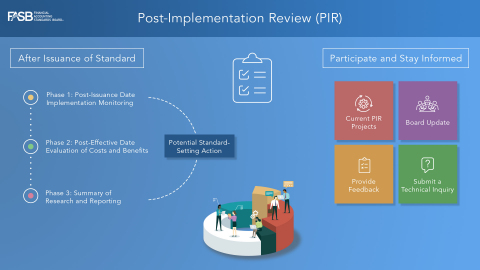

NORWALK, Conn.--(BUSINESS WIRE)--When the Financial Accounting Standards Board (FASB) issues a final standard, it means the FASB has concluded that the benefits derived from the standard justify the cost of preparing and using that information. But the standard-setting process doesn’t end when a final standard is issued; rather, it marks the start of a “quality-control” phase known as the post-implementation review (PIR) process.

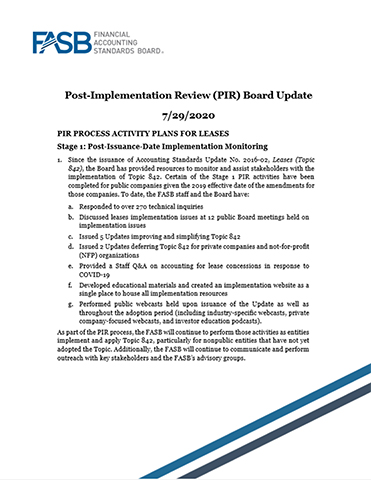

As illustrated by the attached infographic, stakeholder outreach and other research inform each phase of this important work. PIR activities help the FASB monitor implementation progress and ascertain whether the value of information the standard provides the capital markets is worth the resources needed to deliver it. They allow the FASB to promptly identify and address any issues, effectively creating a process of continuous improvement.

In his recent LinkedIn article about the PIR process, FASB Chair Richard R. Jones noted, “As with all standard-setting activities, quality input leads to quality standards—even after a standard is issued. We never ‘finish’ improving standards—and we always welcome your feedback.”

Stakeholders are encouraged to visit the FASB’s new PIR web portal for information on how to participate in and provide input on standards currently under review, including credit losses, leases, and revenue recognition. More information about the PIR process is also covered in a recently issued FASB in Focus overview.

About the Financial Accounting Standards Board

Established in 1973, the FASB is the independent, private-sector organization, based in Norwalk, Connecticut, that establishes financial accounting and reporting standards for public and private companies and not-for-profit organizations that follow Generally Accepted Accounting Principles (GAAP). The FASB is recognized by the Securities and Exchange Commission as the designated accounting standard setter for public companies. FASB standards are recognized as authoritative by many other organizations, including state Boards of Accountancy and the American Institute of CPAs (AICPA). The FASB develops and issues financial accounting standards through a transparent and inclusive process intended to promote financial reporting that provides useful information to investors and others who use financial reports. The Financial Accounting Foundation (FAF) supports and oversees the FASB. For more information, visit www.fasb.org.