MEMPHIS--(BUSINESS WIRE)--New research reveals the extent of the global fashion industry's commitment to sustainability, despite the COVID-19 pandemic, with sustainability ranked as the second most important strategic objective for businesses in the sector1.

The new research, from the U.S. Cotton Trust Protocol and the Economist Intelligence Unit (EIU), is based on a survey of 150 leading executives from top fashion, retail and textile business across Europe and the U.S., and interviews with leading brands like Puma, H&M and Adidas. Explored in a new report, ‘Is Sustainability in Fashion?’ the research comes at a time when the industry finds itself at a crossroads: whether to continue to invest in sustainability, or row back in light of the pandemic.

Sustainability is business critical, say fashion, retail and textile leaders

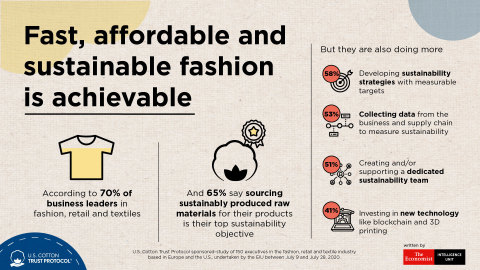

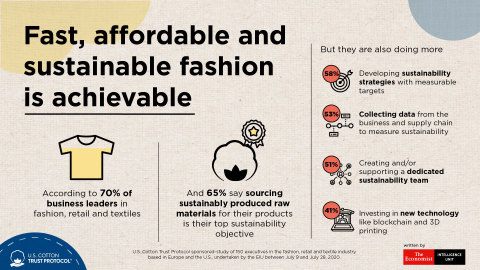

In defiance of the pandemic, the new data shows that for many of the world's biggest brands, sustainability is now business critical. The majority of fashion, retail and textile leaders surveyed (60%), named implementing sustainability measures as a top two strategic objective for their business, second only to improving customers’ experience (ranked first by 64%). This contrasts starkly with the fewer than one in six (15%) that listed 'rewarding shareholders' as a top objective.

Leaders report they’re introducing sustainability measures throughout the supply chain, from sourcing sustainably produced raw materials (65%), introducing a circular economy approach to their business and cutting greenhouse gasses (51% apiece) and investing in new technologies like 3D printing and blockchain (41%). Overall, the majority (70%) were optimistic that sustainable, fast and affordable fashion is achievable.

Data matters

A key finding of the research is that data matters for sustainability. When asked what measures they were implementing today to be more sustainable, collecting data from across the business and in the supply chain to measure performance was listed at the very top of business leaders’ list of priorities by 53%, second only to developing and implementing an environmental sustainability strategy with measurable targets, favoured by almost six in ten (58%).

And data is not important for the immediate term only – three in ten (28%) said the availability of reliable data holds the key to greater sustainability over the next decade, while almost three-quarters of industry leaders (73%) stated their support for global benchmarks and thresholds as an effective means of measuring sustainability performance and driving progress in the industry.

But data collection is patchy

However, although brands clearly recognize the importance of data, the research’s findings on data collection indicates that top fashion brands, retailers and textile businesses may find sourcing good quality data a challenge.

While business leaders report relatively high rates of data collection on supplier sustainability practices (65%) and worker rights and workplace health and safety in the supply chain (62%), a significant proportion (45%) of businesses do not track greenhouse gas emissions across production, manufacturing and distribution of the products they sell, while 41% don’t track the amount of water and energy being used to produce the raw materials they source.

Looking to the future, over a quarter (26%) of respondents saw a lack of available, easily-accessible data as hampering collaboration on sustainability across the industry. As some respondents in interview pointed out, while collecting data could be hard it is important.

Commenting on the findings, Gary Adams, President of the U.S. Cotton Trust Protocol, said: "It is clear that brands are faced with a challenge on driving forward their sustainability efforts. At the U.S. Cotton Trust Protocol we know that accurate, reliable data supports businesses in this work - providing not only the evidence to show hard work and progress, but the insight to drive further improvements. We provide one of the most robust data collection mechanisms available for an essential material – cotton – for unparalleled transparency.”

Partnership offers path to further progress

An additional key finding is that fashion, retail and textile business clearly cannot drive change in isolation: collaboration is needed. According to one respondent, from Reformation, this is already happening. “We’re energized to see collaboration and cooperation across the industry and believe that will only increase over time.”

However, when it comes to external support to help guide that progress, business leaders do not necessarily perceive further regulation as the answer. The UN Sustainable Development Goals (SDGs) and government regulation were each given equal weight in driving sustainability change, both cited by a quarter of respondents (24% apiece). Regulatory requirements were also ranked by only a third (33%) of the business leaders surveyed as being within the top three factors that will drive sustainability progress over the next decade.

Jonathan Birdwell, Regional Head of Public Policy and Thought Leadership, The Economist Intelligence Unit: “It’s clear from the survey results and our interviews with business leaders that the industry is committed to driving progress on its sustainability performance. We were particularly struck by the fact that sustainability is largely considered as pre-competitive – behind the scenes brands are sharing resources and lessons learned”.

The impact of Covid-19

This determination on sustainability flies in the face of COVID-19 uncertainty, although when asked their view on the pandemic, just over half (54%) of respondents said they thought it would make sustainability less of a priority within the industry.

The U.S. Cotton Trust Protocol is a new initiative that sets a new standard in sustainably grown cotton. By working closely with growers, the U.S. Trust Protocol provides clear, consistent data on six key sustainability metrics, including GHG emissions, water use, soil carbon, soil loss, independently audited through Control Union Certification. For the first time, brands can access annualized farm level data and trace their cotton from field to 'laydown'.

Visit us online at:

Follow us at:

https://twitter.com/trustuscotton

https://www.facebook.com/trustuscotton/

https://www.instagram.com/trustuscotton/

https://www.linkedin.com/company/trustuscotton/

1 Research based on quantitative survey of 150 executives in the fashion, retail and textile industry based in Europe and the United States undertaken by the Economist Intelligence Unit between 9th July and 28th July 2020. The survey was complemented by qualitative insight from interviews with ten professionals in the fashion and sustainability space.

About the U.S. Cotton Trust Protocol

In a period of ever greater supply chain scrutiny and a growing demand for transparency, the U.S. Cotton Trust Protocol will set a standard for more sustainably grown cotton. It brings quantifiable and verifiable goals and measurement to the issue of responsibly-grown cotton production and drives continuous improvement in key sustainability metrics.

The Trust Protocol underpins and verifies U.S. cotton’s progress through sophisticated data collection and independent third-party verification. Choosing Trust Protocol cotton will give brands and retailers the critical assurances they need that the cotton fiber element of their supply chain is more sustainably grown with lower environmental and social risk. Brands and retailers will gain access to U.S. cotton with sustainability credentials proven via Field to Market, measured via the Fieldprint Calculator and verified with Control Union Certifications.

The U.S. Cotton Trust Protocol is overseen by a multi-stakeholder Board of Directors comprised of representatives from brands and retailers, civil society and independent sustainability experts as well as the cotton-growing industry, including growers, ginners, merchants, wholesalers and cooperatives, mills and cottonseed handlers.

About the Economist Intelligence Unit

The Economist Intelligence Unit (EIU) is the research and analysis division of the Economist Group providing forecasting and advisory services through research and analysis, such as monthly country reports, five-year country economic forecasts, country risk service reports, and industry reports.