AUSTIN, Texas--(BUSINESS WIRE)--Steadily, a new kind of insurer for landlords, came out of stealth mode today to officially launch its service and offer landlords new opportunities to secure property insurance coverage in this severely underserved market. Landlords can purchase insurance and address property needs directly through a mobile experience without the hassle of going through an agent. The company also announced that it has received $3.8 million in seed funding in a round led by Matrix Partners. Money will be used to accelerate product development as Steadily works, in part, to bring IoT devices to property management, facilitating preventative maintenance and lowering premiums.

“Landlord insurance has historically been too complicated of a product to underwrite entirely online the way auto insurance is today, so the segment is underserved,” said Jake Jolis of Matrix Partners. “But it is a huge opportunity that’s ripe for someone to figure out how to build it right. Steadily has put together a stellar team of industry, technology and design experts who we believe will fundamentally change this space.”

According to HUD, there are 22.7 million units in 16.7 million rental properties owned by individual investors across the U.S. There are another 25.8 million units owned by businesses, which are likely to be multifamily rentals. Together, this accounts for 48 million units that need to be insured, representing approximately $38 billion in annual premiums. Yet, there are few good options for landlords to get the insurance they need for a reasonable price.

Additionally, a landlord policy costs about 25% more than a homeowner’s policy would on the same property due to the higher risk profile of tenants vs homeowners. The insurance industry has been using the same rating factors and expecting different results for years. Steadily aims to look at underwriting with fresh eyes, and it will track novel risk characteristics in order to better price and accept risk.

“As a relatively new landlord, I was surprised at how little attention is paid to this segment by most carriers,” said Darren Nix, founder and CEO of Steadily. “We set out to build the product that we wanted to use ourselves. Our goal is to modernize landlord insurance all the way from the initial purchase through to paying out claims so that property owners are protected and served the way they should be.”

The Steadily Difference

As Steadily moves through the long journey of building out a program for landlords, it has secured multiple carrier partnerships to underwrite policies as it completely remakes front and backend processes. Steadily significantly upgrades the customer acquisition experience while also improving claims and loss ratios once a policy is in place.

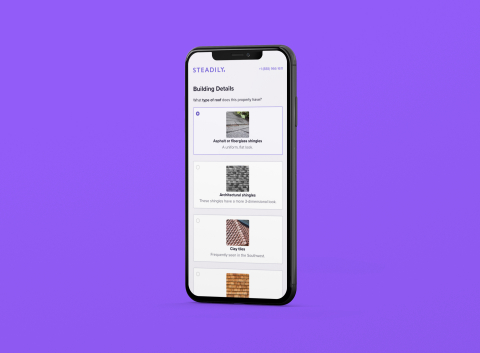

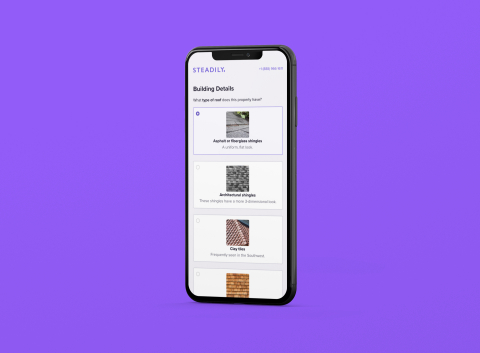

With its meticulously designed, easy-to-use mobile experience, property owners can complete their landlord insurance quote in minutes because the site helpfully pre-fills many data points, like the property size, year of construction, etc. This is a far cry from the lengthy, time-consuming applications landlords have been forced to walk through over the phone up to this point. Once the Steadily application is finished, potential customers receive a highly competitive quote within minutes, rather than the days and weeks they wait today.

Steadily is also building out the technology to help landlords protect their properties in new ways. Its mobile experience will verify fire mitigation and property conditions post-bind. For example, landlords can use their camera to verify the number of fire extinguishers on site and order additional extinguishers at cost through Steadily. Additionally, Steadily is developing non-invasive IoT devices that can ascertain issues before they become problems, such as attaching sensors to the bottom of a washing machine to monitor for leaks. These applications will help Steadily reduce the volume and severity of future claims as well as landlord headaches. Steadily’s advanced data analytics help claims get paid faster, reduce the magnitude of property damage claims and ultimately lower the cost of insurance to customers.

About Steadily

Steadily was created by industry experts to offer landlords great insurance service and a compelling experience from quote request to claim resolution. Mobile-first and direct-to-consumer, Steadily is poised to rapidly remake the insurance segment. The company is based in Austin, Texas and backed by investors including Matrix Partners, Next Coast Ventures, Nine Four Ventures, and SV Angel. Learn more at https://www.steadily.com.