COSTA MESA, Calif.--(BUSINESS WIRE)--In a continued effort to educate consumers about factors influencing their financial health, Experian® today released key findings from its 11th annual State of Credit report, which examined how consumers are managing their credit histories against the backdrop of the COVID-19 pandemic. This year’s report provided an extended view into how consumers are managing and repaying their debts, showing most Americans are practicing responsible credit management by reducing utilization rates, credit card balances and late payments.

Results from this year’s report were released following the announcement of Experian’s collaboration with Operation HOPE, which aims to empower vulnerable consumers to improve their financial health through education and action.

“Against the backdrop of the pandemic, we are seeing promising signs of responsible credit management, including lower credit card balances, decreased utilization rates and fewer missed payments – especially among younger consumers,” said Alex Lintner, group president Experian Consumer Information Services. “Educating Americans about the factors included in their credit profile and how to manage these responsibly is of critical importance, especially on the road to economic recovery.”

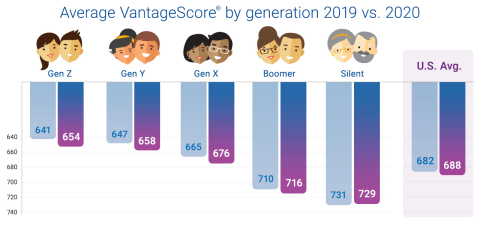

When compared to 2019, Americans are carrying fewer credit and retail cards and less credit card debt on average. Delinquency rates for 30–59, 60–89 and 90–180 days past due all decreased year-over-year. While retail spending, nonmortgage debt and mortgage debt increased, utilization rates — sometimes referred to as balance-to-limit ratios — decreased by four percent to 26 percent in 2020. These factors attributed to an average credit score of 688 — a six-point increase from the same period in 2019.

Highlights of Experian’s State of Credit report:

2020 State of Credit Report |

2019 |

|

|

2020 |

||

Average VantageScore®[1, 2] |

682 |

|

|

688 |

||

Average number of credit cards |

3.07 |

|

|

3.0 |

||

Average credit card balance |

$6,629 |

|

|

$5,897 |

||

Average revolving utilization rate |

30% |

|

|

26% |

||

Average number of retail credit cards |

2.51 |

|

|

2.42 |

||

Average retail credit card balance |

$1,942 |

|

|

$2,044 |

||

Average nonmortgage debt |

$25,386 |

|

|

$25,483 |

||

Average mortgage debt |

$213,599 |

|

|

$215,655 |

||

Average 30–59 days past due delinquency rates |

3.9% |

|

|

2.4% |

||

Average 60–89 days past due delinquency rates |

1.9% |

|

|

1.3% |

||

Average 90–180 days past due delinquency rates |

6.8% |

|

|

3.8% |

1 VantageScore is a registered trademark of VantageScore Solutions, LLC.

2 VantageScore range is 300 to 850.

Positive results driven by younger borrowers

The year-over-year increase in average credit scores can be attributed to younger consumers practicing responsible credit management. While average utilization rates dropped for every generation, the most significant decreases were seen in Gen Z borrowers who saw a 6 percent reduction in their use of available credit, followed by millennials, or Gen Y, who saw a 5 percent decrease year-over-year.

While Gen Z and Gen Y are carrying more credit cards than they were in 2020, their credit card balances decreased year-over-year. Looking at 30–59, 60–89 and 90–180 days past due delinquency rates showed Gen Z had fewer missed payments than all generations, except the silent generation. Lower utilization rates, less credit card debt and fewer missed payments fueled a 13-point increase in average credit scores for Gen Z and an 11-point increase for millennials.

“Credit scores are a reflection of the information included in your credit report,” said Rod Griffin, senior director consumer education and advocacy at Experian. “They are one piece of the puzzle. From buying a home to purchasing a new family car and much more, the types of purchases that are going to create meaningful change in consumers’ lives require a strong credit history. It is encouraging to see trends of responsible credit management for consumers of all ages.”

2020 findings by generation |

|

Gen Z |

|

|

Gen Y |

|

|

Gen X |

|

|

Boomers |

|

|

Silent |

|

Average VantageScore® |

|

654 |

|

|

658 |

|

|

676 |

|

|

716 |

|

|

729 |

|

Average number of credit cards |

|

1.64 |

|

|

2.66 |

|

|

3.3 |

|

|

3.45 |

|

|

2.78 |

|

Average credit card balance |

|

$2,197 |

|

|

$4,651 |

|

|

$7,718 |

|

|

$6,747 |

|

|

$3,988 |

|

Average revolving utilization rate |

|

30% |

|

|

30% |

|

|

32% |

|

|

24% |

|

|

13% |

|

Average number of retail credit cards |

|

1.64 |

|

|

2.1 |

|

|

2.59 |

|

|

2.63 |

|

|

2.21 |

|

Average retail credit card balance |

|

$1,124 |

|

|

$1,871 |

|

|

$2,353 |

|

|

$2,100 |

|

|

$1,558 |

|

Average nonmortgage debt |

|

$10,942 |

|

|

$27,251 |

|

|

$32,878 |

|

|

$25,812 |

|

|

$12,869 |

|

Average mortgage debt |

|

$172,561 |

|

|

$232,372 |

|

|

$245,127 |

|

|

$191,650 |

|

|

$159,517 |

|

Average 30–59 days past due delinquency rates |

|

1.6% |

|

|

2.7% |

|

|

3.3% |

|

|

2.2% |

|

|

1.2% |

|

Average 60–89 days past due delinquency rates |

|

1.0% |

|

|

1.5% |

|

|

1.8% |

|

|

1.2% |

|

|

0.7% |

|

Average 90–180 days past due delinquency rates |

|

2.5% |

|

|

4.4% |

|

|

5.3% |

|

|

3.2% |

|

|

1.9% |

|

In an effort to encourage consumers to regularly monitor and understand the information in their credit reports, Experian joined forces with the other U.S. credit reporting agencies to offer free weekly credit reports to all Americans through April 2021 via www.annualcreditreport.com.

In addition to the free weekly credit report at annualcreditreport.com, Experian also offers consumers free access to their credit report and ongoing credit monitoring at Experian.com.

Additional credit education resources and tools

- Join Experian’s #creditchat hosted by @Experian on Twitter with financial experts every Wednesday at 3 p.m. Eastern time.

- Visit the Ask Experian blog for answers to common questions, advice and education about credit.

- Add positive telecom and utility payments to your Experian credit report for an opportunity to improve your credit scores by visiting www.experian.com/boost3

- For additional resources, visit http://www.experian.com/consumereducation or www.experian.com/coronavirus.

Analysis methodology

Experian’s analysis is based on a statistically relevant sampling of Experian’s consumer credit database, available on the Experian Ascend Technology PlatformTM, from Q2 2019 and 2020. Analyzed credit reports contained no personally identifiable information. Credit scores are based on VantageScore (range 300–850).

About Experian

Experian is the world’s leading global information services company. During life’s big moments — from buying a home or a car to sending a child to college to growing a business by connecting with new customers — we empower consumers and our clients to manage their data with confidence. We help individuals to take financial control and access financial services, businesses to make smarter decisions and thrive, lenders to lend more responsibly, and organizations to prevent identity fraud and crime.

We have 17,800 people operating across 45 countries, and every day we’re investing in new technologies, talented people and innovation to help all our clients maximize every opportunity. We are listed on the London Stock Exchange (EXPN) and are a constituent of the FTSE 100 Index.

Learn more at www.experianplc.com or visit our global content hub at our global news blog for the latest news and insights from the Group.

Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. Other product and company names mentioned herein are the property of their respective owners.

3 Results may vary. See Experian.com for details