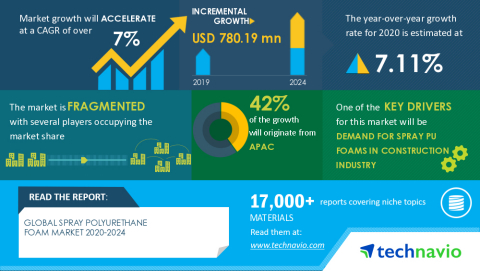

LONDON--(BUSINESS WIRE)--The global spray polyurethane foam market size is expected to grow by USD 780.91 million during 2020-2024, progressing at a CAGR of over 7% during the forecast period. Download Free Sample Report

Demand for spray PU foams in construction industry is one of the major factors propelling the market growth.

Spray PU foam is widely used in the construction industry for insulating walls, panels, and gap fillers in doors and windows. Spray PU foam exhibits high energy efficiency, versatility, and thermal or mechanical performance. Moreover, spray PU foam is also used as a weatherproof sealant as it forms a seamless layer of insulation, fills gap and seams, and covers irregular and hard-to-insulate shapes. Therefore, the growth of the construction industry, owing to increasing infrastructure activities, has led to high demand for spray PU foam. Additionally, the rising demand for housing and flooring materials will also increase the demand for spray PU foam. Thus, the rising number of infrastructure projects will significantly influence the growth of the global spray polyurethane foam market during the forecast period.

More details: www.technavio.com/report/spray-polyurethane-foam-market-industry-analysis

Global Spray Polyurethane Foam Market: Type Landscape

The rising construction activities across the world will increase the demand for open-cell spray PU foam as it is suitable for ceilings, floors, interior walls, and the undersides of roof decks. Moreover, open-cell spray PU foam is a low-density product that uses water as a blowing agent, which makes it highly preferable in the construction industry. Market growth in this segment will be slower than the growth of the market in the closed-cell spray PU foam segment.

Global Spray Polyurethane Foam Market: Geographic Landscape

APAC had the largest spray polyurethane foam market share in 2019, and the region will offer several growth opportunities to market vendors during the forecast period. The growth of the population is increasing the demand for residential and commercial establishments which will significantly influence spray polyurethane foam growth in this region. China, Japan, and South Korea are the key markets for spray polyurethane foam in APAC. Market growth in this region will be faster than the growth of the market in other regions.

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

View market snapshot before purchasing

Companies Covered

- Armacell International SA

- BASF SE

- Compagnie de Saint-Gobain SA

- Covestro AG

- FXI, Huntsman International LLC

- LANXESS AG

- Nitto Denko Corp.

- Rogers Corp.

- Sekisui Chemical Co. Ltd.

What our reports offer:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers market data for 2019, 2020, till 2024

- Market trends (drivers, opportunities, threats, challenges, investment opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Technavio suggests three forecast scenarios (optimistic, probable, and pessimistic) considering the impact of COVID-19. Technavio’s in-depth research has direct and indirect COVID-19 impacted market research reports.

Register for a free trial today and gain instant access to 17,000+ market research reports.

Technavio's SUBSCRIPTION platform

Spray Polyurethane Foam Market 2020-2024: Key Highlights

- CAGR of the market during the forecast period 2020-2024

- Detailed information on factors that will assist coding bootcamp market growth during the next five years

- Estimation of the coding bootcamp market size and its contribution to the parent market

- Predictions on upcoming trends and changes in consumer behavior

- The growth of the coding bootcamp market

- Analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of coding bootcamp market, vendors

Table of Contents:

PART 01: EXECUTIVE SUMMARY

PART 02: SCOPE OF THE REPORT

PART 03: MARKET LANDSCAPE

- Market ecosystem

- Market characteristics

- Value chain analysis

- Market segmentation analysis

PART 04: MARKET SIZING

- Market definition

- Market sizing 2019

- Market Outlook

- Market size and forecast 2019-2024

PART 05: FIVE FORCES ANALYSIS

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Threat of rivalry

- Market condition

PART 06: MARKET SEGMENTATION BY TYPE

- Market segmentation by type

- Comparison by type

- Open cell spray PU foam - Market size and forecast 2019-2024

- Closed cell spray PU foam - Market size and forecast 2019-2024

- Others - Market size and forecast 2019-2024

- Market opportunity by type

PART 07: CUSTOMER LANDSCAPE

PART 08: MARKET SEGMENTATION BY APPLICATION

- Market segmentation by application

- Comparison by application

- Residential - Market size and forecast 2019-2024

- Commercial - Market size and forecast 2019-2024

- Industrial - Market size and forecast 2019-2024

- Market opportunity by application

PART 09: GEOGRAPHIC LANDSCAPE

- Geographic segmentation

- Geographic comparison

- APAC - Market size and forecast 2019-2024

- North America - Market size and forecast 2019-2024

- Europe - Market size and forecast 2019-2024

- MEA - Market size and forecast 2019-2024

- South America - Market size and forecast 2019-2024

- Key leading countries

- Market opportunity

PART 10: DECISION FRAMEWORK

PART 11: DRIVERS AND CHALLENGES

- Market drivers

- Market challenges

PART 12: MARKET TRENDS

- Increasing use of methylal and HFOs as alternatives to HFCs and HCFCs

- Innovations in polyurethane foams

- Mergers and acquisitions in the spray PU foam market

PART 13: VENDOR LANDSCAPE

- Overview

- Landscape disruption

- Competitive scenario

PART 14: VENDOR ANALYSIS

- Vendors covered

- Vendor classification

- Market positioning of vendors

- Armacell International SA

- BASF SE

- Compagnie de Saint-Gobain SA

- Covestro AG

- FXI

- Huntsman International LLC

- LANXESS AG

- Nitto Denko Corp.

- Rogers Corp.

- Sekisui Chemical Co. Ltd.

PART 15: APPENDIX

- Research methodology

- List of abbreviations

- Definition of market positioning of vendors

PART 16: EXPLORE TECHNAVIO

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.