NEW YORK--(BUSINESS WIRE)--fuboTV Inc. (NYSE: FUBO), the leading sports-first live TV streaming platform, today announced its unaudited financial results for the third quarter ended September 30, 2020. The company, which closed its public offering on October 13, 2020, delivered the strongest quarter in its history and exceeded previously raised guidance with solid growth in revenue, subscription and engagement.

Third Quarter 2020 Financial Highlights

-

Revenues were $61.2 million, a 47% increase year-over-year on a pro forma basis, or +71% excluding 2019 licensing revenue from the FaceBank AG business, sold in July 2020. This growth was driven by continued subscriber expansion, an increase in subscription Average Revenue Per User (ARPU) and growth of advertising sales:

- Subscription revenue increased 64% year-over-year to $53.4 million.

- Advertising revenue increased 153% year-over-year to $7.5 million.

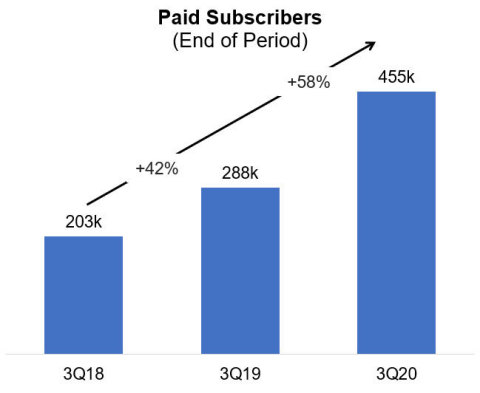

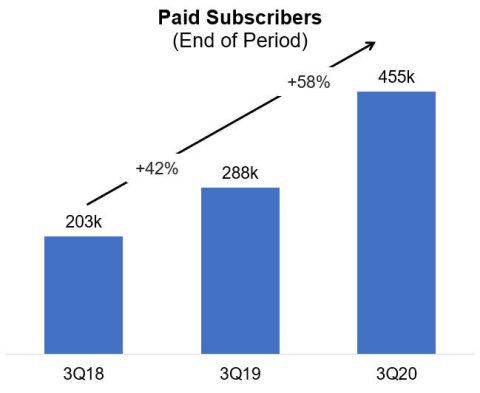

- Paid subscribers at quarter end totaled 455,000, an increase of 58% year-over-year.

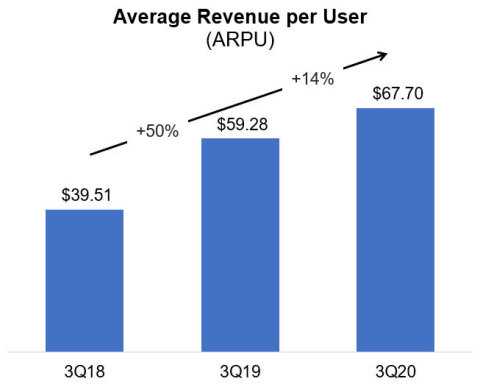

- Average Revenue Per User (ARPU) per month was $67.70, up 14% year-over-year.

- Total content hours streamed by fuboTV users (paid and free trial) in the quarter increased 83% year-over-year to 133.3 million hours.

- Monthly active users (MAUs) watched 121 hours per month on average in the quarter, an increase of 20% year-over-year.

(Note: The company states its key metrics on a year-over-year basis, given the seasonality of sports content. As the legacy FaceBank business reported no revenue in the third quarter of 2020, the comparisons to prior year shown in this document refer to the pro forma 2019 results of the consolidated legacy fuboTV and FaceBank business, unless otherwise stated.)

“Q3 was the strongest quarter in fuboTV’s history, exceeding targets in all of our key metrics: subscription revenue grew 64% year-over-year, ad revenue grew 153% year-over-year and we ended the quarter with an all-time high of 455,000 paid subscribers,” said David Gandler, co-founder and CEO, fuboTV. “A heavy sports calendar, busy news cycle and Hollywood’s fall entertainment season delivered many viewing options for consumers. We continued to grow fuboTV’s premium, personal viewing experience with the launch of new product features and new programming including Disney Media Networks (ABC, ESPN, many more), MLB Network, NBC News Now and more.”

Added Edgar Bronfman Jr., executive chairman, fuboTV, “Our successful public offering in October demonstrated confidence in fuboTV’s strategy, and investor excitement has continued to grow. We believe fuboTV sits firmly at the intersection of three megatrends: the secular decline of traditional TV viewership, the shift of TV ad dollars to connected TVs and online sports wagering, a market which we intend to enter. As a result, we believe our growth opportunities are numerous. Our optimism in the future of fuboTV and the live TV streaming business has never been stronger.”

In a letter released to shareholders today, Gandler and Bronfman described in greater detail the results of the recently completed third quarter and the overall business. The complete shareholder letter is below.

Gandler and CFO Simone Nardi will host a live video webinar today at 5:30 p.m. ET to deliver brief remarks followed by Q&A. The live webinar will be available on the Events page of fuboTV’s investor relations website. Investors can submit questions in advance to ir@fubo.tv with the email subject “Q3 2020 Earnings.” An archived replay will be available on fuboTV’s website following the webinar. Participants should join the webinar 10 minutes in advance to ensure that they are connected prior to the event.

fuboTV’s Letter to Shareholders

November 10, 2020

Fellow Shareholders,

We are thrilled to share fuboTV’s Q3 2020 unaudited financial results and recent business updates with you today. The third quarter was the biggest in our company’s history, and closed just prior to our October public offering on the NYSE. We encourage you to read our full set of financial statements and SEC filings, and to sign up for email alerts, on the investor relations section of our website at ir.fubo.tv.

fuboTV is the leading sports-first live TV streaming platform offering subscribers access to tens of thousands of live sporting events annually as well as leading news and entertainment content. We stream 90% of nationwide NFL games with the majority of the country receiving all games (airing on ESPN/ABC, CBS, FOX, NBC and NFL Network, plus live look-ins of national and regional action on NFL RedZone) and have strong coverage of other nationally televised leagues: 100% of NHL (NBC, NBCSN, NHL Network), 88% of MLB (ESPN, Fox/FS1, MLB Network) and nearly 70% of NBA (ESPN/ABC, NBA TV). We are the only vMVPD streaming in 4K, including 11 Thursday Night Football (FOX) games this season and the recent 2020 World Series (FOX). fuboTV also has more regional sports networks (RSNs) in its base package than any other live TV streaming platform.

At the core of our offering is our proprietary data and technology platform optimized for live TV and sports viewership. Our platform has enabled us to regularly offer new features and functionality for our subscribers and for our advertising partners. For example, we were the first virtual multichannel video programming distributor (vMVPD) to stream in 4K resolution. We believe fuboTV is also the only vMVPD where customers can watch four live streams simultaneously, through our recently updated Multiview on Apple TV feature. Both 4K and Multiview particularly complement sports viewing, which is why we believe fuboTV offers a differentiated and more personalized, premium viewing experience for the sports fan.

Our financial model is driven by strong unit economics. We expect margin improvement to continue over time, aided by a number of initiatives. This includes the growth of advertising on our platform along with strong attachment rates on value-added services, such as cloud DVR storage and the ability to stream on multiple devices.

We believe fuboTV sits firmly at the intersection of three industry megatrends: the secular decline of traditional TV viewership, the shift of TV ad dollars to connected TVs and online sports wagering. Our strong subscriber growth indicates consumers are cutting the cord faster than ever before, and our increased viewer engagement has driven fuboTV’s ad sales growth.

We’ve previously said that we see the online wagering space - a market expected to reach $155 billion by 2024 according to Zion Market Research - as complementary to our sports-first live TV streaming platform. We believe there is a flywheel opportunity with video content and interactivity. As our cable TV replacement product is sports-focused, we believe a significant portion of our subscribers would be interested in online wagering, creating a unique opportunity to drive higher subscriber engagement and open up additional revenue opportunities. Simply put, we expect wagering will lead to more viewing, and this increased engagement will lead to higher ad monetization, better subscriber retention and a reduction in subscriber acquisition costs.

Therefore, we are excited to announce that fuboTV intends to expand into the online sports wagering market. Our goal with wagering is to develop a new revenue stream for fuboTV, and one which we believe will be an important contributor to our business.

We expect to share more tactical details as appropriate. And, of course, we expect to continue to grow our subscribers which will positively impact any decision we make on wagering.

We believe fuboTV has an opportunity to combine a sports wagering service with our leading live sports streaming package. In addition to sports, we continue to grow our news and entertainment offering. We are pleased to announce today new content agreements with Epix and Starz, and will launch their premium entertainment channels on fuboTV before the end of the year. This broad mix of content is why our consumers “come for the sports and stay for the entertainment.”

We’ve also taken fuboTV to 35,000 feet. Earlier this year, we announced the closing of a first-of-its-kind partnership with satellite internet provider Viasat which will make fuboTV the first vMVPD to stream live content to all passengers - at no charge - on U.S. flights equipped with Viasat satellite internet. Today, we are excited to announce that we will bring fubo Sports Network to JetBlue customers. While viewing fubo Sports Network for free, JetBlue customers will also be able to sign up for a fuboTV subscription and begin streaming immediately.

Q3 2020 Financial and Recent Operating Highlights

Our key metrics should be considered on a year-over-year basis given the seasonality of sports content. Sports content has historically contributed to higher subscription revenue and subscriber additions in the third and fourth quarters, and slower growth in the first and second quarters. For example, in 2018 and 2019, gross adds acquired during the second half of the year represented 60% and 65% of our full year total gross paid subscriber additions, respectively. To take advantage of the higher levels of purchase intent in the second half of the year, we have historically incurred the majority of our sales and marketing expenses in these periods. Please note that the legacy FaceBank business reported $5.8 million revenue in the third quarter of 2019, entirely from FaceBank AG, a business sold in July 2020, and reported no revenue in the third quarter of 2020; the comparisons to prior year shown below refer to the pro forma 2019 results.

-

Revenues for the third quarter 2020 were $61.2 million, a 47% increase year-over-year on a pro forma basis, or +71% excluding licensing revenue from FaceBank AG. This growth, significantly ahead of guidance, was driven by continued subscriber expansion, an increase in subscription Average Revenue Per User (ARPU) and growth of advertising sales:

- Subscription revenue increased 64% year-over-year to $53.4 million.

- Advertising revenue increased 153% year-over-year to $7.5 million.

- Paid subscribers at quarter end totaled 455,000, an increase of 58% year-over-year.

- Average Revenue Per User (ARPU) per month was $67.70, up 14% year-over-year.

- Total content hours streamed by fuboTV users (paid and free trial) increased 83% year-over-year to 133.3 million hours.

- Monthly active users (MAUs) watched 121 hours per month on average in the quarter, an increase of 20% year-over-year.

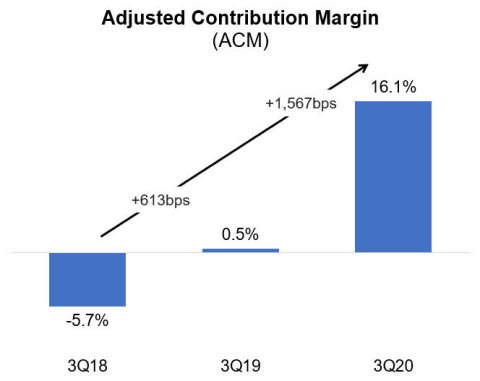

- We use adjusted contribution margin to measure the variable costs against subscriber revenue: adjusted contribution margin was positive 16.1% in Q3 2020, up from 0.5% in Q3 2019. The improvement was driven by growth in subscription ARPU, growth in advertising ARPU and a reduction in the average cost per user (ACPU), mainly driven by lower per-subscriber content expenses. Q3 2020 adjusted contribution margin benefitted in part from the unusual timing of some content deal negotiations in July. Adjusted for this unusual, one-time impact, the Q3 2020 adjusted contribution margin would have been approximately 10.5%. Please refer to the reconciliation of revenue to adjusted contribution margin in the non-GAAP information in the tables accompanying this letter.

-

Total GAAP operating expenses in the period were $363.4 million, or $108.7 million on a non-GAAP adjusted basis excluding $254.7 million non-cash impact from the impairment of goodwill, intangibles and related deferred tax liabilities of the legacy Facebank business, stock-based compensation, one-time non-cash operating expenses and Depreciation and Amortization (please refer to reconciliation of operating expenses to adjusted operating expenses in the tables accompanying this letter). Of these $108.7 million expenses, the main drivers and variances compared to the 3Q 2019 pro forma were:

- Subscriber related expenses totaled $61.2 million, an increase of $10.3 million.

- Sales and marketing expenses totaled $21.3 million (or $22.3 million including stock-based compensation), an increase of $8.2 million.

- General and administrative expenses totaled $8.0 million (or $8.3 million including stock-based compensation and a one-time non-cash adjustment on operating expenses), an increase of $2.6 million including transaction costs.

- The company reported a net loss of $274.1 million in Q3 2020 including non-cash goodwill and intangibles impairment charges of $236.7 million for the legacy FaceBank business, $27.7 million benefit for income taxes associated with the legacy FaceBank business and $7.6 million gain on the sale of Facebank AG. The Non-GAAP net loss excluding the $201.4 million impact of these one-time non-cash items was $72.7 million. Please refer to the reconciliation of net loss to Non-GAAP Net Loss in the tables accompanying this letter.

- Adjusted EBITDA was a loss of $47.5 million in Q3 2020, a $2.9 million lower loss compared to the prior year. Please refer to the reconciliation of net loss to adjusted EBITDA in the tables accompanying this letter.

- We ended the third quarter with 47,392,684 common shares outstanding, as well as 64,648,724 Series AA Convertible Preferred issued and issuable on an as-converted basis, for a total common shares outstanding of 112,041,408 on an as-converted basis.

- We ended Q3 2020 with $40.1 million in cash. This does not include gross proceeds of $197 million from the public offering completed in October.

Recent Business Highlights

- Closed in October a successful public offering of 19,706,708 shares of common stock at the price of $10.00 per share. fuboTV received total gross proceeds of $197 million, before deducting the underwriting discounts and commissions and other offering expenses.

- Appointed Laura Onopchenko, the current CFO of Getaround and former CFO of Nerdwallet, as an independent Director to the Board of Directors.

- Launched Disney Media Networks’ ESPN (all channels) and Walt Disney Television networks (ABC, Disney Channel, Freeform, FX, Nat Geo, etc.) in August following the closing of a multi-year content agreement announced in June.

- Expanded our leading sports, news and entertainment offering with the launches of MLB Network, MLB Network Strike Zone, NBC News Now, Accuweather and Estrella (Spanish language content). Also closed an agreement to carry AT&T SportsNet’s regional sports network (RSN) in Pittsburgh.

- Relaunched our popular Multiview feature on Apple TV, doubling the number of streams subscribers can watch simultaneously to four. We believe fuboTV is the only vMVPD to enable viewing of four live channels.

Guidance

Looking ahead, as noted in recent Shareholder Letters, we continue to be focused on driving both top-line growth and making progress on our path to profitability. Furthermore, we believe fuboTV’s differentiation in the marketplace - sports-focused programming and a tech-first user experience - firmly positions the company for strong growth.

In recent months, sports have returned despite the ongoing pandemic. The NFL has continued to play and college football, including the Pac-12 and Big 10, as well as soccer have begun their return. Sports fans also enjoyed the 2020 World Series - played on schedule in October. These events have driven increased subscriber growth, viewership and ad revenue.

As a result, we are raising our Q4 guidance. We expect Q4 revenues to be $80-85 million, a 51% to 60% increase year-over-year.* We also expect to end the fourth quarter with 500,000-510,000 paid subscribers, an increase of 58% to 62% year-over-year.*

Full year 2020 revenue is expected to be $244-248 million, an increase of over 65% year-over-year.*

Full year 2021 revenue is expected to be $415-435 million, an increase of over 70% year-over-year.*

As mentioned previously, we are excited about the growth and revenue opportunities around online sports wagering. Please note, however, that we have not included in our guidance any projections regarding online sports wagering.

*Metrics compare the combined company (fuboTV Inc. and FaceBank Group, Inc.) in 2020 to the legacy fuboTV company (“pre-merger fuboTV”) in 2019.

Summary

Q3 was the strongest year in fuboTV’s history, exceeding targets in all of our key metrics: subscription revenue grew 64% year-over-year, ad revenue grew 153% year-over-year and we ended the quarter with an all-time high of 455,000 paid subscribers. A heavy sports calendar, busy news cycle and Hollywood’s fall entertainment season delivered many viewing options for consumers. fuboTV continued to iterate its premium, personal viewing experience with the launch of new product features and new programming.

The outlook for Q4 is also solid. The growth of advertising on our platform along with strong attachment rates on value-added services, such as cloud DVR storage and the ability to stream on multiple devices, continue to improve margins. Furthermore, we believe fuboTV’s differentiation in the marketplace - sports-focused programming and a tech-first user experience - firmly positions the company for long-term growth. We are also excited about the potential growth and revenue opportunities around our intended expansion into online sports wagering.

Our successful public offering in October demonstrated confidence in fuboTV’s strategy, and investor excitement has only continued to grow. Our optimism in the future of fuboTV and the live TV streaming business has never been stronger.

Sincerely,

David Gandler, co-founder and CEO

Edgar Bronfman Jr., executive chairman

Q3 Earnings Live Video Webinar

fuboTV CEO David Gandler and CFO Simone Nardi will host a live video webinar today at 5:30 p.m. ET to deliver brief remarks followed by Q&A. The live webinar will be available on the Events page of fuboTV’s investor relations website. An archived replay will be available on fuboTV’s website following the webinar. Participants should join the webinar 10 minutes in advance to ensure that they are connected prior to the event.

More Information

Additional information is available at www.sec.gov under fuboTV Inc.’s filings, as well as https://ir.fubo.tv.

fuboTV intends to use its website as a disclosure channel and investors are encouraged to refer to it, as well as press releases and SEC filings. The company encourages reading the full set of financial statements, including pro forma financial statements for the combined company, and related disclosures, as filed in its Form 10-Q for the quarter ended September 30, 2020 to be filed this week.

About fuboTV

fuboTV (NYSE: FUBO) is the leading sports-first live TV streaming platform offering subscribers access to tens of thousands of live sporting events annually as well as leading news and entertainment content. fuboTV’s base package, fubo Standard, features a broad mix of 100+ channels, including 43 of the top 50 Nielsen-ranked networks across sports, news and entertainment (Primetime A18-49).

Continually innovating to give subscribers a premium viewing experience they can’t find with cable TV, fuboTV is regularly first-to-market with new product features and was the first virtual MVPD to stream in 4K.

fuboTV merged with FaceBank Group in April 2020 to create a leading digital entertainment company, combining fuboTV’s direct-to-consumer live TV streaming platform for cord-cutters with FaceBank’s technology-driven IP in sports, movies and live performances.

Forward-Looking Statements

This letter contains forward-looking statements of fuboTV Inc. (“fuboTV”) that involve substantial risks and uncertainties. All statements contained in this press release are forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. The words “could,” “will,” “plan,” “intend,” “anticipate,” “approximate,” “expect,” “potential,” or the negative of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that fuboTV makes due to a number of important factors, including (i) risks related to the ability to realize the anticipated benefits of the merger, (ii) risks related to the combined entity’s access to capital and fundraising prospects to fund its ongoing operations and its ability to continue as a “going concern”, (iii) risks related to diverting management’s attention from fuboTV’s ongoing business operations to address integration and fundraising efforts, (iv) risks related to our ability to successfully develop and market a sports wagering offering, and (v) other business effects, including the effects of industry, market, economic, political or regulatory conditions, future exchange and interest rates, and changes in tax and other laws, regulations, rates and policies, including the impact of COVID-19 on the broader market. Further risks that could cause actual results to differ materially from those matters expressed in or implied by such forward-looking statements are discussed in the company’s periodic filings with the Securities and Exchange Commission and we encourage you to read such risks in detail. The forward-looking statements in this press release represent fuboTV’s views as of the date of this press release. fuboTV anticipates that subsequent events and developments will cause its views to change. However, while it may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so. You should, therefore, not rely on these forward-looking statements as representing fuboTV’s views as of any date subsequent to the date of this letter.

(fuboTV Inc. Financial Statements begin on the following pages)

fuboTV Inc. Condensed Consolidated Statements of Operations and Comprehensive Loss (Unaudited) (in thousands, except share and per share amounts) |

||||||||||||||||

|

|

For the Three Months Ended

|

|

For the Nine Months Ended

|

||||||||||||

|

|

2020 |

|

2019 |

|

2020 |

|

2019 |

||||||||

Revenues |

|

|

|

|

|

|

|

|

||||||||

Subscriptions |

|

$ |

53,433 |

|

|

$ |

- |

|

|

$ |

92,945 |

|

|

$ |

- |

|

Advertisements |

|

|

7,520 |

|

|

|

- |

|

|

|

11,843 |

|

|

|

- |

|

Software licenses, net |

|

|

- |

|

|

|

5,834 |

|

|

|

7,295 |

|

|

|

5,834 |

|

Other |

|

|

249 |

|

|

|

- |

|

|

|

586 |

|

|

|

- |

|

Total revenues |

|

|

61,202 |

|

|

|

5,834 |

|

|

|

112,669 |

|

|

|

5,834 |

|

Operating expenses |

|

|

|

|

|

|

|

|

||||||||

Subscriber related expenses |

|

|

61,228 |

|

|

|

- |

|

|

|

114,315 |

|

|

|

- |

|

Broadcasting and transmission |

|

|

9,778 |

|

|

|

- |

|

|

|

19,270 |

|

|

|

- |

|

Sales and marketing |

|

|

22,269 |

|

|

|

93 |

|

|

|

33,526 |

|

|

|

417 |

|

Technology and development |

|

|

10,727 |

|

|

|

5,222 |

|

|

|

20,277 |

|

|

|

5,222 |

|

General and administrative |

|

|

8,270 |

|

|

|

2,171 |

|

|

|

42,130 |

|

|

|

3,688 |

|

Depreciation and amortization |

|

|

14,413 |

|

|

|

5,273 |

|

|

|

34,050 |

|

|

|

15,589 |

|

Impairment of intangible assets and goodwill |

|

|

236,681 |

|

|

|

- |

|

|

|

236,681 |

|

|

|

- |

|

Total operating expenses |

|

|

363,366 |

|

|

|

12,759 |

|

|

|

500,249 |

|

|

|

24,916 |

|

Operating loss |

|

|

(302,164 |

) |

|

|

(6,925 |

) |

|

|

(387,580 |

) |

|

|

(19,082 |

) |

|

|

|

|

|

|

|

|

|

||||||||

Other income (expense) |

|

|

|

|

|

|

|

|

||||||||

Interest expense and financing costs |

|

|

(2,203 |

) |

|

|

- |

|

|

|

(18,109 |

) |

|

|

- |

|

Interest income |

|

|

- |

|

|

|

482 |

|

|

|

- |

|

|

|

482 |

|

Loss on extinguishment of debt |

|

|

1,321 |

|

|

|

- |

|

|

|

(23,334 |

) |

|

|

- |

|

Gain on sale of assets |

|

|

7,631 |

|

|

|

- |

|

|

|

7,631 |

|

|

|

- |

|

Unrealized gain in equity method investment |

|

|

- |

|

|

|

- |

|

|

|

2,614 |

|

|

|

- |

|

Loss on deconsolidation of Nexway |

|

|

- |

|

|

|

(1,094 |

) |

|

|

(11,919 |

) |

|

|

(1,994 |

) |

Change in fair value of warrant liabilities |

|

|

4,543 |

|

|

|

- |

|

|

|

9,143 |

|

|

|

- |

|

Change in fair value of subsidiary warrant liability |

|

|

- |

|

|

|

831 |

|

|

|

3 |

|

|

|

4,432 |

|

Change in fair value of shares settled liability |

|

|

- |

|

|

|

- |

|

|

|

(1,665 |

) |

|

|

- |

|

Change in fair value of derivative liability |

|

|

101 |

|

|

|

(1 |

) |

|

|

(426 |

) |

|

|

1,017 |

|

Change in fair value of profit share liability |

|

|

- |

|

|

|

- |

|

|

|

(148 |

) |

|

|

- |

|

Other expense |

|

|

583 |

|

|

|

(1,230 |

) |

|

|

(863 |

) |

|

|

(1,230 |

) |

Total other income (expense) |

|

|

11,976 |

|

|

|

(1,012 |

) |

|

|

(37,073 |

) |

|

|

2,707 |

|

Loss before income taxes |

|

|

(290,188 |

) |

|

|

(7,937 |

) |

|

|

(424,653 |

) |

|

|

(16,375 |

) |

Income tax benefit |

|

|

(16,071 |

) |

|

|

(1,028 |

) |

|

|

(20,589 |

) |

|

|

(3,234 |

) |

Net loss |

|

|

(274,117 |

) |

|

|

(6,909 |

) |

|

|

(404,064 |

) |

|

|

(13,141 |

) |

Less: net income (loss) attributable to non-controlling interest |

|

|

- |

|

|

|

(128 |

) |

|

|

1,555 |

|

|

|

2,653 |

|

Net loss attributable to controlling interest |

|

$ |

(274,117 |

) |

|

$ |

(6,781 |

) |

|

$ |

(402,509 |

) |

|

$ |

(15,794 |

) |

Less: Deemed dividend on Series D Preferred stock |

|

|

- |

|

|

|

(6 |

) |

|

|

- |

|

|

|

(6 |

) |

Less: Deemed dividend - beneficial conversion feature on preferred stock |

|

|

- |

|

|

|

(379 |

) |

|

|

- |

|

|

|

(379 |

) |

Net loss attributable to common stockholders |

|

$ |

(274,117 |

) |

|

$ |

(7,166 |

) |

|

$ |

(402,509 |

) |

|

$ |

(16,179 |

) |

|

|

|

|

|

|

|

|

|

||||||||

Net loss per share attributable to common stockholders Basic and diluted |

|

$ |

(6.20 |

) |

|

$ |

(0.29 |

) |

|

$ |

(11.00 |

) |

|

$ |

(0.80 |

) |

Weighted average shares outstanding |

||||||||||||||||

Basic and diluted |

|

|

44,199,709 |

|

|

|

24,636,124 |

|

|

|

36,577,189 |

|

|

|

20,165,089 |

|

fuboTV Inc. Condensed Consolidated Balance Sheets (in thousands, except for share and per share information) |

||||||||

|

|

September 30, |

|

December 31, |

||||

|

|

2020 |

|

2019 |

||||

|

|

(Unaudited) |

|

* |

||||

ASSETS |

|

|

|

|

||||

Current assets |

|

|

|

|

||||

Cash |

|

$ |

38,864 |

|

|

$ |

7,624 |

|

Accounts receivable, net |

|

|

6,975 |

|

|

|

8,904 |

|

Prepaid and other current assets |

|

|

12,177 |

|

|

|

1,445 |

|

Total current assets |

|

|

58,016 |

|

|

|

17,973 |

|

|

|

|

|

|

||||

Property and equipment, net |

|

|

1,840 |

|

|

|

335 |

|

Restricted cash |

|

|

1,275 |

|

|

|

- |

|

Financial assets at fair value |

|

|

- |

|

|

|

1,965 |

|

Intangible assets, net |

|

|

238,440 |

|

|

|

116,646 |

|

Goodwill |

|

|

493,847 |

|

|

|

227,763 |

|

Right-of-use assets |

|

|

4,886 |

|

|

|

3,519 |

|

Other non-current assets |

|

|

1,009 |

|

|

|

24 |

|

Total assets |

|

$ |

799,313 |

|

|

$ |

368,225 |

|

|

|

|

|

|

||||

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

||||

Current liabilities |

|

|

|

|

||||

Accounts payable |

|

|

61,679 |

|

|

|

36,373 |

|

Accrued expenses |

|

|

37,363 |

|

|

|

20,402 |

|

Due to related parties |

|

|

85,847 |

|

|

|

665 |

|

Notes payable, net of discount |

|

|

5,884 |

|

|

|

4,090 |

|

Notes payable - related parties |

|

|

35 |

|

|

|

368 |

|

Convertible notes, net of $710 discount as of December 31, 2019 |

|

|

- |

|

|

|

1,358 |

|

Shares settled liability |

|

|

43 |

|

|

|

1,000 |

|

Deferred revenue |

|

|

15,424 |

|

|

|

- |

|

Profit share liability |

|

|

2,119 |

|

|

|

1,971 |

|

Warrant liabilities |

|

|

28,085 |

|

|

|

24 |

|

Derivative liability |

|

|

- |

|

|

|

376 |

|

Long term borrowings - current portion |

|

|

9,696 |

|

|

|

- |

|

Current portion of lease liability |

|

|

903 |

|

|

|

815 |

|

Total current liabilities |

|

|

247,078 |

|

|

|

67,442 |

|

|

|

|

|

|

||||

Deferred income taxes |

|

|

9,428 |

|

|

|

30,879 |

|

Lease liability |

|

|

3,997 |

|

|

|

2,705 |

|

Long term borrowings |

|

|

25,905 |

|

|

|

43,982 |

|

Other long-term liabilities |

|

|

3,968 |

|

|

|

41 |

|

Total liabilities |

|

|

290,376 |

|

|

|

145,049 |

|

|

|

|

|

|

||||

|

|

|

|

|

||||

|

|

|

|

|

||||

Convertible preferred stock |

|

|

566,124 |

|

|

|

462 |

|

|

|

|

|

|

||||

Stockholders' equity: |

|

|

|

|

||||

Common stock |

|

|

5 |

|

|

|

3 |

|

Additional paid-in capital |

|

|

385,030 |

|

|

|

257,002 |

|

Accumulated deficit |

|

|

(458,632 |

) |

|

|

(56,123 |

) |

Non-controlling interest |

|

|

16,410 |

|

|

|

22,602 |

|

Accumulated other comprehensive loss |

|

|

- |

|

|

|

(770 |

) |

Total stockholders' equity |

|

|

508,937 |

|

|

|

222,714 |

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY AND TEMPORARY EQUITY |

$ |

799,313 |

|

|

$ |

368,225 |

|

|

fuboTV Inc. Condensed Consolidated Statements of Cash Flows (Unaudited) (in thousands, except share and per share amounts) |

||||||||

|

|

For the Nine Months Ended September 30, |

||||||

|

|

2020 |

|

2019 |

||||

Cash flows from operating activities |

|

|

|

|

||||

Net loss |

|

$ |

(404,064 |

) |

|

$ |

(13,141 |

) |

|

|

|

|

|

||||

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

||||

Depreciation and amortization |

|

|

34,050 |

|

|

|

15,589 |

|

Stock-based compensation |

|

|

24,082 |

|

|

|

- |

|

Impairment expense intangibles |

|

|

88,059 |

|

|

|

- |

|

Impairment expense goodwill |

|

|

148,622 |

|

|

|

- |

|

Issuance of common stock in connection with cancellation of a consulting agreement |

|

- |

|

|

|

13 |

|

|

Issuance of common stock for services rendered |

|

|

- |

|

|

|

101 |

|

Non-cash expense relating to issuance of warrants and common stock |

|

|

2,209 |

|

|

|

- |

|

Loss on deconsolidation of Nexway, net of cash retained by Nexway |

|

|

8,564 |

|

|

|

- |

|

Common stock issued in connection with note payable |

|

|

67 |

|

|

|

- |

|

Loss on extinguishment |

|

|

23,334 |

|

|

|

- |

|

Gain on sale of assets |

|

|

(7,631 |

) |

|

|

- |

|

Amortization of debt discount |

|

|

12,271 |

|

|

|

501 |

|

Deferred income tax benefit |

|

|

(20,589 |

) |

|

|

(3,234 |

) |

Change in fair value of derivative liability |

|

|

426 |

|

|

|

(1,017 |

) |

Change in fair value of warrant liability |

|

|

(9,146 |

) |

|

|

- |

|

Change in fair value of subsidiary warrant liability |

|

|

- |

|

|

|

(4,432 |

) |

Change in fair value of shares settled liability |

|

|

1,665 |

|

|

|

- |

|

Change in fair value of profit share liability |

|

|

148 |

|

|

|

- |

|

Unrealized gain on investments |

|

|

(2,614 |

) |

|

|

- |

|

Amortization of right-of-use assets |

|

|

434 |

|

|

|

46 |

|

Accrued interest on note payable |

|

|

244 |

|

|

|

557 |

|

Foreign currency loss |

|

|

1,010 |

|

|

|

- |

|

Other adjustments |

|

|

(157 |

) |

|

|

(636 |

) |

Changes in operating assets and liabilities of business, net of acquisitions: |

|

|

|

|

||||

Accounts receivable |

|

|

(2,071 |

) |

|

|

3,620 |

|

Prepaid expenses and other current assets |

|

|

(10,558 |

) |

|

|

(100 |

) |

Accounts payable |

|

|

7,881 |

|

|

|

2,819 |

|

Accrued expenses |

|

|

(11,093 |

) |

|

|

617 |

|

Due from related parties |

|

|

36,474 |

|

|

|

- |

|

Deferred revenue |

|

|

6,615 |

|

|

|

- |

|

Lease liability |

|

|

(421 |

) |

|

|

(46 |

) |

Net cash used in operating activities |

|

|

(72,190 |

) |

|

|

1,257 |

|

|

|

|

|

|

||||

Cash flows from investing activities |

|

|

|

|

||||

Purchases of property and equipment |

|

|

(103 |

) |

|

|

- |

|

Advance to fuboTV Pre-Merger |

|

|

(10,000 |

) |

|

|

- |

|

Acquisition of fuboTV’s Pre-Merger cash and cash equivalents and restricted cash |

|

9,373 |

|

|

|

- |

|

|

Sale of Facebank AG |

|

|

(619 |

) |

|

|

- |

|

Investment in Panda Productions (HK) Limited |

|

|

- |

|

|

|

(1,050 |

) |

Acquisition of FaceBank AG and Nexway, net of cash paid |

|

|

- |

|

|

|

2,300 |

|

Sale of profits interest in investment in Panda Productions (HK) Limited |

|

|

- |

|

|

|

655 |

|

Purchase of intangible assets |

|

|

- |

|

|

|

(250 |

) |

Payments for leasehold improvements |

|

|

- |

|

|

|

(9 |

) |

Lease security deposit |

|

|

- |

|

|

|

(21 |

) |

Net cash used in investing activities |

|

|

(1,349 |

) |

|

|

1,625 |

|

|

|

|

|

|

||||

Cash flows from financing activities |

|

|

|

|

||||

Proceeds from sale of common stock and warrants |

|

|

97,143 |

|

|

|

- |

|

Proceeds from exercise of stock options |

|

|

324 |

|

|

|

- |

|

Proceeds from issuance of convertible notes |

|

|

3,003 |

|

|

|

275 |

|

Repayments of convertible notes |

|

|

(3,913 |

) |

|

|

(523 |

) |

Proceeds from issuance of Series D preferred stock |

|

|

203 |

|

|

|

450 |

|

Proceeds from loans |

|

|

33,649 |

|

|

|

- |

|

Repayments of notes payable |

|

|

(14,143 |

) |

|

|

- |

|

Repayments of short term borrowings |

|

|

(8,407 |

) |

|

|

- |

|

Proceeds from sale of subsidiary's common stock |

|

|

- |

|

|

|

65 |

|

Redemption of Series D preferred stock |

|

|

(880 |

) |

|

|

- |

|

Repayments to related parties notes |

|

|

- |

|

|

|

410 |

|

Repayments of notes payable related party |

|

|

(333 |

) |

|

|

(259 |

) |

(Repayments) proceeds from (to) related parties |

|

|

(592 |

) |

|

|

(351 |

) |

Net cash provided by financing activities |

|

|

106,054 |

|

|

|

67 |

|

|

|

|

|

|

||||

Net (decrease) increase in cash |

|

|

32,515 |

|

|

|

2,949 |

|

Cash at beginning of period |

|

|

7,624 |

|

|

|

31 |

|

Cash and restricted cash at end of period |

|

|

40,139 |

|

|

|

2,980 |

|

Key Metrics and Non-GAAP Measures

Paid Subscribers

Total subscribers that have completed registration with fuboTV, have activated a payment method (only reflects one paying user per plan), from which fuboTV has collected payment from in the month ending the relevant period.

Monthly Active Users (MAUs)

Monthly Active Users (MAU) refers to the total count of Paid Subscribers that have consumed content for greater than 10 seconds in the 30-days preceding the period-end indicated.

Content Hours

Content Hours is defined as the sum of total hours of content watched on the fuboTV platform for a given period.

Monthly Content Hours Watched per MAU

Content Hours per MAU refers to the total hours of content viewed by MAUs in a given month divided by the MAU count in the period.

Monthly Average Revenue per User (Monthly ARPU)

ARPU (Average Revenue Per User) is a fuboTV measure defined as total subscriber revenue collected in the period (subscriber and advertising revenues excluding other revenues) divided by the average daily paid subscribers in such period divided by the number of months in the period.

Average Cost Per User (ACPU)

Average Cost Per User (ACPU) reflects variable COGS per user defined as subscriber related expenses less minimum guarantees expensed, payment processing for deferred revenue, IAB fees for deferred revenue and other subscriber related expenses in a given period, divided by the average daily subscribers in the period, divided by the number of months in the period.

Adjusted Contribution Margin

Adjusted Contribution Margin (ACM) is a non-GAAP figure to measure the variable costs against subscriber revenue. ACM is calculated by subtracting ACPU from ARPU.

Reconciliation of Non-GAAP Financial Measures

Our non-GAAP financial measures have limitations as analytical tools and you should not consider them in isolation or as a substitute for an analysis of our results under GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. First, these non-GAAP financial measures are not a substitute for GAAP revenue. Second, these non-GAAP financial measures may not provide information directly comparable to measures provided by other companies in our industry, as those other companies may calculate their non-GAAP financial measures differently.

The following tables reconcile the most directly comparable GAAP financial measure to the non-GAAP financial measure.

fuboTV Inc. Reconciliation of Revenue to Non-GAAP Platform Bookings and Reconciliation of Subscriber Related Expenses to Non-GAAP Variable COGS (in thousands, except share and per share amounts) |

||||||||

|

|

Three Months Ended |

||||||

|

|

September 30, 2020 |

|

September 30, 2019 |

||||

|

|

As reported |

|

Pro-Forma Combined |

||||

Revenue (GAAP) |

|

$ |

61,202 |

|

|

$ |

41,684 |

|

Subtract: |

|

|

|

|

||||

Software licenses, net |

|

|

- |

|

|

|

(5,834 |

) |

Other Revenue |

|

|

(248 |

) |

|

|

(238 |

) |

Prior period subscriber deferred revenue |

|

|

(8,332 |

) |

|

|

(5,163 |

) |

Add: |

|

|

|

|

||||

Current period subscriber deferred revenue |

|

|

15,119 |

|

|

|

8,569 |

|

Non-GAAP Platform Bookings |

|

|

67,741 |

|

|

|

39,019 |

|

|

|

|

|

|

||||

Subscriber Related Expenses (GAAP) |

|

$ |

61,228 |

|

|

$ |

50,893 |

|

Add: |

|

|

|

|

||||

Payment Processing for Deferred Revenue (current period) |

|

|

258 |

|

|

|

197 |

|

In-App Billing Fees for Deferred Revenue (current period) |

|

|

156 |

|

|

|

56 |

|

Subtract: |

|

|

|

|

||||

Minimum Guarantees Expensed |

|

|

(3,548 |

) |

|

|

(11,611 |

) |

Payment Processing for Deferred Revenue (prior period) |

|

|

(202 |

) |

|

|

(129 |

) |

In-App Billing Fees for Deferred Revenue (prior period) |

|

|

(42 |

) |

|

|

(33 |

) |

Other Subscriber Related Expenses |

|

|

(1,031 |

) |

|

|

(530 |

) |

Non-GAAP Variable COGS |

|

|

56,819 |

|

|

|

38,842 |

|

|

|

|

|

|

||||

Non-GAAP Platform Bookings |

|

|

67,741 |

|

|

|

39,019 |

|

Subtract: |

|

|

|

|

||||

Non-GAAP Variable COGS |

|

|

(56,819 |

) |

|

|

(38,842 |

) |

Divide: |

|

|

|

|

||||

Non-GAAP Platform Bookings |

|

|

67,741 |

|

|

|

39,019 |

|

Non-GAAP Adjusted Contribution Margin |

|

|

16.1 |

% |

|

|

0.5 |

% |

fuboTV Inc. Reconciliation of Operating Expenses to Non-GAAP Adjusted Operating Expenses and Reconciliation of Net Loss to Non-GAAP Adjusted EBITDA (in thousands, except share and per share amounts) |

||||||||

|

|

Three Months Ended |

||||||

|

|

September 30, 2020 |

|

September 30, 2019 |

||||

|

|

As reported |

|

Pro-Forma

|

||||

Reconciliation of GAAP Operating Expenses to Non-GAAP Adjusted Operating Expenses |

|

|

|

|

||||

Operating Expenses |

|

$ |

363,365 |

|

|

$ |

97,482 |

|

Depreciation |

|

|

(127 |

) |

|

|

(126 |

) |

Amortization of intangible assets |

|

|

(14,286 |

) |

|

|

(5,273 |

) |

Impairment of Intangible Assets |

|

|

(236,681 |

) |

|

|

- |

|

Stock-based Compensation |

|

|

(6,305 |

) |

|

|

- |

|

non-GAAP one-time non-cash operating expenses |

|

|

2,705 |

|

|

|

- |

|

Non-GAAP Adjusted Operating Expenses |

|

|

108,672 |

|

|

|

92,083 |

|

|

|

|

|

|

||||

|

|

Three Months Ended |

||||||

|

|

September 30, 2020 |

|

September 30, 2019 |

||||

|

|

As reported |

|

Pro-Forma

|

||||

Reconciliation of GAAP Net Loss to Non-GAAP Adjusted EBITDA: |

|

|

|

|

||||

Net Loss |

|

$ |

(274,117 |

) |

|

$ |

(56,235 |

) |

Depreciation |

|

|

127 |

|

|

|

126 |

|

Amortization of intangible assets |

|

|

14,286 |

|

|

|

5,273 |

|

Impairment of Intangible Assets |

|

|

236,681 |

|

|

|

- |

|

Stock-based Compensation |

|

|

6,305 |

|

|

|

- |

|

non-GAAP one-time non-cash operating expenses |

|

|

(2,705 |

) |

|

|

- |

|

Other income (expense) |

|

|

(11,976 |

) |

|

|

1,465 |

|

Provision for income taxes (income tax benefit) |

|

|

(16,071 |

) |

|

|

(1,028 |

) |

Non-GAAP Adjusted EBITDA |

|

$ |

(47,470 |

) |

|

$ |

(50,399 |

) |

fuboTV Inc. Reconciliation of Net Loss to Non-GAAP Net Loss and Non-GAAP Net Loss per Share (in thousands, except share and per share amounts) |

||||||||

|

|

Three Months Ended |

||||||

|

|

September 30, 2020 |

|

September 30, 2019 |

||||

|

|

As reported |

|

As reported |

||||

Reconciliation of GAAP Net loss to non-GAAP Net loss |

|

|

|

|

||||

Net Loss |

|

$ |

(274,117 |

) |

|

$ |

(7,166 |

) |

Less : Net income (loss) attributable to noncontrolling interests |

|

|

- |

|

|

|

(128 |

) |

Less: Impairment and restructuring charges |

|

|

236,681 |

|

|

|

- |

|

Less: Tax benefit associated with impairment |

|

|

(27,643 |

) |

|

|

0 |

|

Less: Gain on sale of assets |

|

|

(7,631 |

) |

|

|

- |

|

Less: Loss on deconsolidation of Nexway |

|

|

- |

|

|

|

1,094 |

|

Non-GAAP Net loss |

|

|

(72,710 |

) |

|

|

(6,200 |

) |

|

|

|

|

|

||||

Weighted average shares outstanding |

|

|

|

|

||||

Basic and diluted |

|

|

44,199,709 |

|

|

|

24,363,124 |

|

|

|

|

|

|

||||

GAAP Net loss per share |

|

$ |

(6.20 |

) |

|

$ |

(0.29 |

) |

Non-GAAP Net Loss per share |

|

$ |

(1.65 |

) |

|

$ |

(0.25 |

) |