation into an NI 43-101 resource estimate.

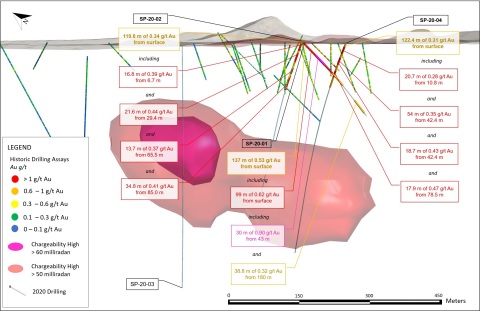

Drill hole SP-20-02 intersected 119.8 m of 0.34 g/t gold from surface, including 21.6 m of 0.44 g/t gold, and 34.8 m of 0.41 g/t gold.

Drill hole SP-20-03 was extended to a depth of 547 m to test a geophysical anomaly starting at a depth of approximately 270 m. This hole encountered low grade mineralization from 11.3 m to 178 m (166.7 m of 0.12 g/t gold), but did not encounter significant mineralization at depth.

Drill hole SP-20-04 intersected 122.4 m of 0.31 g/t gold from a depth of 3.1 m, including 18.7 m of 0.43 g/t gold and 17.9 m of 0.47 g/t gold. This interval was a part of larger mineralized halo, starting at a depth of 3.1 m and extending to 396.5 m, for a total of 393.5 m of 0.22 g/t gold.

As previously reported, drill hole SP-20-01 intersected 137 m of 0.53 g/t gold from surface, including, 99 m of 0.62 g/t gold, and 30 m of 0.90 g/t gold. From 179.7 m to the end of the hole at 218.5 m, the same hole also intersected 38.8 m of 0.32 g/t gold (Table 1). The hole ended in anomalous gold, and intersected gold mineralization approximately 45 m below holes drilled by previous operators in 1990 (Cominco) and 2011 (Choice Gold).

Table 1. Sugarloaf Phase 1 drill program results |

||||||||||||

Hole ID |

From m |

To m |

Length m |

Au g/t |

||||||||

| SP-20-01 | 0.0 |

|

|

137.6 |

|

|

137.6 |

|

|

0.53 |

||

| including | 0.0 |

|

|

98.8 |

|

|

98.8 |

|

|

0.62 |

||

| including | 43.5 |

|

|

73.5 |

|

|

29.9 |

|

|

0.90 |

||

and |

179.7 |

|

|

218.5 |

|

|

38.8 |

|

|

0.32 |

||

| SP-20-02 | 0.0 |

|

|

119.8 |

|

|

119.8 |

|

|

0.34 |

||

| including | 6.7 |

|

|

23.5 |

|

|

16.8 |

|

|

0.39 |

||

| including | 29.4 |

|

|

51.1 |

|

|

21.6 |

|

|

0.44 |

||

| including | 65.5 |

|

|

79.2 |

|

|

13.7 |

|

|

0.37 |

||

| including | 85.0 |

|

|

119.8 |

|

|

34.8 |

|

|

0.41 |

||

| SP-20-03 | 11.3 |

|

|

178.0 |

|

|

166.7 |

|

|

0.12 |

||

| SP-20-04 | 3.1 |

|

|

396.5 |

|

|

393.5 |

|

|

0.22 |

||

| including | 3.1 |

|

|

125.4 |

|

|

122.4 |

|

|

0.31 |

||

| including | 42.4 |

|

|

61.1 |

|

|

18.7 |

|

|

0.43 |

||

| including | 78.5 |

|

|

96.4 |

|

|

17.9 |

|

|

0.47 |

||

Detailed hydrothermal alteration analyses have been completed on all four holes, and representative samples will undergo metallurgical testing at Kappes Cassiday’s facilities in Reno, Nevada. Results of the metallurgical testing are expected in 1Q’21.

Marc Pais, CEO, commented “As expected, drill holes SLP-20-01, -02, and -04, intersected grades and widths of mineralization similar to those reported in the historic estimate. We will incorporate the upcoming metallurgical test results into the design of a drill program for expansion of the near-surface oxide material. Holes SLP-20-03 and -04 were extended to depths of 457 m and 549 m, respectively, in order to test geophysical anomalies at depth. While these holes did not intersect significant high-grade gold mineralization at depth, both encountered widespread faulting and shearing, with alteration typical of greenstone hosted quartz-carbonate systems. Hole SLP-20-04 intersected a 394 m interval of low-grade gold mineralization from surface, which we believe demonstrates that the surface oxide mineralization is the surface expression of a potentially much larger system at depth.”

Table 2. Sugarloaf completed drill hole locations and orientations |

||||||

Hole ID |

East NAD83 |

North NAD 83 |

Elev m |

Az |

Dip |

Depth m |

SP-20-01 |

747630 |

3725020 |

387 |

180 |

-45 |

227 |

SP-20-02 |

747680 |

3725022 |

388 |

0 |

-70 |

369 |

SP-20-03 |

747880 |

3725300 |

375 |

0 |

-90 |

572 |

SP-20-04 |

747600 |

3724920 |

388 |

54 |

-57 |

581 |

Sugarloaf Peak Highlights

- Project is 100% owned by Arizona Metals Corp. with no future payments

- Located on 4,400 acres of BLM claims in mining-friendly La Paz County, Arizona

- Historic estimate of “100 million tons containing 1.5 million ounces gold”* at a grade of 0.5 g/t (Dausinger, 1983, Westworld Resources).

- Heap-leach, open-pit target that starts at surface and is tabular with no dip

- Open for expansion at depth and on strike

- Metallurgical testing (bottle roll) by Kinross (2009) and Agnico (2013) achieved gold recoveries of up to 73% (inline with heap-leach mines currently in operation)

Kay Mine Project, Arizona Update

A total of 20 drill holes have been completed at the Kay Mine. A downhole electromagnetic survey was also completed in September 2020 and results are pending. Permitting is currently underway for a Phase 2 drill program at the Kay Mine of 11,000m in 29 diamond drill holes.

About Arizona Metals Corp

Arizona Metals Corp owns 100% of the Kay Mine Property in Yavapai County, which is located on a combination of patented and BLM claims totaling 1,300 acres that are not subject to any royalties. An historic estimate by Exxon Minerals in 1982 reported a “proven and probable reserve of 6.4 million short tons at a grade of 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver.” The historic estimate at the Kay Mine was reported by Exxon Minerals in 1982. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to be a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Kay Mine is a steeply dipping VMS deposit that has been defined from a depth of 60 m to at least 900 m. It is open for expansion on strike and at depth.

The Company also owns 100% of the Sugarloaf Peak Property, in La Paz County, which is located on 4,400 acres of BLM claims. Sugarloaf is a heap-leach, open-pit target and has a historic estimate of “100 million tons containing 1.5 million ounces gold” at a grade of 0.5 g/t (Dausinger, 1983, Westworld Resources).

*The historic estimate at the Sugarloaf Peak Property was reported by Westworld Resources in 1983. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Qualified Person who reviewed and approved the technical disclosure in this release is David Smith, CPG.

Quality Assurance/Quality Control

All of Arizona Metals’ drill sample assay results have been independently monitored through a quality assurance/quality control (“QA/QC”) protocol which includes the insertion of blind standard reference materials and blanks at regular intervals. Logging and sampling were completed at Arizona Metals’ core handling facilities located in Quartzite, Arizona. Drill core was diamond sawn on site and half drill-core samples were securely transported to ALS Laboratories’ (“ALS”) sample preparation facility in Tucson, Arizona. Sample pulps were sent to ALS’s labs in Vancouver, Canada, for analysis.

Gold content was determined by fire assay of a 30-gram charge with ICP finish (ALS method Au-AA23). Silver and 47 other elements were analyzed by ICP methods with four-acid digestion (ALS method ME-MS61). ALS Laboratories is independent of Arizona Metals Corp. and its Vancouver facility is ISO 17025 accredited. ALS also performed its own internal QA/QC procedures to assure the accuracy and integrity of results. Parameters for ALS’ internal and Arizona Metals’ external blind quality control samples were acceptable for the samples analyzed. Arizona Metals is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to herein.

This press release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation, All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements contained in this press release include, without limitation, statements regarding the resumption of drilling and the effects of the COVID-19 pandemic on the business and operations of the Company. In making the forward- looking statements contained in this press release, the Company has made certain assumptions. Although the Company believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: availability of financing; delay or failure to receive required permits or regulatory approvals; and general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward- looking statements or otherwise.

NEITHER THE TSX VENTURE EXCHANGE (NOR ITS REGULATORY SERVICE PROVIDER) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

Not for distribution to US newswire services or for release, publication, distribution or dissemination directly, or indirectly, in whole or in part, in or into the United States