SAN FRANCISCO--(BUSINESS WIRE)--COVID-19 has raised fresh concerns about Americans’ retirement preparations, with some saying the pandemic has permanently impacted their ability to save for retirement, according to the 2020 Wells Fargo Retirement study conducted by The Harris Poll in August, which examines the attitudes and savings of working adults and retirees.

Particularly for workers whose employment has been negatively impacted by COVID-19,1 retirement has become an even more challenging goal over the last eight months, with many expressing pessimism about their life in retirement – or worried if they can retire at all. Fifty-eight percent of workers impacted by the pandemic say they now don’t know if they have enough saved to retire because of COVID-19, compared to 37% of all workers. Moreover, among workers impacted by COVID-19, 70% say they are worried about how to make sure they don’t run out of money in retirement, 61% say they are much more afraid of life in retirement, and 61% say the pandemic took the joy out of looking forward to retirement.

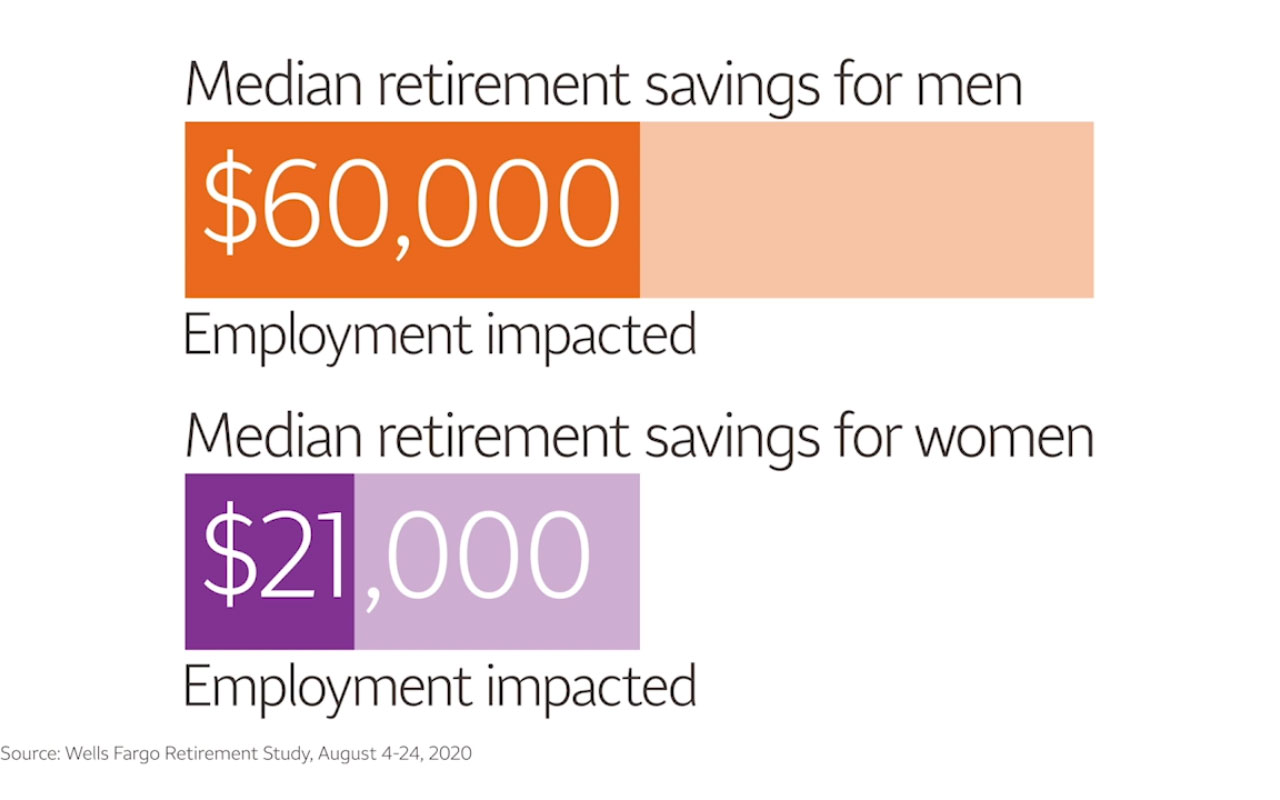

Retirement savings provides a more striking contrast, showing that COVID-19 has driven some workers even further behind: Working men report median retirement savings of $120,000, which compares to $60,000 for working women, according to the study. Yet for those impacted by COVID-19, men report median retirement savings of $60,000, which compares to $21,000 for women.

“With individual investors now largely responsible for saving and funding their own retirement, disruptive events and economic downturns can have an outsized impact on their outlook,” said Nate Miles, head of Retirement for Wells Fargo Asset Management. “Our study shows that even for the most disciplined savers, working Americans are not saving enough for retirement. The good news is that for many of today’s workers, there is still time to save and prepare.”

Women and Younger Generations

The study found that women and younger generations are also falling behind. Women are less sure if they will be able to save enough for retirement, and appear to be in a more precarious financial situation than men. Barely half of working women (51%) say they are saving enough for retirement, or that they are confident they will have enough savings to live comfortably in retirement (51%). Women impacted by COVID-19 have saved less than half for retirement than men and are much more pessimistic about their financial lives. In addition, women impacted by COVID-19 are less likely to have access to an employer-sponsored retirement savings plan (59%), and are less likely to participate (77%).

Similarly, though Generation Z workers started saving at an earlier age and are participating in employer-based savings programs at a greater rate than other generations, they are nonetheless worried about their future. Fifty-two percent of Generation Z workers say they don’t know if they’ll be able to save enough to retire because of COVID-19, 50% say they are much more afraid of life in retirement due to COVID-19, and 52% say the pandemic took the joy out of looking forward to retirement.

Glass Half Full

At the same time, the study showed that despite a challenging environment, many American workers and retirees remain optimistic about their current life, their finances, and their future. A majority of workers say they are very or somewhat satisfied with their current life (79%), in control of their financial life (79%), are able to pay for monthly expenses (95%), and feel confident they are able to manage their finances (86%).

Sixty-nine percent of workers and 73% of retirees feel in control and/or happy about their financial situation. In addition, 92% of workers and 91% of retirees say they can positively affect their financial situation, and 90% of workers and 88% of retirees say they can positively affect how their debt situation progresses. And 83% of workers say they could pay for a financial emergency of $1,000 without having to borrow money from friends or family. Yet Americans acknowledge they could improve their financial planning. Slightly more than half — 54% of workers and 50% of retirees — say they have a detailed financial plan, and just 27% of workers and 29% of retirees have a financial advisor.

“The study found incredible optimism and resiliency among American workers and retirees, which is remarkable in the current environment,” said Kim Ta, head of Client Service and Advice for Wells Fargo Advisors. “As an industry, we must help more investors make a plan for their future so that optimism becomes a reality in retirement.”

Pandemic Underscores Importance of Social Security and Medicare

Despite an increasing shift to a self-funded retirement, nearly all workers and retirees say that Social Security and Medicare play or will play a significant role in their retirement — a reality underscored by the pandemic. According to the study, 71% of workers, 81% of those negatively impacted by COVID-19, and 85% of retirees say that COVID-19 reinforced how important Social Security and Medicare will be or are for their retirement.

Overall, workers expect that Social Security will make up approximately one-third of their monthly budget (30% median) in retirement. And even among wealthy workers, Social Security and Medicare factor significantly into their golden year plans — high-net-worth workers2 expect Social Security to cover 20% (median) of their monthly expenses. The dependence by many on the programs also drives anxiety: The vast majority of the study’s respondents harbor concerns that the programs will not be available when they need them and worry that the government won’t protect them. According to the study:

- 90% of workers would feel betrayed if the money they paid into Social Security is lost and not available when they retire.

- 76% of workers are concerned Social Security will be raided to pay down government debt.

- 72% of workers are afraid that Social Security won’t be available when they retire.

- 67% of workers have no idea what out-of-pocket healthcare costs will be in retirement.

- 45% of workers are optimistic that Congress will make changes to secure the future of Social Security.

- 23% of workers are willing to accept less from Social Security to help pay down the national debt.

Vast majorities also want politicians to help with retirement; 76% of workers and 81% of retirees say retirement should be a top priority for the presidential candidates, and 88% of workers and 91% of retirees say Congress needs to make it easier for workers to access tax-friendly retirement plans.

About The Harris Poll

The Harris Poll is one of the longest running surveys in the U.S. tracking public opinion, motivations and social sentiment since 1963 that is now part of Harris Insights & Analytics, a global consulting and market research firm that delivers social intelligence for transformational times. We work with clients in three primary areas: building 21st-century corporate reputation, crafting brand strategy and performance tracking, and earning organic media through public relations research. Our mission is to provide insights and advisory to help leaders make the best decisions possible. To learn more, please visit www.theharrispoll.com

About the Survey

On behalf of Wells Fargo’s Wealth & Investment Management division, The Harris Poll conducted 4,590 online interviews including 2,660 working Americans age 18-76 whose employment was not impacted by COVID-19, 725 Americans age 18-76 whose employment was impacted by COVID-19, 200 high net worth American workers age 18-76, and 1,005 retired Americans, surveying attitudes and behaviors around planning their finances, saving, and investing for retirement. The survey was conducted from August 4 – August 24, 2020. Working Americans are 18-76 and working full time (or at least 20 hours if they are working part time) or are self-employed and whose employment has not been impacted by COVID-19. Americans whose employment was impacted by COVID-19 are age 18-76 and selected that they personally experience at least one of the following due to the coronavirus pandemic: laid off from a job, furloughed from a job, started working a reduced or staggered schedule, been given a zero-hour schedule, or taken a pay cut. High net worth workers are age 18-76 and have at least $1 million in household investable assets. Retired Americans self-identified as retired regardless of age. All respondents are the primary or joint financial decision-maker for their household. Data are weighted where necessary by age by gender, race/ethnicity, region, education, income, marital status, employment, household size, and propensity to be online to bring them into line with their actual proportions in the population.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a diversified, community-based financial services company with $1.92 trillion in assets.* Wells Fargo’s vision is to satisfy our customers’ financial needs and help them succeed financially. Founded in 1852 and headquartered in San Francisco, Wells Fargo provides banking, investment and mortgage products and services, as well as consumer and commercial finance, through 7,200 locations, more than 13,000 ATMs, the internet (wellsfargo.com) and mobile banking, and has offices in 31 countries and territories to support customers who conduct business in the global economy. Wells Fargo serves one in three households in the United States. Wells Fargo & Company was ranked No. 30 on Fortune’s 2020 rankings of America’s largest corporations. News, insights and perspectives from Wells Fargo are also available at Wells Fargo Stories.

Additional information may be found at www.wellsfargo.com | Twitter: @WellsFargo.

*As of Sept. 30, 2020

Wells Fargo Asset Management (WFAM) is the trade name for certain investment advisory/management firms owned by Wells Fargo & Company. These firms include but are not limited to Wells Capital Management Incorporated and Wells Fargo Funds Management, LLC. Certain products managed by WFAM entities are distributed by Wells Fargo Funds Distributor, LLC (a broker/dealer and Member FINRA).

Investment products and services are offered through Wells Fargo Advisors, a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, registered broker-dealers and non-bank affiliates of Wells Fargo & Company. Wells Fargo Advisors associates referenced are registered with Wells Fargo Clearing Services, LLC.

This material is for general informational and educational purposes only and is NOT intended to provide investment advice or a recommendation of any kind—including a recommendation for any specific investment, strategy, or plan.

PAR-1020-01567

CAR-1020-02799

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

1 The “COVID Impacted” are those whose employment status was impacted in some specific way due to the pandemic, such as being laid off/furloughed from a job, working a reduced or staggered schedule, given a zero-hour schedule, or taken a pay cut. It does not mean they are currently unemployed.

2 High-net-worth workers defined as those with $1 million in Household Investable Assets.