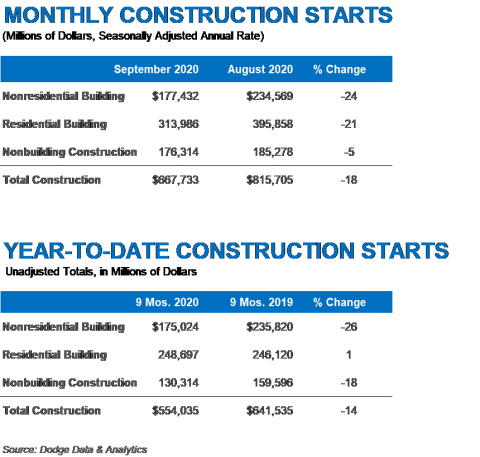

HAMILTON, N.J.--(BUSINESS WIRE)--Total construction starts dipped 18% in September to a seasonally adjusted annual rate of $667.7 billion, essentially taking back August’s gain. While some of this decline is certainly payback from several large projects entering start in August, the drop in activity brought total construction starts below levels seen in June and July. Nonresidential starts fell 24%, while residential building dropped 21% over the month. Nonbuilding starts were 5% lower than August.

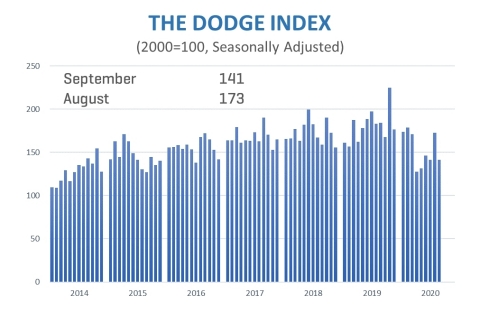

Year-to-date through nine months, total construction starts were down 14% from the same period in 2019. Nonresidential starts were lower by 26% and nonbuilding was down 18%, while residential starts gained 1%. For the 12 months ending September 2020, total construction starts were down 8% from the 12 months ending September 2019. Nonresidential building starts were 19% lower and nonbuilding starts were 11% lower, while residential building starts rose 4% over the 12 months ending September 2020. In September, the Dodge Index fell 18% to 141 (2000=100) from the 173 reading in August. September’s Dodge Index was down 23% compared to a year earlier and 21% lower than its pre-pandemic level in February.

“That construction starts took a significant step back in September is disappointing, but also not surprising,” stated Richard Branch, Chief Economist for Dodge Data & Analytics. “The economic recovery has lost momentum and is showing strain since support provided to consumers and businesses from expanded unemployment insurance benefits and the Paycheck Protection Program have expired. The worsening budget crisis for state and local areas has also slowed growth in public project starts, particularly in the face of a somewhat uncertain outlook for federal infrastructure spending programs. The road to recovery will continue to be uneven and fraught with potholes until a vaccine is developed and widely adopted across the U.S.”

Nonbuilding construction fell 5% in September to a seasonally adjusted annual rate of $176.3 billion. Highway and bridge starts rose for the third consecutive month, jumping 10%, while utility/gas plant starts moved up 21%. However, environmental public works and miscellaneous nonbuilding starts each lost 26% over the month.

The largest nonbuilding project to break ground in September was the $1.6 billion Guernsey Power Station in Pleasant City OH. Also getting underway was the $727 million 1,122 MW Seminole Electric natural gas fired power plant in Palatka FL and the $330 million Liquids Expansion and Solids Treatment Plant in Chino CA.

Through the first nine months of the year, total nonbuilding starts were down 18%. Starts in the highway and bridge category were up 2%, while environmental public works fell 10%, miscellaneous nonbuilding was down 33%, and the utility/gas plant category was 43% lower. On a 12-month rolling sum basis, total nonbuilding starts were down 11% compared to the 12 months ending September 2019. Starts in the street and bridge category were down 1%, while utility/gas plant starts were down 21%. Environmental public works starts dropped 6% in the 12 months ending September 2020 and starts in the miscellaneous nonbuilding category were 22% lower.

Nonresidential building starts were down sharply over the month of September, falling 24% to $177.4 billion. There was little good news in the detail: institutional starts fell 8%, manufacturing starts were 48% lower, and commercial starts dropped 36%. Only two building types posted a gain in September – retail and public buildings.

The two largest nonresidential building projects to break ground in September were the $330 million second phase of the Iceberg Towers in Burbank CA and the $330 million East Market Mixed-Use complex in Philadelphia PA. These projects were followed by the $296 million first phase of the Moffitt Cancer Center Hospital in Tampa FL.

Year-to-date through nine months, total nonresidential building starts were down 26%. Commercial starts declined 27%, while institutional starts were 18% lower. Manufacturing starts dropped a painful 56% compared to the first nine months of 2019. For the 12 months ending September 2020 total nonresidential building starts slid 19%. Institutional building starts were 16% lower, commercial starts down 19% and manufacturing starts plummeted 30% in the 12 months ending September 2020.

Residential building starts lost 21% in September, falling to a seasonally adjusted annual rate of $314.0 billion. Single family starts dropped 6% in the month as multifamily starts tumbled 54%.

The two largest multifamily structures to break ground in September were the $130 million AJ Railyards Mixed Use building in Sacramento CA and the $130 million Sage Valley Apartments in West Valley City UT. The $125 million Avenir Mixed Use building in Jersey City was the next largest project to break ground.

Through the first nine months of 2020, residential construction starts were 1% higher than in the same period of 2019. Single family starts were up 6%, but multifamily starts were down 12%. For the 12 months ending in September, total residential starts were 4% higher compared to the 12 months ending September 2019. Single family starts were up 7%, while multifamily starts were down 5%.

About Dodge Data & Analytics: Dodge Data & Analytics is North America’s leading provider of analytics and software-based workflow integration solutions for the construction industry. Building product manufacturers, architects, engineers, contractors, and service providers leverage Dodge to identify and pursue unseen growth opportunities and execute on those opportunities for enhanced business performance. Whether it’s on a local, regional or national level, Dodge makes the hidden obvious, empowering its clients to better understand their markets, uncover key relationships, size growth opportunities, and pursue those opportunities with success. The company’s construction project information is the most comprehensive and verified in the industry. Dodge is leveraging its 100-year-old legacy of continuous innovation to help the industry meet the building challenges of the future. To learn more, visit www.construction.com.