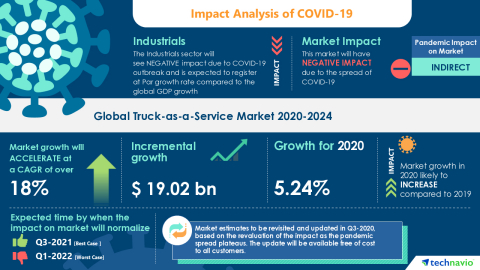

LONDON--(BUSINESS WIRE)--The global truck-as-a-service market size is poised to grow by USD 19.02 billion during 2020-2024, progressing at a CAGR of over 18% throughout the forecast period, according to the latest report by Technavio. The report offers an up-to-date analysis regarding the current market scenario, latest trends and drivers, and the overall market environment. The report also provides the market impact and new opportunities created due to the COVID-19 pandemic. Download a Free Sample of REPORT with COVID-19 Crisis and Recovery Analysis.

The integration of loT-based gadgets is one aspect during the forecast period that will drive the growth of the Truck-as-a-Service market. This integration helps in managing the important aspects of trucking operations such as optimal asset use, public transit management, geofencing, fleet management, and smart inventory management. Also, the use of connected devices such as electronic log devices (ELD) with loT enhances the experience and creates a safer work environment for drivers by accurately managing, tracking, and sharing records of duty status. As a result of these benefits, the trucking industry is expected to grow during the forecast period.

Register for a free trial today and gain instant access to 17,000+ market research reports.

Technavio's SUBSCRIPTION platform

Report Highlights:

- The major truck-as-a-service market growth came from the digital freight brokerage segment owing to an increase in the use of smartphones and rising penetration of wireless connectivity and other digital platforms.

- North America was the largest truck-as-a-service market in 2019, and the region will offer several growth opportunities to market vendors during the forecast period. This is attributed to factors such as the growing e-commerce industry and the rising demand for last-mile delivery and next- and same-day services.

- The global truck-as-a-service market is fragmented. AB Volvo, Daimler AG, Fleet Advantage LLC, Fleet Complete, Ford Motor Co., Hino Motors Ltd., Microlise Group Ltd., Tata Motors Ltd., Trimble Inc., and Volkswagen AG are some of the major market participants. To help clients improve their market position, this truck-as-a-service market forecast report provides a detailed analysis of the market leaders.

- As the business impact of COVID-19 spreads, the global truck-as-a-service market 2020-2024 is expected to have negative impact. As the pandemic spreads in some regions and plateaus in other regions, we revaluate the impact on businesses and update our report forecasts.

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

View market snapshot before purchasing

Adoption of blockchain in trucking will be a Key Market Trend

This blockchain technology not only helps the industry in forecasting and predicting asset volumes more accurately but it also helps to record digital transactions, including logging miles and hours driven and also in improving the security, visibility, and accuracy of data. It prevents fraudulent activities in freight management and manages elements such as freight contracts and parts management. This will increase the number of service providers in the truck-as-a-service market, resulting in market growth during the forecast period.

Technavio’s sample reports are free of charge and contain multiple sections of the report, such as the market size and forecast, drivers, challenges, trends, and more. Request a free sample report

Truck-as-a-Service Market 2020-2024: Key Highlights

- CAGR of the market during the forecast period 2020-2024

- Detailed information on factors that will assist truck-as-a-service market growth during the next five years

- Estimation of the truck-as-a-service market size and its contribution to the parent market

- Predictions on upcoming trends and changes in consumer behavior

- The growth of the truck-as-a-service market

- Analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of truck-as-a-service market vendors

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

View market snapshot before purchasing

Executive Summary

Market Landscape

- Market ecosystem

- Value chain analysis

Market Sizing

- Market definition

- Market segment analysis

- Market size 2019

- Market outlook: Forecast for 2019-2024

Five Forces Analysis

- Five forces summary

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Threat of rivalry

- Market condition

Market Segmentation by Service

- Market segments

- Comparison by Service

- Digital freight brokerage - Market size and forecast 2019-2024

- Telematics - Market size and forecast 2019-2024

- Data analytics - Market size and forecast 2019-2024

- Truck platooning - Market size and forecast 2019-2024

- Market opportunity by Service

Customer landscape

- Customer landscape

Geographic Landscape

- Geographic segmentation

- Geographic comparison

- North America - Market size and forecast 2019-2024

- Europe - Market size and forecast 2019-2024

- APAC - Market size and forecast 2019-2024

- MEA - Market size and forecast 2019-2024

- South America - Market size and forecast 2019-2024

- Key leading countries

- Market opportunity by geography

- Market drivers

- Market challenges

- Market trends

Vendor Landscape

- Overview

- Landscape disruption

Vendor Analysis

- Vendors covered

- Market positioning of vendors

- AB Volvo

- Daimler AG

- Fleet Advantage LLC

- Fleet Complete

- Ford Motor Co.

- Hino Motors Ltd.

- Microlise Group Ltd.

- Tata Motors Ltd.

- Trimble Inc.

- Volkswagen AG

Appendix

- Scope of the report

- Currency conversion rates for US$

- Research methodology

- List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.