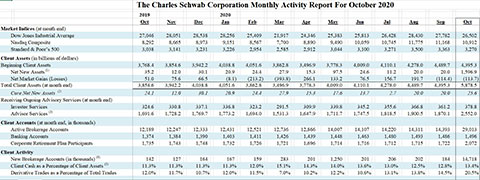

SAN FRANCISCO--(BUSINESS WIRE)--The Charles Schwab Corporation released its Monthly Activity Report today, reflecting for the first time its recent acquisition of TD Ameritrade. Company highlights for the month of October 2020 include:

- Core net new assets brought to the company by new and existing clients totaled $25.6 billion. Core net new assets excluding mutual fund clearing totaled $25.7 billion.

- Total client assets were $5.88 trillion as of month-end October, up 53% from October 2019 and up 34% compared to September 2020.

- Average interest-earning assets on the company’s balance sheet were $442.1 billion in October, up 66% from October 2019 and up 13% compared to September 2020.

Prior to the closing of the acquisition on October 6, 2020, TD Ameritrade recorded the following client operating metrics for the period of October 1 through October 5:

- Daily Average Trades (DATs): 3,932 thousand

- Net New Assets: $1.0 billion

- New brokerage accounts: 32 thousand

Please note that while these standalone TD Ameritrade metrics are not included within the October Monthly Activity Report table, all metrics have been calculated using Schwab’s methodologies.

About Charles Schwab

The Charles Schwab Corporation (NYSE: SCHW) is a leading provider of financial services, with 29.0 million active brokerage accounts, 2.1 million corporate retirement plan participants, 1.5 million banking accounts, and $5.9 trillion in client assets as of October 31, 2020. Through its operating subsidiaries, the company provides a full range of wealth management, securities brokerage, banking, asset management, custody, and financial advisory services to individual investors and independent investment advisors. Its broker-dealer subsidiaries, Charles Schwab & Co., Inc., TD Ameritrade, Inc., and TD Ameritrade Clearing, Inc., (members SIPC, https://www.sipc.org), and their affiliates offer a complete range of investment services and products including an extensive selection of mutual funds; financial planning and investment advice; retirement plan and equity compensation plan services; referrals to independent, fee-based investment advisors; and custodial, operational and trading support for independent, fee-based investment advisors through Schwab Advisor Services. Its primary banking subsidiary, Charles Schwab Bank, SSB (member FDIC and an Equal Housing Lender), provides banking and lending services and products. More information is available at https://www.aboutschwab.com.

TD Ameritrade, Inc. and TD Ameritrade Clearing, Inc. are separate but affiliated companies and subsidiaries of TD Ameritrade Holding Corporation. TD Ameritrade Holding Corporation is a wholly owned subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank.

| The Charles Schwab Corporation Monthly Activity Report For October 2020 | |||||||||||||||||||||||||||||||||||||||||||||

2019 |

2020 |

Change | |||||||||||||||||||||||||||||||||||||||||||

Oct |

Nov | Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Mo. | Yr. | |||||||||||||||||||||||||||||||

| Market Indices (at month end) | |||||||||||||||||||||||||||||||||||||||||||||

| Dow Jones Industrial Average | 27,046 |

|

28,051 |

|

28,538 |

|

28,256 |

|

25,409 |

|

21,917 |

|

24,346 |

|

25,383 |

|

25,813 |

|

26,428 |

|

28,430 |

|

27,782 |

|

26,502 |

|

(5%) |

|

(2%) |

||||||||||||||||

| Nasdaq Composite | 8,292 |

|

8,665 |

|

8,973 |

|

9,151 |

|

8,567 |

|

7,700 |

|

8,890 |

|

9,490 |

|

10,059 |

|

10,745 |

|

11,775 |

|

11,168 |

|

10,912 |

|

(2%) |

|

32% |

||||||||||||||||

| Standard & Poor’s 500 | 3,038 |

|

3,141 |

|

3,231 |

|

3,226 |

|

2,954 |

|

2,585 |

|

2,912 |

|

3,044 |

|

3,100 |

|

3,271 |

|

3,500 |

|

3,363 |

|

3,270 |

|

(3%) |

|

8% |

||||||||||||||||

| Client Assets (in billions of dollars) |

|

|

|

||||||||||||||||||||||||||||||||||||||||||

| Beginning Client Assets | 3,768.4 |

|

3,854.6 |

|

3,942.2 |

|

4,038.8 |

|

4,051.6 |

|

3,862.8 |

|

3,496.9 |

|

3,778.3 |

|

4,009.0 |

|

4,110.1 |

|

4,278.0 |

|

4,489.7 |

|

4,395.3 |

|

|

|

|

||||||||||||||||

| Net New Assets (1) | 35.2 |

|

12.0 |

|

30.1 |

|

20.9 |

|

24.4 |

|

27.9 |

|

15.3 |

|

97.5 |

|

24.6 |

|

11.2 |

|

20.0 |

|

20.0 |

|

1,596.9 |

|

N/M |

|

N/M |

||||||||||||||||

| Net Market Gains (Losses) | 51.0 |

|

75.6 |

|

66.5 |

|

(8.1 |

) |

(213.2 |

) |

(393.8 |

) |

266.1 |

|

133.2 |

|

76.5 |

|

156.7 |

|

191.7 |

|

(114.4 |

) |

(113.7 |

) |

|

|

|

||||||||||||||||

| Total Client Assets (at month end) | 3,854.6 |

|

3,942.2 |

|

4,038.8 |

|

4,051.6 |

|

3,862.8 |

|

3,496.9 |

|

3,778.3 |

|

4,009.0 |

|

4,110.1 |

|

4,278.0 |

|

4,489.7 |

|

4,395.3 |

|

5,878.5 |

|

34% |

|

53% |

||||||||||||||||

| Core Net New Assets (2) | 24.1 |

|

12.0 |

|

30.1 |

|

20.9 |

|

24.4 |

|

27.9 |

|

15.3 |

|

17.6 |

|

13.7 |

|

2.7 |

|

20.0 |

|

20.0 |

|

25.6 |

|

28% |

|

6% |

||||||||||||||||

| Receiving Ongoing Advisory Services (at month end) |

|

|

|

||||||||||||||||||||||||||||||||||||||||||

| Investor Services | 324.6 |

|

330.8 |

|

337.1 |

|

336.8 |

|

323.2 |

|

291.5 |

|

309.9 |

|

339.8 |

|

345.2 |

|

355.6 |

|

366.8 |

|

361.2 |

|

378.8 |

|

5% |

|

17% |

||||||||||||||||

| Advisor Services (3) | 1,691.6 |

|

1,728.2 |

|

1,769.7 |

|

1,773.2 |

|

1,694.0 |

|

1,531.3 |

|

1,647.9 |

|

1,711.7 |

|

1,747.5 |

|

1,818.5 |

|

1,900.5 |

|

1,870.1 |

|

2,552.0 |

|

36% |

|

51% |

||||||||||||||||

| Client Accounts (at month end, in thousands) |

|

|

|

||||||||||||||||||||||||||||||||||||||||||

| Active Brokerage Accounts | 12,189 |

|

12,247 |

|

12,333 |

|

12,431 |

|

12,521 |

|

12,736 |

|

12,866 |

|

14,007 |

|

14,107 |

|

14,220 |

|

14,311 |

|

14,393 |

|

29,013 |

|

102% |

|

138% |

||||||||||||||||

| Banking Accounts | 1,374 |

|

1,384 |

|

1,390 |

|

1,403 |

|

1,411 |

|

1,426 |

|

1,439 |

|

1,448 |

|

1,463 |

|

1,480 |

|

1,493 |

|

1,486 |

|

1,496 |

|

1% |

|

9% |

||||||||||||||||

| Corporate Retirement Plan Participants | 1,735 |

|

1,743 |

|

1,748 |

|

1,732 |

|

1,726 |

|

1,721 |

|

1,696 |

|

1,714 |

|

1,716 |

|

1,712 |

|

1,715 |

|

1,722 |

|

2,072 |

|

20% |

|

19% |

||||||||||||||||

| Client Activity |

|

|

|

||||||||||||||||||||||||||||||||||||||||||

| New Brokerage Accounts (in thousands) (4) | 142 |

|

127 |

|

164 |

|

167 |

|

159 |

|

283 |

|

201 |

|

1,250 |

|

201 |

|

206 |

|

202 |

|

184 |

|

14,718 |

|

N/M |

|

N/M |

||||||||||||||||

| Client Cash as a Percentage of Client Assets (5) | 11.3 |

% |

11.3 |

% |

11.3 |

% |

11.3 |

% |

12.0 |

% |

15.1 |

% |

14.3 |

% |

14.0 |

% |

13.6 |

% |

13.0 |

% |

12.5 |

% |

12.8 |

% |

13.4 |

% |

60 bp |

|

210 bp |

||||||||||||||||

| Derivative Trades as a Percentage of Total Trades | 12.0 |

% |

11.7 |

% |

10.7 |

% |

12.0 |

% |

11.5 |

% |

7.0 |

% |

10.2 |

% |

12.2 |

% |

10.6 |

% |

13.1 |

% |

13.8 |

% |

14.5 |

% |

20.5 |

% |

600 bp |

|

850 bp |

||||||||||||||||

| Mutual Fund and Exchange-Traded Fund |

|

|

|

||||||||||||||||||||||||||||||||||||||||||

| Net Buys (Sells) (6,7) (in millions of dollars) |

|

|

|

||||||||||||||||||||||||||||||||||||||||||

| Large Capitalization Stock | 900 |

|

1,406 |

|

991 |

|

845 |

|

(178 |

) |

984 |

|

(693 |

) |

(768 |

) |

(1,254 |

) |

(2,536 |

) |

(1,422 |

) |

(1,360 |

) |

(935 |

) |

|

|

|

||||||||||||||||

| Small / Mid Capitalization Stock | (458 |

) |

73 |

|

201 |

|

(314 |

) |

(531 |

) |

(954 |

) |

151 |

|

(401 |

) |

(1,063 |

) |

(1,476 |

) |

(441 |

) |

(497 |

) |

(753 |

) |

|

|

|

||||||||||||||||

| International | 340 |

|

735 |

|

993 |

|

1,360 |

|

132 |

|

(2,116 |

) |

(2,207 |

) |

(1,953 |

) |

(1,580 |

) |

(773 |

) |

230 |

|

370 |

|

168 |

|

|

|

|

||||||||||||||||

| Specialized | 618 |

|

484 |

|

455 |

|

762 |

|

397 |

|

333 |

|

2,059 |

|

1,512 |

|

1,020 |

|

1,505 |

|

906 |

|

115 |

|

215 |

|

|

|

|

||||||||||||||||

| Hybrid | (202 |

) |

(290 |

) |

(96 |

) |

615 |

|

(257 |

) |

(4,790 |

) |

(860 |

) |

(518 |

) |

(97 |

) |

(769 |

) |

(124 |

) |

(12 |

) |

(553 |

) |

|

|

|

||||||||||||||||

| Taxable Bond | 2,813 |

|

2,274 |

|

4,710 |

|

5,714 |

|

3,830 |

|

(23,142 |

) |

1,642 |

|

5,469 |

|

9,215 |

|

7,314 |

|

7,680 |

|

5,734 |

|

5,904 |

|

|

|

|

||||||||||||||||

| Tax-Free Bond | 809 |

|

860 |

|

1,255 |

|

1,481 |

|

1,066 |

|

(5,229 |

) |

(242 |

) |

805 |

|

1,710 |

|

1,297 |

|

1,648 |

|

1,123 |

|

861 |

|

|

|

|

||||||||||||||||

| Net Buy (Sell) Activity (in millions of dollars) |

|

|

|

||||||||||||||||||||||||||||||||||||||||||

| Mutual Funds (6) | (473 |

) |

(761 |

) |

1,097 |

|

2,684 |

|

(565 |

) |

(34,382 |

) |

(3,863 |

) |

(564 |

) |

1,768 |

|

(147 |

) |

2,568 |

|

757 |

|

(2,260 |

) |

|

|

|

||||||||||||||||

| Exchange-Traded Funds (7) | 5,293 |

|

6,303 |

|

7,412 |

|

7,779 |

|

5,024 |

|

(532 |

) |

3,713 |

|

4,710 |

|

6,183 |

|

4,709 |

|

5,909 |

|

4,716 |

|

7,167 |

|

|

|

|

||||||||||||||||

| Money Market Funds | 7,059 |

|

4,768 |

|

1,515 |

|

1,911 |

|

1,312 |

|

(1,233 |

) |

8,465 |

|

4,833 |

|

(5,673 |

) |

(9,039 |

) |

(5,614 |

) |

(6,627 |

) |

(4,021 |

) |

|

|

|

||||||||||||||||

| Selected Average Assets (in millions of dollars) |

|

|

|

||||||||||||||||||||||||||||||||||||||||||

| Average Interest-Earning Assets (8,9) | 266,089 |

|

268,254 |

|

274,911 |

|

279,437 |

|

278,966 |

|

317,850 |

|

353,018 |

|

361,814 |

|

373,986 |

|

379,521 |

|

384,690 |

|

392,784 |

|

442,119 |

|

13% |

|

66% |

||||||||||||||||

| Average Bank Deposit Account Assets (9,10) | - |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

132,030 |

|

N/M |

|

N/M |

|||||

(1) |

October 2020 includes an inflow of $1.6 trillion related to the acquisition of TD Ameritrade. July 2020 includes an inflow of $8.5 billion related to the acquisition of Wasmer, Schroeder & Company, LLC. June 2020 includes an inflow of $10.9 billion from a mutual fund clearing services client. May 2020 includes an inflow of $79.9 billion related to the acquisition of the assets of USAA’s Investment Management Company. October 2019 includes an inflow of $11.1 billion from a mutual fund clearing services client. | |

(2) |

Net new assets before significant one-time inflows or outflows, such as acquisitions/divestitures or extraordinary flows (generally greater than $10 billion) relating to a specific client. These flows may span multiple reporting periods. | |

(3) |

Excludes Retirement Business Services. | |

(4) |

October 2020 includes 14.5 million new brokerage accounts related to the acquisition of TD Ameritrade. May 2020 includes 1.1 million new brokerage accounts related to the acquisition of the assets of USAA’s Investment Management Company. | |

(5) |

Schwab One®, certain cash equivalents, bank deposits, third-party bank deposit accounts, and money market fund balances as a percentage of total client assets. | |

(6) |

Represents the principal value of client mutual fund transactions handled by Schwab, including transactions in proprietary funds. Includes institutional funds available only to Investment Managers. Excludes money market fund transactions. | |

(7) |

Represents the principal value of client ETF transactions handled by Schwab, including transactions in proprietary ETFs. | |

(8) |

Represents average total interest-earning assets on the company's balance sheet. | |

(9) |

October 2020 averages reflect a full month of Schwab balances and 26 days of TD Ameritrade balances following the acquisition closing on October 6, 2020. Calculating the consolidated daily average from the closing date onwards would result in Average Interest Earning Assets and Average Bank Deposit Account Assets of $450,004 million and $157,414 million, respectively. | |

(10) |

Represents average TD Ameritrade clients’ uninvested cash sweep account balances held in deposit accounts at third-party financial institutions. | |

| N/M - Not meaningful |