BOSTON--(BUSINESS WIRE)--Fidelity Institutional today announced the results of its 2020 Advisor Movement Studyi, which found that the COVID-19 pandemic has increased how influential compensation and technology are in advisors’ decisions to move firms. Four in 10 advisors surveyed agree that industry-wide digital enhancements due to the pandemic have made it easier to move firms; however, more than half cite concerns about potential difficulties transferring accounts in a virtual environment as a key factor in their decision. Despite these concerns, many advisors have been successful transitioning firms in a fully remote environment. Fidelity has supported more than 140 transitionsii since March, including several facilitated by a new digital bulk advisor onboarding solution, and increased digital tools training for advisors, as well as expanding eSignature availability, resulting in a 190% increase in eSignature enrollment from March 1 – October 1, 2020 and a fourfold increase in eSignature transactions.

Although advisors are not likely to make a final decision to move primarily based on better technology, it has grown in importance as advisors have come to recognize the benefits of digital empowerment:

- 65% of advisors believe firms that have been more digitally innovative during the pandemic have become more attractive destinations for advisors.

- About half of advisors note that working remotely because of the pandemic has made going independent seem more feasible.

- Nearly six in 10 advisors agree that working virtually broadens the pool of firms for consideration.

While some advisors are considering a move within the next 12 months, about eight in 10 advisors noted that greater financial incentives would be needed for them to switch firms due to the uncertainty caused by the pandemic, and nearly one-third of advisors said that higher compensation could convince them to switch firms.

“The pandemic may prove to be a catalyst for advisors considering a move as the remote environment has – for many advisors – emphasized the benefits of greater flexibility,” said Charlie Phelan, vice president of Practice Management & Consulting for Fidelity Institutional. “Firms will need to remain competitive on compensation, but this study shows that there’s significant opportunity for firms to sharpen their advisor technology story and continue to invest in new digital tools that help advisors more efficiently serve their clients.”

Fidelity Offers an Innovative Approach to Addressing Concerns about Virtual Recruiting Process

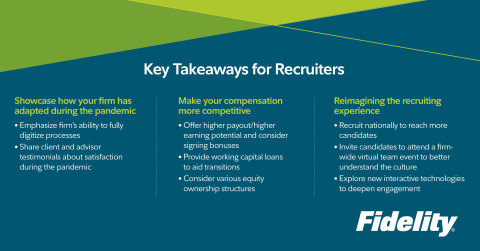

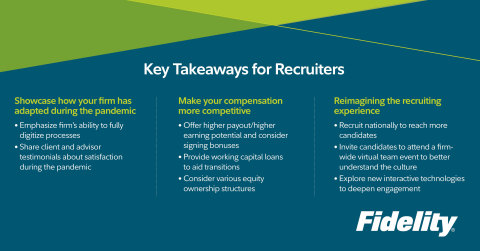

While advisors recognize there are many positive aspects of a fully virtual environment, the pandemic has significantly impacted an important part of the recruiting process – in-person office visits to meet the team and gauge cultural fit. Two-thirds of advisors think that virtual meetings with firms would be less effective than in-person visits, but more than half of advisors still considering a move to a new firm rely on the visits as their top resource for gathering information about their potential new firm.

Fidelity is helping to address these challenges by bringing insights from across its businesses and from industry leaders to advisors and recruiters:

- The Virtual 2020 Recruiters Summit is bringing together broker-dealer and registered investment advisor firms to discuss the competitive talent landscape, and gain insights and best practices from third-party recruiters to help firms attract and retain high-performing advisors. Insights from the event will be available in Fidelity’s recruiting and talent resource library.

- Leveraging technology utilized by the Fidelity Center for Applied Technology, the company piloted an immersive, interactive virtual reality onboarding program to substitute for in-person networking for new employees, and is able to share its learnings with advisors as they evolve their own remote onboarding practices.

“Pre-pandemic, firm culture influenced many advisors’ decision to move, and though our research found that it’s decreased in importance over the past six months, firms still need to consider the culture factor as they reimagine how they engage with advisors through the recruiting and onboarding process,” said Phelan.

Visit go.fidelity.com/recruiters for more insights from Fidelity’s 2020 Advisor Movement Study and to access additional recruiting and talent resources.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $8.8 trillion, including discretionary assets of $3.5 trillion as of September 30, 2020, we focus on meeting the unique needs of a diverse set of customers: helping more than 32 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 institutions with investment and technology solutions to invest their own clients’ money. Privately held for more than 70 years, Fidelity employs more than 45,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

The content provided herein is general in nature and is for informational purposes only. This information is not individualized and is not intended to serve as the primary or sole basis for your decisions as there may be other factors you should consider. Fidelity Institutional℠ does not provide financial or investment advice. You should conduct your own due diligence and analysis based on your specific needs.

Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC. 245 Summer Street, Boston, MA 02210.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

947941.1.0

© 2020 FMR LLC. All rights reserved.

_________________________

i The 2020 Fidelity Financial Advisor Community- Advisor Movement Study: It was an online blind survey (Fidelity not identified) which was conducted in two phases. Phase 1 was fielded prior to the pandemic (between February 14, 2020 and March 4, 2020) and is based on data from 540 participants. Phase 2 was fielded between September 10, 2020 and September 18, 2020 to explore the impact of the COVID-19 pandemic on advisor movement and is based on data from 388 participants, with 90% of them having participated in Phase 1. The surveys were conducted by an independent firm not affiliated with Fidelity Investments and participants included advisors who manage or advise upon client assets either individually or as a team, and work primarily with individual investors. Advisor firm types included a mix of banks, independent broker-dealers, insurance companies, regional broker-dealers, RIAs, and national brokerage firms (commonly referred to as wirehouses), with findings weighted to reflect industry composition.

ii Based on custody onboarding projects active between March 1, 2020 and October 31, 2020.