NEW YORK--(BUSINESS WIRE)--ViacomCBS Inc. (NASDAQ: VIAC; VIACA) today reported financial results for the quarter ended September 30, 2020.

Statement from Bob Bakish, President & CEO

“As we near the first anniversary of the ViacomCBS merger, I’m thrilled about the way our organization has come together to realize the power of the combination and seize our unique global opportunity in streaming. This quarter, we achieved strong user growth across our streaming platforms as we continue to build our linked ecosystem of pay and free services – with big steps taken, including the preview and brand reveal of Paramount+ ahead of its launch in early 2021, and more recently, the unification of our global streaming organization. Our company’s transformation is ahead of schedule and we are incredibly excited by the opportunities ahead.”

Q3 2020 RESULTS |

||||||||||||||||||

Quarter Ended

|

Nine Months Ended

|

|||||||||||||||||

| GAAP | 2020 |

2019 |

B/(W) % |

2020 |

2019 |

B/(W) % |

||||||||||||

| Revenues | $ |

6,116 |

$ |

6,698 |

(9 |

)% |

$ |

19,060 |

$ |

20,941 |

(9 |

)% |

||||||

| Operating income |

|

959 |

|

1,036 |

(7 |

) |

|

3,162 |

|

4,286 |

(26 |

) |

||||||

| Net earnings from continuing operations attributable to ViacomCBS |

|

612 |

|

626 |

(2 |

) |

|

1,598 |

|

3,543 |

(55 |

) |

||||||

| Diluted EPS from continuing operations attributable to ViacomCBS |

|

0.99 |

|

1.01 |

(2 |

) |

|

2.59 |

|

5.74 |

(55 |

) |

||||||

| Operating cash flow |

|

1,414 |

|

500 |

183 |

|

|

2,565 |

|

1,689 |

52 |

|

||||||

| Non-GAAP† | ||||||||||||||||||

| Adjusted OIBDA | $ |

1,109 |

$ |

1,266 |

(12 |

)% |

$ |

4,061 |

$ |

4,367 |

(7 |

)% |

||||||

| Adjusted net earnings from continuing operations attributable to ViacomCBS |

|

561 |

|

680 |

(18 |

) |

|

2,029 |

|

2,490 |

(19 |

) |

||||||

| Adjusted diluted EPS from continuing operations attributable to ViacomCBS |

|

0.91 |

|

1.10 |

(17 |

) |

|

3.29 |

|

4.04 |

(19 |

) |

||||||

| Free cash flow |

|

1,333 |

|

391 |

241 |

|

|

2,352 |

|

1,438 |

64 |

|

||||||

$ in millions, except per share amounts

† Non-GAAP measures referenced in this release are detailed in the Supplemental Disclosures at the end of this release.

OVERVIEW OF Q3 REVENUE

REVENUE BY TYPE

- Affiliate revenue increased 10% year-over-year, fueled by strong growth in subscription streaming revenue, higher reverse compensation and retransmission fees, as well as expanded cable distribution.

- Advertising revenue sequentially improved to a decline of 6% year-over-year. The year-over-year decline was primarily driven by the adverse effects of COVID-19, including lower demand in the advertising market.

- Content licensing revenue decreased 33% year-over-year, reflecting a lower volume of licensing compared to the prior-year quarter, driven by the timing of program availabilities and the adverse impacts of COVID-19.

- Theatrical revenue was immaterial in the quarter due to the closure or reduction in capacity of movie theaters in response to COVID-19.

- Publishing revenue rose 29% year-over-year as a result of higher print and digital book sales that were driven by strong releases during the quarter, including Too Much and Never Enough: How My Family Created the World's Most Dangerous Man by Mary Trump and Rage by Bob Woodward.

| Quarter Ended September 30 |

Nine Months Ended September 30 |

|||||||||||||||||||||||||

|

|

2020 |

|

2019 |

|

$ B/(W) % |

|

2020 |

|

2019 |

|

$ B/(W) % |

||||||||||||||

| Advertising | $ | 2,188 | $ | 2,333 | $ | (145 | ) | (6 |

)% |

$ | 6,606 | $ | 8,044 | $ | (1,438 | ) | (18 |

)% |

||||||||

| Domestic | 1,908 | 2,016 | (108 | ) | (5 |

) |

5,867 | 7,081 | (1,214 | ) | (17 |

) |

||||||||||||||

| International | 280 | 317 | (37 | ) | (12 |

) |

739 | 963 | (224 | ) | (23 |

) |

||||||||||||||

| Affiliate | 2,365 | 2,149 | 216 | 10 |

|

6,756 | 6,469 | 287 | 4 |

|

||||||||||||||||

| Domestic | 2,202 | 1,983 | 219 | 11 |

|

6,282 | 5,962 | 320 | 5 |

|

||||||||||||||||

| International | 163 | 166 | (3 | ) | (2 |

) |

474 | 507 | (33 | ) | (7 |

) |

||||||||||||||

| Content Licensing | 1,221 | 1,828 | (607 | ) | (33 |

) |

4,717 | 5,202 | (485 | ) | (9 |

) |

||||||||||||||

| Theatrical | 6 | 94 | (88 | ) | (94 |

) |

176 | 418 | (242 | ) | (58 |

) |

||||||||||||||

| Publishing | 279 | 217 | 62 | 29 |

|

649 | 599 | 50 | 8 |

|

||||||||||||||||

| Other | 57 | 77 | (20 | ) | (26 |

) |

156 | 209 | (53 | ) | (25 |

) |

||||||||||||||

| Total Revenues | $ | 6,116 | $ | 6,698 | $ | (582 | ) | (9 |

)% |

$ | 19,060 | $ | 20,941 | $ | (1,881 | ) | (9 |

)% |

||||||||

$ in millions

BALANCE SHEET & LIQUIDITY

- ViacomCBS generated $1.4B of Operating Cash Flow and $1.3B of Free Cash Flow† in the quarter, benefiting from the timing of production spending and cost savings.

- The company maintained significant financial flexibility, with $3.1B of cash on its balance sheet and a committed $3.5B revolving credit facility that remains undrawn.

† Non-GAAP measures referenced in this release are detailed in the Supplemental Disclosures at the end of this release.

SPOTLIGHT ON STREAMING

In Q3, ViacomCBS drove significant domestic streaming and digital video revenue growth, with robust sign-ups across its pay and free services as it moves toward the launch of Paramount+

STREAMING & DIGITAL VIDEO HIGHLIGHTS

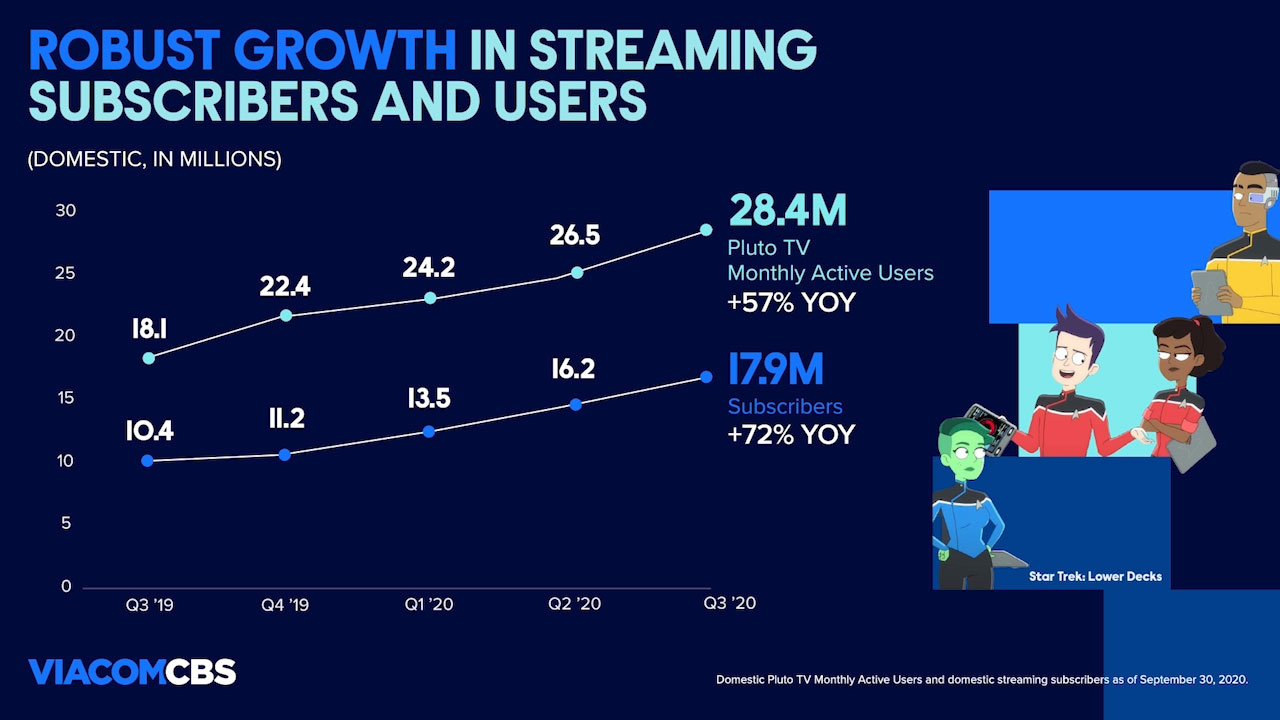

- Domestic streaming and digital video revenue increased to $636M, up 56% year-over-year, driven by 78% growth in subscription streaming revenue and strong double-digit digital video advertising growth.

- Domestic streaming subscribers reached 17.9M, up 72% year-over-year.

− CBS All Access and Showtime OTT had significant growth in sign-ups both sequentially and year-over-year.

- CBS All Access benefited from strong demand for sports content, including UEFA and the NFL, as well as its broad selection of entertainment content, including live TV, reality series, content from ViacomCBS cable brands and original programming.

- Showtime OTT’s strong quarter was driven by original programming, including the third season of The Chi, the continued strength of Billions and the final season of Homeland.

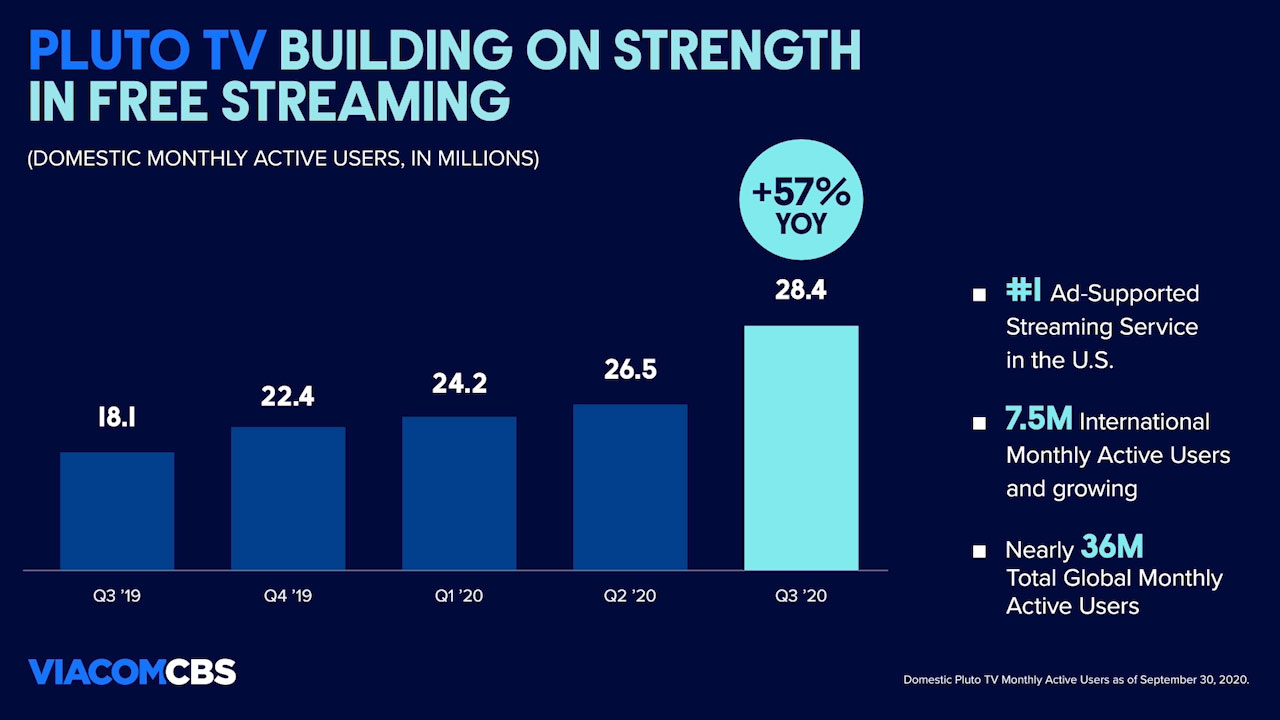

- In free, Pluto TV grew its domestic monthly active users (MAUs) to 28.4M, up 57% year-over-year, and more than doubled its advertising revenue in the quarter.

− Internationally, Pluto TV MAUs grew to 7.5M, bringing its total global MAUs to nearly 36M.

− Building on its international expansion, Pluto TV launched in Spain in October, with upcoming launches in Brazil, France and Italy.

− Pluto TV also signed new distribution agreements with LG and Sony PlayStation, extending its reach to an additional 100M+ devices worldwide.

- In October, ViacomCBS announced Tom Ryan as President and CEO of its new global streaming organization, integrating both its pay and free streaming businesses while enhancing its ability to leverage its content strength and cross-company franchises.

DOMESTIC STREAMING & DIGITAL VIDEO REVENUE

Quarter Ended

|

Nine Months Ended

|

|||||||||||||||||||||

2020 |

|

2019 |

|

$ B/(W) % |

|

2020 |

|

2019 |

|

$ B/(W) % |

||||||||||||

| $ | 636 | $ | 407 | $ | 229 | 56 |

% |

$ | 1,596 | $ | 1,109 | $ | 487 | 44 |

% |

|||||||

$ in millions

ON TRACK FOR PARAMOUNT+ LAUNCH

- In September, ViacomCBS announced CBS All Access will be rebranded as Paramount+ in early 2021, as part of its transformation into a global streaming service that features content from ViacomCBS’ leading portfolio of brands.

− Building on Paramount’s iconic brand and legacy of storytelling, Paramount+ will feature a unique combination of live sports, breaking news and a mountain of entertainment content, spanning more than 30,000 episodes and movies.

− Paramount+ will also include an expansive slate of exclusive, original series from brands including BET, CBS, Comedy Central, MTV, Nickelodeon, Paramount Pictures and more.

− Announced originals include SpongeBob spin-off, Kamp Koral, The Offer, a limited series with never-revealed experiences of making The Godfather, Lioness, The Real Criminal Minds and more.

- Marking a major milestone in the company’s streaming evolution, Paramount+, together with Showtime OTT and Pluto TV, is creating an ecosystem of compelling offerings across pay and free streaming.

- In addition to the US, ViacomCBS will bring Paramount+ to international markets, debuting in Australia, Latin America and the Nordics in 2021.

REPORTING SEGMENTS

TV ENTERTAINMENT

- CBS was once again the most-watched network across Primetime, Daytime and Late Night during the 2019-2020 broadcast year, with the top 3 dramas, 8 of the top 10 comedies and 5 of the top 6 returning new series.

- Revenue declined 4% year-over-year, primarily due to lower content licensing revenue, partially offset by growth in affiliate revenue.

⎯ Affiliate revenue increased 25% year-over-year, fueled by growth in reverse compensation and retransmission fees, as well as strong subscription streaming revenue.

⎯ Advertising revenue decreased 1% year-over-year, reflecting the timing of sporting events and lower demand in the advertising market due to the adverse effects of COVID-19, largely offset by strength in political advertising.

⎯ Content licensing revenue declined 35% year-over-year as a result of a lower volume of licensing compared to the prior-year quarter, driven by the timing of program availabilities and the adverse impacts of COVID-19.

- Adjusted OIBDA decreased 26% year-over-year mainly due to the decline in revenue.

Quarter Ended

|

Nine Months Ended

|

|||||||||||||||||||||||||

|

|

2020 |

|

2019 |

|

$ B/(W) % |

|

2020 |

|

2019 |

|

$ B/(W) % |

||||||||||||||

| Revenue | $ | 2,354 | $ | 2,454 | $ | (100 | ) | (4 |

)% |

$ | 7,588 | $ | 8,798 | $ | (1,210 | ) | (14 |

)% |

||||||||

| Advertising | 1,053 | 1,063 | (10 | ) | (1 |

) |

3,385 | 4,339 | (954 | ) | (22 |

) |

||||||||||||||

| Affiliate | 803 | 641 | 162 | 25 |

|

2,288 | 1,868 | 420 | 22 |

|

||||||||||||||||

| Content Licensing | 455 | 695 | (240 | ) | (35 |

) |

1,796 | 2,442 | (646 | ) | (26 |

) |

||||||||||||||

| Other | 43 | 55 | (12 | ) | (22 |

) |

119 | 149 | (30 | ) | (20 |

) |

||||||||||||||

| Expenses | 2,011 | 1,991 | (20 | ) | (1 |

) |

6,280 | 6,980 | 700 | 10 |

|

|||||||||||||||

| Adjusted OIBDA | $ | 343 | $ | 463 | $ | (120 | ) | (26 |

)% |

$ | 1,308 | $ | 1,818 | $ | (510 | ) | (28 |

)% |

||||||||

$ in millions

CABLE NETWORKS

- In the quarter, ViacomCBS maintained leadership as the #1 portfolio in share of viewing, with more top 30 cable networks than any other media family.

- Showtime also had 2 of the top 5 scripted shows on premium cable in the quarter and the top 2 scripted shows year-to-date.

- Revenue declined 7% year-over-year due to lower advertising and content licensing revenue, partially offset by growth in affiliate revenue.

⎯ Affiliate revenue increased 4% year-over-year, driven by growth in subscription streaming revenue, expanded carriage with YouTube TV and contractual rate increases, partially offset by linear subscriber declines.

⎯ Advertising revenue decreased 11% year-over-year, primarily reflecting weakness in the advertising market as a result of COVID-19, which more than offset growth in streaming and digital video advertising and higher pricing.

⎯ Content licensing revenue declined 26% year-over-year because of a lower volume of licensing compared to the prior-year quarter, driven by the timing of program availabilities.

- Adjusted OIBDA grew 3% year-over-year as the decrease in revenue was more than offset by lower costs from the broadcast of fewer original programs during the quarter and the benefit of cost savings, including from restructuring activities.

Quarter Ended

|

Nine Months Ended

|

|||||||||||||||||||||||||

|

|

2020 |

|

2019 |

|

$ B/(W) % |

|

2020 |

|

2019 |

|

$ B/(W) % |

||||||||||||||

| Revenue | $ | 3,061 | $ | 3,283 | $ | (222 | ) |

(7 |

)% |

$ | 9,151 | $ | 9,361 | $ | (210 | ) |

(2 |

)% |

||||||||

| Advertising | 1,135 | 1,280 | (145 | ) |

(11 |

) |

3,244 | 3,742 | (498 | ) |

(13 |

) |

||||||||||||||

| Affiliate | 1,562 | 1,508 | 54 | 4 |

|

4,468 | 4,601 | (133 | ) |

(3 |

) |

|||||||||||||||

| Content Licensing | 364 | 495 | (131 | ) |

(26 |

) |

1,439 | 1,018 | 421 | 41 |

|

|||||||||||||||

| Expenses | 2,195 | 2,442 | 247 | 10 |

|

6,206 | 6,638 | 432 | 7 |

|

||||||||||||||||

| Adjusted OIBDA | $ | 866 | $ | 841 | $ | 25 | 3 |

% |

$ | 2,945 | $ | 2,723 | $ | 222 | 8 |

% |

||||||||||

$ in millions

FILMED ENTERTAINMENT

- Revenue decreased 31% year-over-year, reflecting the decline in licensing and theatrical revenue.

⎯Theatrical revenue was immaterial in the quarter due to the closure or reduction in capacity of movie theaters in response to COVID-19.

⎯Home entertainment revenue decreased 2% year-over-year, driven by fewer theatrical releases in 2020, primarily offset by higher sales of catalog and Miramax titles.

⎯Licensing revenue decreased 27% year-over-year, as a result of lower revenue from the timing of the availability of programs produced for third parties and the licensing of catalog titles.

- Adjusted OIBDA decreased 18% year-over-year, reflecting the decline in revenue, partially offset by lower distribution costs from fewer theatrical releases in the quarter.

Quarter Ended

|

Nine Months Ended

|

|||||||||||||||||||||||||

|

|

2020 |

|

2019 |

|

$ B/(W) % |

|

2020 |

|

2019 |

|

$ B/(W) % |

||||||||||||||

| Revenue | $ | 590 | $ | 851 | $ | (261 | ) | (31 | )% | $ | 2,048 | $ | 2,458 | $ | (410 | ) | (17 | )% | ||||||||

| Theatrical | 6 | 94 | (88 | ) | (94 | ) |

176 | 418 | (242 | ) | (58 | ) |

||||||||||||||

| Home Entertainment | 150 | 153 | (3 | ) | (2 | ) |

533 | 468 | 65 | 14 | ||||||||||||||||

| Licensing | 418 | 575 | (157 | ) | (27 | ) |

1,294 | 1,490 | (196 | ) | (13 | ) |

||||||||||||||

| Other | 16 | 29 | (13 | ) | (45 | ) |

45 | 82 | (37 | ) | (45 | ) |

||||||||||||||

| Expenses | 536 | 785 | 249 | 32 | 1,851 | 2,259 | 408 | 18 | ||||||||||||||||||

| Adjusted OIBDA | $ | 54 | $ | 66 | $ | (12 | ) | (18 | )% | $ | 197 | $ | 199 | $ | (2 | ) | (1 | )% | ||||||||

$ in millions

PUBLISHING

- Publishing revenue rose 29% year-over-year, as a result of higher print and digital book sales that were driven by strong releases during the quarter.

- Bestselling titles for the quarter included Too Much and Never Enough: How My Family Created the World's Most Dangerous Man by Mary Trump and Rage by Bob Woodward.

- Adjusted OIBDA grew 5% year-over-year as strong revenue growth was partially offset by higher author expenses and costs associated with the mix of titles.

|

Quarter Ended

|

Nine Months Ended

|

||||||||||||||||||||||||

|

2020 |

|

2019 |

|

$ B/(W) % |

|

2020 |

|

2019 |

|

$ B/(W) % |

|||||||||||||||

| Revenue | $ | 279 | $ | 217 | $ | 62 | 29 | % | $ | 649 | $ | 599 | $ | 50 | 8 | % | ||||||||||

| Expenses | 221 | 162 | (59 | ) | (36 | ) | 534 | 490 | (44 | ) | (9 | ) | ||||||||||||||

| Adjusted OIBDA | $ | 58 | $ | 55 | $ | 3 | 5 | % | $ | 115 | $ | 109 | $ | 6 | 6 | % | ||||||||||

$ in millions

ABOUT VIACOMCBS

ViacomCBS (NASDAQ: VIAC; VIACA) is a leading global media and entertainment company that creates premium content and experiences for audiences worldwide. Driven by iconic consumer brands, its portfolio includes CBS, Showtime Networks, Paramount Pictures, Nickelodeon, MTV, Comedy Central, BET, CBS All Access, Pluto TV and Simon & Schuster, among others. The company delivers the largest share of the US television audience and boasts one of the industry’s most important and extensive libraries of TV and film titles. In addition to offering innovative streaming services and digital video products, ViacomCBS provides powerful capabilities in production, distribution and advertising solutions for partners on five continents.

For more information about ViacomCBS, please visit www.viacomcbs.com and follow @ViacomCBS on social platforms.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This communication contains both historical and forward-looking statements. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements within the meaning of section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended. Similarly, statements that describe our objectives, plans or goals are or may be forward-looking statements. These forward-looking statements reflect our current expectations concerning future results and events; generally can be identified by the use of statements that include phrases such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “foresee,” “likely,” “will,” “may,” “could,” “estimate” or other similar words or phrases; and involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause our actual results, performance or achievements to be different from any future results, performance or achievements expressed or implied by these statements. These risks, uncertainties and other factors include, among others: the impact of the COVID-19 pandemic (and other widespread health emergencies or pandemics) and measures taken in response thereto; technological developments, alternative content offerings and their effects in our markets and on consumer behavior; the impact on our advertising revenues of changes in consumers’ content viewership, deficiencies in audience measurement and advertising market conditions; the public acceptance of our brands, programming, films, published content and other entertainment content on the various platforms on which they are distributed; increased costs for programming, films and other rights; the loss of key talent; competition for content, audiences, advertising and distribution in consolidating industries; the potential for loss of carriage or other reduction in or the impact of negotiations for the distribution of our content; the risks and costs associated with the integration of the CBS Corporation and Viacom Inc. businesses and investments in new businesses, products, services and technologies; evolving cybersecurity and similar risks; the failure, destruction or breach of critical satellites or facilities; content theft; domestic and global political, economic and/or regulatory factors affecting our businesses generally; volatility in capital markets or a decrease in our debt ratings; strikes and other union activity; fluctuations in our results due to the timing, mix, number and availability of our films and other programming; losses due to asset impairment charges for goodwill, intangible assets, FCC licenses and programming; liabilities related to discontinued operations and former businesses; potential conflicts of interest arising from our ownership structure with a controlling stockholder; and other factors described in our news releases and filings with the Securities and Exchange Commission, including but not limited to our most recent Annual Report on Form 10-K and reports on Form 10-Q and Form 8-K. There may be additional risks, uncertainties and factors that we do not currently view as material or that are not necessarily known. The forward-looking statements included in this communication are made only as of the date of this communication, and we do not undertake any obligation to publicly update any forward-looking statements to reflect subsequent events or circumstances.

VIACOMCBS INC. AND SUBSIDIARIES

|

||||||||||||||||

|

||||||||||||||||

|

Quarter Ended

|

|

Nine Months Ended

|

|||||||||||||

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|||||||||

Revenues |

$ |

6,116 |

|

|

$ |

6,698 |

|

|

$ |

19,060 |

|

|

$ |

20,941 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|||||||||

Operating |

3,634 |

|

|

3,959 |

|

|

11,184 |

|

|

12,417 |

|

|||||

Selling, general and administrative |

1,373 |

|

|

1,473 |

|

|

3,936 |

|

|

4,157 |

|

|||||

Depreciation and amortization |

98 |

|

|

108 |

|

|

335 |

|

|

323 |

|

|||||

Restructuring and other corporate matters |

52 |

|

|

122 |

|

|

443 |

|

|

307 |

|

|||||

Total costs and expenses |

5,157 |

|

|

5,662 |

|

|

15,898 |

|

|

17,204 |

|

|||||

Gain on sale of assets |

— |

|

|

— |

|

|

— |

|

|

549 |

|

|||||

Operating income |

959 |

|

|

1,036 |

|

|

3,162 |

|

|

4,286 |

|

|||||

Interest expense |

(259) |

|

|

(246) |

|

|

(763) |

|

|

(723) |

|

|||||

Interest income |

14 |

|

|

19 |

|

|

39 |

|

|

53 |

|

|||||

Loss on extinguishment of debt |

(23) |

|

|

— |

|

|

(126) |

|

|

— |

|

|||||

Other items, net |

(20) |

|

|

(27) |

|

|

(47) |

|

|

(2) |

|

|||||

Earnings from continuing operations before income taxes and equity in loss of investee companies |

671 |

|

|

782 |

|

|

2,265 |

|

|

3,614 |

|

|||||

(Provision) benefit for income taxes |

(38) |

|

|

(126) |

|

|

(377) |

|

|

9 |

|

|||||

Equity in loss of investee companies, net of tax |

(9) |

|

|

(14) |

|

|

(30) |

|

|

(53) |

|

|||||

Net earnings from continuing operations |

624 |

|

|

642 |

|

|

1,858 |

|

|

3,570 |

|

|||||

Net earnings from discontinued operations, net of tax |

3 |

|

|

4 |

|

|

14 |

|

|

23 |

|

|||||

Net earnings (ViacomCBS and noncontrolling interests) |

627 |

|

|

646 |

|

|

1,872 |

|

|

3,593 |

|

|||||

Net earnings attributable to noncontrolling interests |

(12) |

|

|

(16) |

|

|

(260) |

|

|

(27) |

|

|||||

Net earnings attributable to ViacomCBS |

$ |

615 |

|

|

$ |

630 |

|

|

$ |

1,612 |

|

|

$ |

3,566 |

|

|

|

|

|

|

|

|

|

|

|||||||||

Amounts attributable to ViacomCBS: |

|

|

|

|

|

|

|

|||||||||

Net earnings from continuing operations |

$ |

612 |

|

|

$ |

626 |

|

|

$ |

1,598 |

|

|

$ |

3,543 |

|

|

Net earnings from discontinued operations, net of tax |

3 |

|

|

4 |

|

|

14 |

|

|

23 |

|

|||||

Net earnings attributable to ViacomCBS |

$ |

615 |

|

|

$ |

630 |

|

|

$ |

1,612 |

|

|

$ |

3,566 |

|

|

|

|

|

|

|

|

|

|

|||||||||

Basic net earnings per common share attributable to ViacomCBS: |

|

|

|

|

|

|

|

|||||||||

Net earnings from continuing operations |

$ |

.99 |

|

|

$ |

1.02 |

|

|

$ |

2.60 |

|

|

$ |

5.76 |

|

|

Net earnings from discontinued operations |

$ |

— |

|

|

$ |

.01 |

|

|

$ |

.02 |

|

|

$ |

.04 |

|

|

Net earnings |

$ |

1.00 |

|

|

$ |

1.02 |

|

|

$ |

2.62 |

|

|

$ |

5.80 |

|

|

|

|

|

|

|

|

|

|

|||||||||

Diluted net earnings per common share attributable to ViacomCBS: |

|

|

|

|

|

|

|

|||||||||

Net earnings from continuing operations |

$ |

.99 |

|

|

$ |

1.01 |

|

|

$ |

2.59 |

|

|

$ |

5.74 |

|

|

Net earnings from discontinued operations |

$ |

— |

|

|

$ |

.01 |

|

|

$ |

.02 |

|

|

$ |

.04 |

|

|

Net earnings |

$ |

1.00 |

|

|

$ |

1.02 |

|

|

$ |

2.61 |

|

|

$ |

5.78 |

|

|

|

|

|

|

|

|

|

|

|||||||||

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|||||||||

Basic |

616 |

|

|

615 |

|

|

615 |

|

|

615 |

|

|||||

Diluted |

618 |

|

|

617 |

|

|

617 |

|

|

617 |

||||||

VIACOMCBS INC. AND SUBSIDIARIES

|

||||||||||||

|

At

|

|

At

|

|||||||||

ASSETS |

|

|

|

|

|

|

|

|||||

Current Assets: |

|

|

|

|

|

|

|

|||||

Cash and cash equivalents |

|

$ |

3,086 |

|

|

|

|

$ |

632 |

|

|

|

Receivables, net |

|

6,946 |

|

|

|

|

7,206 |

|

|

|||

Programming and other inventory |

|

1,869 |

|

|

|

|

2,876 |

|

|

|||

Prepaid and other current assets |

|

1,256 |

|

|

|

|

1,188 |

|

|

|||

Total current assets |

|

13,157 |

|

|

|

|

11,902 |

|

|

|||

Property and equipment, net |

|

1,994 |

|

|

|

|

2,085 |

|

|

|||

Programming and other inventory |

|

9,365 |

|

|

|

|

8,652 |

|

|

|||

Goodwill |

|

16,995 |

|

|

|

|

16,980 |

|

|

|||

Intangible assets, net |

|

2,832 |

|

|

|

|

2,993 |

|

|

|||

Operating lease assets |

|

1,795 |

|

|

|

|

1,939 |

|

|

|||

Deferred income tax assets, net |

|

1,007 |

|

|

|

|

939 |

|

|

|||

Other assets |

|

4,020 |

|

|

|

|

4,006 |

|

|

|||

Assets held for sale |

|

260 |

|

|

|

|

23 |

|

|

|||

Total Assets |

|

$ |

51,425 |

|

|

|

|

$ |

49,519 |

|

|

|

|

|

|

|

|

|

|

|

|||||

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|||||

Current Liabilities: |

|

|

|

|

|

|

|

|||||

Accounts payable |

|

$ |

436 |

|

|

|

|

$ |

667 |

|

|

|

Accrued expenses |

|

1,765 |

|

|

|

|

1,760 |

|

|

|||

Participants’ share and royalties payable |

|

2,100 |

|

|

|

|

1,977 |

|

|

|||

Accrued programming and production costs |

|

1,125 |

|

|

|

|

1,500 |

|

|

|||

Deferred revenues |

|

710 |

|

|

|

|

739 |

|

|

|||

Debt |

|

18 |

|

|

|

|

717 |

|

|

|||

Other current liabilities |

|

1,609 |

|

|

|

|

1,688 |

|

|

|||

Total current liabilities |

|

7,763 |

|

|

|

|

9,048 |

|

|

|||

Long-term debt |

|

19,703 |

|

|

|

|

18,002 |

|

|

|||

Participants’ share and royalties payable |

|

1,396 |

|

|

|

|

1,546 |

|

|

|||

Pension and postretirement benefit obligations |

|

2,045 |

|

|

|

|

2,121 |

|

|

|||

Deferred income tax liabilities, net |

|

816 |

|

|

|

|

500 |

|

|

|||

Operating lease liabilities |

|

1,769 |

|

|

|

|

1,909 |

|

|

|||

Program rights obligations |

|

266 |

|

|

|

|

356 |

|

|

|||

Other liabilities |

|

2,226 |

|

|

|

|

2,494 |

|

|

|||

Redeemable noncontrolling interest |

|

196 |

|

|

|

|

254 |

|

|

|||

|

|

|

|

|

|

|

|

|||||

Commitments and contingencies |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||

ViacomCBS stockholders’ equity: |

|

|

|

|

|

|

|

|||||

Class A Common Stock, par value $.001 per share; 55 shares authorized; 52 (2020 and 2019) shares issued |

|

— |

|

|

|

|

— |

|

|

|||

Class B Common Stock, par value $.001 per share; 5,000 shares authorized; 1,067 (2020) and 1,064 (2019) shares issued |

|

1 |

|

|

|

|

1 |

|

|

|||

Additional paid-in capital |

|

29,719 |

|

|

|

|

29,590 |

|

|

|||

Treasury stock, at cost; 503 (2020) and 501 (2019) Class B shares |

|

(22,958) |

|

|

|

|

(22,908) |

|

|

|||

Retained earnings |

|

9,704 |

|

|

|

|

8,494 |

|

|

|||

Accumulated other comprehensive loss |

|

(1,910) |

|

|

|

|

(1,970) |

|

|

|||

Total ViacomCBS stockholders’ equity |

|

14,556 |

|

|

|

|

13,207 |

|

|

|||

Noncontrolling interests |

|

689 |

|

|

|

|

82 |

|

|

|||

Total Equity |

|

15,245 |

|

|

|

|

13,289 |

|

|

|||

Total Liabilities and Equity |

|

$ |

51,425 |

|

|

|

|

$ |

49,519 |

|

|

|

VIACOMCBS INC. AND SUBSIDIARIES

|

||||||||

|

Nine Months Ended

|

|||||||

|

2020 |

|

2019 |

|||||

Operating Activities: |

|

|

|

|||||

Net earnings (ViacomCBS and noncontrolling interests) |

$ |

1,872 |

|

|

$ |

3,593 |

|

|

Less: Net earnings from discontinued operations, net of tax |

14 |

|

|

23 |

|

|||

Net earnings from continuing operations |

1,858 |

|

|

3,570 |

|

|||

Adjustments to reconcile net earnings from continuing operations to net cash flow provided

|

|

|

|

|||||

Depreciation and amortization |

335 |

|

|

323 |

|

|||

Deferred tax provision (benefit) |

176 |

|

|

(506) |

|

|||

Stock-based compensation |

191 |

|

|

171 |

|

|||

Gain on sale of assets |

— |

|

|

(549) |

|

|||

Gains from investments |

(32) |

|

|

(89) |

|

|||

Loss on extinguishment of debt |

126 |

|

|

— |

|

|||

Equity in loss of investee companies, net of tax and distributions |

34 |

|

|

58 |

|

|||

Change in assets and liabilities |

(123) |

|

|

(1,289) |

|

|||

Net cash flow provided by operating activities |

2,565 |

|

|

1,689 |

|

|||

Investing Activities: |

|

|

|

|||||

Investments |

(60) |

|

|

(137) |

|

|||

Capital expenditures |

(213) |

|

|

(251) |

|

|||

Acquisitions, net of cash acquired |

(142) |

|

|

(384) |

|

|||

Proceeds from dispositions |

146 |

|

|

755 |

|

|||

Other investing activities |

— |

|

|

6 |

|

|||

Net cash flow used for investing activities |

(269) |

|

|

(11) |

|

|||

Financing Activities: |

|

|

|

|||||

Repayments of short-term debt borrowings, net |

(706) |

|

|

(624) |

|

|||

Proceeds from issuance of senior notes |

4,365 |

|

|

492 |

|

|||

Repayment of notes and debentures |

(2,896) |

|

|

(820) |

|

|||

Dividends |

(450) |

|

|

(446) |

|

|||

Purchase of Company common stock |

(58) |

|

|

(14) |

|

|||

Payment of payroll taxes in lieu of issuing shares for stock-based compensation |

(62) |

|

|

(52) |

|

|||

Other financing activities |

(87) |

|

|

(96) |

|

|||

Net cash flow provided by (used for) financing activities |

106 |

|

|

(1,560) |

|

|||

Effect of exchange rate changes on cash, cash equivalents and restricted cash |

(6) |

|

|

(16) |

|

|||

Net increase in cash, cash equivalents and restricted cash |

2,396 |

|

|

102 |

|

|||

Cash, cash equivalents and restricted cash at beginning of period (includes $202 (2020) and $120 (2019) of restricted cash) |

834 |

|

|

976 |

|

|||

Cash, cash equivalents and restricted cash at end of period (includes $138 (2020) and $122 (2019) of restricted cash, and $6 (2020) of assets held for sale) |

$ |

3,230 |

|

|

$ |

1,078 |

|

|

SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL MEASURES

(Unaudited; in millions, except per share amounts)

Results for the quarters and nine months ended September 30, 2020 and 2019 included certain items identified as affecting comparability. Adjusted operating income before depreciation and amortization (“Adjusted OIBDA”), adjusted earnings from continuing operations before income taxes, adjusted provision for income taxes, adjusted net earnings from continuing operations attributable to ViacomCBS, and adjusted diluted EPS from continuing operations (together, the “adjusted measures”) exclude the impact of these items and are measures of performance not calculated in accordance with accounting principles generally accepted in the United States of America (“GAAP”). We use these measures to, among other things, evaluate our operating performance. These measures are among the primary measures used by management for planning and forecasting of future periods, and they are important indicators of our operational strength and business performance. In addition, we use Adjusted OIBDA to, among other things, value prospective acquisitions. We believe these measures are relevant and useful for investors because they allow investors to view performance in a manner similar to the method used by our management; provide a clearer perspective on our underlying performance; and make it easier for investors, analysts and peers to compare our operating performance to other companies in our industry and to compare our year-over-year results.

Because the adjusted measures are measures of performance not calculated in accordance with GAAP, they should not be considered in isolation of, or as a substitute for, operating income, earnings from continuing operations before income taxes, (provision) benefit for income taxes, net earnings from continuing operations attributable to ViacomCBS or diluted EPS from continuing operations, as applicable, as indicators of operating performance. These measures, as we calculate them, may not be comparable to similarly titled measures employed by other companies.

The following tables reconcile the adjusted measures to their most directly comparable financial measures in accordance with GAAP.

|

Quarter Ended

|

|

Nine Months Ended

|

|||||||||||||

|

|

2020 |

|

2019 |

|

2020 |

|

2019 |

||||||||

Operating income (GAAP) |

$ |

959 |

|

|

$ |

1,036 |

|

|

$ |

3,162 |

|

|

$ |

4,286 |

|

|

Depreciation and amortization (a) |

98 |

|

|

108 |

|

|

335 |

|

|

323 |

|

|||||

Restructuring and other corporate matters (b) |

52 |

|

|

122 |

|

|

443 |

|

|

307 |

|

|||||

Programming charges (b) |

— |

|

|

— |

|

|

121 |

|

|

— |

|

|||||

Gain on sale of assets (b) |

— |

|

|

— |

|

|

— |

|

|

(549) |

|

|||||

Adjusted OIBDA (Non-GAAP) |

$ |

1,109 |

|

|

$ |

1,266 |

|

|

$ |

4,061 |

|

|

$ |

4,367 |

|

|

(a) The nine months ended September 30, 2020 includes an impairment charge for FCC licenses of $25 million and accelerated depreciation of $12 million for technology that was abandoned in connection with synergy plans related to the merger of Viacom Inc. with and into CBS Corporation (the “Merger”).

(b) See notes on the following tables for additional information on items affecting comparability.

SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL MEASURES (Continued)

|

|||||||||||||||

|

Quarter Ended September 30, 2020 |

||||||||||||||

|

Earnings from

|

|

Provision for

|

|

Net Earnings

|

|

Diluted EPS

|

||||||||

Reported (GAAP) |

$ |

671 |

|

$ |

(38 |

) |

|

$ |

612 |

|

|

$ |

.99 |

|

|

Items affecting comparability: |

|

|

|

|

|

|

|

||||||||

Restructuring and other corporate matters (a) |

|

52 |

|

|

(13 |

) |

|

|

39 |

|

|

|

.06 |

|

|

Loss on extinguishment of debt |

|

23 |

|

|

(5 |

) |

|

|

18 |

|

|

|

.03 |

|

|

Discrete tax items (b) |

|

— |

|

|

(117 |

) |

|

|

(117 |

) |

|

|

(.19 |

) |

|

Impairment of an equity-method investment |

|

— |

|

|

— |

|

|

|

9 |

|

|

|

.02 |

|

|

Adjusted (Non-GAAP) |

$ |

746 |

|

$ |

(173 |

) |

|

$ |

561 |

|

|

$ |

.91 |

|

|

(a) Primarily reflects severance, exit costs and other costs related to the Merger.

(b) Primarily reflects a benefit from the remeasurement of our UK net deferred income tax asset as a result of an increase in the UK corporate income tax rate from 17% to 19% enacted during the third quarter.

|

Quarter Ended September 30, 2019 |

|||||||||||||||

|

Earnings from

|

|

Provision for

|

|

Net Earnings

|

|

Diluted EPS

|

|||||||||

Reported (GAAP) |

$ |

782 |

|

|

$ |

(126 |

) |

|

$ |

626 |

|

|

$ |

1.01 |

|

|

Items affecting comparability: |

|

|

|

|

|

|

|

|||||||||

Restructuring and other corporate matters (a) |

|

122 |

|

|

|

(1 |

) |

|

|

121 |

|

|

|

.20 |

|

|

Gains from investments |

|

(12 |

) |

|

|

3 |

|

|

|

(9 |

) |

|

|

(.02 |

) |

|

Discrete tax items (b) |

|

— |

|

|

|

(58 |

) |

|

|

(58 |

) |

|

|

(.09 |

) |

|

Adjusted (Non-GAAP) |

$ |

892 |

|

|

$ |

(182 |

) |

|

$ |

680 |

|

|

$ |

1.10 |

|

|

(a) Primarily reflects costs incurred in connection with the Merger and severance costs.

(b) Primarily reflects tax benefits realized in connection with the preparation of the 2018 federal tax return, based on further clarity provided by the U.S. government on tax positions relating to federal tax legislation enacted in December 2017 (the “Tax Reform Act”).

SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL MEASURES (Continued)

|

||||||||||||||||

|

||||||||||||||||

|

Nine Months Ended September 30, 2020 |

|||||||||||||||

|

Earnings from

|

Provision for

|

Net Earnings

|

Diluted EPS

|

||||||||||||

Reported (GAAP) |

|

$ |

2,265 |

|

|

$ |

(377 |

) |

|

$ |

1,598 |

|

|

$ |

2.59 |

|

Items affecting comparability: |

|

|

|

|

|

|

|

|

||||||||

Restructuring and other corporate matters (a) |

|

|

443 |

|

|

|

(94 |

) |

|

|

349 |

|

|

|

.57 |

|

Impairment charge (b) |

|

|

25 |

|

|

|

(6 |

) |

|

|

19 |

|

|

|

.03 |

|

Depreciation of abandoned technology (c) |

|

|

12 |

|

|

|

(3 |

) |

|

|

9 |

|

|

|

.01 |

|

Programming charges (d) |

|

|

121 |

|

|

|

(29 |

) |

|

|

92 |

|

|

|

.15 |

|

Gains from investments (e) |

|

|

(32 |

) |

|

|

8 |

|

|

|

(24 |

) |

|

|

(.04 |

) |

Loss on extinguishment of debt |

|

|

126 |

|

|

|

(29 |

) |

|

|

97 |

|

|

|

.16 |

|

Discrete tax items (f) |

|

|

— |

|

|

|

(120 |

) |

|

|

(120 |

) |

|

|

(.19 |

) |

Impairment of an equity-method investment |

|

|

— |

|

|

|

— |

|

|

|

9 |

|

|

|

.01 |

|

Adjusted (Non-GAAP) |

|

$ |

2,960 |

|

|

$ |

(650 |

) |

|

$ |

2,029 |

|

|

$ |

3.29 |

|

(a) Reflects severance, exit costs and other costs related to the Merger and a charge to write down property and equipment classified as held for sale.

(b) Reflects a charge to reduce the carrying values of FCC licenses in two markets to their fair values.

(c) Reflects accelerated depreciation for technology that was abandoned in connection with synergy plans related to the Merger.

(d) Programming charges primarily related to the abandonment of certain incomplete programs resulting from production shutdowns related to COVID-19.

(e) Reflects an increase to the carrying value of an equity security based on the market price of a similar security.

(f) Primarily reflects a benefit from the remeasurement of our UK net deferred income tax asset as a result of an increase in the UK corporate income tax rate from 17% to 19% enacted during the third quarter.

|

Nine Months Ended September 30, 2019 |

|||||||||||||||

|

Earnings from

|

|

Benefit (Provision) for

|

|

Net Earnings

|

|

Diluted EPS

|

|||||||||

Reported (GAAP) |

$ |

3,614 |

|

|

$ |

9 |

|

|

$ |

3,543 |

|

|

$ |

5.74 |

|

|

Items affecting comparability: |

|

|

|

|

|

|

|

|||||||||

Restructuring and other corporate matters (a) |

|

307 |

|

|

|

(46 |

) |

|

|

261 |

|

|

|

.43 |

|

|

Gain on sale of assets (b) |

|

(549 |

) |

|

|

163 |

|

|

|

(386 |

) |

|

|

(.63 |

) |

|

Gains from investments (c) |

|

(89 |

) |

|

|

19 |

|

|

|

(70 |

) |

|

|

(.11 |

) |

|

Discrete tax items (d) |

|

— |

|

|

|

(858 |

) |

|

|

(858 |

) |

|

|

(1.39 |

) |

|

Adjusted (Non-GAAP) |

$ |

3,283 |

|

|

$ |

(713 |

) |

|

$ |

2,490 |

|

|

$ |

4.04 |

|

|

(a) Reflects severance, exit costs, costs associated with the settlement of a commercial dispute, and other legal proceedings involving the Company.

(b) Reflects a gain on the sale of the CBS Television City property and sound stage operation.

(c) Reflects a gain on marketable securities of $78 million and a gain of $11 million on the sale of an international joint venture.

(d) Reflects a deferred tax benefit of $768 million resulting from the transfer of intangible assets between our subsidiaries in connection with a reorganization of our international operations, a net tax benefit of $58 million realized in connection with the preparation of the 2018 federal tax return, based on further clarity provided by the U.S. government on tax positions relating to the Tax Reform Act and $32 million principally related to the bankruptcy of an investee.

SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL MEASURES (Continued)

(Unaudited; in millions, except per share amounts)

Free Cash Flow

Free cash flow is a non-GAAP financial measure. Free cash flow reflects our net cash flow provided by operating activities less capital expenditures. Our calculation of free cash flow includes capital expenditures because investment in capital expenditures is a use of cash that is directly related to our operations. Our net cash flow provided by operating activities is the most directly comparable GAAP financial measure.

Management believes free cash flow provides investors with an important perspective on the cash available to us to service debt, make strategic acquisitions and investments, maintain our capital assets, satisfy our tax obligations, and fund ongoing operations and working capital needs. As a result, free cash flow is a significant measure of our ability to generate long-term value. It is useful for investors to know whether this ability is being enhanced or degraded as a result of our operating performance. We believe the presentation of free cash flow is relevant and useful for investors because it allows investors to evaluate the cash generated from our underlying operations in a manner similar to the method used by management. Free cash flow is among several components of incentive compensation targets for certain management personnel. In addition, free cash flow is a primary measure used externally by our investors, analysts and industry peers for purposes of valuation and comparison of our operating performance to other companies in our industry.

As free cash flow is not a measure calculated in accordance with GAAP, free cash flow should not be considered in isolation of, or as a substitute for, either net cash flow provided by operating activities as a measure of liquidity or net earnings as a measure of operating performance. Free cash flow, as we calculate it, may not be comparable to similarly titled measures employed by other companies. In addition, free cash flow as a measure of liquidity has certain limitations, does not necessarily represent funds available for discretionary use and is not necessarily a measure of our ability to fund our cash needs.

The following table presents a reconciliation of our net cash flow provided by operating activities to free cash flow.

|

Quarter Ended

|

|

Nine Months Ended

|

|||||||||||||

|

|

2020 |

|

2019 |

|

2020 |

|

2019 |

||||||||

Net cash flow provided by operating activities (GAAP) |

$ |

1,414 |

|

|

$ |

500 |

|

|

$ |

2,565 |

|

|

$ |

1,689 |

|

|

Capital expenditures |

(81) |

|

|

(109) |

|

|

(213) |

|

|

(251) |

|

|||||

Free cash flow (Non-GAAP) |

$ |

1,333 |

|

|

$ |

391 |

|

|

$ |

2,352 |

|

|

$ |

1,438 |

|

|

VIAC-IR